Snake oil sellers in the stablecoin world

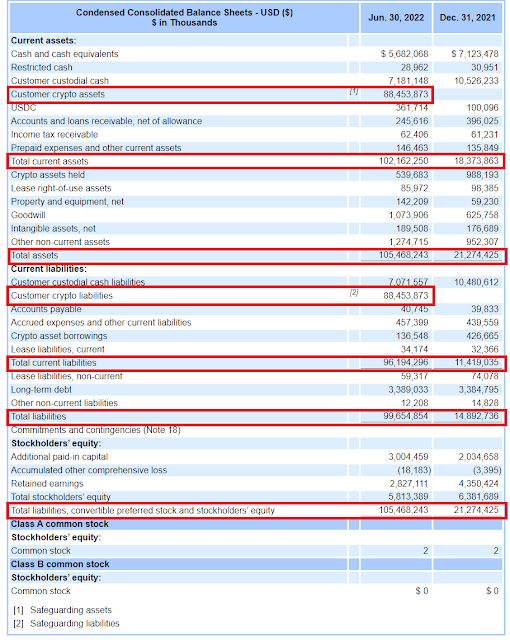

It's been evident for some years now that those selling risky crypto products to risk-averse investors like to have federal branding on their snake oil. Tether claimed to have 100% actual dollar backing for its stablecoin. Various exchanges and platforms claimed that customer deposits were FDIC insured. The New York Attorney General showed that Tether didn't have 100% dollar backing or anything like it. And now the FDIC has sent cease & desist orders to FTX , Voyager and several other crypto companies , it has become dangerous even to mention FDIC insurance in marketing material. But that doesn't meant they've given up on the quest for a credible claim to Federal backing. The new Holy Grail is gaining access to Federal Reserve funding without becoming a licensed bank. Accordingt to analysts at Barclays, Circle, the issuer of the USDC stablecoin widely regarded in crypto markets as a "safe" dollar equivalent, may have found a way: This screenshot com...

.jpg)