Celebrating the Spanish recovery

Lots of people have been celebrating the Spanish recovery. "From boom to bust to export-led recovery", crowed one Twitter commentator.

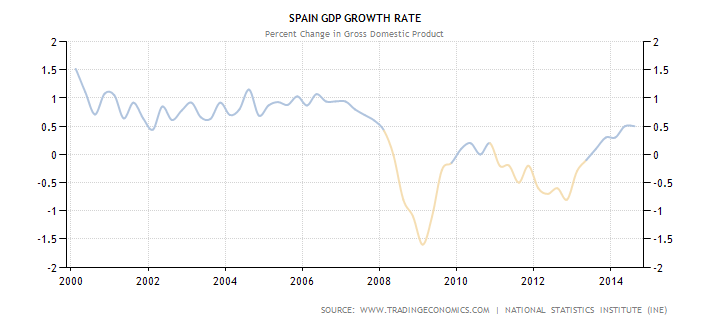

This is the reality:

Well, real GDP growth is now positive. I suppose that is a recovery, sort of. Though 0.5% growth is not exactly robust. In the UK we call 0.5% growth "stagnation", not recovery.*

But look at this:

Note the red at the far right. That is deflation. Consumer prices in Spain are falling by about 0.5%, according to the latest figures. To be sure, this is an annual chart: using annual GDP figures, NGDP is about 1%. I don't call that much of a recovery.

And I doubt if the Spanish see it as recovery, either. This is GDP per capita:

Yes, the Spanish are worse off now than they were in 2003. Ouch.

So if the "recovery" is largely due to falling consumer prices flattering real GDP, what about those exports?

Here's the Spanish current account:

This looks like something of a success story. The current account is indeed slightly positive, which might indicate a trade surplus (more on that shortly). More importantly, though, the very large imbalances that built up prior to the 2008 crisis largely due to inflows of capital into Spain's overblown construction industry have unwound. This is a much healthier current account than six years ago. But the cost has been terrible. Spain's construction industry was a major source of employment. This is what happened when the property bubble burst and the construction industry collapsed in 2008:

Spain's unemployment rate is now beginning to fall - though how much of that is due to emigration is unclear. But at 23% for adults and double that for 18-24 year olds, there is an awfully long way to go. Indeed it is by no means certain that unemployment can ever return to pre-2008 levels. The OECD's latest forecast of the sustainable (i.e. non-inflation accelerating) rate of unemployment is 18.9%. This is based upon a Phillips curve relationship which assumes growth returning to something like 3%. But structural unemployment at this level is a considerable drag on both growth and public finances. Putting it bluntly, if Spain is to recover AND put its public finances on to a sustainable path, about a fifth of its current population must leave.

So for the Spanish people, there really is not much to celebrate, is there? But wait. What about those exports?

Here are Spain's exports:

And these are imports:

Now, maybe my eyes are deceiving me, but this doesn't look like a story of export success to me. Exports appear simply to have returned to their pre-2008 trend growth rate - in fact if anything the export growth rate appears now to be declining slightly. The real story is the collapse of imports. And that is unquestionably due to the fall in household incomes from benefit cuts, tax increases, wage falls and above all unemployment, coupled with unserviceable debts and an extraordinarily harsh attitude to mortgage defaults. This is no export-led recovery. The current account balance has been achieved almost entirely through a massive fall in the standard of living of Spain's population.

I can't see anything to celebrate.

Related reading:

Structural destruction

Magical thinking at the G20 - Pieria

* This is a chart of quarter-on-quarter percentage RGDP growth. Annual percentage growth is 1.6%.

This is the reality:

Well, real GDP growth is now positive. I suppose that is a recovery, sort of. Though 0.5% growth is not exactly robust. In the UK we call 0.5% growth "stagnation", not recovery.*

But look at this:

Note the red at the far right. That is deflation. Consumer prices in Spain are falling by about 0.5%, according to the latest figures. To be sure, this is an annual chart: using annual GDP figures, NGDP is about 1%. I don't call that much of a recovery.

And I doubt if the Spanish see it as recovery, either. This is GDP per capita:

Yes, the Spanish are worse off now than they were in 2003. Ouch.

So if the "recovery" is largely due to falling consumer prices flattering real GDP, what about those exports?

Here's the Spanish current account:

This looks like something of a success story. The current account is indeed slightly positive, which might indicate a trade surplus (more on that shortly). More importantly, though, the very large imbalances that built up prior to the 2008 crisis largely due to inflows of capital into Spain's overblown construction industry have unwound. This is a much healthier current account than six years ago. But the cost has been terrible. Spain's construction industry was a major source of employment. This is what happened when the property bubble burst and the construction industry collapsed in 2008:

Spain's unemployment rate is now beginning to fall - though how much of that is due to emigration is unclear. But at 23% for adults and double that for 18-24 year olds, there is an awfully long way to go. Indeed it is by no means certain that unemployment can ever return to pre-2008 levels. The OECD's latest forecast of the sustainable (i.e. non-inflation accelerating) rate of unemployment is 18.9%. This is based upon a Phillips curve relationship which assumes growth returning to something like 3%. But structural unemployment at this level is a considerable drag on both growth and public finances. Putting it bluntly, if Spain is to recover AND put its public finances on to a sustainable path, about a fifth of its current population must leave.

So for the Spanish people, there really is not much to celebrate, is there? But wait. What about those exports?

Here are Spain's exports:

And these are imports:

Now, maybe my eyes are deceiving me, but this doesn't look like a story of export success to me. Exports appear simply to have returned to their pre-2008 trend growth rate - in fact if anything the export growth rate appears now to be declining slightly. The real story is the collapse of imports. And that is unquestionably due to the fall in household incomes from benefit cuts, tax increases, wage falls and above all unemployment, coupled with unserviceable debts and an extraordinarily harsh attitude to mortgage defaults. This is no export-led recovery. The current account balance has been achieved almost entirely through a massive fall in the standard of living of Spain's population.

I can't see anything to celebrate.

Related reading:

Structural destruction

Magical thinking at the G20 - Pieria

* This is a chart of quarter-on-quarter percentage RGDP growth. Annual percentage growth is 1.6%.

Very interesting and well structured argument. Thanks!

ReplyDeleteWell noted Frances, but is any of this really surprising? With a committed austerity mandate, a decline in the standard of living is to be expected. I'd draw most heart from the 1% GFCF number.

ReplyDeleteFrances, Interesting article, but haven’t you got the import and export charts mixed up? I ask because contrary to your claim that exports have not done well, they actually doubled in Euro terms between 2002 and 2014 according to the above chart.

ReplyDeleteI’m also skeptical about the OECD’s claim that NAIRU in Spain is 18.9%. Given that ACTUAL unemployment was around 10% between 2002 and 2008 without excess inflation, it’s hard to see why something like 19% unemployment should now pose some sort of inflationary threat. Obviously the Spanish labour market has been disrupted: people have had to shift out of construction and find other work and that will have raised NAIRU somewhat. On the other hand the evidence from the US (where construction obviously also took a hit at the start of the recent crisis) is that former construction employees found no more difficulty finding alternative work than former employees from other industries.

Ralph,

DeleteNo, I haven't muddled anything up. I said that exports had returned to their previous trend after the 2008 dip - which is correct. That is not saying that they are not rising, it is saying that they are rising NO MORE than they were prior to the financial crisis. Eyeballing the trend, the growth rate appears to be tailing off - which Edward Hugh has also observed (his chart is less noisy than mine).

The US has provided considerable fiscal and monetary stimulus to its economy, including extensive support to the housing market. Spain has had no such support. Consequently its property market and associated construction industry has had a far deeper collapse than the US's, dragging the rest of the economy down with it. Failure to fix Spain's dysfunctional banking system didn't help either. The fact is that Spain's economy is currently unable to create the jobs needed to employ all its people. We can argue about the NAIRU - the OECD's current forecast is 2% lower than last year's, which does suggest that the economy is beginning to recover. But supply-side destruction on this scale is very slow to heal. Just look at the former industrial towns in England and the mining valleys of Wales.

Spain:

ReplyDelete€1tr negative net international investment position http://www.bde.es/webbde/es/estadis/infoest/e0706e.pdf

€1.67tr external debt http://www.bde.es/webbde/en/estadis/bpagos/deudae.pdf

is there any precedent in history of a country than manages to avoid bankruptcy from this situation?

and if they try the export way there are implications for France and Italy.

Bankruptcy is not a meaningful word for a country. You can liquidate a bankrupt company. You can't liquidate a country.

Deletecall it then default on €1.67tr of external debt. hardly changes the picture

DeleteIf that Trading Economics chart really is GDP growth rate and not GDP per capita then there seems to be something seriously out of whack with it. 2000-2007 looks more like Italy or Portugal. Spain's average growth rate 2000-2007 (inclusive) is 3.6% annually according to IMF data. So the chart seriously underestimate the before and after effect.

ReplyDeleteI would also emphasize how much Spain has benefited from central bank liquidity generated fund inflows over the last 18 months. Without those even the meager growth we are seeing would be yet more meager.

Chart 1 looks to be quarterly changes in GDP, so growth is running at around 2% annualised at the moment. In the UK, we would call that a recovery.

DeleteIt's actually 1.6% annualised, see the footnote. But NGDP is lower because Spain is experiencing outright deflation.

DeleteThe Shape of the line on the export graph 2009 to 2014 does not look like a return to trend. It does not continue to the right constantly offset with the 2009 negative offset in the y axis.

ReplyDeleteYour question about the unemployment rate is dead on. I looked up the total of employed persons. It peaked at just over 20 million in 2007 and has now fallen to 17.5 million. That's a drop of over 2.5 million.

ReplyDeleteI think that what happened to Spain had to happen. You start back in the late 90s with an unemployment rate of 25%, a very poor education system, and a work force with relatively poor skills. Then you join the euro and interest rates drop to close to German levels, so there is an employment boom, but where? It has to be in low-skilled jobs, such as construction. Anyone in Spain that had real skill was already employed in 1999, and there was no surplus in skilled labour to draw on, so the cheap credit had to go into low-skilled jobs,

Then the boom comes to an end, you are left with hundreds of thousands of empty houses, and unemployment goes back to 25%, and you *still* have a poor education system and a low-skilled work-force.

Some people insist that the "pendulum" will swing and the empty houses will be bought and things will get back to normal, but I don't see it. I don't think the hundreds of thousands of houses were built to fill a market demand; they were just built because credit was cheap. In fact, maybe 25% unemployment is "normal" for Spain, and will be until they carry out very fundamental reform, especially in skills and education.

I find this a very strange article. You have to be very biased to not see an increase in exports (through a terrible recession in Spain's market) as an unalloyed good thing. Spain now exports more than France, the UK and Italy as a percentage of GDP. Also it has a current account surplus (unlike the UK) quite a feat since it has to import all oil and gas for domestic consumption.

ReplyDeleteUnemployment is horrific and unacceptably high, but we all know that the real figure is a lot lower than the numbers suggest as there is a very large black economy. http://www.elmundo.es/especiales/vivir-en-negro/una-sociedad-manchada.html, for those that read Spanish.

Also the population has gone down in the past few years as locals and recent immigrants have gone abroad looking for jobs.

There is a persistent wish to make Spain look as bad as possible among the blogosphere, why? I don't know.

I do regard an increase in exports as an unalloyed good thing. I do not regard an increase in NET exports achieved mainly through destruction of domestic demand causing import collapse as a good thing, at all. Current account surpluses are not intrinsically better than current account deficits: one is the mirror image of the other. Suppressing imports through demand destruction in order to flatter exports is mercantilism. If everyone does it, it results in reduced global trade, which benefits no-one. In order for there to be exports, there must be imports.

DeleteRegarding unemployment, I mentioned in the post that there was migration from Spain, including the pre-crisis immigrants leaving for better opportunities elsewhere. As far as the black economy goes, yes I'm prepared to believe that it has grown, but your attempt to explain away 23% unemployment as being due to a mass outbreak of tax avoidance and benefits fraud stretches credibility too far, I'm afraid.

If you read my post you will see that there to say that I'm trying to explain away 23% unemployment is a great exaggeration. All I say is that it is lower than the official figures state.

DeleteExports have grown the fact that imports have decreased is a separate story. And exports have grown mainly thanks to an increase in industrial production. http://www.ft.com/intl/cms/s/0/4d08c57a-be44-11e3-961f-00144feabdc0.html#axzz3Kp6v9jX9

Spain's industry is now bigger than the UK's as a percentage of GDP.

I'm not interested in comparing Spain with the UK, or indeed with any other country. I do not deny that exports have grown - indeed I showed that in the post. But the collapse of imports DOES matter. The current account balance has been achieved mainly through import collapse, not export growth.

DeleteA possible return of bank credit in 2015 s as reported in the ft yesterday will be the final nail in the coffin for people who relay on welfare or low wages.

ReplyDeleteCar sales up 18 % this year oil consumption steady at 1.2 MBE when it should be falling....capital goods overproduction will again be socialized on the masses.

...at least they're not Greece!

ReplyDelete