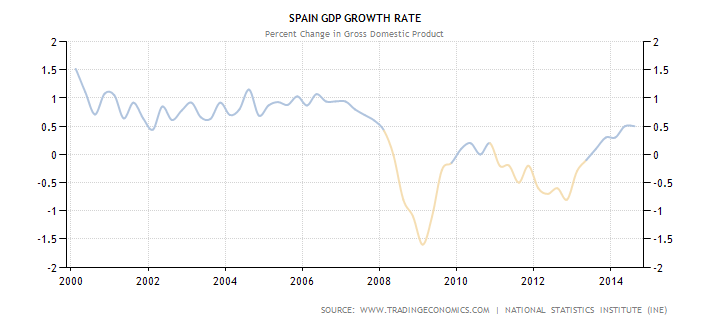

Celebrating the Spanish recovery

Lots of people have been celebrating the Spanish recovery. "From boom to bust to export-led recovery", crowed one Twitter commentator. This is the reality: Well, real GDP growth is now positive. I suppose that is a recovery, sort of. Though 0.5% growth is not exactly robust. In the UK we call 0.5% growth "stagnation", not recovery.* But look at this: Note the red at the far right. That is deflation. Consumer prices in Spain are falling by about 0.5%, according to the latest figures. To be sure, this is an annual chart: using annual GDP figures, NGDP is about 1%. I don't call that much of a recovery. And I doubt if the Spanish see it as recovery, either. This is GDP per capita: Yes, the Spanish are worse off now than they were in 2003. Ouch. So if the "recovery" is largely due to falling consumer prices flattering real GDP, what about those exports? Here's the Spanish current account: This looks like something of a success...