Spurious precision

Over at Bloomberg View, Noah Smith has a pop at what he calls “heterodox economics”. By this he means the new ideas in economic thinking that have sprung up since the 2008 financial crisis but so far haven’t made it into mainstream economic journals.

Noah starts by admitting that mainstream economics abjectly failed to predict the crisis and gave little or no guidance on how to deal with it. Because of this, according to Noah, “many people have looked around for an alternative paradigm -- a new way of thinking about macroeconomics that would have allowed us to avoid the pitfalls of the Great Recession.”

Indeed they have. Though some of the ideas are not so new – Hyman Minsky’s “Financial Instability Hypothesis”, for example, dates back to 1992.

According to Noah, the search for alternative thinking inevitably attracted people who – for whatever reason – “felt shut out” of the mainstream. And as an example of one of these so-called “heterodox” economists, he cites me. Here’s Noah's quotation from my post “The necessary arrogance of elites”, together with his introduction to it:

Many among the heterodox would have us believe that their paradigm worked perfectly well in 2008 and after. As an example, take a recent blog post by British economics writer Frances Coppola. Coppola likens mainstream macro to classical music, which walled itself off from the innovations of rock and jazz. Like the musical innovators of the 20th century, she claims, the heterodox have found something that works better than the ossified old ways of the elite:

(The post from which these quotations are taken was actually written in 2012. It was reprinted recently by Evonomics under the title “What UnpopularMusic Can Teach Us About The Future of Economics”.)Heterodox economists working in the real economy –- many of them untrained in formal economics –- not only predicted it but correctly identified the causes …The redefinition of the foundations of economics that is currently being done by heterodox economists will inevitably result in many of the models beloved of academic economists becoming obsolete.

The paragraphs from which Noah has taken these quotations actually say the exact opposite of what he claims. Here they are, in full:

And as with “serious” music, when economics becomes so divorced from reality that it fails adequately to explain the real world in which people live, people reject it. People rightly ask why academic economists failed either to predict or adequately explain the financial crisis, whereas heterodox economists working in the real economy – many of them untrained in formal economics – not only predicted it but correctly identified the causes. There is a real danger that the anger people feel over what they see as the failure of mainstream economics leads to rejection of mainstream economics in its entirety and, importantly, withdrawal of funding for academic economic research. This, I feel, would be a mistake.

We may not see the relevance of dynamic stochastic general equilibrium models in a world which manifestly is not in equilibrium. But that doesn’t mean that these, and other mathematical models, have nothing to contribute. The redefinition of the foundations of economics that is currently being done by heterodox economists will inevitably result in many of the models beloved of academic economists becoming obsolete: as with much of the experimental serious” music of the 20th century, they will not survive the test of time. But there will be models that remain relevant, and there will be others that appear obsolete but that will in due course be redeveloped and find new life in the new economic paradigm. If we allow them to disappear, our economic understanding in the future will be the poorer.Contrary to the impression Noah gave, I was defending mainstream economics and its beloved mathematical models. But not because they have done a good job – they have not. And not because economics does not need a different paradigm. It does, desperately. Noah’s arrogant defence of mainstream economics shows this more clearly than anything the heterodox community could say.

We who live through this paradigm shift have a blinkered and biased view, rendering us unable to see the true value of either the old or the new. We either defend the old and reject the new, because the old is all we know and the new has yet to prove itself; or we reject the old and defend the new, because the old has failed and we need something to believe. These are, of course, extremes. The eventual synthesis will include elements of both old and new. In what proportions, history will decide.

And this brings me to my fundamental objection to Noah's post.

Noah's core proposition is that economics has no validity unless it is expressed in mathematical terms. He says that economics without mathematics doesn’t add up. But economics consisting entirely of mathematics doesn’t add up either. Exclusive reliance on mathematics as language is highly problematic, and not just because it inevitably creates a protected elite. It is because of the impossibility of precision. To explain this, here is another musical analogy.

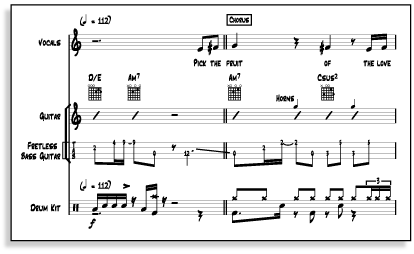

Anyone who has ever attempted to write down, in conventional musical notation, exactly what a jazz singer does knows how imprecise and inadequate musical notation is. Yet when it is removed from the source and viewed academically, it creates a kind of spurious precision. The original intention is demeaned and deformed to fit into the straitjacket of the notation, and the notation then “becomes” the music. Gifted performers, of course, interpret the music from the notation – but in bringing it to life, they re-create imprecision.

So too, relying on mathematical models to explain how our complex, ever-changing world works demeans and deforms it. The more precise a model is, the more unrealistic assumptions have to be made to make it work, and the less likely it is to be an adequate representation of reality. Reality is imprecise and transient.

The great economists of the past knew this - which is why we do not find pages of Greek symbols even in the writings of those who, like John Maynard Keynes, were fine mathematicians. And some members of the mainstream are beginning to realise that economics is much bigger than their beloved DSGE models. Olivier Blanchard, for example, recently called for a more diverse range of models, including "ad hoc" schematics that have little precision and much imagination. "There is room for both science and art", he said. Though he can't quite let go of the DSGE dream, not yet......

Noah's post unfortunately seems to have elicited some rather defensive responses from the heterodox community, along the lines of “But we DO like mathematics!” or even, “Actually our mathematics is better than yours”. But this is to buy into Noah's core proposition. The heterodox economics community should - and, to be fair, in most cases does - reject it outright. Economics is not, and cannot be, exclusively mathematical. This is the terrible mistake that the mainstream economists of our time have made.

The spurious precision of mathematics led "serious" music down the blind alley of serialism. And it has led mainstream economics down the blind alley of general equilibrium. I defend DSGE models, yes, but for their future possibilities, not for their current application.

There is no need for the heterodox economic community to be defensive about vagueness. Vagueness is creative, and imprecision and ad-hocery are the future. The art of economics is being reborn.

UPDATE: I have removed from this post five bullet points which were intended as a very brief summary of Noah's post, and reorganised the post to compensate. Noah says that they are not what he meant, and I respect that. And anyway, they are a distraction from the core argument of this post.

Related reading:

Where danger lurks - Olivier Blanchard

Colds, strokes and Brad Delong

The Slowly Changing Resistance of Economists To Change - Steve Keen (Forbes)

Image from Sibelius.

Here's my personal take, and I have many points. First of all, can everyone PLEASE stop equating economics with macroeconomics; did macro fail? Maybe. Did ALL of economics fail? Of course not. Economics is a far larger discipline than just macro.

ReplyDeleteSecondly, you definitely don't need obscure heterodox models to predict a financial crisis. I've cited it before, but for instance Kiyotaki-Moore (http://www-users.york.ac.uk/~psm509/ULB2012/KiyotakiMooreJPE1997.pdf) basically sketches out how a crisis like this can occur. There are actually plenty of examples of perfectly fine mainstream papers on this topic. And it wasn't just heterodox economists that predicted it. People like Dean Baker, Roubini or even Krugman didn't exactly rely on post-Keynesian or Minskyian economics, their logic was fairly straight forward. Stiglitz has some great models on bank failure, which are essentially mainstream info-asymmetry economics. I also think Minsky is useful but not that useful, and it's not especially scientific. He doesn't really have any kind of model, he just essentially asserts that banks will turn to speculators (and also made a lot of mistakes with regards to importance of credit cards, diminishing importance of large infrastructure loans etc..) The mechanisms aren't adequately explained. At least the Austrians, who I definitely oppose, have a mechanism for how banks turn to unstable speculators - aggressive monetary policy.

I don't think economics has to be mathematical. In fact I think there are very valuable insights from non mathematical economists, such as Ronald Coase. But I think the low hanging fruit has almost all been picked in that regard - eventually 'verbal' economics becomes inadequate to deal with all the confounding factors and dynamic problems that make problems very hard to think through without using maths. It's also quite difficult to test and reject verbal theories, because people can constantly claim they're being misinterpreted, and that they meant something else.

There is an exception though, one non (especially) mathematical low fruit that has yet to be picked. There is definitely a bit of a blindspot in macro as to how modern banking works, and heterodox econ is definitely helpful here to enrich economics in general.

1) I do in fact distinguish between micro and macroeconomics. See this post: http://www.coppolacomment.com/2015/02/the-failure-of-macroeconomics.html

Delete2) With respect, any model which treats the cause of a financial crisis like that in 2008 as exogenous ("a temporary shock to productivity") is unable to "predict" it. It may describe how a crisis propagates itself, but that is not predicting the crisis. Kiyotaki-Moore is a helpful model, I agree, but the lack of endogeneity limits its usefulness. I have a similar problem with Diamond-Dybvig on bank runs, and Shin on cross-border regulatory arbitrage. They do not model the endogeneity of money, and because of that they fail to capture the toxic leveraging effect that makes a crisis possible. It really isn't good enough to say "but mainstream models can predict financial crises". They can't, because they don't accurately model the financial sector.

But going beyond that, "your models aren't very good" is a fallacious response to criticism. it is playing the man, not the ball. And since models are by their nature inadequate explainers of reality, I'd rather economists took a more philosophical approach. "Show me your thinking" is considerably better than "Show me your model", surely.

3) We do not know much about the economic system we are creating (note the present tense), yet you say with amazing certainty that mathematics - despite its flaws - is now the only game in town. That's a fine example of the arrogance I am discussing.

YOU find it difficult to think through complex problems without using the language of mathematics. My experience of mathematics-dominant thinkers is that their learning style is highly visual. That would make them dominant in the population, but it does not mean that their approach to thinking through problems works for everyone. For auditory-dominant people like me, words are better tools. I can do maths, but it does not help me to understand.

Why are you so worried about misunderstanding? Misunderstanding sparks debate, which is how we learn. One of the most distressing effects of mathematical modelling is to provide ample opportunities to STOP debate by appealing to authority - which you did yourself in your second paragraph, by the way. Argumentum ad verecundiam is as fallacious as ad hominem. Just because something is expressed in Greek symbols littered with superscripts and subscripts doesn't make it either complete or accurate.

And I repeat again my warning about spurious precision. I completely disagree that using mathematics eliminates misunderstanding. On the contrary, in attempting to make precise that which is innately imprecise, it may cause it.

4) Generous of you to admit that macro hasn't got a clue about banking.

"The spurious precision of mathematics..."

ReplyDeleteDon't blame mathematics for economists' misuse of it. If economists are writing down spuriously precise - non-probabilistic - mathematical models, that's the spurious precision of economics not the spurious precision of mathematics.

I have not blamed mathematics. But I dispute your underlying assumption that probabilistic mathematical models are free of the spurious precision problem. Many economic models are probabilistic, but the calibration of them requires hefty assumptions. When these add up to reinventing reality to suit the model, we are in the realms of spurious precision, since the model can only be AT BEST a partial and flawed view. Macroeconomic models are particularly badly affected by the "heroic assumptions" problem, but microeconomic models can be wrongly founded too.

DeleteI suppose what I am saying amounts to the old computer programmer's adage - "garbage in, garbage out". The model itself may be wonderful, but if the assumptions and/or the data on which it relies are rubbish, so will its results be. An elegant model is no substitute for a well-thought-out theory and decent data - neither of which come readily to hand in macroeconomics, as far as I can see.

Well you do seem to believe that the spurious precision in economics is a consequence of its reliance on mathematical models. And that just doesn't make sense to me - at least not while probability theory is a part of mathematics. If those economic models you say are probabilistic were fully probabilistic then there's no good reason why they should suffer from spurious precision. Of course one can specify spuriously precise and/or ill-founded probabilistic models but that's just bad science. And if economists are building models which aren't even based on 'well thought out' theory and 'decent' data, it's not even that. GIGO, as you say. If economists honestly and diligently represented the uncertainty in the assumptions, parameters and initial data of their necessarily partial and flawed mathematical models I don't see how there could be any spurious precision. The models would either usefully - i.e. not unusably imprecisely - and accurately describe reality or they wouldn't. Economics is and is likely to remain a high entropy science. If it's pretending not to be that's not because its description by mathematical models is intrinsically spuriously precise.

Delete"We may not see the relevance of dynamic stochastic general equilibrium models in a world which manifestly is not in equilibrium."

ReplyDeleteIf the world is manifestly not in equilibrium, then what?

"Consumption is the sole end and purpose of all production; and the interest of the producer ought to be attended to only so far as it may be necessary for promoting that of the consumer. The maxim is so perfectly self-evident that it would be absurd to attempt to prove it. But in the mercantile system the interest of the consumer is almost constantly sacrificed to that of the producer; and it seems to consider production, and not consumption, as the ultimate end and object of all industry and commerce." --Wealth of Nations

Consumption is, inter alia, food and shelter, which are political questions. If the market is not self-regulating, and cannot by virtue of its self regulation assure reliable baseline consumption of food and shelter, that is a political problem, for which the political solution is then, necessarily, state regulation of and intervention in the market.

The "original sin" of economics as a discipline is the initial motivation to preserve and expand the power of capital relative to the power of the state. "Self regulation" and "equilibrium" are the foundations of that program.

If you remove the foundations of "self regulation" and "equilibrium", economics then becomes the study of effective state regulation of and state intervention in the market to ensure reliable baseline consumption, which may well be a perfectly viable intellectual program, but it is certainly not the program that the people paying the bills have been buying for the last two hundred years.

c.f. http://delong.typepad.com/kalecki43.pdf

For regular articles which take the mick out of excessive use of maths in economics, see Lars Syll's blog. https://larspsyll.wordpress.com/

ReplyDeletePlus statistics seems to be his speciality, so he's well qualified to say when and when not to use maths.

I have linked to Lars Syll's recent post on this very topic.

DeleteQualified, maybe. Right, no. He has repeatedly written nonsense criticisms of Bayesian statistics/probabilty/inference and doesn't even respond to counter-criticism: https://larspsyll.wordpress.com/2012/06/12/one-of-the-reasons-im-a-keynesian-and-not-a-bayesian/

DeleteI have a Noah Smith filter.

ReplyDeleteThrow out the old that is false! Just get rid of the false!

Isn't there much more constructive material to draw on that Smith's? Yes there is.

Here's some sloppy thinking from Smith which infuriated me (entirely unrelated to this post). Apparently American liberals have to go much slower than Sanders and do things "one by one" otherwise you turn into Venezuela or something. Never mind that his "political revolution" would do less at one time than British Labour did in 1945. "A bit glib" indeed. (And Venezuela had similar economic, and political, problems under past right-wing govts. It's because of the oil price) https://www.bloomberg.com/view/articles/2016-05-18/a-socialist-revolution-can-ruin-a-country

ReplyDelete