About that ECB interest rate cut

Consumer price inflation in the Eurozone has been below the target of 2% and falling for quite some time. But until now, the ECB has been sitting on its hands. Inflation some distance below target didn't appear to bother it - most likely because the (unbelievable) forecasts for Eurozone recovery created inflation expectations in the 1.5 - 2% range, so it saw no need to act on what was assumed to be a temporary problem.

In fact a falling Euro is helpful to nobody. The Eurozone as a whole has a trade surplus. Yes, periphery countries still have trade deficits, although these are reducing - but the trade surplus in the core is so enormous now that the periphery deficits no longer offset it. The Eurozone as a whole does not need currency depreciation.

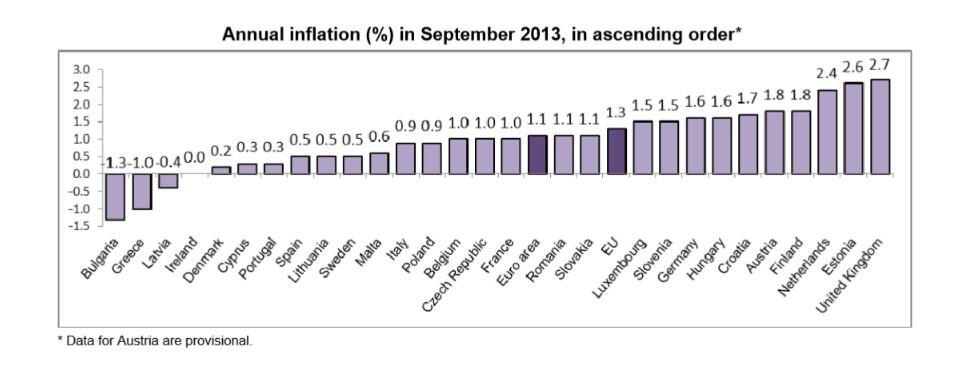

So why did the ECB, in a complete reversal of its previous stance, suddenly cut the refi rate to 0.25%? Well, Eurozone consumer price inflation has touched a record low of 0.7%, driven by falling energy prices and stagnant prices in other sectors. But inflation expectations are still where they were before, based on expectation of a strong Eurozone recovery.

And Reuters reports that German inflation has unexpectedly fallen to 1.2% in October. Well, well. German inflation is below target and falling. So the ECB is doing what the ECB does - responding to German monetary indicators. I suppose this is inevitable, since Germany is the dominant economy in the Eurozone. But it just shows how impossible a one-size-fits-all monetary policy really is where there are such disparities of size and competitiveness between countries in a monetary union. Monetary policy is inevitably driven by the needs of the largest, even if it is actually damaging to the smallest.

And damaging it certainly is. The monetary policy transmission mechanism in Europe depends very much on banks. And European banks are a dysfunctional lot. They are loaded up with poor quality sovereign debt, which bizarrely they can STILL hold without additional capital allocation even though it is anything but risk-free. And they are deleveraging at a rate of knots (chart from Morgan Stanley via Business Insider):

When banks deleverage, broad money falls. Eurozone M3 has been falling for most of 2013 (chart from the ECB's Statistical Data Warehouse):

Eurozone banks don't want to increase risky lending. They are busy reducing balance sheet risks. So they don't want to lend to businesses in riskier parts of the Eurozone. SME lending rates in Spain and Italy are far higher (£) than they are in Germany, which makes those businesses uncompetitive. This refi rate cut is not going to mean lower rates for them: it will mean lower rates for German businesses, already benefiting from the Eurozone's bifurcated credit market. So the Eurozone countries that really need lower interest rates aren't going to get them, because of dysfunctional banks and worries about sovereign solvency. Instead, their competitiveness is going to be hammered again.

When banks deleverage, broad money falls. Eurozone M3 has been falling for most of 2013 (chart from the ECB's Statistical Data Warehouse):

Eurozone banks don't want to increase risky lending. They are busy reducing balance sheet risks. So they don't want to lend to businesses in riskier parts of the Eurozone. SME lending rates in Spain and Italy are far higher (£) than they are in Germany, which makes those businesses uncompetitive. This refi rate cut is not going to mean lower rates for them: it will mean lower rates for German businesses, already benefiting from the Eurozone's bifurcated credit market. So the Eurozone countries that really need lower interest rates aren't going to get them, because of dysfunctional banks and worries about sovereign solvency. Instead, their competitiveness is going to be hammered again.

The problem is that cutting the refi rate pushed down the value of the Euro. It fell like a stone when the rate cut was announced, and although it rose a bit it didn't return to its previous value.

This will provide a boost to German exporters - who are the last people in the world to need such encouragement. Coming on top of Germany's generally mercantilist stance ("hands off our trade surplus"), it is difficult to see how a falling Euro would improve domestic demand. It seems more likely that it would increase exports.

This will provide a boost to German exporters - who are the last people in the world to need such encouragement. Coming on top of Germany's generally mercantilist stance ("hands off our trade surplus"), it is difficult to see how a falling Euro would improve domestic demand. It seems more likely that it would increase exports.

No doubt some people will argue that a falling Euro would benefit periphery exporters. But I'm afraid they are mistaken. I've already pointed out that this rate cut will reduce borrowing costs for German businesses but not for periphery ones. The fall in the Euro will mitigate high borrowing costs for periphery businesses to some extent, but it will also benefit German businesses in addition to the benefit they will get from lower borrowing costs. Overall, therefore, German businesses will benefit more than periphery ones. This rate cut actually worsens the periphery's competitiveness problem. Of course, it can be argued that German and, say, Spanish exporters don't directly compete because they are in different markets. But if Spanish exporters are competing with, say, Chinese, the fall in the Euro will make little difference (because the yuan is managed) and the ECB's inability to influence lending rates to Spanish businesses means that Spanish exporters will benefit not at all: meanwhile Germany will do even better in its export markets.

In fact a falling Euro is helpful to nobody. The Eurozone as a whole has a trade surplus. Yes, periphery countries still have trade deficits, although these are reducing - but the trade surplus in the core is so enormous now that the periphery deficits no longer offset it. The Eurozone as a whole does not need currency depreciation.

So the ECB's actions in support of Germany actually make matters worse for the periphery. And it is still sitting on its hands in regard to the real problem in the Eurozone, which is the deepening depression in Southern Europe and Ireland. In fact I fear that it is not sitting on its hands, it has washed them - because it seems to me that the ECB is actually incapable of dealing with the depression in Southern Europe.

Scott Sumner argues that the ECB is not yet out of firepower and that fiscal policy is impotent because rates are still above zero. But I fear Sumner is making a fundamental mistake. The Eurozone is not a homogenous area. Real rates in the periphery are far higher than they are in Germany, and the bifurcated credit market makes it impossible for the ECB to force down rates. The ECB simply is not in control of monetary conditions in the periphery. Conversely, real rates in Germany are probably negative: I doubt if this rate cut is anywhere near enough to raise inflation in Germany. The divergence between the periphery and the core widens all the time. There are still things the ECB could do, but a short run-down of some of them shows how limited they are:

1) It could do another round of long-term loans (LTROs). The problem with this is that it is a racing certainty that the new LTRO money would be used yet again to buy up sovereign debt, which would reinforce the disastrous dependency of sovereigns on banks and vice versa.

2) It could cut the deposit rate to negative, thus charging banks for safe assets. The problem with this is, of course, the existence of physical cash. To have much impact, the depo rate would have to be quite significantly negative, in which case there is a serious risk that banks will simply hoard vaulted cash instead. Alternatively, they could buy up sovereign debt instead of hoarding cash....which creates the same problem as LTROs. And it is worth remembering that German bunds are substitutes for Euro reserves: the short-term yield on bunds would therefore also drop into negative territory. Should we really be paying to lend to the German government?

3) It could stop accepting weekly deposits. Various people seem quite keen on this idea. The deposits in question are used to sterilise the money issuance consequent on the ECB's buying of some sovereign debt as part of its normal open market operations. But I don't see how it could possibly work. The ECB can't stop banks leaving money in their reserve accounts. The amount of reserves in the system is what it is, and someone has to hold them. The idea that reducing reserve requirements or eliminating the requirement for open market operations to be sterilised will give banks more funds to lend shows a lack of understanding of how the banking system works, which is worrying given that one of the people suggesting this is a member of the ECB's governing council. Banks don't "lend out" deposits. And they don't "lend out" reserves.

4) It could do some form of QE. Exactly what assets it would purchase is not clear. It could be based on the ECB's list of eligible collateral, but this is very extensive and much of it decidedly dodgy: the Eurosystem governors may not be too happy about the ECB actually owning this stuff (as opposed to simply accepting it as collateral). So presumably the assets the ECB would purchase would only be "safe assets" - i.e. government debt. This immediately causes a problem. OMT - the pledge that the ECB made to buy up periphery government debt under exceptional circumstances - has strict conditionality attached to it. Is the same conditionality going to apply if these assets are purchased as part of a general QE programme? If so, then the ECB would be making fulfilment of its mandate to ensure price stability conditional on fiscal rectitude by periphery government - so much for ECB "independence". And if not, then what credibility would OMT have any more? So QE is either impossible or useless while the OMT conditionality exists.

What the ECB really needs to do is improve monetary policy transmission to the periphery. This could involve the following:

- direct purchases of corporate and sovereign bonds

- some form of GSE structure to pool and securitize SME loans so that they could be purchased as well

- in Spain, Ireland and Portugal, direct purchases of residential and commercial mortgages

And it also needs to reflate the periphery economies. This would mean either "helicopter drops" or purchases of sovereign debt. The two could be combined, which would amount to a form of QE targeted at distressed sovereigns. But that means removing the conditionality of OMT, which exists to avoid the charge that the ECB is monetizing the debt of fiscally irresponsible sovereigns. Monetization of sovereign debt is explicitly outlawed by EU treaty. Even though OMT is so hedged around with conditionality that it has never been used, it has already been subject to legal challenge. I have no doubt that if the conditionality were removed to allow the ECB to reflate the periphery economies, there would be howls of protest and a spate of lawsuits from Germany, which has an almost religious belief that monetization will inevitably lead to hyperinflation despite the complete lack of evidence that reflation in a depression has any such effect.

Reflation of Germany cannot be done by monetary policy alone, either. For Germany to recover, the whole Eurozone must be healed. While Germany continues to insist that the problems of Southern Europe are not its concern, it too will remain in the doldrums. Though there are plenty of people in Germany who are very happy with zero inflation: there has been extensive criticism of the ECB's action from German media concerned about rising property prices and poor returns to savers. The ECB may be doing its job, but the principal beneficiary doesn't seem to want it to do so.

As far as I can see all the actions that the ECB really needs to take are politically impossible. I have been severely critical of the ECB's handling of the Eurozone crisis: it has gone way beyond its mandate in imposing fiscal conditionality on sovereign states, and it has failed to address the deepening depression in a growing number of Eurozone states. But I acknowledge that the real problem is the political set-up in the Eurozone. It is not just OMT that is so hedged around with conditionality that it is virtually useless. It is the ECB itself.

Related reading:

ECB reacts to below target inflation with a rate cut - Georgie Markides

A central bank crisis - Coppola Comment

The ECB's very own tapering problem - FT Alphaville

Two more nails in the Keynesian coffin - The Money Illusion

Related reading:

ECB reacts to below target inflation with a rate cut - Georgie Markides

A central bank crisis - Coppola Comment

The ECB's very own tapering problem - FT Alphaville

Two more nails in the Keynesian coffin - The Money Illusion

.jpg)

Italy leaves Euro. Job done. Why am I wrong? (Scaring the shit out of Germany is part of my cunning plan.)

ReplyDeleteItaly leaves Euro, bye bye Euro.

DeleteWhat about the idea of reforming the monetary system a bit so that it operates properly instead of tinkering with it? There is no other sustainable way out it seems.

ReplyDeleteFrances, I’m not sure about your suggestion that Germans think OMT will lead to hyperinflation. A more moderate objection from Germans (one I would agree with) is that OMT will lead to a finite, but small increase in inflation in the periphery. And that just isn't allowable, if costs in the periphery are to decline relative to Germany’s with a view to equalising competitiveness as between Germany and periphery.

ReplyDeleteAnd the difference in inflation as between Germany and periphery is small enough as it is (about 1% according to one of your charts above).

I.e., I don’t blame the ECB or the “political set-up”. The root problem is the inherent problems of a currency. The ECB and the “political set-up” are dealing with the latter inherent problem in the only way possible: imposing severe deflation with all its horrendous social costs on the periphery. (Although a bit more demand and inflation in Germany would help)

I.e. this is a shambles which won’t end for some years yet: unless they adopt the “bye-bye” Euro solution.

No, Ralph. The German objection to OMT is not remotely benign. It is entirely to do with preventing monetization of government debt under any circumstances. And that is primarily driven by their belief that the Weimar hyperinflation was caused by monetization.

DeleteThis comment has been removed by the author.

DeleteSome nitpicking:

ReplyDelete- The peripheral/core bank loans spread is a problem, but you're arguing that this spread increases with every rate change. Makes no sense to me. The spread should be broadly constant here, so the rate change should help a bit (if not that materially as 25bps is small compared to the spread problem).

- You're assuming that borders are not porous. Any mid-size business with offices in both core and peripheral locations will obviously load their group-wide borrowing on their core branches so will show up as "German" lending up and peripheral lending down in the stats but the proceeds can be used otherwise. For smaller business, it's an obvious arb for an intermediary to offer (e.g. buy trucks with a German covered loan, and lease them to Italian greengrocers, same effect as the greengrocers getting a core rate loan to buy their own truck, but again showing up in the wrong place in the stats).

- OMT conditionality is easy to work around: bonds bought for monetary easing purposes can be allocated equally (per head of population or the like). Any extra can remain conditional. This does make Bund rates lower than need be, but that seems a minor problem and can be compensated by buying more on the conditional allocation than otherwise would be the case, while conditions are satisfied.

- What is important in reflating Germany is wage inflation (so that peripheral workers become more competitive without more nominal cuts), that aggregate German price inflation is not following (as fast) is virtuous here as then the ECB need not take action. This seems to be progressing some, as expected when you're close to full employment. This is also pretty popular as you'd expect.

- German savers don't like low rates, well, yeah, nor do savers anywhere (you've covered the UK reaction in the past), and we want them to save less (in risk free) anyway, so discontent is good here.

Hi cig,

Delete- Yes, I am arguing that the peripheral/core bank loans spread increases when the ECB cuts rates. Interest rates in the periphery simply don't respond to ECB action. I agree this seems nonsensical, but it is because periphery interest rates are risk-driven not cost-driven. ECB cutting rates doesn't change the perceived risk of lending in the distressed periphery. I agree that the rates not responding when funding costs are cut amounts to a perception that risk is increasing, but this isn't about rational pricing - it's about the mess that banks are in. As I said in the post, European banks are a dysfunctional lot. Increasing spreads is a way of recapitalising, which they are under pressure to do as fast as possible. They won't get away with wider spreads after the rate cut in the core, where competition is fiercer, but they definitely can in in the periphery. In a nutshell, this is the "broken transmission mechanism" that Nick Rowe thinks doesn't exist.

- I agree that large companies will borrow where it is cheapest to fund business elsewhere, obviously, but the majority of businesses in the periphery are SMEs, which don't have that alternative. Also, the evidence seems to be that borders are not particularly porous. Balkanisation in the Eurozone is widespread and increasing. Consequently businesses in the periphery really are disadvantaged relative to the core.

- It remains to be seen how they would address OMT conditionality if the ECB decided to do QE. No doubt they will find a way. But the aim of QE would be to reflate the entire Eurozone, and Germany in particular, while avoiding putting the ECB's solvency at risk - so I suspect the preference will be for purchases of German bunds, rather than periphery debt.

- German inflation is higher than in the periphery but still well below the ECB's target - Reuters say 1.2% and falling. That does not suggest there is much wage inflation in Germany, unless you think that German workers are saving their wage increases instead of spending them?

- I didn't mean to imply that German savers were right. I think they are wrong just as the UK savers are. I'm simply noting that the German media reaction to the ECB's rate cut has been almost uniformly negative, which is perverse given that as far as I can see it is in response to German disinflation. Ungrateful, much?

- The broken transmission/credit risk model, which I agree with, should imply a fixed spread, arguably difficult to measure/prove with relatively tiny moves. Maybe sticky prices do win in the short term.

Delete- I don't think you need to be that big to do the business loan rate arb, a 100 employee company (definitely a SME) with an office somewhere in the core can do it, and intermediaries providing the service should pop up too for the smaller cos with single-country presence. Core SMEs can also get (or increase) their peripheral presence funded by domestic loans.

- Yes I think wage inflation doesn't show in price inflation that quickly. Structurally the impact is diminished because it appears primarily in services as movable products are not priced nationally (shops can import substitutes if local edition of the product becomes more expensive, which may be happening with a now close to neutral Germany/rest-of-eurozone trade balance), some of it is in public services which doesn't show up in the price index (and may not even mean increased tax with cheap debt and cyclical stabilisers helping), and finally yes some of it will be saved or used to reduce debts as thrifty people like to do that when they get a windfall.

Also it's a dynamic that has barely started, as you can see for example here in the fairly good deals in the more recent round of negotiations:

https://www.destatis.de/DE/PresseService/Presse/Pressemitteilungen/2013/09/PD13_324_622.html

and as you get close to full employment this will likely propagate to unregulated professions, this should become a bit more visible over the next 2-3 years, but still without creating a matching amount of inflation (absent some other inflationary factor).

On using Bunds in preference to other bonds from the euro area to do monetary easing, I doubt it because:

Delete- Technically, there's just not enough bunds to go round, the whole stock is about 30% of German GDP (the rest of the debt is in other non-federal instruments) which makes about 10% of eurozone GDP. They can't really buy the whole lot, so it's just too small to be an effective instrument on its own.

- The "solvency" issue -- ignoring for a moment that the ECB like any fiat central bank can have a persistently negative balance sheet with no problems -- does not really apply when preferring bunds would almost be like accepting the euro is finished, and I don't think the ECB will self immolate.

- It would be politically unacceptable for the ECB to do that in so many ways that I will leave that as exercise to the reader.

Regarding - direct purchases of corporate and sovereign bonds , purchase of GSE structures that pool and securitize SME loans. In Spain, Ireland and Portugal, direct purchases of residential and commercial mortgages -

ReplyDeleteThey look a lot like interventions in the economy rather than only a way improving transmission of monetary policy.

Politics may want to intervene to help the periphery, but the ECB itself is in the business of providing a currency for people to do business in, rather than intervening in the results of that situation.

The peripheral/core bank loans spread is a problem, but you're arguing that this spread increases with every rate change. Makes no sense to me. The spread should be broadly constant here, so the rate change should help a bit (if not that materially as 25bps is small compared to the spread problem).

ReplyDelete