The Eurozone credit crunch

As I noted in my previous post, business lending in the Eurozone is very poor - flat in the major core countries and falling in the periphery. The ECB's report on MFI lending to businesses and households for January 2014 confirms the fall in business lending volumes both on a monthly and a yearly basis:

(For some reason the ECB doesn't include loans of 0.25 - 1 million euros in this table, but volumes of these loans are also falling. The full list can be found at the end of the ECB's document.)

The ECB also reports that interest rates are rising for smaller loans and falling for larger ones.

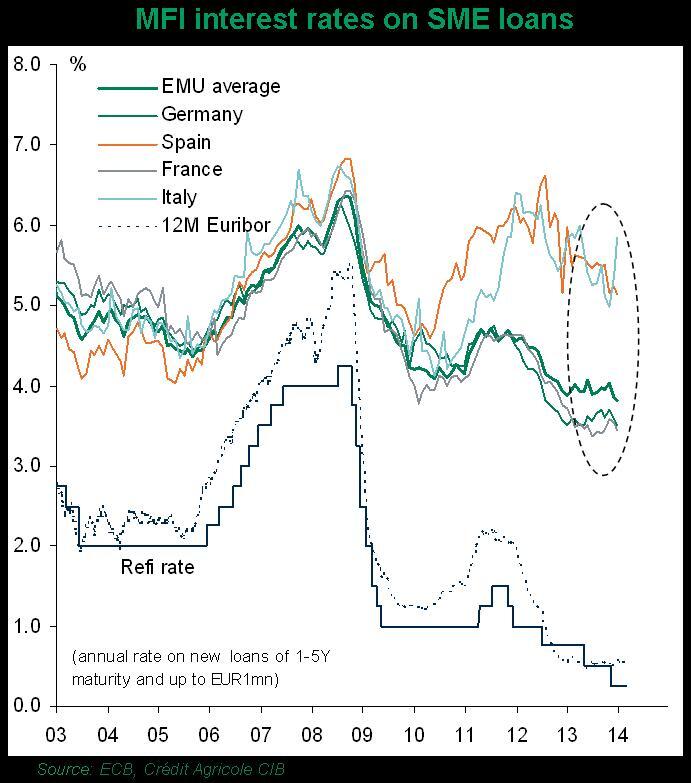

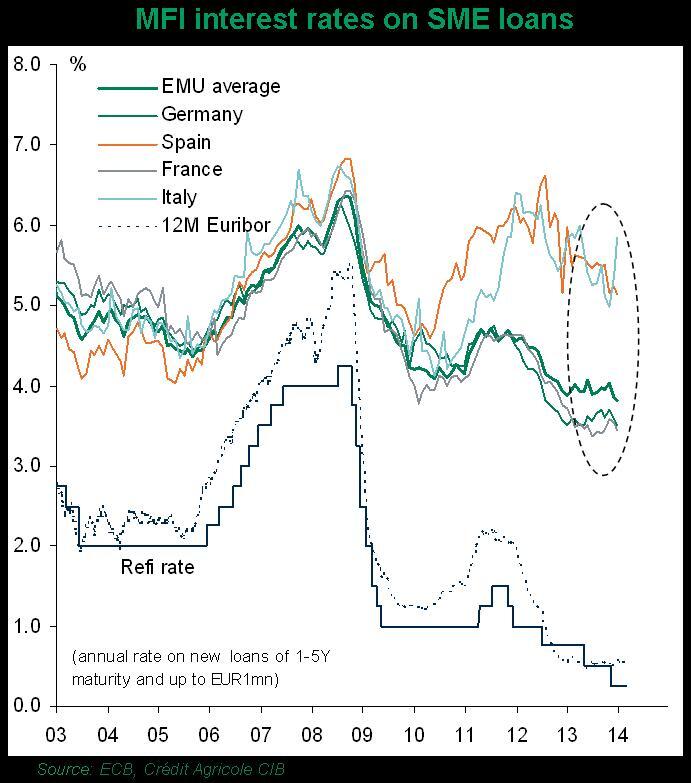

But as usual (I'm getting slightly tired of saying this), Eurozone aggregates don't tell the whole story. This chart shows the path of SME interest rates since the start of the Euro:

(H/t @fwred)

According to this, EMU average interest rates are now falling on SME loans (see circled area). But the ECB says that average interest rates on new lending to non-financial corporations are rising. How do we explain this discrepancy?

I wasn't able to find the source of the data for this chart, despite @fwred's comment that it was ECB data, but it seems to be to do with the amount and duration of the loan. Here is the table of loans to non-financial corporations from the ECB's document:

I've outlined in red those that correspond to the "EMU average" line on the chart. For those loans, the average interest rate has indeed fallen, both month-on-month and year-on-year. But overall, the composite cost of borrowing is rising, not falling. There is nothing to be cheerful about yet.

However, despite its limited data set, this chart is still informative - indeed fascinating. Firstly, average interest rates on this particular subset of MFI loans to German, French and Spanish SMEs are falling, but Italy seems to be heading in the opposite direction. This is probably due to its government shenanigans. It's hardly a stable political situation.

Secondly, there is evident credit bifurcation. The "EMU average" SME interest rate does not exist in reality: SMEs in core countries benefit from lower interest rates, while those in periphery countries suffer much higher rates. This is also consistent with lending volume figures that show rapidly falling lending volumes in periphery countries. Basically, banks don't want to lend to SMEs in periphery countries, and if they have to, they charge high rates.

The reason for this is undoubtedly bank perception of higher risk. It's easy to blame elevated sovereign risk in these countries, and that might indeed be a factor. But so might this:

(h/t @minefornothing)

Clearly, the financial crisis took its toll. Corporate defaults have been rising since 2008. In Spain's case, the sharp rise in defaults in 2008-9 is undoubtedly due to the collapse of its construction bubble. But it's hard not to draw the conclusion that deepening recession in all three countries since 2011 is increasing corporate defaults and therefore raising the risk of lending to SMEs. The ECB raised interest rates in 2011, which may have triggered a rise in corporate defaults, but when the ECB cut interest rates again the corporate default rate did not fall back, and neither did interest rates to SMEs. Evidently any banks still lending to periphery SMEs simply used the rate cuts as a means of increasing margins, rather than reducing rates to borrowers.

Banks are certainly under pressure to reduce higher-risk lending and improve their capital positions. The forthcoming Asset Quality Review is the latest in a long line of attempts to cajole or coerce banks into cleaning up their balance sheets. Unfortunately SME lending, which is generally fairly high-risk, tends to be badly hit when bank regulation is being tightened. And lending to SMEs in damaged periphery countries is about the riskiest form of lending there could be. No wonder SME lending volumes in periphery countries are falling off a cliff and interest rates are much higher than in core countries.

It cannot be assumed that companies that are being forced out of business by lack of finance are all "zombie" companies that should be allowed to die. As Tom Papworth of the ASI notes (in relation to the UK, but the same applies in the Eurozone), some of the companies that struggle to get finance are the new generation of startups....and if they die in infancy, then the future of the economy is compromised:

There is a desperate need to ease credit conditions for SMEs in periphery countries. The slight easing of interest rates on certain categories of loan for Spanish SMEs is welcome, but it is nowhere near enough. The EU must find ways of improving access to finance for SMEs in periphery countries. The future of those countries, and perhaps even of the Eurozone itself, depends on them.

(For some reason the ECB doesn't include loans of 0.25 - 1 million euros in this table, but volumes of these loans are also falling. The full list can be found at the end of the ECB's document.)

The ECB also reports that interest rates are rising for smaller loans and falling for larger ones.

But as usual (I'm getting slightly tired of saying this), Eurozone aggregates don't tell the whole story. This chart shows the path of SME interest rates since the start of the Euro:

(H/t @fwred)

According to this, EMU average interest rates are now falling on SME loans (see circled area). But the ECB says that average interest rates on new lending to non-financial corporations are rising. How do we explain this discrepancy?

I wasn't able to find the source of the data for this chart, despite @fwred's comment that it was ECB data, but it seems to be to do with the amount and duration of the loan. Here is the table of loans to non-financial corporations from the ECB's document:

However, despite its limited data set, this chart is still informative - indeed fascinating. Firstly, average interest rates on this particular subset of MFI loans to German, French and Spanish SMEs are falling, but Italy seems to be heading in the opposite direction. This is probably due to its government shenanigans. It's hardly a stable political situation.

Secondly, there is evident credit bifurcation. The "EMU average" SME interest rate does not exist in reality: SMEs in core countries benefit from lower interest rates, while those in periphery countries suffer much higher rates. This is also consistent with lending volume figures that show rapidly falling lending volumes in periphery countries. Basically, banks don't want to lend to SMEs in periphery countries, and if they have to, they charge high rates.

The reason for this is undoubtedly bank perception of higher risk. It's easy to blame elevated sovereign risk in these countries, and that might indeed be a factor. But so might this:

(h/t @minefornothing)

Clearly, the financial crisis took its toll. Corporate defaults have been rising since 2008. In Spain's case, the sharp rise in defaults in 2008-9 is undoubtedly due to the collapse of its construction bubble. But it's hard not to draw the conclusion that deepening recession in all three countries since 2011 is increasing corporate defaults and therefore raising the risk of lending to SMEs. The ECB raised interest rates in 2011, which may have triggered a rise in corporate defaults, but when the ECB cut interest rates again the corporate default rate did not fall back, and neither did interest rates to SMEs. Evidently any banks still lending to periphery SMEs simply used the rate cuts as a means of increasing margins, rather than reducing rates to borrowers.

Banks are certainly under pressure to reduce higher-risk lending and improve their capital positions. The forthcoming Asset Quality Review is the latest in a long line of attempts to cajole or coerce banks into cleaning up their balance sheets. Unfortunately SME lending, which is generally fairly high-risk, tends to be badly hit when bank regulation is being tightened. And lending to SMEs in damaged periphery countries is about the riskiest form of lending there could be. No wonder SME lending volumes in periphery countries are falling off a cliff and interest rates are much higher than in core countries.

It cannot be assumed that companies that are being forced out of business by lack of finance are all "zombie" companies that should be allowed to die. As Tom Papworth of the ASI notes (in relation to the UK, but the same applies in the Eurozone), some of the companies that struggle to get finance are the new generation of startups....and if they die in infancy, then the future of the economy is compromised:

To terminate these firms in a misguided belief that capital and labour needs to be reallocated would be to kill the next generation of firms and undermine the process of creative destruction.If it is true that the combination of recession, fiscal austerity measures and tightening of bank regulation is causing a severe credit crunch for periphery SMEs, then it seems appropriate for targeted support for SME lending in periphery countries to be provided at EU level, most appropriately by the ECB. After all, both sovereign and bank reforms are being done at the behest of the European Commission with the intention of restoring sustainable growth in the long-term. Killing off the very companies that will be needed to secure that sustainable growth is folly.

There is a desperate need to ease credit conditions for SMEs in periphery countries. The slight easing of interest rates on certain categories of loan for Spanish SMEs is welcome, but it is nowhere near enough. The EU must find ways of improving access to finance for SMEs in periphery countries. The future of those countries, and perhaps even of the Eurozone itself, depends on them.

In view of the ballooning levels of private sector debt we’ve seen in recent decades, and to which Adair Turner amongst others has objected, I’ve got doubts about the wisdom of effecting stimulus by encouraging yet more debt.

ReplyDeleteI suggest the EZ copies the US, and spends more base money into it’s economy.

This comment has been removed by the author.

Deleteyou say base money but it would be more accurate to say M2 money. Base money can only effect interest rates, and actually it has been increased http://coppolacomment.blogspot.co.uk/2014/01/banks-do-not-lend-reserves.html

DeleteAs there is no banking procedure by which the ECB could do it , it would have to be more like the Funding For Lending scheme.

ReplyDeleteDinero, If you’re saying base money can’t get out into the real economy, that’s a common belief with which I disagree. To illustrate….

ReplyDeleteIf I sell Gilts worth £X (say as part of the QE operation) I get a cheque from the Bank of England for £X which I deposit at my commercial bank, which in turn presents the cheque to the BoE, who in turn credit the commercial bank (in the BoE’s books) with £X. I.e. the commercial bank’s reserves rise by £X. Now that dollop of dinero / money (excuse my Spanish) is very much mine to use or spend anyway I want, isn't it?

Strictly speaking I don’t have direct access to base money or reserves. But the reality is that I do: it’s just that my commercial bank acts as a go-between or agent for me in “my dealings” with the BoE.

But that is not base money is it. In your illustration you explicitly said " I get a cheque" so that is not base money that is checking account , personal current account money M2.

ReplyDeleteYour original point was about government spending. You suggested it would stimulate the economy if the government did some spending and thus put money into peoples current accounts which they would then do some spending in turn. That's not base money that personal current account checking account money M2.

M2 isn't used in the UK. There is M0 which is monetary base, and M4, which is deposits at commercial banks.

ReplyDeleteRe the rest of your comment, you are still assuming that a given chunk of money has to be M0 or M4 (what you call M2). In fact a given chunk of money can be BOTH M0 and M4 at the same time. Here is a quote from Richard Lipsey’s text book which makes the same point as I made above.

“Consider a situation in which there are initially no net transactions between the Bank of England and the rest of the economy. The Bank now buys £1m of securities from an agent the private sector. The seller receives a cheque for £1m from the Bank of England which is paid into the recipient’s bank account at, say, Lloyds. Lloyds’ deposits rise by £1m, but at the same time Lloyds receives an increase of £1m in its deposits at the Bank of England.”

That £1m is both monetary base and M4 or “checking account” money.

Incorrect, Ralph. M4 is much more than just deposits at commercial banks. M2 is deposits at commercial banks, though these days it is recorded in M4 figures as "retail M4". See the explanatory notes from the Bank of England here:

ReplyDeletehttp://www.bankofengland.co.uk/statistics/Pages/iadb/notesiadb/M4.aspx

Well Ralph they are the same thing or more accurately base money follows deposit account transactions if the transacting banks choose to use crest or chaps. But the point is no one can spend base money, the government cannot "spend more base money into the economy".

ReplyDeleteWhat is completely bizarre here is that Robert Mugabe worked out how to print money (the state’s money or base money) and spend it into his economy. Indeed he did so in excessive quantities. But there seem to be a large number of folk who cannot work out how to do it: including, strange to relate, several leading economists. I did a blog post on this bizarre phenomenon some time ago:

Deletehttp://ralphanomics.blogspot.co.uk/2013/06/robert-mugabwe-should-be-in-charge-of.html

Whoever the group pick needs to be someone with that vital ability to genuinely lead and engage and encourage the group's staff in a way that has been sadly lacking.

ReplyDelete