Reshoring is hype

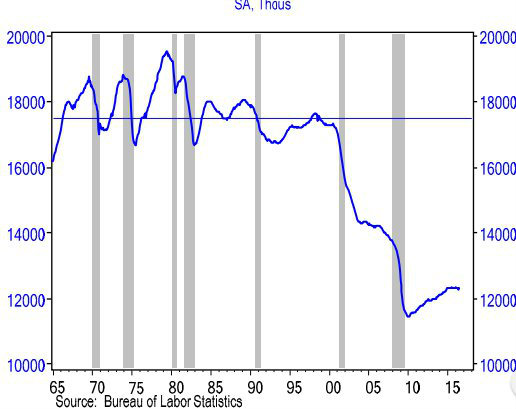

This chart has been doing the rounds on Twitter (h/t @dbcurren). It shows manufacturing employment in the USA.

See that huge drop? That's the drain of manufacturing jobs to South East Asia.

And see that uptick since 2010, that appears to be tailing off? That's the return of manufacturing jobs to the USA. What they call "reshoring".

Reshoring is hype, isn't it?

Related reading

U.S. reshoring: over before it began? - ATKearney (pdf)

It depends what you mean by the term. Reshoring production does not necessarily entail moving jobs "back". If automation is now cost-effective, it will lead to production moving closer to the main consumer market to further reduce transport costs.

ReplyDeleteHere's an example involving Adidas in Germany ...

https://www.theguardian.com/world/2016/may/25/adidas-to-sell-robot-made-shoes-from-2017

The hype is the assumption that reshoring is about labour.

You have a good point. And, it goes to the heart of productive activity and tool using. You point applies to current onshore production too. x

DeleteA goal is to produce what sells or is wanted. After that, it is to produce high quality.

Then, if one could approach producing some thing in no time (fastest rate), no effort, no management, and no capital, one would have large production with minimum people. Productivity per person would be huge! The plant would be smaller. More could be produced with less people employed in manufacturing.

That would also could make a great passive financial investment. {output/(0 input)=infinity. }

By the way I think they tried to appear to be appoching putting 0 in the denominator on the companies income statement by moving the capital expenses and other expenses on the foreign producers financial statements, not their own. But, the foreign manufacture need to charge for those costs! Or, they will go out of business.

For instance the accounting ratios Return on Assets is lower if some one else owns the manufacturing plant. The inventory turnover rate is much higher if some one else owns your inventory (Apple).

No, where on the financial statements is a measurement of the customers loosing income and spending less.

Many of the Robber barrons and famous manufacurers have tried it.

Here is that story in a graph.

https://fredblog.stlouisfed.org/2014/12/manufacturing-is-growing-even-when-manufacturing-jobs-are-not/

Correction;

DeleteFor instance the accounting ratios Return on Assets is higher if some one else owns the manufacturing plant.

Even if reshoring doesn't lead to a resurgence in manufacturing employment, isn't it still a very good thing because it reduces the nation's current account deficit?

DeleteLook, you can see there is about a 2-20% peek to peek 2-10 year (period) cycle in the thing! (It is not an equilibrium thing.) And, the non-oscilating trend has been downward sloping.

ReplyDeleteSo, it looks like it might have just been the top of the cycle. Warning if this was disaggregated or in sectors each sector could have its own more accurate cycle. In the aggregate, by adding a large bunch of cycles together could make almost any graph shape. Yet if the sector cycles are effected systematically the aggregate might be partly representative. But, being lazy I continue with my hand wavy argument...

I would draw the trend line by drawing a smooth line that crosses the time series data at points that are near midpoint (in the x and y axi) between the large troughs and the peeks. And, to not be predicting the future, one should stop drawing the trend line at year 2013.

https://fred.stlouisfed.org/series/MANEMP

Natural log;

https://fred.stlouisfed.org/graph/?g=5pqy

Does any one know how to find out what is the data series name for off shore manufacturing employees? I have never seen one. If there is not one in existence there would be an other justifiable critque of economics.

You've taken a small piece of information and made an exaggerated statement. Those of us working on reshoring do not promise to bring every single job back. In fact, we don't want the $.23/hr t-shirt production back because these kinds of jobs do not pay a US living wage. What we do want back are skilled advanced manufacturing jobs that utilize automation and innovation to accomplish the manufacture of sophisticated goods. You are way off base. Manufacturing is coming back.

ReplyDeleteRosemary Coates, Executive Director of the Reshoring Institute www.ReshoringInstitute.org

In terms of jobs - which is what this chart shows - reshoring simply is not making much difference. Yes, there may be an increase in highly-skilled technical jobs, but the vast majority of people can't do those. And yes, there may be more manufacturing, but if it doesn't generate jobs, Americans could be forgiven for asking what all the fuss is about. in short, you have completely missed the point - which is unfortunate, given your role.

DeleteNo. Not hype. In a job sense it is hype. In a product sense maybe not. It only makes sense to do when the cost disadvantage is not overwhelming. That tends to be in insanely automated or technical manufacture. Its not a lot of jobs. It is stuff that is highly important. And the job gain is offset by the same robots being applied to the local manufacturing jobs.

ReplyDeleteJohn, indeed that is the problem. Reshoring won't make a great deal of difference to employment if production becomes more automated. In many ways this is a good thing. My pushback is to those who claim that a resurgence of manufacturing will generate thousands of semi-skilled production line jobs. As far as I can see - and this chart somewhat confirms my view - it won't. This doesn't mean resthoring is a bad thing, just that it is not going to solve the problem of disappearing industrial jobs and should not be expected to.

DeletePlay Nickelodeon Games Free on your browser now!

ReplyDeletePlay Nickelodeon Games

Play Nickelodeon Games

Play Nickelodeon Games

Play Nickelodeon Games

So the atk Kearney report suggests that 12 percent of US manufacturing has been off-shored and that percentage is slowly increasing. That looks like Hype to me. I was curious to see how the UK compared to the US but cannot find any overall statistics. The little statistics I could find suggest that this is very manufacturing industry dependent and ranges from 70 percent for industries like leather to -10 percent for the likes of food.

ReplyDeleteWhilst manufacturing presents one picture business services and Research and development show things differently. Where the likes of the Germany and the US differ from the UK is in R&D with Germany and the US seeing slight declines while one report I have seen suggested that up to 40 percent of UK R&D has be outsourced outside the UK up to 2001. If true then I guess this might be due to firm ownership tending to move out of the UK , although I don't really trust these numbers.

The ten reasons for Re-shoring make for interesting reading in the report. Timeliness features in a few slots , along with freight/fuel costs and productivity. The re-shoring peak of 2011 I guess could be a reflection of oil prices which would suggest that now oil prices have dropped offshoring might pick up pace.

Throw in TPP weakening the business case for re-shoring and commodity price drops so that wage costs are a higher percentage of total costs then I would definitely say Hype.

Brick