An Alternative Brexit Polemic

You would think, wouldn't you, that an "Alternative Brexit Economic Analysis" by four highly experienced and qualified economists would be a rigorous exercise in economic forecasting, supported by excellent econometrics and with care taken to avoid confirmation and selection bias?

A new paper from the Brexit-supporting thinktank Economists for Free Trade critiques the Government's recent forecast that Brexit would cause a GDP loss of between 2 and 8 percent over 15 years relative to remaining in the EU, with the "hardest" Brexit causing the greatest loss. Or at least, that's what the paper says it is doing. But the way it goes about it is decidedly odd for something claiming to be an "Alternative Brexit Economic Analysis".

The first section of the report is an extensive discussion of the reasons why no-one should ever believe forecasts produced by the UK Civil Service. The authors argued that because HMT's forecasts are frequently wrong, they could not be trusted to make forecasts.

But this is ridiculous. I would be much more worried if HMT was frequently right. The whole point of making official economic forecasts is to inform policymakers and trigger policy decisions in response. Successful policymaking inevitably renders forecasts wrong. So giving chapter and verse on all the wrong forecasts made by HMT and others since the Gold Standard proved absolutely nothing.

More importantly, it had no place in a serious economic analysis. Making ad hominem attacks on the authors of the report you are critiquing is bad form. And in this case, it was downright stupid. I lost interest very quickly and moved on to the second section, which at least actually critiqued DexEU/HMT's report.

It was immediately evident that none of the authors had actually seen the report they were aiming to critique. They had only seen the carefully curated Buzzfeed leak. Nor did they have direct access to the model that DexEU/HMT used. It is a bit difficult to critique a report you haven't read and a model you haven't seen. You have to make hefty assumptions about the report, the model, and the data and assumptions used to generate the results.

Making assumptions is not in itself a problem. It is an inevitable part of economic forecasting, since no-one ever knows everything about an economy (or indeed about the future). However, assumptions need to be reasonable, supported by empirical evidence if possible, and fully documented. The group did document their assumptions. But reason and evidence were sadly lacking.

Here is the assumption they made about the nature of the model:

We now understand that Whitehall’s new approach employs a standard Computable General Equilibrium (CGE) Model, just the same as the World Trade Model created and used by the Cardiff University macroeconomics research group.Er, if you haven't seen the model, how do you know it is "just the same" as the World Trade Model used by the Cardiff University group?

Because the Government Economic Service does not have the in-house capability to develop such complex models, they sensibly have elected to use the Global Trade Analysis Project (GTAP) model, a workhorse created at Purdue University in Indiana that has been developed since 1992 by multiple universities, government and international agencies.A trade model created at Purdue University in Indiana can't possibly be "just the same" as a trade model created and used by Cardiff University. But Cardiff's model is created by a research group run by Patrick Minford, one of the authors of the paper. Understandably, he wants to use it. So the paper assumes equivalence between the two models to justify using the Cardiff model to debunk an analysis produced using the GTAP model.

To be fair, the two models do appear to produce similar results. The respected Canadian consulting group Ciuriak Consulting used a version of GTAP to estimate the economic effects of adopting "unilateral free trade" (UFT), which Economists for Free Trade take as an approximation to "general free trade" (more on this shortly). Ciuriak's model shows only a very small GDP growth boost for the UK from UFT, about 0.8%. It bases this on an estimate that removing trade barriers would reduce average import costs by 4%. But Patrick Minford thinks import costs would reduce by 20%, not 4%. To adjust Ciuriak's results for his higher estimate, Economists for Free Trade multiplies the GDP growth boost from UFT by 5, arriving at a figure of 4% of GDP. Apparently this is the same as Minford's Cardiff model produces.

But this causes Economists for Free Trade a problem. They rejected HMT's previous forecasts because they had been produced using a "gravity" model of trade, whereas Economists for Free Trade prefer a Computable General Equilibrium (CGE) model. But the new DexEU/HMT model is a CGE model. Furthermore, Ciuriak's GTAP model produced similar results to Cardiff's when adjusted for different assumptions. But Whitehall's GTAP model forecasts are nothing like them. They are actually within spitting distance of those produced by the "discredited" gravity model.

So how do Economists for Free Trade deal with this? They cast aspersions on GTAP:

An additional important problem in the Whitehall calculations is with the GTAP model itself. It is a good CGE model - in principle, much like the World Trade Model used by the Cardiff research team. However, it is a vast and detailed model and is unlikely to model the UK economy and trade very well. No one has attempted to test it on the UK and, because it is so large, no one is likely to do so.This is an entirely spurious explanation. Ciuriak used essentially the same GTAP model as DexEU/HMT, but their results were much closer to Cardiff's.

The real reason for the differences is the data and assumptions fed into the models. Indeed, Economists for Free Trade themselves say this:

If the correct Brexit policies are fed in, it seems that all of the models – GTAP, Cardiff, and gravity models – produce directionally the same results – all clustered around a positive 2 per cent to 4 per cent of GDP range."Correct Brexit policies" is another ad hominem attack. DexEU is the department tasked with implementing the Government's Brexit policies. Economists for Free Trade are alleging that it is not using the Government's Brexit policies when producing forecasts. The implication is that the civil servants tasked with delivering Brexit are trying to undermine it. Subtle allegations of this kind do not belong in a serious economic analysis.

However, DexEU/HMT do appear to have used an entirely different set of assumptions from those of Economists of Free Trade. How do the authors explain this inconsistency?

Simple. They say the DexEU/HMT assumptions are wrong:

The latest Whitehall analysis makes many assumptions that are simply not credible. Strangely, it does not even model the new agreement with the EU that the government is seeking. But it does appear to assume that even with an EU agreement there would be absurdly large border costs on UK-EU trade; also that eliminating current EU-set trade barriers against non-EU countries would have negligible effects on the UK's non-EU trade and the UK economy, an assumption that is demonstrably false on the very GTAP model it is using.It is a trifle unfair to criticise DexEU/HMT for not modelling the effects of a trade agreement which not only has yet to be agreed but on which the Government itself is divided. But the real issue is the claim that DexEU/HMT has made unrealistic assumptions about border costs and the effects of ending EU-set tariffs. This is the cause of the differences between the Whitehall and Cardiff models. Both rest on Government policy as laid out in the Lancaster House speech, but the interpretation of that policy is entirely different.

Economists for Free Trade define the Government's preferred outcome for Brexit as "general free trade with the non-EU world" plus a "close relationship with the EU". And they equate "general free trade" with UFT.

But UFT is not Government policy. How can Economists for Free Trade call this the "correct Brexit policy", and criticise DexEU/HMT for not using it in the GTAP model?

The key is in their view of how UFT would work in practice. Economists for Free Trade describe UFT thus:

UFT approximates the combined effect of many FTAs with the rest of the non-EU world in eliminating protection of food and manufactures: in an FTA you seek opening of other markets in return for opening yours. Other countries therefore demand you eliminate your protection in exchange for eliminating theirs: so your own trade barriers decrease as they would in UFT.In a free trade agreement (FTA), both sides agree to lower trade barriers. So Economists for Free Trade assume that if the UK were to lower all its trade barriers, the rest of the world would reciprocate. This would in effect create a worldwide FTA, amounting to "general free trade".

But there is not one shred of empirical evidence that the UK unilaterally lowering trade barriers would necessarily result in other countries lowering theirs. There is even some historical evidence to the contrary.

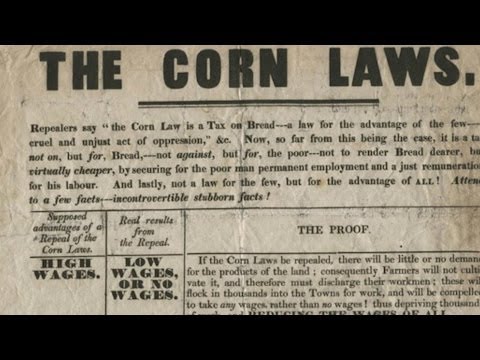

In 1846 Britain repealed the last of its major tariffs (the famous Corn Laws) in the hope that European countries and the USA would repeal theirs. Minor tariffs were also dismantled over the ensuing decade or so. But other countries happily took advantage of the trade advantage that Britain's zero tariffs afforded them. Ten years later, Richard Cobden, architect of the free-trade movement, despairingly concluded that Britain would need to construct free trade agreements. The first such FTA was agreed with France in 1860. Others followed. By 1870, trade between the UK and European countries was governed by a web of FTAs. I suppose, if you have enough FTAs, you can claim you have "general free trade", sort of. But boy is it complex to administer. And it is incredibly fragile. All it needs is one large country not to play the "spaghetti FTAs" game, and the whole house of cards collapses.

It was the USA that wouldn't play. During the Civil War it raised import tariffs, and they remained high thereafter. European countries responded in kind. But not Britain. Dear me, no. The free market ideologues still ran the roost, so Britain maintained zero tariffs in an increasingly protectionist world. It was, of course, running the largest empire in history at that time, so was protected from the worst effects of this crazy policy through coercive trade relationships with its colonies. But it nevertheless paid a price - the decline of its agricultural industry as cheaper imports flooded the market. By 1911, Britain's agricultural industry was in such bad shape that the sons of farmers were emigrating to Australia to farm sheep because there was "no money in farming" in the UK. There's some evidence, too, that America's burgeoning manufacturing sector, protected by high tariffs, crowded out Britain's manufacturing to some extent in the late 19th century.

Economists for Free Trade's assumption that UFT would be equivalent to "many FTAs" is thus another spurious equivalence. UFT is not remotely similar to "general free trade". Even with sterling depreciation (not possible in the late 19th century due to the gold standard), it could be very damaging to the UK's domestic industries, in particular agriculture and manufacturing. This is indeed what other economic analysis shows.

But even if UFT were a credible proxy for general free trade, there is still a large difference between Economists for Free Trade's estimates of the GDP gain from UFT and Ciuriak's estimates, and not in the right direction. Unsurprisingly, therefore, Economists for Free Trade also criticise Ciuriak's assumptions:

However, it has been shown - rather uncontroversially - that trade barriers erected by the EU for food and manufactures are each 20% (see Minford, et al) when nontariff barriers are included; 4 per cent is simply the tariff barriers alone. In other words, Ciuriak and Xiao assume post-Brexit that we do not eliminate non-tariff barriers set up by the EU against the world. But if we wish to achieve free trade that would be nonsensical.No, it is this statement that is nonsensical. If the EU puts up non-tariff barriers against the world, then after Brexit, the UK will face those barriers even if it adopts UFT, unless it enters into an agreement with the EU to lower the barriers. It may get a trade boost from the rest of the world if it lowers its own non-tariff and tariff barriers, though this is unlikely to be reciprocated, as I explained above. But Minford's estimate is based upon EU trade barriers disappearing, which they clearly won't. If we wish to keep trading with the EU, we will have to replicate what Economists for Free Trade call "non-tariff barriers" and the rest of us know as "product safety standards", not only on exports but on imports as well, because imports feed into exports and the EU is going to want to know that their imports comply with their standards. And since it is unlikely that trade with the rest of the world could suddenly ramp up sufficiently to substitute for trade with the EU, a large reduction in trade with the EU would be extremely damaging. A 20% benefit from tariff and non-tariff barrier reduction thus looks anything but uncontroversial.

So having criticised both Whitehall and Ciuriak for using far more prudent estimates than their own, Economists for Free Trade then make matters worse by blithely magicking away all border costs under the guise of a "close relationship with the EU". "We have assumed for the purposes of modelling that border costs are effectively zero," they say.

There isn't a border crossing in the world where border costs are zero, except within the EU's single market - and the UK is leaving it. There is no reason whatsoever to assume that border costs for the UK after Brexit would be zero when those of other third party countries with which the EU has free trade agreements are not.

Combining a spurious equivalence between UFT and general free trade with an extraordinary assumption that border costs would be zero has a remarkable effect on GDP forecasts:

Thus, having redone the GTAP trade calculations reported for Open Europe with the assumptions appropriate for the Government’s expressed Brexit policy of ‘EU Canada+ plus’ ROW Free Trade’, GTAP produces a GDP gain of 2 per cent. This compares to the 5 per cent loss reported by Whitehall officials in the Buzzfeed leaked report - a directional difference of 7 percentage points.Economists for Free Trade turned a substantial loss into a reasonable profit by making unsupported and unrealistic assumptions. If only Carillion had employed them.

The third section of the piece, by far the longest, is an exposition of Economists for Free Trade's own views on Brexit. Others have commented on the obvious errors in this section, which are due to the authors' evident lack of understanding of WTO rules. My greater concern is that a long discourse on your own position is not appropriate in a paper purporting to critique someone else's. As a reminder, the stated purpose of the report was to critique the economic forecasts for Brexit recently produced by DexEU & HMT, and leaked to Buzzfeed.

And this brings me to the report's "key points". There are three:

- Based on the track record of Whitehall and associated institutions, it must be questioned if the conclusions of this secret report can be trusted

- If the Government's policy - as declared at Lancaster House - is fed into the new Whitehall model, it produces positive outcomes for Brexit that are essentially the same as those of the models of other independent economists

- The UK can have a bright future outside of the EU irrespective of whether or not the UK is successful in securing an attractive trade deal with the EU, assuming Government implements the correct policies with regard to the exit and subsequently after we have left

This is not an economic analysis, it is a polemic.

Related reading:

Magnanimous Albion - Deirdre McCloskey

Tariffs and Growth in Late 19th Century America - Irwin

The latest pro-Brexit analysis has got its sums badly wrong - Financial Times

Image from Wikipedia.

The distant past is too different, the immediate past we cannot be sure about, the now is too confusing, the future is elaborate guess work. What if the USA were to have a major debt crisis? But is already has one and the consequences for the world are entirely unpredictable. Also, you only need one badly informed ruler to start a serious war somewhere or perhaps in the wrong place to send it all into a spin.

ReplyDelete"the Government's recent forecast that Brexit would cause a GDP loss of between 2 and 8 percent over 15 years"

ReplyDeleteThat's an odd interpretation of scenarios that say we will forego gains in GDP of between 2 and 8%. Most people do not read reports, just headlines, and their takeaway from this is that people are predicting that in some trading futures the predictions say we will be worse off than now which is not at all what is being projected. Many supporters of the transfer of public funds to the owners of qualifying land ( for that is the EU's primary fiscal purpose ) are endorsing this false narrative and I cannot figure out why.

"By 1911, Britain's agricultural industry was in such bad shape that the sons of farmers were emigrating to Australia to farm sheep because there was "no money in farming" in the UK. "

No. That's an anecdote and it was ONE son. But even if there was no money in farming would this be a bad thing. It's getting fed that matters. Based on the UK and Commonwealth putting half a million soldiers into South Africa for the Boer War and millions more in 14-18 food security wasn't a problem. Of course by the 1930s farm subsidies had returned to the UK in a massive way ( bigger than now in relative terms ) and then we did have security problems.

That's a very good point about the 'GDP loss' statement.

DeleteIn the 'calculus for journalists' blog dated August 8 2017, the point was made that life expectancy was not falling, but the rate of growth in life expectancy was. Further;

"I spent long hours on Twitter and Facebook trying to explain this to people, to no avail. I was presented with numerous articles, most of them repeating the same error. Never mind the fact that life expectancy is actually rising, all we need is Robert Peston to say that it is not, and the whole world is convinced. Fake news, entirely caused by the fact that some journalists don't understand rates of change".

So what is the situation here? Is GDP forecast to fall, or to grow at a slower rate?

Economists cannot even predict whether growth will be positive or negative or whether employment will be up or down one year ahead. The whole Brexit forecast business is a charade.

DeleteAnd on projections of future growth, what matters to individuals is not what percentage rise the shelf-stacking wage has seen but but whether their children are engineers, nurses, or shelf stackers. People voted to leave a system that found it better to import labour and throw their own children on the scrap heap than invest in their children.

I agree with the person who wrote "The Euro is a misbegotten, deformed creature that exists for one thing only, and that is to deny sovereignty to members of the EU." Yes, that in spades to everything the EU does. If only I could remember who that person was.

But the argument that ‘we won’t be worse off compared to now’ is akin to saying ‘it’s okay to fall a decade behind everyone else by the late 2020s’. I would rather continue to live in the present, thanks very much.

DeleteThis comment has been removed by the author.

DeleteAndrew Carey,

Delete1) The "loss" of 2 to 8 percent of GDP growth is of course relative to the counterfactual. I would have thought this was obvious, but since it clearly isn't, I shall add that in. However, if you are going to criticise me for sloppy terminology, you should also criticise Economists for Brexit, surely? Nowhere in their piece do they say that the 2 to 4 percent of GDP growth gain is relative to the counterfactual. It is implied, just as it was in my comment. Do be consistent, please.

2) I used an anecdote to illustrate the parlous state of British farming because the fact that agriculture declined considerably under unilateral free trade is discussed in the history link two paragraphs before. However, if you would like to know more about the Long Depression, here is a link: http://www.bahs.org.uk/AGHR/ARTICLES/20n1a3.pdf

Anonymous, I believe I have addressed your point in my reply to Andrew Carey. I shall add "relative to the counterfactual" for clarification, but please be aware that Economists for Brexit's figures are also relative to the counterfactual. Their estimates for GDP gains are ON TOP OF whatever GDP growth the UK would have had if it had remained in the EU.

DeleteI must add that comparing the terminology here with my criticism of journalistic reporting of life expectancy figures is comparing apples and pears. I agree the maths is the same, but the context is entirely different.

DeleteThe life expectancy rate-of-change slowdown is an update of an existing forecast in the light of new data, similar to the OBR updating its forecasts for GDP. Statistical bodies do these updates all the time, whether or not there are policy changes. Journalists misinterpreted a forecast update to mean an actual change in life expectancy.

In contrast, the estimates from both the Treasury and Economists for Brexit aim to identify specific gains or losses from a policy change. It's only possible to identify these if the forecast for conditions absent the policy change (the "counterfactual") is assumed not to change.

My informal poll of just 5 people who saw the headlines saying 'hit', 'damage' 'suffer' and 'worse off' resulted in 4 people saying they thought that meant relative to now. However, I'd rather not criticise Economists For Brexit on this as I think they covered the point about the future being richer on page 4.

ReplyDeleteThank you for the link to the bhas.org.uk article. It was interesting although I still disagree with the claim that UFT will make us poorer than systems of TAs with quotas and protections. The swings are low either way and small compared to the known things that make us poorer such as war, communism, and abandoning the rule of law.

Your informal poll is hardly representative. However, as I have now added a statement clarifying the meaning, your point is moot. I just find it interesting that you criticised me for not saying explicitly that my comment was relative to the counterfactual, but did not criticise Economists for Brexit for not saying that their figures were relative to the counterfactual. Double standards, much?

DeleteUFT that was not reciprocated would be considerably worse than a system of TAs. We would be flooded with cheap imports while our own industries faced high tariff barriers to export. This would be offset to some degree by sterling depreciation, but that is not a "free lunch" either, since the price for it would be high inflation. Particularly damaging to industry would be the impact of depreciating sterling on the cost of oil.

Even Economists for Brexit don't claim that UFT which was not reciprocated would be beneficial. They assume that it would be reciprocated. The benefits they claim are thus not from UFT but from mutual lowering of trade barriers around the world - which is why they equate UFT with "general free trade".

However, we should be very cautious about promoting "general free trade" as an unalloyed good. The reality is that it would tend to benefit larger and richer countries at the expense of smaller, poorer ones. This is because poor countries currently enjoy positive discrimination under the WTO's "enabling clause", which encourages richer countries to give them preferential treatment in tariff schemes. In the EU, this takes the form of the Generalised Preferences scheme, under which less developed countries have lower tariffs and the very poorest countries have zero tariffs for everything except arms.

Back in 2011 David Frum said of the contemporary US Republicans: "this isn’t conservatism; it’s a going-out-of-business sale for the baby-boom generation."

ReplyDeleteHow much do you think the same could be said of the current Brexit Tories, particularly those who advocate unilateral free trade? It certainly seems like they's obsessed with making imports cheaper, with scant regard for the UK's already disastrous balance of payments deficit.

It is also notable that only a small minority of big businesses support Brexit, and they are disproportionately companies that heavily import from outside the EU, not companies that produce products for export. Examples would be Next (a retailer of clothing, almost all of which is now made cheaply in third-world countries), Dyson (which makes its vacuum cleaners in Malaysia) and Tate and Lyle (with its Caribbean cane sugar).

The UFT loons aren't baby boomers. Boris Johnson, Rees-Mogg, Hannan are Generation X. There are some older hardliners, such as Liam Fox and IDS, but I don't think this is a baby boom phenomenon. I do however think that many of them have a desire to bring back something akin to the British Empire. A high proportion seem to come from a colonial background (brought up in Britain's ex-colonies, where they were the children of the Sahibs).

DeleteI do however think that a considerable driver of the Brexit vote in general was older generations fighting against the loss of their entitlements and the poorer future that their children face.

On Brexit supporting businesses: I've previously explained on this blog (see here: http://www.coppolacomment.com/2017/11/the-amazing-conversion-of-sir-james.html) it is wrong to regard Dyson as a UK business at all. It is a Malaysian manufacturer that exports finished goods to the UK. James Dyson himself is a British farmer who benefits hugely from the CAP. So his position on Brexit is this: zero tariffs on imports to benefit his Malaysian manufacturing business, plus continuation of CAP subsidies to benefit his UK farming business. His sole intent is to enrich himself. I do wish people would stop lionising him. He's a hypocrite. Mind you, so are the other two: Next is an import business, buying and distributing goods manufactured by its suppliers, and Tate and Lyle imports commodities. Both stand to benefit from zero tariffs.

While the leading UFT advocates (I like the way you called them "loons") may not be boomers, I suspect they see themselves as insulated from the consequences of their actions in a different way: while boomers may expect to die before the shit hits the fan, people like Bojo and Rees-Mogg may feel protected by their wealth.

DeleteAnd while I don't think they have dreams of restoring the British Empire (I can't believe anyone is that deluded, especially given how our military spending has been cut to the bone), it is potentially the case that wealthy rentiers living off the wealth acquired by their imperialist ancestors may feel as if (for them personally at least) the Empire never really fell.

As for ordinary voters, why do you think that older people would feel that voting Leave would improve their children's economic prospects, while those children felt themselves that their prospects would be better within the EU?

Arguably the biggest factor in weakening the British economy since the 1980s has been the explosion in urban land prices (due to the abolition of rent controls, the sale of council housing, rising NIMBYism, the replacement of rates with council tax, the end of restrictions on mortgage lending, and falling interest rates). This provided an irresistible incentive for asset strippers to destroy Britain's industrial SMEs, as they could often get more money from selling off the land for housing than they paid for the entire business!

It has me thinking of Timothy Snyder's analysis of the Holocaust in the Baltic states: many of the local Nazi collaborators who murdered Jews had previously collaborated with the Soviet occupation, and the Nazi propaganda trope of "Judeo-Bolshevism" provided a convenient way for these people to distance themselves from their earlier treason.

Two of the tabloids which pushed hard for Brexit (the Express and the Daily Mail) were also notorious for cheering on house price inflation – perhaps this was partly for commercial reasons, as they made lots of money by advertising housing equity release schemes, as well as products (such as cruises) that were often paid for by means of equity release.

I wonder if some of the people who had bought foreign holidays or imported luxuries from the proceeds of housing equity release were subconsciously aware that they had undermined Britain's economy through their actions, and were groomed by the tabloids into believing that a a vote for Brexit would somehow fix this (especially if immigrants could be made the scapegoat for high house prices, just as Jews were made the scapegoat for the Soviet occupations of Estonia, Latvia and Lithuania)?

This comment has been removed by the author.

ReplyDeletehis must certainly study. It is the most interesting.

DeleteDon't know about the UK. But in the US, there is a working model. It is precise. Economics is an exact science. Everyone should read Steve Keen. He almost gets it right. He's on to bank vs. non-bank lending.

ReplyDeleteThe time for stagflationist’s recalcitrance “will soon be at an end” (Gladiator).

See second verse, same as the first:

22 Luminaries (And Dick Bove) Sign Open Letter To Fed Demanding End Of QE2

http://bit.ly/2F3T2Xm

N-gDp LPT targeting by stagflationist advocates is unwarranted and destructive. It has now produced, since the advocates banded together and wrote a letter to Janet Yellen, higher prices, a breakout in yields, a falling U.S. dollar, and a credit downgrade from China.

And after all this "irrational exuberance", stocks have declined into the 4th Elliott wave correction. The Fed acted and produced a “soft landing”?

http://bit.ly/2s67De9

There’s a very important lesson in the latest failed coup d'é·tat.

See the: “Secular Stagnation Project”

http://bit.ly/2IsizHR

Larry Summers said in December: “And as soon as prices stop rising, the economy will lose one of its important props. Since the 1990s, he says, the U.S. has alternated between bubbles and busts.”

It’s once again, FOMC schizophrenia: Do I stop -- because inflation is increasing? Or do I go -- because R-gDp is falling? [Stagflation’s dilemma, viz., the FOMC’s policy mix]

And for the gold bugs, that transmogrifies into an inflation/deflation debate.

So in case you aren't tracking the markets, targeting N-gDp LPT, caps real-output, maximizes inflation, and exacerbates trade deficits (exporting aggregate monetary purchasing power, and importing underemployment).

The advanced change in thinking was pointed out and emphasized by Doug Short:

”However, at their December 2012 FOMC meeting, the inflation ceiling was raised to 2.5% while their accommodative measures (low Fed Funds Rate and quantitative easing) were in place.”

Steve Keen's on to this: "Banks don’t “intermediate loans”, they “originate loans”.

"The fallacy in their thinking is easily demonstrated by looking at the two types of lending – from one non-bank agent to another (Loanable Funds or LF) and by a bank to a non-bank (Bank Originated Money or BOM as an accountant might call it)."

Keen: "A 'Loanable Funds' loan simply shuffles existing money from one person’s bank account to another: no new money is created (row 1 in Table 2). A “Bank Originated Money” loan creates a new asset for the Bank, and creates new money as well – which the recipient then spends."

http://bit.ly/2GXddnC

That's how I denigrated Nassim Nicholas Taleb’s “Black Swan” theory (un-foreseeable event), 6 months in advance and within one day:

ReplyDelete[1] To: anderson@stls.frb.org

Subject: As the economy will shortly change, I wanted to show this to you again – forecast:

Date: Wed, 24 Mar 2010 17:22:50 -0500

Dr. Anderson:

It’s my discovery. Contrary to economic theory and Nobel Laureate Milton Friedman, monetary lags are not “long & variable”. The lags for monetary flows (MVt), i.e., the proxies for (1) real-growth, and for (2) inflation indices, are historically, always, fixed in length.

Assuming no quick countervailing stimulus:

2010

jan….. 0.54…. 0.25 top

feb….. 0.50…. 0.10

mar…. 0.54…. 0.08

apr….. 0.46…. 0.09 top

may…. 0.41…. 0.01 stocks fall

Should see shortly. Stock market makes a double top in Jan & Apr. Then real-output falls from (9) to (1) from Apr to May. Recent history indicates that this will be a marked, short, one month drop, in rate-of-change for real-output (-8). So stocks follow the economy down.

And:

flow5 Message #10 – 05/03/10 07:30 PM

The markets usually turn (pivot) on May 5th (+ or – 1 day).

I.e., the May 6th “flash crash”, viz., the second-largest intraday point swing (difference between intraday high and intraday low) up to that point, at 1,010.14 points.

The Oct. 15th dis-equilibria was so profound and unique that the Treasury did a joint staff study on it with the (1) U.S. Department of the Treasury, (2) Board of Governors of the Federal Reserve System, (3) Federal Reserve Bank of New York, (4) U.S. Securities and Exchange Commission, and (5) the U.S. Commodity Futures Trading Commission.

ReplyDeletehttp://bit.ly/1VKxCQw

I also predicted this: “Diminishing market depth and a surge in volatility were both on display Oct. 15, when Treasuries experienced the biggest yield fluctuations in a quarter century in the absence of any concrete news. The swings were so unusual that officials from the New York Fed met the next day to try and figure out what actually happened”

From: Spencer (@hotmail.com)

Sent: Thu 9/18/14 12:42 PM

To: FRBoard-publicaffairs@... (frboard-publicaffairs...

Dr. Yellen:

Rates-of-change (roc’s) in money flows (our “means-of-payment” money times its transactions rate-of-turnover) approximate roc’s in gDp (proxy for all transactions in Irving Fisher’s “equation of exchange”).

The roc in M*Vt (proxy for real-output), falls 8 percentage points in 2 weeks. This is set up exactly like the 5/6/2010 flash crash (which I predicted 6 months in advance and within 1 day).

This is one facet of BuB's mistake:

ReplyDeletePOSTED: Dec 13 2007 06:55 PM |

The Commerce Department said retail sales in Oct 2007 increased by 1.2% over Oct 2006, & up a huge 6.3% from Nov 2006.

10/1/2007,,,,,,,-0.47,... -0.22 * temporary bottom

11/1/2007,,,,,,, 0.14,,,,,,, -0.18

12/1/2007,,,,,,, 0.44,,,,,,,-0.23

1/1/2008,,,,,,, 0.59,,,,,,, 0.06

2/1/2008,,,,,,, 0.45,,,,,,, 0.10

3/1/2008,,,,,,, 0.06,,,,,,, 0.04

4/1/2008,,,,,,, 0.04,,,,,,, 0.02

5/1/2008,,,,,,, 0.09,,,,,,, 0.04

6/1/2008,,,,,,, 0.20,,,,,,, 0.05

7/1/2008,,,,,,, 0.32,,,,,,, 0.10

8/1/2008,,,,,,, 0.15,,,,,,, 0.05

9/1/2008,,,,,,, 0.00,,,,,,, 0.13

10/1/2008,,,,,,, -0.20,,,,,,, 0.10 * possible recession

11/1/2008,,,,,,, -0.10,,,,,,, 0.00 * possible recession

12/1/2008,,,,,,, 0.10,,,,,,, -0.06 * possible recession

Trajectory as predicted.

This is the error:

ReplyDeleteIn "The General Theory of Employment, Interest and Money", John Maynard Keynes’ opus ", pg. 81 (New York: Harcourt, Brace and Co.), gives the impression that a commercial bank is an intermediary type of financial institution (non-bank), serving to join the saver with the borrower when he states that it is an “optical illusion” to assume that “a depositor & his bank can somehow contrive between them to perform an operation by which savings can disappear into the banking system so that they are lost to investment, or, contrariwise, that the banking system can make it possible for investment to occur, to which no savings corresponds.”

In almost every instance in which Keynes wrote the term bank in the General Theory, it is necessary to substitute the term non-bank in order to make his statement correct, viz., the Gurley-Shaw thesis, the elimination of Reg Q ceilings, the DIDMCA of March 31st, 1980, the Garn-St. Germain Depository Institutions Act of 1982, the Financial Services Regulatory Relief Act of 2006, the Emergency Economic Stabilization Act of 2008, sec. 128. “acceleration of the effective date for payment of interest on reserves”, etc.

The DFIs can force a contraction in the size of the non-banks, NBFIs, & create liquidity problems in the process, by outbidding the non-banks for the public’s savings. This process is called “disintermediation” (an economist’s word for going broke). The reverse of this operation cannot exist. Transferring saved TR or TD deposits through the non-banks cannot reduce the size of the payment’s system. Deposits are simply transferred from the saver to the non-bank to the borrower, etc.