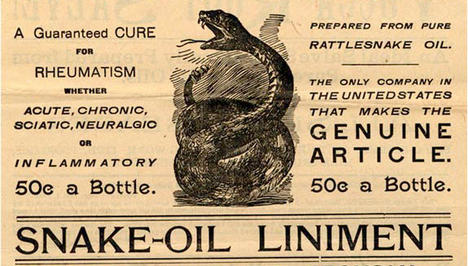

Monetary Snake Oil

Guest post by Paddy Carter.

Jeremy Corbyn’s People’s QE offers the alluring prospect of spending more without borrowing more. Which is just the ticket, if you want to replace austerity with largesse, and cut the deficit to boot. Sadly, this appealing miracle cure is pure snake oil (although there is, perhaps, a version of the idea which might be helpful, if substantially less miraculous).

The basic idea behind People’s QE is to finance public spending by printing money. This is actually something that happens all the time, and it is by understanding how, and why, that we shall see why People’s QE, as sold, is an empty promise.

As the real economy grows, the money supply has to keep up. Suppose we wanted zero inflation then, as a first approximation, we would expect the money supply to grow at the same rate as the real economy. If the economy grows at 2 per cent a year and base money (reserves and bank notes) grows at the same rate as the broad money supply (debit accounts etc.) then the newly printed money implied by expanding base money at 2 per cent is government revenue. The word for this is seignorage and for PQE to enable spending without borrowing, it must increase the long-run rate of seignorage.

Over the short run, the base money supply ebbs and flows as the Bank of England (BoE) goes about its business. The BoE does not directly target the money supply, instead it sets the interest rate and lets the money supply do whatever is needed to meet demand at that rate. The process is rather convoluted and involves banks setting targets for the amount of money on reserve over a certain period. There is not a neat relationship between the interest rate and money supply growth, so you cannot say that when the interest rate is low the money supply is expanding, and vice versa. But you would not go far wrong to think that when the interest rate is stimulating the economy, the rate of seignorage grows, and shrinks when monetary policy is tightened (potentially becoming negative).

And here’s why People’s QE (PQE) is snake oil. So long as the BoE is still targeting inflation, it will still be pushing and pulling money in and out of the system, as required to meet demand for money at the interest rate it has set. If the BoE is still targeting inflation, then whatever money PQE puts into the economy on one hand, the BoE is going to be taking out with the other. Or, if the BoE happens not to take the money out, that implies it would have been putting it in, anyway. And that means that over the long run the rate of seignorage, or the extent to which the government is able to spend without borrowing, is not affected by PQE.

But why would the BoE want to remove whatever money PQE puts in? After all, we just put £375bn of freshly printed money into the economy, without causing inflation. Conventional QE is an entirely different animal from PQE. Conventional QE merely swapped one asset (bonds) for another (cash). This did not much affect banks’ ability to lend nor the demand for borrowing, so that cash has merely accumulated on reserve. Conventional QE works by changing - only by a little - the returns on assets so that they become a little less attractive and spending relatively more so. This probably only had a modest impact on the economy. PQE, in contrast, is there to directly finance spending, pay wages, purchase goods. The whole point is to boost aggregate demand. For PQE inflation is a feature, not a bug. Now it’s true that there may be some slack in the economy and some of the things the envisaged PQE-financed National Development Bank would do might raise productive capacity, so there might be some scope to raise demand without inflationary pressure. But step beyond that and either the BoE would neutralise it, or, if prevented from doing so, we’d get inflation. Judging by campaign rhetoric, I think we can expect a Corbyn administration would err on the side of too much spending.

It is not clear exactly how PQE would be implemented. The most important question is whether it would be a countercyclical tool in the hands of the BoE, or something the government uses whenever it wants to finance expenditure. Richard Murphy has suggested the Bank governor would be fired if he tried to block the policy. If, somehow, the flow of money fed into the system is forced above whatever is consistent with the BoE setting its interest rate to hit its inflation target, then we can expect inflation to rise above target. The government could spend without borrowing, if it decided to abandon the current arrangements for inflation targeting. In the extreme, if a Corbyn administration opened the monetary taps every time it thought unemployment was too high and investment too low (i.e. all the time), and neutered the BoE’s ability to offset, then warnings about inflation might start to look warranted.

None of this says we currently have the best possible system. The failure to exploit low interest rates to finance infrastructure investment during the great depression has been particularly egregious. Perhaps a version of PQE could have a role, as a countercyclical tool in the hands of the BoE, in solving that problem and combating deflationary pressure. In theory PQE is entirely unnecessary and governments can finance investment during downturns by borrowing when rates are low. In practice, some short-run seigniorage earmarked for public investments might help the system overcome its reluctance to do so and deliver countercyclical fiscal policy via a monetary backdoor. But that’s not what Corbyn is selling.

_________________________________________________________________________________

Paddy Carter is really a development economist but has been brainwashed by years of teaching undergraduate macroeconomics and absorbing more by osmosis, briefly having had an office down the hall from Tony Yates. A long time ago he was a journalist. His academic research can be found here: https://sites.google.com/site/

Does not sound like a people's Qe to me.

ReplyDeleteIt is in fact a corporate Qe.

A real people's Qe is when you give people directly the money without condution to use the existing capacity.

Under the above classic socialist example people will be forced to work for corporates to access the money.

This will add costs perhaps expressed through inflation, higher tax etc etc.

The basic problem is of course a lack of distribution of the commons as it was seized many hundreds of years ago now

You can print money to increase the rate of deflation (not Inflation).... It's called the compensated price.

ReplyDeleteStart with railway tickets as it the only transport mechanism that has seen a real decrease in energy consumption despite or indeed because of increased passenger numbers.

Investment will then follow,

At the moment the idea is to front run investment without a demand signal which seems crazy but from a bankers perspective it preserves relative wealth differences so is a good sin.

The investment money will merely lead to another spending Gap down the road preserving the pointless nature of current commerce which the money monopoly just love to bits.

Politicians in the UK cannot under any circumstances cannot interfere with the workings of the Cb tabernacle.

Corbyn is yet another predictable auld political soul.

For the purposes of PQE as proposed by Corbyn/Murphy Seigniorage is irrelevant as the money created will not form part of base money, that is to say that no money will be printed (or minted).

ReplyDelete97% of money creation pre-2008 was via commercial banks issuing loans (private,commercial and sovereign) and this expansion of broad money is indeed monitored by central banks and interest rates are used to exert some control over it. However there is another mechanism that controls the broad money supply and that is taxation which is in the control of governments.

The only other source of money is QE. Traditional QE is the central bank buying assets by creating money and expanding their balance sheets, but in effect these transactions are neutral as they can be unwound by selling the assets and destroying the money. The world has seen the creation of $10 trillion in QE and in UK and US the inflation rate is lower than target. So creating money in this way has not lead to inflation problems. PQE is the same as ordinary QE except that the bonds being bought by the central bank will be "corporate" bonds issued by the National Investment Bank. The NIB will indemnify the central bank for the amount of PQE in the same way that the government has done for the £375 billion QE. So no printing, no inflation, calm down and carry on.

Richard,

Delete"PQE is the same as ordinary QE except that the bonds being bought by the central bank will be "corporate" bonds issued by the National Investment Bank".

Sorry, but this isn't right.

QE purchases gilts already in circulation. It is therefore simply an exchange of an existing asset for new base money. When these gilts are purchased from non-banks, bank money (deposits) also increase by the same amount. There is however no change in the net financial assets of the private sector. All that has changed is their composition.

The PQE proposal is for NEW bonds to be issued by the NIB for the BoE to purchase. This in itself is an increase in the net financial assets of the private sector. When the BoE purchased them, therefore, there would actually be new base and bank money in circulation. PQE is thus fundamentally different from QE.

This is well explained by Bill Mitchell here: http://bilbo.economicoutlook.net/blog/?p=31626

Fine, but surely with PQE you just issue a few less gilts and so the net effect is similar!?

DeleteI was going to cover this in a separate post, but since you've commented, I will explain.

DeleteIn the absence of other actions, the Bank of England neutralisating PQE's monetary expansion necessarily also neutralises its fiscal expansion. The Bank would sell the same value of gilts as the NIB bonds purchased, leaving both the monetary AND fiscal positions flat. Such a neutralised ("sterilised") PQE operation would thus simply exchange regular gilts for NIB bonds. It is not clear to me that this is in any way beneficial to the economy. Indeed it is not clear to me why it would have any net effect at all.

Issuing fewer gilts, as you suggest, would neutralise the monetary effects of PQE. However, it would actually tighten liquidity conditions in the economy, since not only would the new NIB bonds be removed from circulation by PQE but there would also be fewer gilts in circulation. This would be fiscal tightening and actually counterproductive. I would remind you that since as an EU member the UK government is unable to finance its deficit with central bank funding, issuing fewer gilts would mean cuts to government spending and/or higher taxes.

Two further flaws in PQE not mentioned above.

ReplyDelete1. PQE concentrates all or nearly all spending on infrastructure. Unfortunately there’s a shortage of relevant skills (bricklayers, engineers, etc).

2. While more infrastructure may be needed, any democratically elected government also has other priorities: health, education, fighting ISIS, or whatever. The idea that 100% of a given increase in public spending should all go on one item is bizarre.

In Corybn's pdf on his economic plan he writes:

Delete"One option would be for the Bank of England to be given a new mandate to upgrade

our economy to invest in new large scale housing, energy, transport and digital projects:

Quantitative easing for people instead of banks. Richard Murphy has been one of many

economists making that case."

Ireland has a huge surplus of cars and roads and yet has a major housing crisis as its people cannot afford to buy existing capacity.

DeleteThe UK also had a purchasing power crisis.

Any look at Uk domestic energy consumption will tell you this as despite atomic like living we see major declines in household energy consumption,

there is many reasons for this but the primary one is lack of distribution.

So in short if people cannot afford to live inside the existing stock of houses how can increasing the stock of houses help?

A Ireland independent from the bankers could have engaged in a major policy of distribution given its lower population density, returning to a fergonson tractor /2cv economy / push bike economy but distribution is far more problemic for such a densly populated country.

In many ways the UK is to far gone down the rat hole.

I will need to read Bill Mitchell's analysis but I wonder if he and Murphy agree. Murphy said a People's QE is like a Banker's QE - which they tried - but instead of giving the new money to the banks, they give it to the government to invest and spend. Mitchell mischaracterizes Wren-Lewis's take I believe.

ReplyDeleteOriginally Wren-Lewis characterizes a helicopter drop as a "People's QE" which confuses things. Instead of a bankers' QE - which they tried and it didn't work very well, he suggested a helicopter drop which would put newly printed money in people's bank accounts directly instead of mediating it through the banks and via lower mortgage rates.

Wren-Lewis is worried that after the next down turn, we'll be near or at the Zero Lower Bound and fiscal policy - which Coppola, Wren-Lewis, everyone prefers - will be blocked with a focus on austerity so the job will be left to a bankers' QE. But that was unpopular and didn't work well. Note that QE is done at the ZLB when regularly monetary policy can't be used. A People's QE - like a Bankers' QE - would end once they are ready to raise rates, i.e. when were' nearing full employment and inflation is rising. So the following is wrong: "So long as the BoE is still targeting inflation, it will still be pushing and pulling money in and out of the system, as required to meet demand for money at the interest rate it has set." The BoE would be doing a Bankers' QE if a People's QE wasnt' happening. It wouldn't push and pull.

Pace Bill Mitchell, Wren-Lewis would like a Government QE or People's QE per Corbyn/Murphy but worries about central bank independence, etc. Wren-Lewis in the blog post Mitchell links to:

"Suppose that a NIB is created, not on the back of QE but using more conventional forms of finance. (If the government wants to encourage it, just directly subsidise that finance with conventional borrowing. Don’t be put off doing so by deficit fetishism.) Suppose we also like the concept of helicopter money - not for now, but for the next time interest rates hit their lower bound and the central bank wants more stimulus. In those circumstances, it might well make sense for helicopter money to be used not only to send cheques to individuals, but also to bring forward investment financed by the NIB, or public sector investment financed directly by the state. If those investment projects could get off the ground quickly, and crucially would not have happened for some time otherwise, then what I have elsewhere described as ‘democratic helicopter money’ would make sense. [2] This is because investment that also boosts the supply side is likely to be a far more effective form of stimulus than cheques posted to individuals."

NIB is a national investment bank. Tony Yates is worried it would work to well. He is worried politicians would go bananas spending and inflation would get out of control (but note about how I said a People's QE would end when the central bank is ready to raise rates. Bernanke tapered and didn't do Bankers' QE forever.) Looking at the past 40 years, the problem is the other way about. Wage stagnation and increasing inequality are the norm because of insufficient inflation and insufficient demand. Politicians would rather be "fiscally responsible" and force austerity on the economy. Yates has proposed raising the inflation target to 4 percent. That would work too. If the next economic recovery is as bad as this current one it's because of the politics, not the economics. There are plenty of ideas and Corbyn's People's QE is a good one.

"Judging by campaign rhetoric, I think we can expect a Corbyn administration would err on the side of too much spending. "

DeleteThat might be a good thing as long as it doesn't get out of hand. They could raise the inflation target to 4 percent and allow labor markets to get tight so workers share in productivity gains.

Inflation fetishism is just as bad as deficit fetishism. The Blairites couldn't attack Corbynomics as busting the budget so they said it would cause inflation to get out of control. Murphy says it wouldn't and I believe him.

As a sidenote I see that Bill Mitchell is a prominent MMTer and I don't really understand how MMT differs from mainstream Keynesian economics. I mean Robert Murphy isn't and MMTer is he? Wren-Lewis isnt and he likes "democratic helicopter money" even if he balks at the implications for central bank independence.

DeleteRichard Murhpy, not Robert.

DeletePeter,

DeleteRichard Murphy didn't understand the fundamental difference between PQE and QE. Seriously, read Bill Mitchell. I disagree with Bill about lots of things but he does understand PQE and QE.

But you're not getting it either, sadly.

The Bank of England uses changes in the size of the monetary base to influence interest rates and hence control inflation. This is normally done through what are known as Open Market Operations, where the Bank buys and sells gilts on the open market. The "push and pull" of open market operations on the monetary base is what Paddy is referring to, not QE. Assuming that the Bank remained responsible for controlling inflation, open market operations would continue even if the government were compelling the Bank to purchase NIB bonds. Indeed the Bank might have to step them up (i.e. raise interest rates) to prevent inflation rising. I'm sure you can see that this would negate the monetary expansion effect of PQE. (It would also negate the fiscal expansion, but I will explain that myself in another post.)

At present, because we have excess reserves in the system due to QE (which as I explained previously simply changes the composition of net financial assets rather than increasing their quantity), the Bank of England influences the size of the available monetary base by changing the interest rate it pays banks for depositing reserves with it. Raising the interest rate encourages banks to place more money on deposit with it - thereby taking it out of circulation - and therefore reduces the size of the available monetary base. The effect is similar to the open market operations discussed above.

Whichever mechanism is used, Paddy's point stands. If the Bank of England remains responsible for controlling inflation, it will act to neutralise the monetary expansion caused by PQE.

The consensus among economists like Paddy and Tony is that the fiscal stance is too tight. They want to see an end to austerity just as much as you do. So do I. We just don't think PQE is the right way to go about it.

Frances, you're not getting it either. About half way through the article Paddy admits that he doesn't know how PQE is going to actually work in practice.

Delete"It is not clear exactly how PQE would be implemented."

So he doesn't know. He;'s trying to say 'I don't know, but', as are you. The BoE has very little effect, and they admit it. Commercial banks, when undertaking a loan, create their own reserves as part of the process. They do not need the reserves to already be there. The banking crisis was one of credit not money.

"Whichever mechanism is used, Paddy's point stands. If the Bank of England remains responsible for controlling inflation, it will act to neutralise the monetary expansion caused by PQE."

But the stimulus caused by PQE will completely bypass the BoE as the people seek to take out more loans from commercial banks. It is not how the money is raised, it is how it is spent.

Dan H,

DeleteThis is technically wrong, I'm afraid. Commercial banks create deposits when they lend. They do not "create their own reserves". Reserves are created only by the central bank. As reserves are needed for the deposits created by lending to be withdrawn (paid out), it is completely impossible for people borrowing from commercial banks to bypass the BoE.

Richard Murphy has not seen fit to explain the mechanics of PQE. So we are all working in the dark to some extent, I agree. But we do have to pay attention to how a debt monetisation scheme would work in the context of the current monetary framework. That is what Paddy has tried to do, and I have tried to develop further in my replies to comments here. Paddy's post is by no means the last word on the subject: indeed my purpose in posting it was to spark debate about how this might actually work in practice. I welcome constructive comments.

Dan H,

DeleteThis explains why banks don't lend reserves

http://www.3spoken.co.uk/2014/07/on-nature-of-banks-payment-clearing.html?m=1

Inflation cannot be increased as people cannot afford to consume higher prices.

ReplyDeleteIt's therefore not a question of increasing capacity through increased investment as it will get stranded.

World trade in coal especially has tripled since 1990.

We are currently seeing a implosion of this vast system of energy trade which will have grave consequences for industrial production in coal deficit countries.

Given the heavy albeit wasteful production of electricity by these plants the only investment worth the Uks money is a cable connecting it Hydro rich Norway which is perhaps the only viable renewable technology.

Peoples QE and a national investment bank is about much more than the intricacies of monetary operations. It's about telling the privately run banks that they no longer have a free reign. They have failed in their job of capital allocation, preferring to blow bubbles than invest. This is almost entirely political. We don't need privately owned banks. We don't need to pay interest on government bonds. It's a rent-extraction machine, and it's actions are creating inequality and reducing living standards. Sure, all this could be funded with regular government borrowing, but this is about private power versus democracy.

ReplyDeleteThe anti-Corbyn Neoliberal or Libertarian stance of this article gives the game away let alone it is fallaciously argued. Abnormal inflation is caused by feckless banks in cahoots with government as equally if not more than monetary system illiterate governments. Average house price inflation, for example, in the UK between 1997 and 2007 was 123%. The fallaciousness of Carter's monetary system arguments are revealed in the following article by Stephanie Kelton:-

ReplyDeletehttp://www.taxresearch.org.uk/Blog/wp-content/uploads/2015/08/Kelton_QE.pdf

Her argument should be augumented by Lau and Smihin's belief that for investment and stability reasons an economy should aim in normal circumstances to maintain a positive interest rate of return relative to inflation:-

http://cn.ckgsb.com/web2005/files/forum0607/TheRoleofMoney_louyifei.pdf

Finally the fallaciousness of Neoliberalism's or Libertarianism's anti-government bias is best argued by this David Sloan article:-

http://aeon.co/magazine/society/how-evolution-can-reform-economics/

Schofield,

DeleteI don't think it is remotely helpful to describe people as "anti-Corbyn" or use epithets like "neoliberal" and "libertarian". Please confine your remarks to the subject rather than indulging in speculation about the political beliefs of the author. This blog is politically neutral and I welcome commentary from both the left and the right.

We do not really know the causes of inflation. Blaming it on "feckless banks" is no more accurate than blaming it on irresponsible government, incompetent central banks, over-powerful trades unions, unfair competition, monopolies and cartels - all of which have been blamed in the past.

Asset price inflation and consumer price inflation are very different things and subject to different control mechanisms. Currently, the Bank of England targets one but not the other. You may believe this is foolish (so do I) but please don't conflate the two. Consumer price inflation is what we are discussing in this post, not asset price inflation.

Stephanie's post is interesting but does not really undermine Paddy's argument. Why does the Fed (or the combined Fed & Treasury, in her framework) have a "target rate"? Why, to meet its mandate. And the Fed's mandate is 1) price stability - ie. inflation at or near 2% 2) full employment. The BoE only has one of these, namely the inflation target.

Paddy's argument is that if PQE caused inflation to rise above target, the Bank of England would tighten monetary policy to return it to target, thus undermining the monetary expansion effects of PQE. If the government didn't want it to do this, it would either have to raise the target (which Tony Yates has advocated) or end the BoE's responsibility for inflation control. Neither of these is going to go down well with the grey vote - and it is the grey vote that is driving fiscal austerity. If it is too difficult to persuade the grey vote that austerity is harmful and deficits necessary, it is surely also too difficult to persuade them that it is ok to erode the value of their savings with higher inflation. The politics of this just don't add up.

The Lau & Smithin again does not address the point. Investment in the economy is required. It does not need to be dependent on the Bank of England buying NIB bonds. Deficit spending alone is sufficient. We can argue about what amount of deficit spending is enough, and whether the government should or shouldn't temporarily neutralise the monetary effects of deficit spending by issuing bonds in advance of taxation, but the underlying issue here is the refusal by all three political parties to countenance significant deficit spending, either for current spending or investment.

Evolutionary economics is fascinating stuff. I've dabbled in it a bit myself - and experienced the wrath of genuine libertarians as a consequence. If you think Paddy is a libertarian, you haven't met the real thing, believe me.

But again, although David Sloan's article is lovely, I don't see what on earth it has to do with this discussion. The central bank is an arm of government and its mandate is set by politicians. The whole debate is thus about the objectives of government and its democratic mandate. Currently, the democratic mandate is for fiscal austerity to "balance the books" and reduce government debt. We know that this is based on an economically illiterate argument. But our job is to change the prevailing political paradigm, not invent clever schemes to give the impression of buying into it while actually circumventing it.

PQE seriously muddies the waters. No-one is discussing the need for deficit spending. Everyone is talking about whether or not the central bank should be independent. It's a massive distraction from the real issue.

You and Paddy are making the assumption that the BoE is not part of the problem in containing inflation when it is blatantly obvious that house price bubbles are caused in part by a failure of central banks including the BoE to run "tight" underwriting standards. Part of their reason for doing that is clinging onto the dogma of Neoliberalism that markets self-equilibrise. That belief in my view is to cover the fact that those who wish to dominate others for heir own selfish advantage want to bury the issue of political equality under the spurious myth of markets achieving the common good through the workings of an Invisible Hand.

DeleteWhilst from an MMT perspective Corbyn's PQE can be regarded as a work-around one of the uses Corbyn wants to put it too is to launch a large programme of affordable homes construction which would clearly also be part of the solution to contain house price inflation. The BoE's failure to fully contain house price inflation and therefore ripple-through general inflation works against Corbyn's affordable homes objective because the BoE is targetting a reduction in demand through interest rate rises. On the face of it this would appear an argument to remove central bank quasi independence although I find myself supporting Ann Pettifor's arguments this would not be a good idea.

Schofield,

DeleteThe people you should be blaming for house price inflation are politicians. Show me the politician who thinks falling house prices are a good thing. When underwriting standards are tight, then politicians complain about "market failure" and demand that banks loosen up.

One of the big problems with an independent central bank in my view is it lets politicians off the hook. You've clearly bought the "everything's the fault of the central bank" myth.

House price inflation doesn't "ripple through" general inflation. Ten years ago the Western world had the largest housing bubble in history. But inflation was low and stable. The central banks were not asked to prevent house price inflation. They were responsible for controlling consumer price inflation, and they did their job.

What was neglected was financial stability. Central banks now have been clearly tasked with maintaining that. But they still are not responsible for preventing house price inflation.

Building more homes can't be assumed to bring down house prices. Look at Ireland in the mid-2000s.

In a nutshell Alan Greenspan, the chairman of the United States central bank, failed to recognize that he had the wrong “Invisible Hand” model. He should have been operating on the Darwinian one that aims to reconcile Individualism with Mutualism through Multi-Selection Theory. He should not have relied upon the Adam Smith “Invisible Hand” model that attempts to pretend that reliance upon Individualism alone ensures that an economy will self-balance for the common good. In consequence Greenspan failed to use the Federal Reserve’s powers to stop an inflationary house bubble being blow by the private banks. He also failed to realise that house price inflation would pass-through into abnormal inflation because this was masked by the fact that the United States had become the de facto “deficit” spender of last resort for the global economy(applicable to the UK also as a continuing reserve currency and “deficit” spender):-

Deletehttp://theweek.com/articles/455261/americas-greatest-export-debt

Moving to the BoE it too under its adherence to the Neoliberal “addiction” to the wrong “Invisible Hand” of Adam Smith failed to tackle the general pass-through inflation implications of allowing a house price bubble although it has partially redeemed itself under Mark Carney. As an arm of government the BoE should have been telling both Red and Blue Neoliberal politicians that if they were not prepared to engage in fiscal spending to meet the large pent up demand for affordable homes they must move to rationing/ price controls via tight mortgage loan underwriting standards to avoid house price inflation (so yes in one sense we are agreeing about the ineptitude of politicians but I’m saying they swallowed the wrong Kool-Aid model Adam Smith’s “Invisible Hand”).

PQE should, therefore, be regarded as a form of political work-around mechanism to get around the national addiction to the wrong “Invisible Hand” model. The success in using it lies I believe in coupling it with appropriate restraints to avoid triggering abnormal inflation (as I’ve suggested in the case of meeting pent up demand for affordable homes) and setting a positive rate of interest on any state “savings” scheme.

http://www.professormarkvanvugt.com/images/files/DarwinJEBOfinal.pdf

Just to add a little more flesh to my arguments:-

Deletehttp://www.reuters.com/investigates/special-report/usa-swaps/

www.financeforthefuture.com/GreenQuEasing.pdf

See Appendix 2 of Murphy’s and Hine’s paper then the following:-

http://bankunderground.co.uk/2015/08/14/very-much-anticipated-ecb-qe-had-a-big-impact-on-asset-prices-even-before-it-was-officially-announced/#more-445

I've already told you that asset price inflation does not flow through into general inflation, but you still keep saying it. And bizarrely you cite an article by me in The Week in support of your argument: I presume you didn't notice that I was the author. I know what I wrote in that piece. It says absolutely nothing about asset price inflation feeding through into general inflation.

DeleteNo-one is disputing that QE boosted asset prices. Indeed that was its purpose. Where you go wrong is in assuming that a) asset price inflation causes consumer price inflation b) central banks should control asset price inflation. Neither is true, and none of the pieces you cite support this argument.

Murphy & Hine's paper is very seriously flawed. Here is my analysis of it from 2011:

http://www.coppolacomment.com/2011/09/doomed-assessment.html and http://www.coppolacomment.com/2011/09/new-name-for-old-game_30.html

Hello everyone, thanks for the comments.

ReplyDeleteI shall have another crack at it.This comment will be in two parts.

I am trying to establish that PQE cannot deliver sustained extra spending without extra borrowing (or inflation) - that's the snake oil that I think has been sold.

the key point is that "spending without borrowing" *means* permanent base money expansion - it is about the size of the CB balance sheet, the rate of seigniorage. If the CB prints money and buys bonds which are used to finance spending, but later turns round and sells the bonds into private hands, that's debt financed spending, it's just that the CB held on to the debt for a while.

what determines the size of the CB balance sheet? under inflation targeting, it's some function of how the BoE's chosen interest rate interacts with the economy, demand for base money and all that. That implies seigniorage is a function of the inflation target.

One response to what I have argued could be: well yes, PQE might be inflationary, and that's no bad thing. That would miss the point. If we changed the inflation target to 4 per cent, that alone would imply a change in the rate of seigniorage. Then, under a 4 per cent target, PQE would not deliver "more spending without borrowing" over and above that.

In the post, I used an example in which the real economy, base money and broad money all grow at 2 per cent. It is perhaps worth bearing in mind that if you want money-financed spending of $Xbn, you need that CB balance sheet to expand by $Xbn *relative to what it would have been otherwise*. So if you think there are secular trends in things like the relationship between AD and inflation, the velocity of money, and whatever else you think explains the ratio of base to broad money, then fine, these variables do not all have to grow at the same rate, they can find new levels. The point is that whatever you think would have been happening to the base money supply, if you want "borrowing without spending" you need the base money supply to be growing relative to that counterfactual.

Paddy

second part:

ReplyDeleteA lot of responses to this post have mentioned private money creation (private banks expanding their balance sheets), or interpreted me as meaning base money drives inflation (not true).

I personally think that nobody has an entirely satisfactory account of inflation and mechanical stories about demand or money also need a theory of expectations formation. But let's say for sake of argument that the difference between nominal aggregate demand and real output causes (or defines?) inflation, and that we have a 4% inflation target so the CB is trying to get AD to grow 4% faster than real output, and let's further say (bearing in mind what I wrote above about there being room for secular trends if you want them) that this means broad money created by private banks would be expected to growth at same rate too, if CB hitting target. All this would imply under current MP regime a certain rate of seigniorage, to fix ideas let's say 4% too. It doesn't matter if you want to alter these assumptions, I am just trying to set up a counterfactual, you may prefer a different one.

Now you want PQE to deliver spending without borrowing. Let's say the amount you want to spend implies that base money would have to be growing 2 per cent faster than the counter-factual. I should maybe make allowance for some use of spare capacity and productivity gain, and assume that the chosen rate 2 percent exceeds the non-inflationary rate implied by these because politicians and economists aren't good at judging things so they are just right.

If you want to say all that happens is that we get to spend without borrowing, but we don't get inflation running away, what does that imply about long term trends of ratios like base to broad, or broad to AD? You now have base money growing at 6% (in this example) - if you don't, you aren't spending without borrowing - but other things growing at 4%, with implications for ratios like base to broad and broad to AD and AD to inflation. If you have one thing growing faster than other, these ratios tend to either zero or infinity.

What I am trying to do here is show the logic of my argument without relying on any particular theory, MMT or otherwise. Whichever way you have it, sustained spending without borrowing means sustained base money supply growth over and above the counter factual, and I am trying to make clear that under inflation targeting that ain't going to happen, not because I think base money expansion causes inflation, but because expansionary spending policy does, and the BoE's inevitable monetary policy response would put the brakes on its balance sheet expansion, which would mean your spending turns out to be debt financed after all.

Paddy

QE v PQE

ReplyDeleteQE = chancellor directs BoE to swap treasuries for reserves (flatten the liquidity schedule)

PQE = chancellor directs BoE to swap investment bonds for reserves (initially to put floor in that market, later to potentially flatten out the curve)

QE Intention = make corporate bond issues cheaper by draining away 'competing' gov't debt and so encourage endogenously financed investment, leading to growth.

PQE Intention = pay for investment, leading to growth. Creates private income directly via coupons. Help BoE get off the lower bound through covert fiscal activism.

QE Effect = Procyclical /Deflationary. BoE fails to hit mandated target. Corporates had no appetite to borrow and invest at any price. Savings desire of Non bank holders of treasuries unaffected (saved in equities and property instead). Private Income falls as coupon payments sent as remittance back to treasury.

PQE effect = stabilising at lower bound/ potential monetary inflation (if BoE allows high yields or takes loses) investment happens, productivity and growth rises, BoE gets off zero.

Conclusion: DO PQE NOW

Hugo,

DeleteI'm no fan of QE. But I think your endorsement of PQE as an alternative is highly questionable.

You tie together additional bond issuance to finance investment with a Bank of England large asset purchase programme. It is not at all clear to me why these two need to be tied together at all. I agree that the BoE should stand ready to buy these bonds if necessary to set a floor under their price, but it already does that for government bonds anyway - that is how the target interest rate is maintained. If setting a floor is all PQE is supposed to do, that would be fine. But that is not what Jeremy Corbyn and Richard Murphy are selling.

Why do you think that increased government spending for investment is impossible unless the Bank of England buys bonds? Surely there is sufficient demand out there for sterling safe assets for a major investment programme to be financed without the BoE doing anything at all.

Why do you think that bond purchases are necessary to raise rates above ZLB? Surely a very large investment programme funded by new debt issuance would have the same effect? You are essentially saying that fiscal stimulus has no effect. That's a rather extreme monetarist position, if you don't mind my saying so.

PQE cannot provide private income via coupons. Issuing bonds would by itself, but PQE presumes that the Bank of England would purchase them - in which case the private sector would not receive the income, it would be remitted back to the Treasury. For me this would be a lost opportunity. People on fixed incomes need safe savings vehicles delivering stable returns. Bonds issued by a NIB for infrastructure development and other projects could potentially provide this. Keep them out of the BoE's clutches, please.

Why do you want to flatten out the yield curve - especially if you envisage there being some degree of private sector ownership of these bonds, as your comment about coupon income seems to suggest? Surely people should have the right to receive additional return for tying up their money for long periods?

If these bonds are sold only to UK residents, as they should be, then in my view they should deliver above-market returns. After all, the residents will spend this money into the UK economy, either now or in the future, so the returns are actually monetary stimulus. All this stuff about keeping interest rates down assumes that the government has constraints on money issuance. It doesn't.

Francis

DeleteThank you for taking the time to answer me. I should say first that I don’t presume to know exactly what PQE really would be in practice, and nor does the voting public. That’s why it’s politically excellent, worthy of Gideon’s own play book. It’s a communication tool that links the idea fiscal activism, which I think we all broadly agree is needed, with an existing policy whilst circumventing the deficit narrative. We are not going to beat that one soon, so lets not play away from home at the City ground.

So, despite fully recognizing that the BoE does not need to buy bonds to finance investment, I say let the BoE buy the bonds if need be. I agree there is demand for sterling safe assets, so one day maybe Jeremy will write a letter to the BoE telling it to set a floor and let it work out the amount, but if he ever got to write that letter the terms of this debate will have already moved far on.

It’s not the purchasing of the bonds that gets you off ZLB. I never meant to imply that. It’s the stimulatory effect of the actual investment, creating expectations of growth, wot does that. PQE creates coupon payments, because either 1. The BoE sells treasuries to cover purchases of NIB bonds or 2. It never actually has to buy them because it credibly promised to do it.

I have no view on the yield curve. The bank flattened it to give the gov’t spending power under an orthodox fiscal thinking cap. The gov’t declined the offer, but found itself spending automatically via the stabilisers. Thank heaven for those, but it wasn’t the kind of spending we really wanted to have to do. Of course the gov’t has no spending limit. They will never ever admit that. EVER.

I can see you want a NIB, and one free of the BoE’s clutches. But a NIB is just another journal in the treasury book, and it’s the treasury who won’t play ball right now, not the bank.

P.S Why are you so scared of the foreign sector holding gilts?

Hugo,

DeleteYour view of this seems to be refreshingly different. I agree with a lot of what you've said. I suppose it's just my anti-political nature but I really don't like playing Gideon at his own game. I want openness, honesty and transparency. This doesn't deliver that.

I don't think the political argument adds up anyway. The same people who want the government to "balance the books" because they believe this will preserve their wealth also object to deficit monetisation because they believe it will erode their wealth. And however you look at it, PQE is deficit monetisation or as these people prefer to call it, "money printing". I've had so many arguments with people about this....

I object to the foreign sector holding gilts because they have no incentive to hold them as a long-term store of value, unlike UK residents. They do not use sterling as a currency either now or in the future, they do not pay taxes in the UK and they do not benefit from government spending. Therefore they are far more likely to dump their holdings if the UK government does something they don't like, such as running a large deficit. We really don't need to be dictated to by foreign investors. However, ending foreign holdings of gilts means closing the trade deficit, which isn't going to happen any time soon. So I am dreaming, really.

But NIB bonds don't have to be sold to foreigners. They can be sold to the people who will benefit from the investments. UK residents should invest in their own future.

On that note of reconciliation may I counter your slight pessimism by requesting you duet 'don't give up' with Richard Murphy on your blog, the one with Gabriel and Bush.

DeleteHugo

Hugo

ReplyDeleteI think you're wrong about effects of QE (and intentions) but idea of using PQE now to get off ZLB is interesting. But now what Corbyn's selling.

Paddy

Paddy

DeleteAgree QE effects are not a matter of record. We can all take our view on that. The intention however is. At para. 4

http://webarchive.nationalarchives.gov.uk/+/http:/www.hm-treasury.gov.uk/d/ck_letter_boe290109.pdf

Hugo

Further PQE effects: higher inflation lowers private debt burden. Productivity and growth gains raise employment. V increases. Money hits tax lines. Sterling weakens leading to improvement in current account position. Deficit falls. Private sector repairs balance sheet. Employment. confidence improves, BoE regains upward traction on yield curve and raises base rate without fear of curve inversion regaining de facto independence from treasury. ACTION THIS DAY.

ReplyDeleteIt's absolutely absurd to pretend that PQE isn't a viable vehicle for growth because of the BoE's inflation targettting remit when the BoE itself allows inflation leakage on private banks lax underwriting standards, for example, previously mortgages for homes for personal consumption now lax loan to income underwriting on Buy-to-Let house mortgages. The vendors of homes are often in a windfall position from their sales to push up market prices as they spend. The lax underwriting standards are, of course, a consequence of a flawed belief system that markets always self-equilibrise. This was the famous flaw in his thinking that Alan Greenspan admitted to in appearance before a congressional committee in the immediate aftermath of e 2007/2008 Financial Crash.

ReplyDeleteNo-one has said that investment spending isn't a viable vehicle for growth.

DeleteActually current investment spending is actually increasing costs over and above the surplus it creates.

ReplyDeleteMuch of it is because of European energy and climate policy.

I am sorry but it is screaming off the charts.

You can only distribute a industrial surplus when you actually create a net surplus.

This is clearly not happening as energy intensity and most importantly final consumption is following a negative trend.

We can see this in action when observing the pitiful exchanges of electrical energy between Ireland and the UK.

Neither have a surplus to trade with eachother as they have nothing to give.

Only the flow of energy between surplus France and the UK is working as they have more recent legacy nuclear units.

The UK policy is to impose industrial / finance capital laws on top of essentially diffuse rather then concentrated energy production.

This is simply unprecedented.

The loss of energy production last year was possibly bigger then the 1942 Battle of Atlantic Low point.!!'

The policy is to simply impose scarcity so as to maintain concentration.

We are currently witnessing the true face of capitalism as defined by Bolloc and Chesterton.

If the policey is to reintroduce agrarian energy density then fine - but you must you must introduce distribution mechanisms also

ReplyDeleteWhat we are witnessing is the worst of both systems.

We are observing the concentration of a smaller pie.

This is pure high criminality of the worst kind.

The connected capitalists are desperate to keep abundant products scarce (Think of the Irish water debacle) while wasting vast amounts of energy chasing tokens (UK and Irish transport energy use is on the rise again......

ReplyDeleteI am afraid the problem is far deeper then many naive socialists realize - obviously the problem is the London scarcity Dragon itself.

Was it not that Mick fellow who slayed the beast ?

The UK is a vast rentier structure with little to no domestic production.

It has been increasingly that way inclined since the enclosure period.

If anything it seeks to drag the whole world down with it.

What's most depressing is the reaction of ordinary people when you propose to give stuff away free of charge

ReplyDelete(for example giving mortgage serfs the house without condition given the corrupt nature of the transactuon) which would have untold psychological and physical benefits for the person, family and society.

Something very great was lost when the Christian heritage vanished from these Isles.

People cannot grasp the parable of the loaves and the fishes, the water into wine etc.

It's so sad really.

All is lost

Civilizations collapse has happened already I fear but as we are not sentient people we failed to notice.

The Capitalist materialist religion cannot produce the goods now(it's Opiate) and will morph into its true demonic form.

If the policey is to reintroduce agrarian energy density then fine - but you must you must introduce distribution mechanisms also

ReplyDeleteWhat we are witnessing is the worst of both systems.

We are observing the concentration of a smaller pie.

This is pure high criminality of the worst kind.

Actually current investment spending is actually increasing costs over and above the surplus it creates.

ReplyDeleteMuch of it is because of European energy and climate policy.

I am sorry but it is screaming off the charts.

You can only distribute a industrial surplus when you actually create a net surplus.

This is clearly not happening as energy intensity and most importantly final consumption is following a negative trend.

We can see this in action when observing the pitiful exchanges of electrical energy between Ireland and the UK.

Neither have a surplus to trade with eachother as they have nothing to give.

Only the flow of energy between surplus France and the UK is working as they have more recent legacy nuclear units.

The UK policy is to impose industrial / finance capital laws on top of essentially diffuse rather then concentrated energy production.

This is simply unprecedented.

The loss of energy production last year was possibly bigger then the 1942 Battle of Atlantic Low point.!!'

The policy is to simply impose scarcity so as to maintain concentration.

We are currently witnessing the true face of capitalism as defined by Bolloc and Chesterton.

Actually current investment spending is actually increasing costs over and above the surplus it creates.

ReplyDeleteMuch of it is because of European energy and climate policy.

I am sorry but it is screaming off the charts.

You can only distribute a industrial surplus when you actually create a net surplus.

This is clearly not happening as energy intensity and most importantly final consumption is following a negative trend.

We can see this in action when observing the pitiful exchanges of electrical energy between Ireland and the UK.

Neither have a surplus to trade with eachother as they have nothing to give.

Only the flow of energy between surplus France and the UK is working as they have more recent legacy nuclear units.

The UK policy is to impose industrial / finance capital laws on top of essentially diffuse rather then concentrated energy production.

This is simply unprecedented.

The loss of energy production last year was possibly bigger then the 1942 Battle of Atlantic Low point.!!'

The policy is to simply impose scarcity so as to maintain concentration.

We are currently witnessing the true face of capitalism as defined by Bolloc and Chesterton.

This Murphy fellow is just too thin-skinned, Frances.

ReplyDeleteHis comments about you on his blog are thin-skin paranoia and not worth worrying about.

I happened to read that Bill Mitchell post - an unusual thing for me to do. It's quite good in the sense of pointing out the basic distinction between legitimate QE as monetary policy and "people's QE" as fiscal policy.

And I don't regard "Snake-Oil" as a particularly over the top epithet in this particular case.

In the context of monetary and fiscal matters, I haven't seen a term more pathetic than "helicopter drop" until running into "people's QE".

I'll back off mildly from this comment. I've browsed a number of articles out there, and I don't think anybody is particularly coherent on this subject. There are a number of dimensions to be strung together in a methodical explanation of the various QE versus/cum fiscal permutations. The Mitchell post is OK, but on second reading not great and even mildly confused. That said, I have nothing further to offer myself.

DeleteJKH, the proper term for "helicopter drop" is "Basic Income" :)

ReplyDeleteHere is my take:

PQE does work by creating money, but then so does all bank lending and govt spending. If it was "borrow and spend" it would be the same.

But it is certainly different from QE, which an asset swap (bonds for reserves) and has little effect on anything. Calling it "People's QE" is misleading.

Although the mainstream refers to QE as "money printing." And Murphy has gotten all political.

Another post by Bill Mitchell that people should probably read:

ReplyDeletehttp://bilbo.economicoutlook.net/blog/?p=31711

This entirely makes sense (even to a layman), but I had the following responses:

ReplyDelete1. You assume this is primarily a monetary policy. But isn't the policy more about getting stuff built? And even if the monetary effects will be unwound immediately by inflation targeting, surely the buildings, factories, houses, etc. remain standing?

2. Whilst the net effect of PQE might be neutralized, that is not the same as saying there will be no monetary effect on the economy. PQE would replace a blanket approach to monetary policy, which applies to all sectors of the economy, with a nuanced policy which discriminates. This would encourage productive aspects of the economy which need a leg up (e.g. house building) at the expense of less productive/damaging bits, which don't (e.g. buy to let).

I'd be very interested in your thoughts. Sorry if I posted this several times, something was up with the website.

Hello

Delete1. Absolutely. Public spending builds stuff. My argument merely that claim of being able to do so without associated borrowing or inflation is wrong.

2. not sure what you mean by monetary effects, but yes to extent PQE associated with particular capital allocation decisions (build this, not that) it can hope to increase supply of productive public investments. The track record of national development banks is mixed, and I would expect a certain amount of bad projects, but NDB could be a good idea on net. I even think showering some countercyclical PQE financing on the NDB could be a good idea.

Paddy