Patrick Minford's holidays

Skewering Patrick Minford has become something of an economists' bloodsport. I admit, I have done my fair share of Minford-bashing, though I do try to stay away from trade economics. Others are much better at lampooning Minford's antediluvian approach to trade economics than me.

But when Minford starts pontificating on the effect of currency movements on the balance of trade, I can't resist getting out the shotgun. Minford is appallingly bad on anything that involves foreign exchange. He just doesn't seem to understand how floating exchange rates interact with trade dynamics and capital flows. So it is unsurprising that his latest venture into this complex subject is as disastrous as the last.

Here is Minford, in the Express, talking about Brits and their holidays:

No, you are not seeing things. Most of the real depreciation happened before the Brexit vote. Maybe the FX community priced in Brexit even though they didn't really expect it? Mind you, the pound has never recovered - perhaps Brexit might have something to do with that. Though personally I think it is more likely that what is keeping the pound down is the total shambles that the Government is making of Brexit. Would you invest in sterling assets right now, if you didn't have to?

But even if there were a "Brexit devaluation", the notion that it makes holidays in the U.K. "unbeatable value" for Brits is completely loony. What sterling depreciation has done is make holidays everywhere else more expensive for Brits. Holidays in the U.K. are no cheaper than they were before. They may even be more expensive, if the tourist industry is cashing in on a windfall from Brits forced to forego their customary 10 days on the Algarve. You know, demand rising faster than supply results in higher prices? For some reason, when foreign exchange is involved, Minford's grasp of basic economics seems to desert him. However you look at it, British holidays for Brits are not "unbeatable value". They are a poor substitute for the sun and sand to which Brits have become accustomed. I would also have to say, from my own experience of holidaying in the U.K., that even with sterling depreciation they may not work out much cheaper than a holiday abroad. Entertaining the kids in the British rain can be extremely expensive.

But are holidays in Britain "unbeatable value" for everyone else? This is sterling versus the U.S. dollar:

Hmm. If I were an American, I would be kicking myself if I didn't visit the UK in late 2016 or early 2017. That was "unbeatable value". Now, not so much.

It's also worth noting that the "Brexit devaluation" in the second half of 2016 was short-lived: by the end of 2017 the pound was almost back to where it had been before the vote, though not back to where it was in 2015. Sterling depreciation in 2018 is mainly because of a very strong dollar, driven up by Fed interest rate rises, quantitative tightening and the Trump administration's tax cuts. The pound is far from the only currency that is depreciating versus the dollar.

How about Europeans? Here's sterling versus the Euro:

Holidaying in the U.K. looks pretty good for Europeans right now - as indeed it has for the whole of the last year, largely because of the strength of the Euro due to the Eurozone economic recovery. Yes, you read that right. The persistent weakness of sterling versus the Euro is because the Eurozone is growing more strongly than the U.K. The U.K. may have record low unemployment, but real wages are barely keeping pace with the inflation caused by sterling depreciation and, more recently, oil price rises. Furthermore, U.K. GDP growth has collapsed since the Brexit vote and is now weaker than in either the Eurozone or the U.S., according to the OECD:

.But what about the "mood of consumers"? Is it as buoyant as Minford says? Here is what Deloitte has to say about U.K. consumer confidence right now:

But I have been saving the best till last. Minford says that the "Brexit devaluation" - which remember is now over two years old - is "driving a strong improvement in the balance of payments". Now of course he is quoted in the Express, which is not noted for its strength in the economics department. I'm not sure that the average Express reader would have much idea what the "balance of payments" is. But readers of this blog do, so I've fact-checked Minford's statement. It's complete baloney.

Here is the U.K.'s balance of payments since 2015, from the latest ONS balance of payments release (which unfortunately does not take us beyond March 2018):

Perhaps my eyes aren't what they used to be, but this doesn't look like a "strong improvement" to me. It looks like a stubborn deficit in trade in goods, an equally stubborn surplus in trade in services, and some variation in primary income. The narrowing of the current account deficit since Q4 2015 appears to be almost entirely driven by changes in primary income, and all it has done is restore the balance to where it was in Q1 2015. That's not "improvement", it's stagnation.

But perhaps Minford means the trade balance, not the current account. The trade balance is the balance of exports and imports in both goods and services. Here it is from 2016 to Q2 2018:

Umm, this doesn't look like a "strong improvement" either. What does the ONS itself have to say about the trade balance?

The fact is that everything Minford said is wrong. There is no "strong improvement" in the balance of payments, holidays in Britain aren't "unbeatable value" for Brits, consumer mood is not "good", and although the U.K. economy is "continuing to grow", it is much weaker than before the Brexit vote. Brexit uncertainty is undoubtedly weighing on the pound, but the "Brexit devaluation" simply is not generating the benefits that Minford claims.

Of course, if Brits all chose to holiday in Britain instead of flying to the sun, there would be an improvement in the balance of payments. Perhaps that's what Minford wants. After all, his exuberant post-Brexit forecasts (as much as 6.8% boost to GDP) depend upon sterling depreciation strongly boosting the UK's external position. He's got to bring it about somehow. So, Brits, stay at home. Your country needs it.

If I were of a suspicious frame of mind, I would at this point start wondering whether Minford set out to deceive Express readers, who - let's face it - are somewhat gullible when it comes to fictitious data and voodoo economics which support their Brexit faith. But it may be that he was misquoted by Express journalists, who aren't exactly known for factual accuracy. Or perhaps he is just losing it.

Whatever the reason, those two sentences from Minford are no more true than "£350m for the NHS" on the side of a bus. And no more honest.

Related reading:

Tariffs, trade and money illusion

An Alternative Brexit Polemic

The snake oil sellers

But when Minford starts pontificating on the effect of currency movements on the balance of trade, I can't resist getting out the shotgun. Minford is appallingly bad on anything that involves foreign exchange. He just doesn't seem to understand how floating exchange rates interact with trade dynamics and capital flows. So it is unsurprising that his latest venture into this complex subject is as disastrous as the last.

Here is Minford, in the Express, talking about Brits and their holidays:

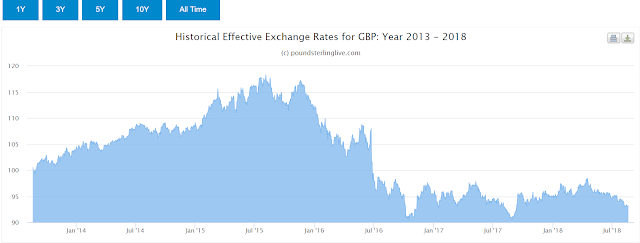

The mood of British consumers is good, reflecting the fact that the economy continues to grow and create record employment.As a reminder, here is the Brexit depreciation,* charted:

A staycation is best because of the Brexit devaluation, which makes British holidays unbeatable value and is driving a strong improvement in the UK’s balance of payments.

No, you are not seeing things. Most of the real depreciation happened before the Brexit vote. Maybe the FX community priced in Brexit even though they didn't really expect it? Mind you, the pound has never recovered - perhaps Brexit might have something to do with that. Though personally I think it is more likely that what is keeping the pound down is the total shambles that the Government is making of Brexit. Would you invest in sterling assets right now, if you didn't have to?

But even if there were a "Brexit devaluation", the notion that it makes holidays in the U.K. "unbeatable value" for Brits is completely loony. What sterling depreciation has done is make holidays everywhere else more expensive for Brits. Holidays in the U.K. are no cheaper than they were before. They may even be more expensive, if the tourist industry is cashing in on a windfall from Brits forced to forego their customary 10 days on the Algarve. You know, demand rising faster than supply results in higher prices? For some reason, when foreign exchange is involved, Minford's grasp of basic economics seems to desert him. However you look at it, British holidays for Brits are not "unbeatable value". They are a poor substitute for the sun and sand to which Brits have become accustomed. I would also have to say, from my own experience of holidaying in the U.K., that even with sterling depreciation they may not work out much cheaper than a holiday abroad. Entertaining the kids in the British rain can be extremely expensive.

But are holidays in Britain "unbeatable value" for everyone else? This is sterling versus the U.S. dollar:

Hmm. If I were an American, I would be kicking myself if I didn't visit the UK in late 2016 or early 2017. That was "unbeatable value". Now, not so much.

It's also worth noting that the "Brexit devaluation" in the second half of 2016 was short-lived: by the end of 2017 the pound was almost back to where it had been before the vote, though not back to where it was in 2015. Sterling depreciation in 2018 is mainly because of a very strong dollar, driven up by Fed interest rate rises, quantitative tightening and the Trump administration's tax cuts. The pound is far from the only currency that is depreciating versus the dollar.

How about Europeans? Here's sterling versus the Euro:

Holidaying in the U.K. looks pretty good for Europeans right now - as indeed it has for the whole of the last year, largely because of the strength of the Euro due to the Eurozone economic recovery. Yes, you read that right. The persistent weakness of sterling versus the Euro is because the Eurozone is growing more strongly than the U.K. The U.K. may have record low unemployment, but real wages are barely keeping pace with the inflation caused by sterling depreciation and, more recently, oil price rises. Furthermore, U.K. GDP growth has collapsed since the Brexit vote and is now weaker than in either the Eurozone or the U.S., according to the OECD:

.But what about the "mood of consumers"? Is it as buoyant as Minford says? Here is what Deloitte has to say about U.K. consumer confidence right now:

Consumer confidence improved in the second quarter of 2018, according to the latest Deloitte Consumer Tracker. Overall consumer confidence grew by two percentage points to -4% benefitting from the effects of a strong labour market, gradual wage growth and the feel-good factor associated with the start of the summer...Eh, wait....minus four percent?

...This represents the highest level of consumer confidence since the Tracker started in 2011 and comes after a year of consistent growth from a low point of -10% in Q2 2017. However, there is a note of caution alongside these results as confidence remains in overall negative territory.Consumer mood, gloomy but improving. Hardly "good", is it, Patrick?

But I have been saving the best till last. Minford says that the "Brexit devaluation" - which remember is now over two years old - is "driving a strong improvement in the balance of payments". Now of course he is quoted in the Express, which is not noted for its strength in the economics department. I'm not sure that the average Express reader would have much idea what the "balance of payments" is. But readers of this blog do, so I've fact-checked Minford's statement. It's complete baloney.

Here is the U.K.'s balance of payments since 2015, from the latest ONS balance of payments release (which unfortunately does not take us beyond March 2018):

Perhaps my eyes aren't what they used to be, but this doesn't look like a "strong improvement" to me. It looks like a stubborn deficit in trade in goods, an equally stubborn surplus in trade in services, and some variation in primary income. The narrowing of the current account deficit since Q4 2015 appears to be almost entirely driven by changes in primary income, and all it has done is restore the balance to where it was in Q1 2015. That's not "improvement", it's stagnation.

But perhaps Minford means the trade balance, not the current account. The trade balance is the balance of exports and imports in both goods and services. Here it is from 2016 to Q2 2018:

Umm, this doesn't look like a "strong improvement" either. What does the ONS itself have to say about the trade balance?

- The total UK trade deficit widened £4.7 billion to £8.6 billion in the three months to June 2018, due mainly to falling goods exports and rising goods imports.

- Removing the effect of inflation, the total trade deficit widened £4.1 billion in the three months to June 2018; falling goods export volumes were the main factor as prices generally increased.

Oops. So much for sterling depreciation causing a "strong improvement in the balance of payments". Currently, the trade deficit is worsening.

- The trade in goods deficit widened £2.9 billion with countries outside the EU and £2.6 billion with the EU in the three months to June 2018.

The fact is that everything Minford said is wrong. There is no "strong improvement" in the balance of payments, holidays in Britain aren't "unbeatable value" for Brits, consumer mood is not "good", and although the U.K. economy is "continuing to grow", it is much weaker than before the Brexit vote. Brexit uncertainty is undoubtedly weighing on the pound, but the "Brexit devaluation" simply is not generating the benefits that Minford claims.

Of course, if Brits all chose to holiday in Britain instead of flying to the sun, there would be an improvement in the balance of payments. Perhaps that's what Minford wants. After all, his exuberant post-Brexit forecasts (as much as 6.8% boost to GDP) depend upon sterling depreciation strongly boosting the UK's external position. He's got to bring it about somehow. So, Brits, stay at home. Your country needs it.

If I were of a suspicious frame of mind, I would at this point start wondering whether Minford set out to deceive Express readers, who - let's face it - are somewhat gullible when it comes to fictitious data and voodoo economics which support their Brexit faith. But it may be that he was misquoted by Express journalists, who aren't exactly known for factual accuracy. Or perhaps he is just losing it.

Whatever the reason, those two sentences from Minford are no more true than "£350m for the NHS" on the side of a bus. And no more honest.

Related reading:

Tariffs, trade and money illusion

An Alternative Brexit Polemic

The snake oil sellers

* Minford incorrectly uses the term "devaluation" to mean "depreciation". Devaluation is a deliberate act of policy, usually in a fixed or managed exchange rate system - for example, Wilson's devaluation of the pound in 1967. Depreciation is a fall in the market exchange rate.

Some indication of what Minford had in mind on the balance of payments might be given by his letter to The Times from July (https://www.economistsforfreetrade.com/Media/the-times-brexit-devaluation/). His figures are correct and only a little selective. However, I think his assertion that this reflects changes in trade rather than in investment income is incorrect.

ReplyDeleteThanks Nick. That's interesting. I think you may well be right about investment income. I will have a look at the NIIP for that period.

DeleteNick, it's definitely caused by changes in primary income, not trade. Specifically, income from direct investment turned negative in Q4 2015, but has now recovered and is roughly back to where it was in Q1 2015. The peak to trough movement is getting on for £10bn, which is more than enough to account for the improvement in the current account balance. See chart 3 here: https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/bulletins/balanceofpayments/quarter1jantomar2018

DeleteThis comment has been removed by the author.

ReplyDeleteI used figures going back over two years. That is what the charts show, including the trade balance chart from the latest ONS release.

DeleteI have warned you before about personal attacks and rudeness. I will not post comments from you that attack me or anyone else commenting on this site.

This comment has been removed by the author.

DeleteThis is not a political post, it is simply a debunking of extremely dodgy economic assertions and wrong statistics. Please confine yourself to discussing the subject of the post and refrain from political grandstanding.

DeleteI remind you AGAIN of the comment policy of his blog, as stated on the About This Blog page:

Delete- be polite and refrain from personal attacks on me or anyone else

- stick to the topic.

I will delete any posts you make that violate either of these rules.

This comment has been removed by a blog administrator.

DeleteThis comment has been removed by a blog administrator.

DeleteDepends entirely on the period over which the analysis takes place, e.g.

ReplyDelete1. Consumer confidence - is (i) much higher than in 08/09, (ii) lower than in 15, and (iii) had been increasing from late 17.

(https://tradingeconomics.com/united-kingdom/consumer-confidence)

2. Current account balance - is significantly better than in Q5 15, worse than in Q1 17, had been trending up since Q2 17.

(https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/timeseries/hbop/pnbp)

On the 'value' point, similarly depends on if the term is being used on an absolute or comparative basis.

Minford may not have made all of that clear. I'm not taking a position either way. But there are valid arguments supported by selective data points for his position, just as there are for yours.

Do other economies - the Eurozone for example - take 0.7% of all domestic sales/purchases, i.e. their GDP and send it abroad by law as foreign aid?

ReplyDeleteOur 2018 Economic growth figure is an expansion in sales/purchases (GDP) in the economy, of just 0.3%.

If 0.7% of that economies GDP is then to be taken, and sent abroad, doesn't that mean actual domestic economic activity has shrunk overall by -0.5%???

If GDP = C + I + G + (I -E) i.e. the Balance of Payments bit (Imports-Exports) on the end, means we subtract the money that is sent/spent abroad, this would indicate we are in a recession caused by excessive foreign aid payments.

How have I got this wrong???

It's not that simple.

DeleteFirstly, you have the national accounting wrong. Foreign aid is not part of the external sector (I-E). It is part of G. If you reduce G by that amount, total GDP is reduced, obviously. But as the benefit of foreign aid shows itself in the balance of payments (countries receiving aid can be better able to afford our exports), removing it from G only overstates GDP ex-foreign aid.

Secondly, you have GDP growth figures wrong. 0.3% is a quarterly figure, not a full-year figure. Independent forecast figures published by HM Treasury show estimated full-year GDP growth rate for 2018 as 1.4%. https://www.gov.uk/government/statistics/forecasts-for-the-uk-economy-june-2018

Nice try, but foreign aid is a fleabite, no more.