Debt hysteria

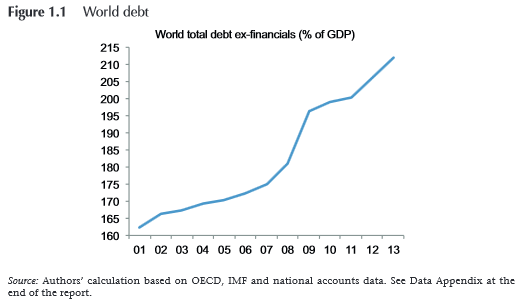

I have been reading the Geneva 16 report , which came out yesterday. It's scary stuff. If you thought the world was reducing its debt pile - forget it: The debt is still growing, but the world's GDP growth is slowing. Indeed as aggregate debt figures are usually quoted versus GDP, the two are connected. The debt pile grows faster as growth slows, simply because the denominator is falling. The report looks at total debt/GDP - not just sovereign debt. This is refreshing: unrelenting media focus on sovereign debt as the principal problem misses the fact that in many countries the bigger burden is PRIVATE debt. However, it makes the figures even worse. Global debt, it seems, is a terrible problem. None of this will come as a surprise to anyone, except perhaps the news that the world as a whole is actually accumulating debt rather than deleveraging. The deleveraging efforts by developed countries are being more than offset by the increasing debt of emerging markets, particu...