Everything's under control, China edition

Daiwa Securities has forecast Armageddon. They say that over-investment in China in recent years has created a debt bubble so great that Chinese authorities would not able to manage its collapse, resulting in a debt deflationary spiral which would make 2008 look like a walk in the park. Such a meltdown would, in their words, "send the global economy into a tailspin".

But they also outline another scenario, in which China's economy undergoes a nasty, possibly prolonged recession, from which it will emerge with lower growth.

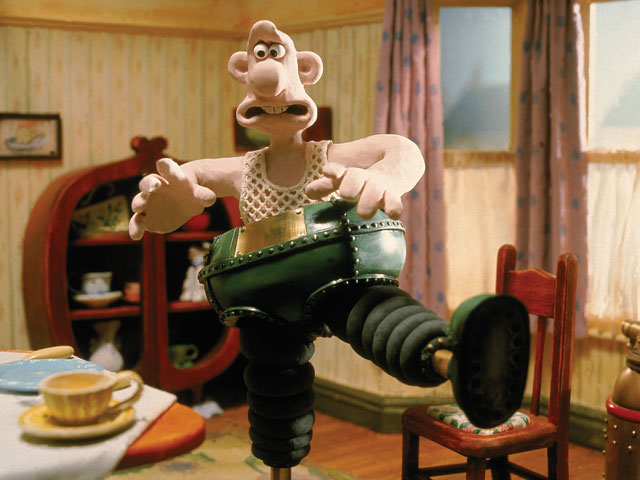

Which of these scenarios will play out? Well, as I discuss in my latest Forbes post, it really depends what Chinese authorities do. They insist that "everything is under control". But are they actually in the wrong trousers?

Read my analysis and conclusions here.

Related reading:

Never mind Greece, look at China

Lessons for China from Japan

China's economy: no collapse, but it's serious and so are the politics - George Magnus

If we don't understand both sides of China's balance sheet we understand neither - Michael Pettis

Other Forbes posts on China:

Quantitative tightening is a myth (but that doesn't mean there isn't a problem)

China's interest rate cuts will not solve its real problem

China's Black Monday signals the end of its growth cycle

China joins the global devaluation party

Damn and I wanted to buy a now well made chinese Lyra 4 inch F 11 refractor of classic traditional design to add to my other 3 refractors.......

ReplyDeleteHowever it appears to be recently discontinued for higher value added products of dubious added utility.

Will euro hobbyists be the main losers from the Chinese collapse ?

Certainly not people who previously burned coal and other useless stuff to keep wwarm above 50 lat

This comment has been removed by the author.

ReplyDeleteAll this talk of peak oil but it appears coal consumption in 2014 (first since 1999) went negative

ReplyDeleteWhat was the fundamental driver of this . decline ?

A collapse of Asian mercantalism perhaps but more importantly the surplus coal could not flow to Europe.....

You see we have these non driving euro drones trapped inside bankrupt nat gas utilities - for them at least China is a bigger economy then the US of A.

Banks simply don't like simple supply chains with little fixed costs......they want to add friggin "value" everywhere

ReplyDeleteAs recently as the 1990s coal was dumped on the Cork docks and simply travelled a extra mile or two at most to be burned directly without transformation loss.

It was no accident that the most notorious neo- liberal minister we ever had grace our presence used green names to cement their monopoly hold over the population.

ReplyDeleteNeo liberals do not believe in real on the ground competition , this is a falsehood.

They are monopolists.

Someone better take Steve from Virginia on

ReplyDeleteHe is excessively Malthusian.

He states that peak UK coal happened in 1917 without context.

It peaked for the same reason UK food peaked in the 19th century.

Cheaper products abroad.

1917 was the year major US oil shipments moved into the UK , a sort of mini 1944.

He is mixing up capitalistic concentration dynamics with peak something or other.

The UK had a problem as that is where the population moved to - for the reason of that is where the money was rather then where the resources were but that is a slightly different problem.

UK continues to see coal production decline because all it can do is absorb euro and Asian excess production.

ReplyDeleteThere is simply no need to do real work in the UK.

The authorities give the illusion of work by providing us with the service economy ,which although wasteful provided the central state with the appropriate control apparatus to maintain centralized control.

Digging coal out of the ground is not complicated , coal is not in a shortage in the UK period.

Coal digging is a order of mag less complicated then laying gas pipes on the north sea floor.

Even today it requires large numbers of miners relative to capital.

The drop in EU/UK coal consumption in 2014 can be entirely explained by EU/UK energy scarcity policy.

ReplyDeleteThey turned Drax into a biomass plant for Christ sake ??????

The most wasteful energy policy imaginable.

Steve is caught in a pit of his own wish full thinking.

His disgust for the modern world is clouding his judgement.

Isn't the problem in China, like the west, that the level of private debt, secured against often empty buildings (or indeed empty cities), far, far too high? And a known unknown because so much of it is borrowed in the 'shadow economy'?

ReplyDeleteProblem is much simpler then that.

ReplyDeleteTry not to think like a Bank.

Think like a peasant.

Worlds production cannot be joined with worlds consumption. (See dramatic UK energy data)

Everything is being lost down a transmission hole so as to preserve concentration.