Celsius is heading for absolute zero

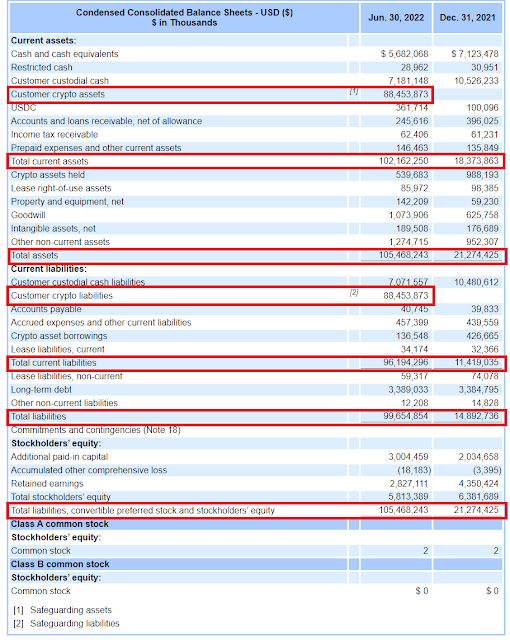

Yesterday, the failed crypto lender Celsius filed a monthy cash flow forecast and a statement of its assets and liabilities held in the form of cryptocurrency and stablecoins. They showed that the lender is deeply underwater and will run out of money within two months. Today, Celsius presented an update regarding its chapter 11 bankruptcy plans. Reading this, you'd think it was a different company. Liquidation isn't on the agenda. No, they are talking about "reorganization" and and seeking debtor-in-possession (DIP) financing: DIP financing is a specialist form of finance for companies in chapter 11 bankruptcy to enable a company to continue operating. It usually takes the form of term loans. DIP loans are secured on the company's remaining assets and are typically senior over all other claims, so must be repaid before claims from existing creditors can be settled. Because DIP finance dilutes existing claims, the bankruptcy court must agree to it. In Celsius...