The high price of dollar safety

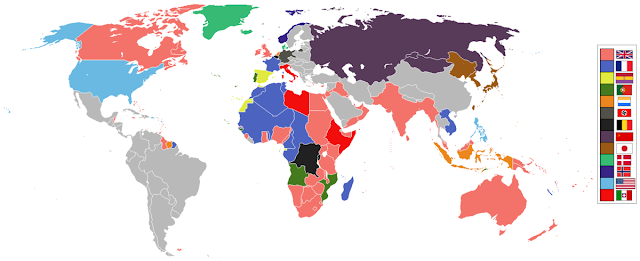

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “ savings glut ,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that offers the safety that fearful investors desperately crave. That, fundamentally, is what is driving down the returns on assets. It is also the primary cause of the wide US trade deficit. The President likes to think that the reason for the US’s persistent trade deficits is unfair trade practices and currency manipulation. And for some countries, these are undoubtedly contributing factors. But the biggest reason by far is the global dominance of the dollar, and above all, the pre-eminence of dollar