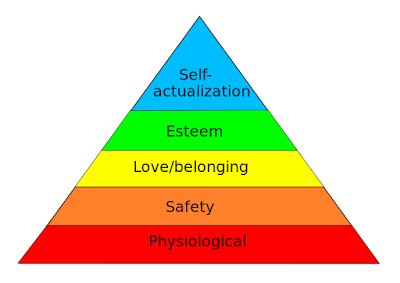

Maslow's hierarchy of money

A new study shows that the form of shadow "money" used in US prisons is changing. For many years it has been cigarettes (tobacco), and to a lesser extent stamps and envelopes. But now it seems the popularity of these in the prison black economy is declining - in favour of food. Specifically, Ramen noodles, a high-calorie, substantial foodstuff. Without examining the reasons for this change, it would be easy to assume that this is a matter of relative scarcity. Perhaps Ramen noodles are cheaper and more widely available than cigarettes, so inmates are turning to them because they are easier to obtain. If so, then Gresham's Law tells us that Ramen noodles would eventually become the principal medium of exchange. Cigarettes would gradually disappear from circulation, becoming an increasingly expensive store of value. Of course, rich prisoners might worry that lack of demand for cigarettes would reduce their value - after all, if you can't sell your ciggies, yo...