The untold story of the UK's productivity slump

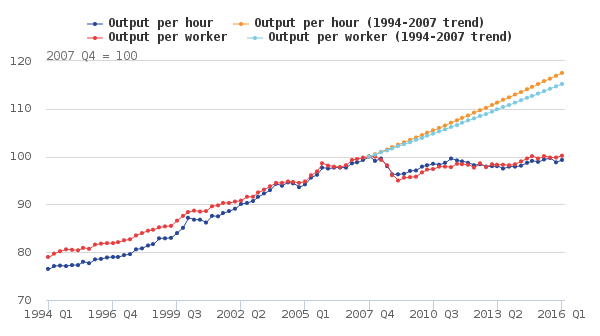

The ONS has produced a fascinating discussion of the UK's productivity puzzle, with some great charts. This one shows just how much the UK's productivity has slumped:

Notice when productivity started to slump. It was much earlier than 2008. In fact the data (which ONS have helpfully provided in Excel) show that output per hour started to fall in Q4 2006. The productivity slump, therefore, cannot be caused by the financial crisis. I suspect we have a "third variable" problem here. It seems likely that the financial crisis and the productivity slump are both symptoms of an underlying shock. But what was that shock?

To shed some light on this, here is another great ONS chart from the same publication:

In the middle of this we had the biggest financial crash since the 1930s, so the productivity drop for financial services is not surprising. What is surprising is that it is by no means the biggest productivity drop. There has been a catastrophic productivity collapse in extractive industries and utilities.

This chart comes from Tomas Hirst:

* Yes, I know this is a controversial view. Everyone thinks the credit bubble was about property. But in my view this was itself symptomatic of an underlying unsustainable oil price dynamic. I shall write about this in another blogpost, as it is global rather than UK-specific.

Notice when productivity started to slump. It was much earlier than 2008. In fact the data (which ONS have helpfully provided in Excel) show that output per hour started to fall in Q4 2006. The productivity slump, therefore, cannot be caused by the financial crisis. I suspect we have a "third variable" problem here. It seems likely that the financial crisis and the productivity slump are both symptoms of an underlying shock. But what was that shock?

To shed some light on this, here is another great ONS chart from the same publication:

In the middle of this we had the biggest financial crash since the 1930s, so the productivity drop for financial services is not surprising. What is surprising is that it is by no means the biggest productivity drop. There has been a catastrophic productivity collapse in extractive industries and utilities.

This chart comes from Tomas Hirst:

That big red bubble is North Sea Oil. The UK's massive productivity growth from 1990-2006 was due to oil, not financial services. Even energy utilities downstream from North Sea Oil had a greater productivity rise than financial services. And both oil and utilities suffered a massive collapse.

The collapse of North Sea Oil productivity started in 2004. And as this chart shows, that is when the price of Brent crude started to rise - astronomically:

Since this is a global price, to what extent the price rise is linked with the productivity fall is unclear. But it does speak of a supply/demand imbalance, to which falling productivity in the North Sea must have contributed.

The collapse of NSO productivity was followed by a productivity collapse in downstream utilities, probably due to input price rises. Tom's chart shows that this was partly offset by a rise in financial services output per hour - though the gigantic falls in NSO and utilities output per hour dwarf the increasing productivity of financial services.

We now know that the financial services rise was due to a credit bubble which disastrously burst in 2008. But just have a look at that oil price chart. Why is no-one talking about the mammoth oil price spike from 2004 to the first half of 2008 and its relationship to the financial crisis?

Anyway, the UK's productivity puzzle is perhaps not such a puzzle after all. It seems to be mainly a story of the rise and fall of North Sea Oil. The financial bubble maintained productivity growth for a while as NSO declined. But as the bubble was itself driven by oil price dynamics*, it was doomed. It burst disastrously in September 2008, though the warning signs were there from 2007 onwards.

This suggests that, far from representing some kind of slump, the present productivity trend could actually be normal. We thought the productivity growth of the NSO period was normal, but it is in fact abnormal - and will never return. That does not bode well for future wage growth. Though of course technology might still save us.....

But somehow I doubt it.

UPDATE: Richard Jones of SPERI has reached similar conclusions, though he says the oil productivity slump is not the whole story. He says the UK economy is suffering from Dutch disease, and desperately needs to diversify and invest in R&D and innovation. I can only concur.

Here's Richard's fascinating paper on UK productivity (pdf). Do read it.

Related reading

Not quite untold. Neil Wilson picked it up in 2014

ReplyDeletehttp://www.3spoken.co.uk/2014/10/a-little-light-on-uk-productivity-puzzle.html?m=1

I'm also discussing on Twitter with Richard Jones of SPERI, who has written about this a lot. I will add his papers to the reading list on this blogpost. There is an interesting chart, too: financial bubble from 2000 onwards masked the decline of NSO. Rather supports my argument that the unsustainable rise of financial services was driven by oil price dynamics (though I haven't yet worked out exactly how).

DeleteLooking at that post of Wilson's, I'm disappointed. He could have developed that a lot more.

DeleteI picked up the economically damaging effects of inflation in energy inputs (driven by very high oil prices) in a blogpost a while ago, see Further Reading.

I suppose Neil's more general point, which he makes in other places (and I hope I'm not putting words in his mouth) is that productivity puzzles are potentially accounting artefacts. When we decompose the figures and see what's going to the denominator we can see that long days created by office presenteeism, or hanging onto workers is analogous to going deeper for the oil.

DeleteYes, that is similar to David Graeber's argument that many jobs are simply not worth doing. Or Guy Standing's point that benefits claims are "make-work", similar to picking oakum in a workhouse. They serve no productive purpose but create the illusion of productive activity.

DeleteAs far as I'm aware, NSO's best days were in the first half of the eighties, where it made money hand over fist. Why did productivity pick up strongly after that time, and why did it fall away so rapidly?

ReplyDeleteI'd suggest reading Richard's paper - he discusses this. Basically it is diminishing returns - productivity remains high or even rises as long as extraction is profitable, but when costs start to rise significantly as extraction becomes more difficult, productivity falls sharply.

DeleteOil is actually gold. Until now, when it is not. Hence the global uncertainty. No one can see a replacement to underpin the dollar and every other currency. What were fringe ideas are now more coherent according to reality as it is happening. They used to say, follow the money. In our world's case, everything can be said to follow the oil except, ironically, all of our futures.

ReplyDeleteI have many left-wing friends, from middle-of-the-road Labour voters to antediluvian Marxists.

ReplyDeleteI have never managed to persuade any of them that the UK coal industry was destroyed by North Sea gas, rather than Margaret Thatcher.

The UK coal industry was systematically destroyed by Margaret Thatcher. There is no doubt about that. But she might have found that much more difficult had North Sea Oil not been coming on stream at that time.

DeleteThe decline in North Sea Oil productivity doesn't explain that. I made that clear in the post. However, the Brent chart shows that there was a huge oil price shock in the run up to the financial crisis. I haven't included it in this post, since I am only discussing NSO, but the WTI chart shows the same picture. I find it extraordinarily hard to believe that an oil price shock of that magnitude, at that time, has nothing to do with the largest financial crash since the 1930s.

ReplyDeleteAlthough it looks impressive in that chart, the weightings for those two sectors - mining and quarrying, electricity and gas - are relatively small. If you strip them out of the aggregate productivity figures, you still get a pattern that looks very much like that in your first graph.

ReplyDeleteBut it's a part of the overall story. One useful thing from looking at the breakdown is that it shows that no consistent pattern across industries. There is no single explanation for what is happening to UK productivity, it's a combination of things.

Is it any surprise that the sectors that are doing the worst are the ones that are heavily regulated by the State? Mining, water, gas, sewerage, finance - all have massive barriers to entry (both practical and regulatory) and are able to pass on State regulation to their customers. Hence no need to increase productivity, the customer will have to pay. And given they are all basic services there's nowhere the customer can go.

ReplyDeleteIf you keep stuffing up the economy with regulations, while any given one is not a specific problem, collectively it all has an effect.

I am not convinced that we need to enlarge the finance sector.

DeleteBut the barrier to small businesses is now immense. Zoning, employment, safety, taxes, high rents all work to prevent a small businessman with an idea from opening up a business and trying something. The initial costs are large.

Sure regulations serve a purpose, but there has to be a limit when it comes to stifling the formation of new small businesses. Look at Asia, where anybody can start up a business in their front room. A lot fail but many more become a modest success, creating employment and churning the money around in the local economy.

Try that in the UK. Before day one is over you will have been visited by at least six government departments, possibly the police and shut down.

My gut feeling is that oil prices may be part of the key but maybe not for the reasons so far highlighted and while UK productivity may have fallen, business over all productivity may be different. I suspect that when oil prices went over 60 dollars a barrel UK businesses were faced with a cost shock. Faced with that shock, rather than increase prices, business looked to reduce costs elsewhere. This took many forms one of which was restructuring and outsourcing back office functions.Since UK barriers are different and UK business approach to moving work outside the UK is different to other countries, this took the form of moving highly skilled technical work to centers of excellence out side the UK rather than moving lower paid jobs as some European business styles would. I think some UK firms underestimated the staffing required to manage this work and were not prepared for the levels of detail they would need to provide, possibly resulting in stalled innovation due to rework. Firms may also have shortened times to market in response to market conditions with supply chains struggling to cope resulting in down times. So some of the productivity went abroad and low investment in UK workers has resulted in inefficiencies. Low investment in R&D and innovation could be part of the story but so could badly managed or inefficient R&D.

ReplyDeleteBrick

Frances,

ReplyDeleteJames Galbraith touches on the relationship of the spike in oil price to the financial crisis in his book "The End of Normal". He mentions that he tried to get it looked at during the inquiry into the crisis, but that this suggestion was rebuffed. The role of the commodity bubble in the dynamics of the early 2000's is surely under appreciated. It's ongoing collapse is quite a serious event (though as someone who works in oil exploration I would say that).

Ooh thanks. I missed this comment. There are a few academic papers about this but they have never hit the headlines.

DeleteThank you so much for this and for the link to the Richard Jones paper which is fascinating. I specially enjoyed the passing ref to how labour mkt deregulation seemed not to help total factor productivity - indeed was probably negative. From a London perspective will be helpful if the ego/hubris and power of the financial sector dwindles (and/or they migrate abroad) but the great challenge remains how to foster productivity and wage growth in non-sexy low wage sectors like caring, driving, retail, security... especially in the face of housing land price bubble continuing to squeeze everything else out of the city. We are grappling with this at JustSpace.org.uk and welcome help/comments.

ReplyDeletehttps://www.ons.gov.uk/economy/nationalaccounts/uksectoraccounts/bulletins/profitabilityofukcompanies/jantomar2016

ReplyDeleteThis ONS series looks at several sectors including UKCS, UK Continental Shelf Companies, basically North Sea oil and gas. FYI

I am late here but my usual graph here is one of the two graphs that describe UK politics since the 1980s:

ReplyDeletemazamascience.com/OilExport/output_en/Exports_BP_2016_oil_bbl_GB_MZM_NONE_auto_M.png

It is amazing that T Blair resigned as PM more or less in the month in which the UK became a net oil importer again after 35 years.

As to T Blair, this is my usual quote from an article he wrote in 1987:

www.lrb.co.uk/v09/n19/tony-blair/diary

«Mrs Thatcher has enjoyed two advantages over any other post-war premier. First, her arrival in Downing Street coincided with North Sea oil. The importance of this windfall to the Government’s political survival is incalculable. It has brought almost 70 billion pounds into the Treasury coffers since 1979, which is roughly equivalent to sevenpence on the standard rate of income tax for every year of Tory government.

Without oil and asset sales, which themselves have totalled over £30 billion, Britain under the Tories could not have enjoyed tax cuts, nor could the Government have funded its commitments on public spending.

More critical has been the balance-of-payments effect of oil. The economy has been growing under the impetus of a consumer boom that would have made Lord Barber blush. Bank lending has been growing at an annual rate of around 20 per cent (excluding borrowing to fund house purchases); credit-card debt has been increasing at a phenomenal rate; and these have combined to bring a retail-sales boom – which shows up dramatically in an increase in imported consumer goods.

Previously such a boom and growth in imports would have produced a balance-of-payments deficit, a plunging currency and an immediate reining-back on spending, with lower rates of growth. Instead, oil has earned foreign exchange and also produces remittance payments from overseas investments bought with oil money.

The situation is neither stable nor healthy in the long term: but in the short term it allows the living standards of the majority to rise rapidly, even though the industrial base, the ultimate foundation of a successful economy, is still only achieving the levels of output of 1979.

The fact that we have failed to use oil to build a productive and modern industry for the future is something historians will deplore.»

Currently the UK has a 7% balance of payment deficit and a 6% government deficit. Interesting times... :-)