Repeat after me: sectoral balances must sum to zero

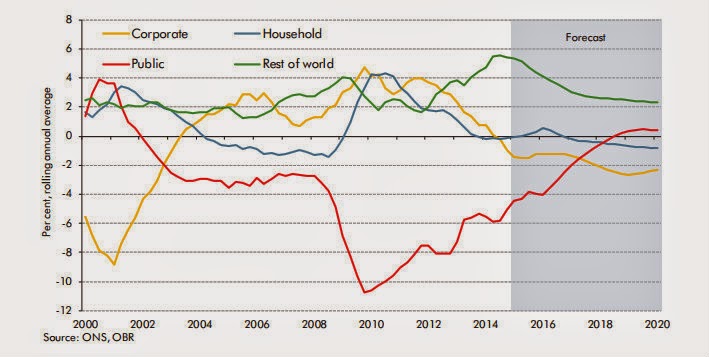

I do like sectoral net lending charts. This one is from the OBR's latest Economic Forecast:

The thing to remember about sectoral balances is they must sum to zero. It is not possible to have a negative external balance, as the UK does, with concurrent surpluses in the public, household and corporate sectors. If the UK is a net borrower from the rest of the world because of its current account deficit, then somewhere in the domestic economy must be a balancing deficit.

It is pretty obvious where this deficit has been. In 2010, the external sector was in deficit (green line on chart) and corporates (yellow line) were net saving. The external balance had been in deficit for a long time, but corporate net saving commenced at the same time as the public sector (red line) switched from surplus to deficit. This may have been a traumatic response to the dot-com crash, but to me this looks more like a policy change around 2001 that encouraged corporate saving. I wonder what it was. Any suggestions?

The net saving of corporates and foreigners during the pre-crisis years was balanced both by a public sector deficit and by a growing deficit in the household sector (blue line). We now know that the household deficit was associated with unsustainable credit growth. When the crash came, households switched abruptly from deficit to surplus. Foreigners, corporates and households were all net saving at the same time. As I said, the sectoral balances have to sum to zero: so the increase in the government deficit balanced the desire of all three private sectors to save at the same time. When no-one wants to spend, someone must, and that someone is inevitably government. Government is the "spender of last resort".

The trouble is that when everyone is saving like crazy (including paying down debt, which economically is equivalent to saving) people get very worried indeed at the sight of apparently out-of-control government deficit spending, failing to see the relationship of that spending to their own saving behaviour. So governments then embark on austerity programmes to shrink the deficit. The result of this (assuming no fall in GDP) is that deficit spending moves around. The public sector deficit is shifted back to the private sector.

If you are Germany, deficit spending moves abroad, and you run an ever-larger trade surplus. But if you are the UK, with a deeply entrenched external deficit in part because of a still-dominant financial sector, deficit spending moves to domestic households and corporations. George Osborne's claim that he wants to build an economy "based upon savings and investment" is economic gibberish, since his plans aim only to eliminate the fiscal deficit, not the trade deficit. As the chart above shows, the OBR forecasts - based upon the Treasury's spending plans as outlined in the Budget last week - that for the foreseeable future the only people doing any significant saving will be foreigners.

Saving is not necessarily a good thing. Generally, we expect households to save (for their old age, for rainy days) but corporations to invest. The problem prior to the financial crisis was that corporations were saving and households were investing (in property). Now, despite everything we have heard about corporations hoarding cash, corporate saving is falling and the corporate sector has switched from surplus to deficit. This is a welcome development, since it suggests that corporations are investing. And indeed they are:

Business investment is now back to its 2000 level. This is no doubt what has generated the UK's recovery. Perhaps the malaise that has affected corporations ever since the dot-com crisis is over? The OBR seems to think so. It forecasts corporate investment continuing to rise to historically unprecedented levels. Is this credible? I confess that I am unconvinced. The path of business investment has never been smooth. Not only the level of investment projected for 2020 but also the rate of change looks unsustainable to me. I reckon it would level off or dip sooner than that. Indeed there was a dip at the end of 2014 which the forecasters chose to ignore. Hockey-stick projections always worry me.

Sadly, the picture for households is not so encouraging. The household saving ratio has already fallen considerably from its 2010 high:

Perhaps more worringly, there is an evident downwards trend in this chart. Household saving has been diminishing since the late 1990s. The OBR projects that the household sector will be in deficit by 2018, no doubt as a result of the planned sharp fiscal squeeze in 2016-18. As older and richer households would still be net savers, the growing deficit of the household sector would be due to sharply rising debt, particularly among younger and poorer people. Here is the OBR's projection for household debt to income:

The OBR expresses some concern about this:

Perhaps more importantly, it is by no means clear that such an increase in debt is actually possible. Productivity is on the floor and nominal wage growth remains poor. The OBR identifies this as a key risk to the recovery:

Note that the worst-case scenario here is for the UK to fall into recession from 2016 onwards. This would be likely to be the case if productivity and wage growth disappointed and the fiscal squeeze hurt household incomes sufficiently to eliminate debt-fuelled consumption and investment spending.

And this brings me back to my sectoral net lending. Remember that sectoral balances must sum to zero. If household income falls so much that spending and borrowing cannot be sustained, as the OBR suggests, then there are two possibilities. The first is that there is a sharp correction to the trade balance. This would be due to collapse in imports as domestic demand falls, and rising exports as corporations seek markets elsewhere. We have seen this in many EU (not just Eurozone) countries in the last few years. It is always accompanied by recession, which may be severe.

But if the trade balance does not correct - and remember that the UK's trade deficit is deeply entrenched - then fiscal consolidation becomes all but impossible. Deficit reduction slows to a crawl, as this chart from the OBR shows:

The worst-case scenario here (deficit of 4% of GDP in 2020) would be associated with the worst case in the GDP fan chart, i.e. the UK in recession. When GDP is falling, public sector borrowing as a proportion of GDP naturally rises. This chart therefore assumes that fiscal consolidation efforts would continue despite recession, no doubt because of disappointing deficit reduction. But continued attempts to eliminate the deficit and reduce the deficit would drive the economy ever deeper into recession. Although the deficit itself may reduce further, debt/GDP actually rises in this scenario. As Irving Fisher put it, "the more the borrowers pay, the more they owe". For Greece, this nightmare was probably inevitable. But the UK has no reason whatsoever to go down that path. If it does, it will be because of political stupidity on a simply mammoth scale.

Unfortunately the simple fact that sectoral balances must sum to zero is currently being ignored by all of the main parties. I do wish politicians would pay more attention to national accounting. It would save a lot of grief.

The thing to remember about sectoral balances is they must sum to zero. It is not possible to have a negative external balance, as the UK does, with concurrent surpluses in the public, household and corporate sectors. If the UK is a net borrower from the rest of the world because of its current account deficit, then somewhere in the domestic economy must be a balancing deficit.

It is pretty obvious where this deficit has been. In 2010, the external sector was in deficit (green line on chart) and corporates (yellow line) were net saving. The external balance had been in deficit for a long time, but corporate net saving commenced at the same time as the public sector (red line) switched from surplus to deficit. This may have been a traumatic response to the dot-com crash, but to me this looks more like a policy change around 2001 that encouraged corporate saving. I wonder what it was. Any suggestions?

The net saving of corporates and foreigners during the pre-crisis years was balanced both by a public sector deficit and by a growing deficit in the household sector (blue line). We now know that the household deficit was associated with unsustainable credit growth. When the crash came, households switched abruptly from deficit to surplus. Foreigners, corporates and households were all net saving at the same time. As I said, the sectoral balances have to sum to zero: so the increase in the government deficit balanced the desire of all three private sectors to save at the same time. When no-one wants to spend, someone must, and that someone is inevitably government. Government is the "spender of last resort".

The trouble is that when everyone is saving like crazy (including paying down debt, which economically is equivalent to saving) people get very worried indeed at the sight of apparently out-of-control government deficit spending, failing to see the relationship of that spending to their own saving behaviour. So governments then embark on austerity programmes to shrink the deficit. The result of this (assuming no fall in GDP) is that deficit spending moves around. The public sector deficit is shifted back to the private sector.

If you are Germany, deficit spending moves abroad, and you run an ever-larger trade surplus. But if you are the UK, with a deeply entrenched external deficit in part because of a still-dominant financial sector, deficit spending moves to domestic households and corporations. George Osborne's claim that he wants to build an economy "based upon savings and investment" is economic gibberish, since his plans aim only to eliminate the fiscal deficit, not the trade deficit. As the chart above shows, the OBR forecasts - based upon the Treasury's spending plans as outlined in the Budget last week - that for the foreseeable future the only people doing any significant saving will be foreigners.

Saving is not necessarily a good thing. Generally, we expect households to save (for their old age, for rainy days) but corporations to invest. The problem prior to the financial crisis was that corporations were saving and households were investing (in property). Now, despite everything we have heard about corporations hoarding cash, corporate saving is falling and the corporate sector has switched from surplus to deficit. This is a welcome development, since it suggests that corporations are investing. And indeed they are:

Business investment is now back to its 2000 level. This is no doubt what has generated the UK's recovery. Perhaps the malaise that has affected corporations ever since the dot-com crisis is over? The OBR seems to think so. It forecasts corporate investment continuing to rise to historically unprecedented levels. Is this credible? I confess that I am unconvinced. The path of business investment has never been smooth. Not only the level of investment projected for 2020 but also the rate of change looks unsustainable to me. I reckon it would level off or dip sooner than that. Indeed there was a dip at the end of 2014 which the forecasters chose to ignore. Hockey-stick projections always worry me.

Sadly, the picture for households is not so encouraging. The household saving ratio has already fallen considerably from its 2010 high:

Perhaps more worringly, there is an evident downwards trend in this chart. Household saving has been diminishing since the late 1990s. The OBR projects that the household sector will be in deficit by 2018, no doubt as a result of the planned sharp fiscal squeeze in 2016-18. As older and richer households would still be net savers, the growing deficit of the household sector would be due to sharply rising debt, particularly among younger and poorer people. Here is the OBR's projection for household debt to income:

The OBR expresses some concern about this:

Strong growth of residential investment and ongoing growth in house prices and property transactions leave households’ gross debt to income ratio rising back towards its pre-crisis peak by the forecast horizon. That seems consistent with supportive monetary policy and other interventions (such as Help to Buy and further support for first-time buyers announced in this Budget), but it could pose risks to the sustainability of the recovery over the medium term.This concern is well-founded. Despite all his rhetoric about encouraging saving, the Chancellor's fiscal plans actually depend on blowing up a household debt bubble of larger proportions than that which burst disastrously in 2008, and using various forms of government support to delay its inevitable implosion. Why do we have to repeat the errors of the past?

Perhaps more importantly, it is by no means clear that such an increase in debt is actually possible. Productivity is on the floor and nominal wage growth remains poor. The OBR identifies this as a key risk to the recovery:

Domestically, productivity and real wages remain weak and the pick-up we forecast from 2015 is a key judgement. If productivity fails to pick up as predicted, consumer spending and housing investment could falter as the resources to sustain them would be lackingIf productivity and wage growth do not pick up, then the fiscal squeeze planned for 2016-18 would have serious consequences for the recovery. The OBR points out that deep spending cuts to unprotected government departments and the welfare budget would have a direct impact on GDP, and expresses concern about the scale and pace of the cuts:

We expect some significant changes in the composition of expenditure associated with the fiscal consolidation and, in particular, with the fact that on current policy so much of that consolidation is delivered through cuts to day-to-day spending on public services that will directly reduce GDP. The scale and speed of the adjustments this switch in spending implies may also represent a risk to the economy evolving in line with our central forecast.The OBR's central forecast for the path of GDP shows real GDP growth over the next 5 years of around 2% per annum. But there is a considerable amount of uncertainty around this forecast:

Note that the worst-case scenario here is for the UK to fall into recession from 2016 onwards. This would be likely to be the case if productivity and wage growth disappointed and the fiscal squeeze hurt household incomes sufficiently to eliminate debt-fuelled consumption and investment spending.

And this brings me back to my sectoral net lending. Remember that sectoral balances must sum to zero. If household income falls so much that spending and borrowing cannot be sustained, as the OBR suggests, then there are two possibilities. The first is that there is a sharp correction to the trade balance. This would be due to collapse in imports as domestic demand falls, and rising exports as corporations seek markets elsewhere. We have seen this in many EU (not just Eurozone) countries in the last few years. It is always accompanied by recession, which may be severe.

But if the trade balance does not correct - and remember that the UK's trade deficit is deeply entrenched - then fiscal consolidation becomes all but impossible. Deficit reduction slows to a crawl, as this chart from the OBR shows:

The worst-case scenario here (deficit of 4% of GDP in 2020) would be associated with the worst case in the GDP fan chart, i.e. the UK in recession. When GDP is falling, public sector borrowing as a proportion of GDP naturally rises. This chart therefore assumes that fiscal consolidation efforts would continue despite recession, no doubt because of disappointing deficit reduction. But continued attempts to eliminate the deficit and reduce the deficit would drive the economy ever deeper into recession. Although the deficit itself may reduce further, debt/GDP actually rises in this scenario. As Irving Fisher put it, "the more the borrowers pay, the more they owe". For Greece, this nightmare was probably inevitable. But the UK has no reason whatsoever to go down that path. If it does, it will be because of political stupidity on a simply mammoth scale.

Unfortunately the simple fact that sectoral balances must sum to zero is currently being ignored by all of the main parties. I do wish politicians would pay more attention to national accounting. It would save a lot of grief.

Isn't the biggest work here being done by the external sector. The trade deficit is apparently going to drop by 60%. Exactly how?

ReplyDeleteThe projection is actually that the trade deficit will fall back to its level of three years ago. I agree that the forecast shows the trade deficit falling the most, but if we look back to the start of public sector deficit reduction in 2010 it is evident that the external sector is actually falling the least. The largest fall is in corporate saving, but as I said I think there is a fair amount of wishful thinking in the forecast for business investment. My hunch is that any fall in the trade deficit would actually arise from fiscal consolidation squeezing domestic demand - in which case the household debt to income ratio is utterly unrealistic and the GDP forecast is over-optimistic.

Delete"My hunch is that any fall in the trade deficit would actually arise from fiscal consolidation squeezing domestic demand ..."

DeleteThat was my point really. IIUC, in recent history, expanding household expenditures has led to a widening of the trade deficit, as it sucks in imports. In that sense a significant drop in the trade deficit implies significantly falling household expenditures/incomes.

Really, the projection of household debt is terrible. How is it possible? I cannot believe it!

ReplyDeleteI agree with the above article, though Frances could have brought out the central absurdity in the conventional wisdom more clearly and briefly. The absurdity is that all else equal, an increased deficit (which is allegedly “bad”) must be matched by increased private sector saving (which is allegedly “good”). LOL.

ReplyDeletePut another way, in the simple case of a closed economy, an increased public sector deficit (bad) must be matched pound for pound by increased private sector saving (allegedly good).

MMTers have actually been making that point for some time, e.g. see http://bilbo.economicoutlook.net/blog/?p=10384.

But the message needs repeating ad nausiam till the twits in high places get the message.

The UK is not a closed economy. That is why the external balance is so important. In an open economy, a trade deficit almost always implies a fiscal deficit. Measures to cut the fiscal deficit therefore tend to force a sharp correction to the trade balance as I described. As this would be achieved primarily through falling imports as domestic demand is squeezed, such a strategy does not bode well for economic growth.

DeleteThe UK is effectively a closed economy in Sterling. Sterling doesn't occur anywhere else and isn't used anywhere else independently. All Sterling roads lead ultimately to the Bank of England.

DeleteYou have to be careful with national accounting. The nature of a reporting denomination alters the reality a little. Things get recast in Sterling that are not actually in Sterling and vice versa.

Sectoral balance feedback magic works best within a *currency zone*, which are not necessarily aligned directly with national borders (as the Euro demonstrates in spades).

So the UK external balance isn't overly important, and is likely misleading. Since it is just foreigners saving in Sterling denominated assets - either voluntarily, because we're a nice safe country in a world of turmoil, or forced by policy due to their largely irrational desire to accumulate foreign currency.

Foreign savers in Sterling are functionally no different from domestic savers in Sterling.

The whole external sector concept just leads to bad thinking and that leads to bad policy.

Neil,

DeleteI'm afraid I fundamentally disagree that the external sector doesn't matter. The UK actually pays for its most important imports in dollars, not sterling, and is therefore vulnerable to a balance of payments crisis - although this would likely be mitigated to some degree by use of Fed swap lines.

The mechanics work as I said: reducing the fiscal deficit is likely to cause a sharp correction in the trade balance due to domestic demand squeeze. Likewise, large increases in the fiscal deficit would be likely to push the external sector further into deficit. Whether or not the external balance is in sterling or something else is irrelevant. The main concerns are firstly, that squeezing domestic demand to cut imports creates the illusion of economic rebalancing but in reality simply reduces the volume of trade without improving export capacity, so is detrimental to economic growth: and secondly, that sharp corrections in trade and capital flows (in either direction) are economically destabilising.

I'm surprised by Neil's claim that the 'external sector doesn't matter'. There is no guarantee that the UK can continue to conjure up capital and financial assets that it exchanges for goods. Where these asset sales are visible, they are fodder for nationalism; where they are less visible, they sow the seeds of the next crisis by adding to profit flows offshore... for these reason alone, the external sector and the trade balance matter a great deal.

DeleteI didn’t mean to suggest the external sector doesn’t matter: I just made the “all else equal” assumption, which is a common ploy when illustrating a point. I.e. I assumed the external sector was in balance.

DeleteNeil makes an interesting point. But seems to me his point is invalid assuming a country has a decent stock of foreign currency. In that case the relevant country is effectively in what Neil calls a “currency zone”: i.e. everyone has plenty of money (dollars, yen, pounds, etc) and that money flows in and out of the country with everyone exchanging dollars for pounds etc when necessary.

In contrast, if the UK was out of foreign currency (as happened in 1976 when the UK had to borrow from the IMF) then the currency collapses if there is any further outflow of pounds, and assuming it can’t borrow from the IMF or whoever. In that extreme scenario, an outflow of currency just isn't possible. And that was exactly the problem facing the UK in 1976. But that’s an unusual situation.

So normally countries are effectively in Neil’s “currency zone”, a scenario where the external sector is relevant. Hope I got something right there???

Frances,

DeleteIn reply to Neil you say "The UK actually pays for its most important imports in dollars, not sterling".

There's something not right with that logic. If the UK is always in trade deficit, where does it get all the dollars from in the first place?

The UK's most important imports are not all its imports, and some of the UK's exports are also priced in dollars. There is therefore an inflow of dollars through trade. A balance of payments crisis would be likely to arise if there was a sharp rise in the price of something essential that is priced in dollars. The most obvious is oil, but actually the fact that the UK is an oil producer (even though it is a net importer) makes this less likely, since export prices would also rise.

DeleteNeil Wilson ignores the fact that external trade is generally not conducted in the domestic currency. He also ignores the political issue that Neil Lancastle raises: how long will domestic households tolerate a demand squeeze that means the only people who can save in the domestic currency are foreigners? I mentioned Greece for a reason.

IMHO the key issue is FOREIGN DEBT by which I mean denominated in foreign currencies. In UK's case it's almost ZERO ( both for public and private sector ) and I have BoE data on hand to prove it.

DeleteThere must be something wrong with your British USD exports/imports numbers. Why doesn't British economy accumulate foreign currency liabilities ?

Balance of payments crisis cannot happen in Britain just as it cannot happen in USA because paying foreigners simply means crediting their accounts with GBP/USD.

This is called SOVEREIGNTY :)

I'm afraid this is simply wrong. The UK cannot pay for dollar-priced imports in GBP. The reason why the UK does not have much in the way of foreign currency debt is probably because it is the centre of the Eurodollar market. But that does not mean it could not have a balance of payments crisis. It has, several times, though not in the last two decades.

DeleteFrances,

DeleteThanks for your reply to my question (of 24 March 2015 at 21:56).

You stated that "Neil Wilson ignores the fact that external trade is generally not conducted in the domestic currency." I'm struggling to understand how such an arrangement is any use to UK companies.

Taking a concrete example, are you saying that when Rolls Royce sell a jet engine to a US airline customer they simply deposit the money in their US bank account (rather than exchange it for £s)?

I can see that might have a benefit to avoid FX costs when they buy parts from US subcontractors and would also be a hedge against currency fluctuations. But you assert Rolls Royce would as a rule hardly ever transfer those $ revenues back into £s. So that leads to the question where does Rolls Royce (as an export-driven business) get the funds it needs to pay wages, dividends etc. which are all denominated in £s?

Surely you cannot have a balance of payments crisis if you have a floating exchange rate. What you get is a depreciating currency, which drops to alevel where payments 'rebalance'. The last time there was a UK balance of payments crisis was when we were trying to fix the pound via the ERM. The fix was dropped, the currency depreciated and the crisis disappeared.

DeleteCorrect it has to add to zero.

DeleteWhat you don't see is the world is a closed system. So yes we could reduce our trade deficit Frances, but some other country will have to increase theirs!

Exports = Imports

And where every country

Net exporters won't want the pound to go down. They won't have a place to buy their stuff! Especially true in Euroland where the govts are NOT sovereign in their own currency and have to "export or die." See German exports to US cutting into demand due to tight fiscal policy in both the US and Germany.

So the question is - will net exporters let the pound drop? If they can there is a medium term rebalancing needed (I wouldn't call it crisis.)

All external sectors add up to zero. So for any nation's citizens to net save there will have to be budget deficits. Maybe it would be their govt or they net export to another nation who run trade deficits and budget deficits.

The solution to this is to abolish the requirement that nations £-£ issue debt in relation to spending. Or QE stuff.

I agree partially. If there is a rise in oil price, there is a new claim on real income. The UK is dependent on oil so you get the workers and corporation to moderate their claims via wage restraint.

Delete"how long will domestic households tolerate a demand squeeze that means the only people who can save in the domestic currency are foreigners? I mentioned Greece for a reason."

DeleteI would say - until our idiot politicians start increasing the deficit and stop destroying private savings ;)

But this is entirely self-inflicted, unlike Greece where the troitka rule the country despite election of Jan 2015 of new govt.

Random,

DeleteOh, but I DO see that the world is a closed system. I keep saying we don't (yet) trade with Mars. So yes, for us to reduce our trade deficit, others - principally in the EU, since that is by far our largest trading partner - must give up their trade surpluses. Germany is our largest trade creditor.

I am wondering where this is going to come from then.

DeleteWhy are we not seeing the obvious if we want to do this - manipulate the exchange rate down.

The BoE has unlimited ability to print pounds and swap for foreign exchange and build up reserves.

Also, in Euroland govts are not sovereign so it is "export or die."

There are two very good reasons why outright manipulation of the exchange rate as you suggest is not viable.

Delete1) It is contrary to the terms of the UK's IMF membership and is a violation of international law. Personally I think the ECB is legally on thin ice with its QE programme, given that it admits the channel through which this is most likely to work is the exchange rate channel - i.e. deliberate devaluation of the Euro.

2) It would inevitably be countered by similar action from our trade partners. We would be engaged in competitive devaluation, which is always doomed to fail - as indeed it did in the 1930s. If everyone tries to devalue their currency in order to boost exports, no-one can.

Why isn't UKIP as anti-import as they are anti-immigrant? As I see it the only good reason to leave the EU would be to stop the deluge of imports wrecking our economy...

ReplyDeleteRemember, imports are a real goods and services surplus. Just abandon the £-£ issuance of debt rules if you are worried about foreigners buying debt.

DeleteWhat do we mean when we say money or capital flows in or out of a country? The sector balance approach helps us to see that from the perspective of govt all relevant entities are by definition on their balance sheet, regardless of the nationality of the owner. To me 'outflow' means demand to hold vis a vis another falls. In a global currency war, with CBs chasing each other down by buying fx and foreign bonds to prop up their exports who is the patsy? Is it meaningful to worry about which sector owns the debt? What distinguishes the UK for the current account is our domestic settings that lets just anyone buy national infrastructure, including housing, boosting the rent sector. Crush the rents, force them to hold paper in return for real goods and services they are desperate to send to you.

ReplyDeletehttps://www.gov.uk/government/statistics/energy-trends-march-2015

ReplyDeleteNotice the rise in transport fuel and the decline of all other inputs such as domestic heating oil.

ReplyDeleteThis is the monopoly of credit in action.

Increased corporate activity infact reduces the resources available to individuals , families and communities.

And no its not the milder weather.

The mild weather of 2014 merely highlights the continual structural deformation within the economy.

The banks front load consumption typically today by creating credit for diesel cars.

Refer to page 40

ReplyDeleteElectricity generated fell 6.7 %……

Coal fired generation fell 25.6 % !!!!!

The conversion of Drax to biomass is a form of deep industrial sabotage.

As a man from the bogs I can tell you Biomass is only effective for local domestic heating.

The Transformation and transmission losses from this policy is absurd.

We can clearly see the energy policy of the UK and Europe is to destroy the Industrial surplus so as to maintain wealth concentration.

To partially compensate for this we can see that net imports of electricity were at a record high (chiefly from depression hit nuclear France)

ReplyDeleteAt 20.5 TWH , up a truly massive 42% on 2013.

The UK is getting all the benefits of a couple of large nuclear power stations but without the costs.

To partially compensate for this we can see that net imports of electricity were at a record high (chiefly from depression hit nuclear France)

ReplyDeleteAt 20.5 TWH , up a truly massive 42% on 2013.

The UK is getting all the benefits of a couple of large nuclear power stations but without the costs.

I just couldn’t leave your website prior to suggesting that I really enjoyed the usual information a person supply on your guests?

ReplyDeleteIs going to be again regularly to check up on new posts

Obat Rheumatoid Arthritis Herbal, Obat Kanker Prostat Alami

And now Norse Hydro........I suppose once its connected London will conspire with the British state to induce a demand killing depression in Norway.

ReplyDeletehttps://www.gov.uk/government/news/uk-and-norway-building-links-to-deliver-energy-security-and-prosperity

Always ask - who benefits..........

Who benefits from MMT (theory)? Does any one see any big gaping holes in the theory?

DeleteWhat does sectoral (only financial) balances represent? What is missing from sectoral (only financial) balances? If what is missing is counted how does the picture get more realistic?

Hint: Is this purely financial accounting commonly acceptable accounting practice? What is their definition of savings? Is it a poor definition?

Most financial assets have a counter party for the value or price.

DeleteMany tangible assets are held by the owner. Tangible assets usually not financial assets. But, they are assets.

If a theory says only count financial stuff and you trade all the tangible for financial are you actually more wealthy?

The treasury getting tangibly wealthier, makes us all non treasury financially wealthier. Is that it?

DeleteCorrection:

DeleteTangible assets are usually not financial assets. But, they are assets.

UK energy consumption now below the implosion level reached in 1984. ( the previous restructuring of society and economy so as to absorb euro surplus production)

ReplyDeleteThis despite the population being just 56.4 million back then so arguments regarding improved efficiency don't hold water.

UK's present population a result of capitalistic ranch style exploitation of the colonies and subsequent resettlement of displaced populations in the core beginning on a mass scale with the Irish migration of the 19 the century toward the industrial NW.

This is completely insane - all the parties want to reduce the deficit but do not have a plan to reduce the trade deficit. The private sector is net dissaving (

ReplyDeleteThe latest data -http://www.3spoken.co.uk/2015/04/uk-sectoral-balances-q4-2014.html?m=0

"This may have been a traumatic response to the dot-com crash, but to me this looks more like a policy change around 2001 that encouraged corporate saving. I wonder what it was. Any suggestions?"

ReplyDelete2001 marks the re-election of the Labour Party and Gordon Brown's subsequent abandonment of Ken Clarke's fiscal policies (with the attendent extra spending on hospitals and schools leading the govt back into deficit circa 2002 etc which the Tories now ironically blame for our present difficulties...) Could this be the answer? Ie. Government policy was the driver.

You asked for suggestions on why the corporate sector started saving in 2001. One contribution to this is, I believe, the transfer of the cost of pensions from workers who leave a job early to the corporate sector. Previously firms essentially acted as a benefit organisation taking money off people who would never get any benefit from it and giving it to current pensioners.

ReplyDeleteGovernment policy to ensure that money paid into pensions for that individual - by firm and individuals - gave that individual an entitlement to money when they leave the job - either to retire or any other form of job separation.

There were also rules brought in at the same time to ensure that pension liabilities were reflected on firm's balance sheet.

And as this saving is for current expenditure not investment that would boost the growth rate of the economy so you are robbing Peter to pay Paul.

With firms now responsible for pensions they began to close down the most costly - defined benefit schemes but they still have to pass on money in defined contribution schemes so need to increase their non-investment savings. Therefore, although I think some of the effect is likely to have worn off as DB schemes are closed down there is still a structural rise in non-growth inducing savings. It is analogous to a hypothecated tax on firms to pay a pension.

And I think that the introduction of auto-enrolment will have a similar effect. I have always seen it as a tax on wages and an increase in non-wage labour costs.

Bill Wells

Thank you for this interesting piece to understand how money is distributed. But I have a question: You say at onset; "In 2010, the external sector was in deficit (green line on chart) ..."

ReplyDeletehttp://bit.ly/1BfTzyS

But the said green line is always in positive territory.

This is a sectoral net lending chart. The green line shows the net lending of foreigners to the domestic economy. If the net lending of foreigners is positive, then the external sector of the domestic economy is in deficit. In the national accounts this shows up as a deficit on the current account and a surplus on the capital account.

DeleteComing back to this post, perhaps the shift to a greater share towards capital and away from labour led to household borrowing and corporate saving?

ReplyDeletePlus the dot com boom, tight labour market and minimum wage effects in the late 90s.