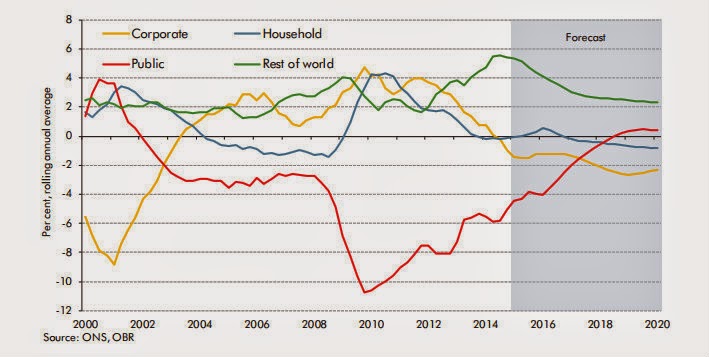

Repeat after me: sectoral balances must sum to zero

I do like sectoral net lending charts. This one is from the OBR's latest Economic Forecast : The thing to remember about sectoral balances is they must sum to zero. It is not possible to have a negative external balance, as the UK does, with concurrent surpluses in the public, household and corporate sectors. If the UK is a net borrower from the rest of the world because of its current account deficit, then somewhere in the domestic economy must be a balancing deficit. It is pretty obvious where this deficit has been. In 2010, the external sector was in deficit (green line on chart) and corporates (yellow line) were net saving. The external balance had been in deficit for a long time, but corporate net saving commenced at the same time as the public sector (red line) switched from surplus to deficit. This may have been a traumatic response to the dot-com crash, but to me this looks more like a policy change around 2001 that encouraged corporate saving. I wonder what it was. ...