Euro area depression, charted

"The euro area economy is gradually emerging from a deep and protracted downturn. However, despite improvements over the last year, real GDP is still below the level of the first quarter of 2008. The picture is more striking still if one looks at where nominal growth would be now if pre-crisis trends had been maintained."

So said Peter Praet, Member of the Executive Board of the ECB, in a recent presentation to the FAROS Institutional Investors' Forum.

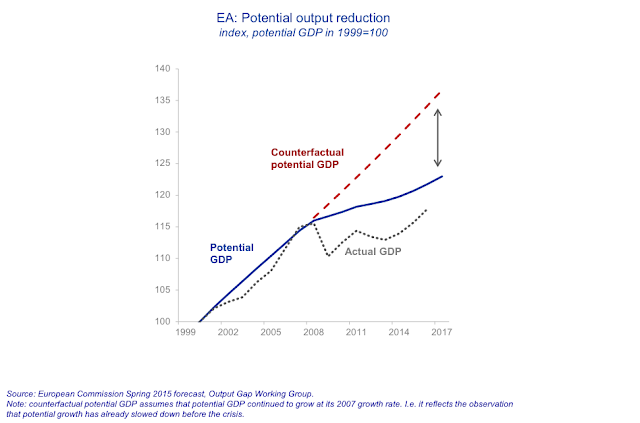

He's not wrong. From his presentation, here is a chart showing the difference between current output, current (estimated) potential output and projected output prior to 2007:

That is indeed a striking gap. It is reflected in this chart from Eurostat (August 2015):

So, the fall in GDP growth between 2007 and 2015 has resulted in a rise in unemployment of nearly 4 percentage points. Currently, across the Euro area as a whole (population about 340m), adult unemployment stands at 11% and youth unemployment about twice that. That is a LOT of wasted lives.

Since 2008, the Euro area has experienced a severe, extended double-dip recession from which it has not yet emerged:

Comparisons with previous recessions in Euro area countries (prior to the formation of the Euro, of course), as well as to the US's 2009 recession, show just how severe and prolonged this recession has been. It is probably reasonable to call it a depression.

If the Euro area continues on the path shown in this chart, it should emerge from depression by the end of 2016. But as Praet observes, the outlook for the global economy is not exactly bright, and the projected recovery path for the Euro area is by no means certain:

Praet observes that:

Importantly, Praet also notes that expectations of future growth in the Euro area are declining:

The debt overhang is undoubtedly a cause of the investment chill, but so are the low expectations of investors. After all, if you expect GDP growth 5 years hence to be a measly 1.4%, why would you bother to invest?

This is, of course, one of those nasty feedback loops that complicate macroeconomic forecasting. Low expectations cause low investment, which in turn depresses future growth prospects, causing expectations to fall further. It seems unlikely that private sector investment will improve any time soon. And because of this, inflation is unlikely to rise. This is therefore a matter of some concern to the ECB. Inflation (HICP) is currently far below target, and the latest ECB forecast predicts an extremely slow return to target - more than two years. Praet comments that inflation expectations are being affected by short-term supply-side effects (low oil prices), which suggests that they are becoming "unanchored" on the downside. Putting the two together, people expect growth to disappoint and inflation to remain below target for the foreseeable future.

Assuming that the Phillips curve remains negatively sloped - i.e. that there is an inverse correlation between inflation and unemployment - expectations of poor growth and very low inflation indicate that unemployment will remain stubbornly high for the foreseeable future.

The Euro area is stuck in a low-growth, low-inflation, high-unemployment equilibrium. It will take one heck of a big bazooka to knock it out of this toxic balance. The countries in the Euro area don't have that kind of bazooka. They are restricted by fiscal rules that make it impossible for them to do the large-scale investment spending that will be needed to restore growth. There is no Euro area federal government that could take on an investment programme of the necessary scale: President Juncker's plan is nowhere near adequate. The ECB is the only player with the necessary firepower, but it is insanely prevented by treaty directive from using its really big guns.

Perhaps predictably, Praet deflects criticism of the ECB for the Euro area malaise, arguing that restoring growth requires "structural reforms" from governments, not a more active role for the ECB. Yet this is the ECB that triggered the double-dip recession by failing to do its job of lender of last resort, allowing the Euro to fragment and sovereign yields to spike due to fears of Euro breakup and redenomination. And although Draghi's "whatever it takes" in 2012 ended fears of redenomination risk, the ECB then allowed M3 growth to fall for over a year, which was completely unwarranted - and very damaging - monetary tightness for an economy as depressed as the Euro area:

source: ECB statistical data warehouse

It is very hard to excuse the ECB for these errors.

It is not reasonable to claim, as Praet does, that restoring growth in the medium term is solely the responsibility of governments. To the contrary, it is extremely difficult for governments to undertake structural reforms when money is unjustifiably tight. M3 growth has improved, but as the chart shows it is now flatlining at the 2004 level. If unemployment and growth were at their 2004 levels, this level of M3 growth would be appropriate. But for a depressed economy with high unemployment, no inflation and a substantial output gap, it is way too low. Further stimulus is unquestionably needed.

Unfortunately there are influential voices arguing not only that further monetary stimulus is not necessary, but that the stimulus applied so far should be removed. For the sake of the unemployed, and those suffering from income restrictions, tax rises and benefit cuts, I hope these siren voices are resisted. The combination of tight money and fiscal restriction entrenches depression and unemployment.

I know I've said this before (and been criticised for saying it), but there is an uncomfortable historical precedent here. A similar toxic equilibrium was reached in certain European countries in the 1930s. It resulted in the rise to power of nationalistic governments, autarky and extremism, and eventually war. I do not forecast this, but we should not forget it. A war is certainly a big bazooka, and as long as people perceive it as politically justified, it is unlikely to be opposed on economic grounds.

But war, however justifiable, is terribly destructive. It would be far better for the Euro area to risk fiscal profligacy and monetary irresponsibility than travel that road again. So let's ditch the ridiculous rules and directives, spend a lot of money - ideally by means of helicopter drops, since increasing the fiscal burden on highly-indebted countries in a dysfunctional monetary union is not a sustainable solution - and get people working, and the economy growing, again.

Related reading:

The Slough of Despond

The dangers of historical taboos

The ECB is not doing its job. Again.

A terrible stability - Pieria

Structural destruction - Pieria

So said Peter Praet, Member of the Executive Board of the ECB, in a recent presentation to the FAROS Institutional Investors' Forum.

He's not wrong. From his presentation, here is a chart showing the difference between current output, current (estimated) potential output and projected output prior to 2007:

That is indeed a striking gap. It is reflected in this chart from Eurostat (August 2015):

So, the fall in GDP growth between 2007 and 2015 has resulted in a rise in unemployment of nearly 4 percentage points. Currently, across the Euro area as a whole (population about 340m), adult unemployment stands at 11% and youth unemployment about twice that. That is a LOT of wasted lives.

Since 2008, the Euro area has experienced a severe, extended double-dip recession from which it has not yet emerged:

Comparisons with previous recessions in Euro area countries (prior to the formation of the Euro, of course), as well as to the US's 2009 recession, show just how severe and prolonged this recession has been. It is probably reasonable to call it a depression.

If the Euro area continues on the path shown in this chart, it should emerge from depression by the end of 2016. But as Praet observes, the outlook for the global economy is not exactly bright, and the projected recovery path for the Euro area is by no means certain:

The risks around the evolution of the global economy have shifted downward, making the contribution of external demand to the recovery less assured. Domestic demand, though rising, also appears relatively weak if one considers that we are still in an early phase of the recovery and that there are important tailwinds supporting the economy – namely our monetary stimulus and lower oil prices.These aren't the only tailwinds supporting the economy. Lending figures from the ECB for September 2015 show continuing weakness in private sector loan demand, largely offset by strong growth of general government borrowing (7.2%, up from 6.3% in August). Despite continuing attempts by Brussels/Berlin to squash government support in the name of "fiscal discipline", it seems that governments are still borrowing to spend - fortunately, since there is little support coming from anywhere else. Investment in the Euro area fell sharply in 2008 and again in 2012, and remains shockingly low:

Praet observes that:

investment has so far failed to perform its "accelerator" role for the recovery.He goes on to attribute this to the continuing overhang of private and public sector debt, and to the very poor returns on capital in some Euro area countries.

Importantly, Praet also notes that expectations of future growth in the Euro area are declining:

The debt overhang is undoubtedly a cause of the investment chill, but so are the low expectations of investors. After all, if you expect GDP growth 5 years hence to be a measly 1.4%, why would you bother to invest?

This is, of course, one of those nasty feedback loops that complicate macroeconomic forecasting. Low expectations cause low investment, which in turn depresses future growth prospects, causing expectations to fall further. It seems unlikely that private sector investment will improve any time soon. And because of this, inflation is unlikely to rise. This is therefore a matter of some concern to the ECB. Inflation (HICP) is currently far below target, and the latest ECB forecast predicts an extremely slow return to target - more than two years. Praet comments that inflation expectations are being affected by short-term supply-side effects (low oil prices), which suggests that they are becoming "unanchored" on the downside. Putting the two together, people expect growth to disappoint and inflation to remain below target for the foreseeable future.

Assuming that the Phillips curve remains negatively sloped - i.e. that there is an inverse correlation between inflation and unemployment - expectations of poor growth and very low inflation indicate that unemployment will remain stubbornly high for the foreseeable future.

The Euro area is stuck in a low-growth, low-inflation, high-unemployment equilibrium. It will take one heck of a big bazooka to knock it out of this toxic balance. The countries in the Euro area don't have that kind of bazooka. They are restricted by fiscal rules that make it impossible for them to do the large-scale investment spending that will be needed to restore growth. There is no Euro area federal government that could take on an investment programme of the necessary scale: President Juncker's plan is nowhere near adequate. The ECB is the only player with the necessary firepower, but it is insanely prevented by treaty directive from using its really big guns.

Perhaps predictably, Praet deflects criticism of the ECB for the Euro area malaise, arguing that restoring growth requires "structural reforms" from governments, not a more active role for the ECB. Yet this is the ECB that triggered the double-dip recession by failing to do its job of lender of last resort, allowing the Euro to fragment and sovereign yields to spike due to fears of Euro breakup and redenomination. And although Draghi's "whatever it takes" in 2012 ended fears of redenomination risk, the ECB then allowed M3 growth to fall for over a year, which was completely unwarranted - and very damaging - monetary tightness for an economy as depressed as the Euro area:

source: ECB statistical data warehouse

It is very hard to excuse the ECB for these errors.

It is not reasonable to claim, as Praet does, that restoring growth in the medium term is solely the responsibility of governments. To the contrary, it is extremely difficult for governments to undertake structural reforms when money is unjustifiably tight. M3 growth has improved, but as the chart shows it is now flatlining at the 2004 level. If unemployment and growth were at their 2004 levels, this level of M3 growth would be appropriate. But for a depressed economy with high unemployment, no inflation and a substantial output gap, it is way too low. Further stimulus is unquestionably needed.

Unfortunately there are influential voices arguing not only that further monetary stimulus is not necessary, but that the stimulus applied so far should be removed. For the sake of the unemployed, and those suffering from income restrictions, tax rises and benefit cuts, I hope these siren voices are resisted. The combination of tight money and fiscal restriction entrenches depression and unemployment.

I know I've said this before (and been criticised for saying it), but there is an uncomfortable historical precedent here. A similar toxic equilibrium was reached in certain European countries in the 1930s. It resulted in the rise to power of nationalistic governments, autarky and extremism, and eventually war. I do not forecast this, but we should not forget it. A war is certainly a big bazooka, and as long as people perceive it as politically justified, it is unlikely to be opposed on economic grounds.

But war, however justifiable, is terribly destructive. It would be far better for the Euro area to risk fiscal profligacy and monetary irresponsibility than travel that road again. So let's ditch the ridiculous rules and directives, spend a lot of money - ideally by means of helicopter drops, since increasing the fiscal burden on highly-indebted countries in a dysfunctional monetary union is not a sustainable solution - and get people working, and the economy growing, again.

Related reading:

The Slough of Despond

The dangers of historical taboos

The ECB is not doing its job. Again.

A terrible stability - Pieria

Structural destruction - Pieria

"there is an uncomfortable historical precedent here. A similar toxic equilibrium was reached in certain European countries in the 1930s."

ReplyDeleteA more accurate historical precedent is the "long depression", which engulfed all developed countries from 1873 to 1896, a period of "low-growth, low-inflation, high-unemployment equilibrium".

The mechanism has been cogently described (notably by Paul Bairoch), and is eerily reminiscent of what is taking place nowadays:

1) A first period of "globalization" marked by the organization of commerce on the basis of unfettered free trade (from 1858 onwards, robustly pushed by the UK via a succession of bilateral and multilateral agreements).

2) While urban populations and industrial workers benefited from the resulting drop in prices for industrially produced consumer goods, those whose income derived from agricultural activities (and at that time they represented a large fraction of the population) saw a continuous degradation of their income, and hence of the corresponding economic demand. The reason: a few large producers (USA, Russia, Hungary) could produce cheaply on vast, extensive estates, while countries like France or the Netherlands could only manage with intensive, costly production on comparatively small plots.

3) Meanwhile, massive stock exchange bubbles were generated, especially around railways, and banks in Europe and the USA were increasingly exposed to speculative risk.

4) Everything came to a crash in 1873, with all countries falling like dominoes via inter-related stock exchange collapses and bank failures that spread to all European countries and the USA. The economy was then stuck in a permanent slump, with suppressed demand growth. There was just a brief bout of recovery in 1878-1879 before the economy stumbled back into stagnation.

5) A return to normal (for 19th century conditions) was achieved around 1896 after all countries (except the UK) re-introduced protectionist measures in the agricultural sector. Not just for economic reasons: farmers and landowners were also the electoral basis for conservative governments, and they needed their support against the emerging socialist parties (thus, those Junkers supporting Bismarck lived from their land estates, inherited from long lines of German nobility, not from industrial activities).

This seems to me a more proper comparison than the 1930s, as we can observe neither the emergence of structured ideologies like fascism, nor well-organized groups on military basis like the Falange, the Fascio or the NSDAP, nor the sheer brutality in politics that was typical of that period. It does not mean that violence was not present during the long depression: actually, it saw the emergence of extremely violent anarchist and nihilist groups that embarked on widespread terrorist tactics -- which again is much more akin to what we observe nowadays in Europe (with all the complex links this has with the Near East).

Interesting that you do not see the genesis of World War I in the Long Depression and the protectionist measures that ended it.

DeleteFirst, the Long Depression ended some 18 years before WWI. When WWII started, the Great Depression was not even fully over and its consequences were being felt.

DeleteSecond, the Long Depression was ended through selective protectionist measures in the agricultural sector (Germany did likewise for a couple of industrial products) -- there was neither attempts nor calls for autarky at that time. There is no comparison with what took place shortly before WWII.

Perhaps you are referring to the (discredited) argument that countries trading with each other do not wage war against each other, and that therefore the reduction in free trade was a (very belated) cause of WWI. Available historical statistics show that foreign trade was growing briskly till 1914, in conjunction with, and often faster than, the overall manufacturing sector in all countries of interest. I seem to remember that the share of foreign trade in GDP reached before WWI was unequalled till approximately the 1980s.

Interestingly, that period was also the heyday of monetary unions -- which were plagued by various issues. The current argument that the Euro is one measure ensuring peace in Europe is also historically discredited: Austria-Hungary and Bulgaria, France and Italy were all members of the large Latin Monetary Union; they ended up on opposite sides in WWI.

Bill Mithchells Jap Keynesian growth story is fine until you consider the consequences.

DeleteAll those machines needed natural resources, specifically oil in the Dutch east indies and elsewhere.

This resulted in a major naval toe to toe between the 3 big powers of the Pacific.

The RN, USN and the imperial navy of Japan

Both the British and Japanese lost control of the Pacific, leaving the Us to grow internal consumption at the expense of the others who were forced to engage in mercantalism and late stage Venetian financial tricks.

Exponential growth always leads to zero sum games (War)

https://en.m.wikipedia.org/wiki/Easter_Sunday_Raid

DeletePrime Minister Winston Churchill said:

DeleteThe most dangerous moment of the War, and the one which caused me the greatest alarm, was when the Japanese Fleet was heading for Ceylon and the naval base there. The capture of Ceylon, the consequent control of the Indian Ocean, and the possibility at the same time of a German conquest of Egypt would have closed the ring and the future would have been black.

— From a conversation at the British Embassy, Washington, D.C.[10]

@anonymous .

DeleteThe 19th century certainly was not the first period of capitalist globalization.

I always like this quotation.

Mercator by Nick Crane

Chapter 1 :A little town called Gangelt

“In Gangelt they were locked into the fate of the peasant, who was currently enduring rural Europe transition from an ancient feudal system to a money economy ,where the freedom to work for a wage came at the cost of dispossession from the land , as owners consolidated their estates for commercial production”

The rising prices of farm produce benefited the large farmers and estate owners,but crippled the peasants who were forced to work more ,for lower wages for crops that were not theirs.

As larger farms became more viable ,the ancient privileges which gave peasants the wherewithal to live off the land was eroded.

A new term emerged ,”roboten” , meaning drudge ,toil ,fag , sweat.

The peasant became a wage slave ,a Robot.

To the daily drudgery was added punitive taxes and periodic demands for men and horses to fight the emperors campaigns”

There is no net benefit to capitalism.

Europe must return to feudal structures with a modern twist (national dividend) before the remaining bits of its civilization collapse from the weight of usury.

Anonymous, I'm inclined to agree. Trade protectionism appears likely to be the next stage, rather than extremist governments. However, we should be careful not to assume that foreign trade would grow as it did between the end of the Long Depression and WWI. That was the heyday of the great empires, for whom much of their foreign "trade" was extraction of resources from their colonial acquisitions. We aren't going to see that again.

Delete"Trade protectionism appears likely to be the next stage"

DeleteI would say protectionism in all its forms -- for instance, there are many calls to abolish Schengen, re-instate strong border controls, and end the free flow of people. Further serious financial or banking degradation might lead to capital and currency controls. And so on. Depending on the circumstances and the mode of application, those measures might be good or bad, just like debt, deficits, investments and stimulus.

"That was the heyday of the great empires, for whom much of their foreign "trade" was extraction of resources from their colonial acquisitions."

It is incontrovertible that trade between colonies and their respective masters was actually resource extraction. However, the majority of foreign trade carried out by those empires took place with other European and American countries, and the resources they could not procure indigenously (rubber, copper, tin, oil, nitrate, leather, etc) were largely acquired via trade with Latin American countries, not from colonies (Brazil, Argentina, Chile and Colombia became genuinely prosperous at that time through this trade). Europe started crucially depending on its colonies after WWI, once the "pacification" was over (not long before WWI), and the infrastructure (mines, roads, railways, harbours) to ship those resources in large quantities to Europe had been developed at the required scale. We tend to infer the scale and variety of resources acquired from colonies a century ago from the scale and variety of resources traded from countries that are former colonies nowadays -- but we forget how much of those resources started being exploited only at the very end or even after the colonial period (case in point: hydrocarbons).

I disagree, any further rises of Gdp( activity) will subtract from the basic act of living.

ReplyDeleteIn the Ireland of 2009-10 there was a major return of purchasing power to people albeit extremely unbalanced.

In November 2010 we got the formal bailout.

This was not a bailout of the people but a act to save the then dying corporate consumer war economy.

Since then we have seen major increases in Gdp but further increases in mass poverty as people are forced to work to access purchasing power ( thus destroying it before it can be effectively consumed)

The choice is between Industrial depression and famine / war.

I am sure the authorities will choose the later as they have form in this regard.

People are working in the British Isles but are not producing much.

ReplyDeleteLabour value theories hold no water in a world swamped with billions of capital goods.

In Ireland they currently eat 40+% of the energy pie. (transport / distribution costs)

This 40% figure was last seen during the 2005-08 period.

Peaking in 2007 at 43% of total final energy consumption....

In the late 80s it was 20 to 25%.......

Everybody knows "structural reforms" is code for increasing corporate profitability

ReplyDeleteWhy would a humanist do such a thing ?

It has no altruistic purpose , its a simple extraction of flesh.

Ireland has just passed a record 1.9 million private tanks / cars on the road.

ReplyDeleteSoon we will have 2 million tanks and a million starving in the streets.

Under a wage slavery model you can never have enough as most people cannot get it.

(WAGES add to Costs)

Why not have 200,000 cars ~ enough for the Gp, the taxi driver and perhaps a 2cv for the farmer.

Instead of burning 2,200 kbd a year on such toys we need only burn 220kbd as they again do useful work.

It will be shown yet again that the financial cost of oil is a mirage.

It is how it is used that is important.

The entire growth period in Ireland that I can remember ( 70s Irish baby boom kid) has been a complete socialical disaster.

Why oh why Francis do you want to sustain it.

Let the wealth go

Distribute the existing surplus.

Do not destroy it.

The Single Mandate is the eurozone's original sin.

ReplyDeleteBuiter via Ft alpha claiming now that Jesus & Marx agree ( works sets you free)

ReplyDeleteA man who pressed a bunch of fishermen to walk the Earth Kung foo style did not believe in work for works sake.

The Dutchman knows this of course.

Given the banks total control of all life they can push the knife in ever deeper into society without consequence.

Their ivory tower fear of football hooligans is quite funny given that capitalist wage slavery created that phenomena while under the shadow of the satanic mill.

It will be much more like the wine of st martins day at least when observed with puritan Dutch eyes.

In their RUR little stage play have they calculated how much extra electrical energy is required .........

They can indeed make the energy books balance if they decide to wipe us out which sadly looks likely.

Where is Sarah Conner when you need her ?

Humans are getting in the way of growth.

ReplyDeleteThey prefer to sit in the pub and talk shit.

The solution...........

https://m.youtube.com/watch?v=EeOSlC_yvk0

Buiter & Lizzie also give us this idea we have always worked hard.......how will we cope work etc etc.

ReplyDeleteCows work hard to chew the cud , humans did not do this pre - agriculture

https://m.youtube.com/watch?v=xOUcQeNzzx0