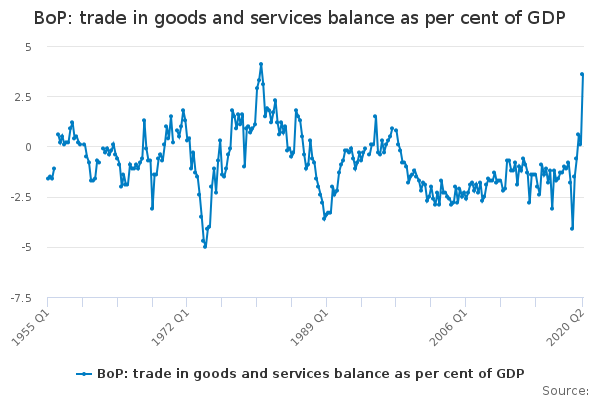

The UK is running a trade surplus. No, really, I am not joking. This is from the ONS's latest trade statistics release:

The UK total trade surplus, excluding non-monetary gold and other precious metals, increased £3.8 billion to £7.7 billion in the three months to August 2020, as exports grew by £21.4 billion and imports grew by a lesser £17.5 billion

It's the first time the UK has run a trade surplus since the late 1990s:

And if you were thinking this was because of the lockdown, you would be wrong. The UK has been running a trade surplus since the beginning of 2020:

Admittedly, the trade surplus widened under lockdown. But the UK economy reopened to some degree from June to August - and yet the trade surplus continues to widen.

This is no doubt music to the ears of balance of payments obsessives. Could the UK at last be pivoting away from a consumption-led growth model to an export-led one?

At first sight, it appears so. Exports have increased more than imports. And the strongest growth in goods exports was in manufactured goods, particularly machinery and transport equipment:

Hooray! If this continues, the UK will become an export powerhouse to rival Germany! There will be jobs and prosperity for all!

Not so fast. The trade balance is a net figure. The gross figures that make it up matter too - and gross imports and exports have both fallen considerably since August 2019:

The UK's trade surplus is not a sign of a booming export economy. Far from it. The only reason for the trade surplus is that imports have fallen even more than exports over the last 12 months.

An abrupt switch from trade deficit to trade surplus accompanied by sharp falls in both imports and exports is usually caused by what is known as a "sudden stop", when investors abruptly pull their funds from the country, causing the currency to collapse and bond yields to spike. It is almost always associated with a deep recession. The UK has experienced sudden stops twice since World War II, in 1975 and 1989. In both cases, the pound's exchange rate fell sharply - so sharply, in fact, that in 1975, when the UK still had exchange controls, it was forced to ask the IMF for help to stop the pound collapsing.

But this time is different. Sterling's exchange rate did drop sharply in March, but it bounced back again:

There was no sustained currency collapse. And although there was a brief spike in March, bond yields then fell to the lowest levels in history:

Resilient currency, falling bond yields....this is hardly a typical "sudden stop".

In fact the UK is in no serious danger of running out of the foreign currency it needs to pay for imports. Permanent central bank swap lines make FX-driven sudden stops a thing of the past for currency-issuing developed countries (though not for Eurozone countries). Imports are falling not because of lack of FX, but because the UK population has cut back discretionary spending hard. This is what is causing both the widening trade surplus and the deep recession. And the fact that the UK was already running a trade surplus before pandemic restrictions were imposed shows that it was collapsing consumer confidence, not the lockdown, that caused the switch to trade surplus.

The import figures for August show that domestic consumer confidence is still on the floor. And this is supported by the GDP figures:

A trade surplus is not necessarily a sign of a healthy economy.

When there is a trade surplus, domestic saving must be high, since the country is exporting capital. The UK's domestic saving ratio is currently at an all-time high:

In my view this massive increase in the domestic saving ratio is the cause of the trade surplus. And it is not a healthy sign. It does not reflect the desire of people to provide for their own age or build an economy for future generations. And it is not providing capital for needed investment: if it were, interest rates would be significantly positive, rather than heading for the basement. The extraordinarily high domestic saving ratio actually reflects the unease that many people feel about exposing themselves to the virus for the sake of an evening's entertainment, the fear of many more people that their jobs and incomes will evaporate, and the obstacles that pandemic restrictions create for people who do want to spend.

The saving ratio is

a tale of two halves, too. Higher earners who can work from home are saving like mad, while people on lower incomes are losing their jobs or suffering pay cuts, forcing them to dis-save:

(chart from Resolution Foundation)

So both high and low earners are cutting discretionary spending, though for very different reasons. And large though it is, the UK government's deficit spending is nowhere near large enough to compensate for this massive fall in domestic consumption. That's why GDP has fallen so much and has been slow to recover. Now that the government is imposing more restrictions while cutting support for those affected, GDP will fall again.

Neither a trade surplus nor a high saving ratio necessarily mean a strong economy. It depends on the circumstances. A country with a large middle class and an effective social safety net might have a low saving ratio and a trade deficit, because people enjoy buying foreign-made goods and have little need to save. But this is without question a more prosperous country than a country with a trade surplus and high saving ratio, if the population of that country doesn't earn enough to buy foreign-made goods and must save because there is no social safety net.

If the prosperous country, driven by mistaken envy of the poorer country's trade surplus, deliberately depresses domestic incomes to gain international market share, and shreds its safety net with the aim of "making work pay", then it might find its saving ratio rises and its trade balance shifts towards surplus. But its population won't be more prosperous. They will be poorer. Rather than the poorer country becoming more like the richer one, the richer one becomes more like the poorer.

Right now, the UK's high but divided saving ratio is raising its (already high) wealth inequality, while collapsing consumption is destroying the jobs and incomes of those at the lower end of the income spectrum. The trade surplus and high saving ratio aren't making us prosperous. Indeed they have no causative effect at all, in either direction. As is so often the case, the switch to trade surplus and excessive saving simply reflects the effects of an economic disaster. Those who think that a trade surplus and a high saving ratio are the route to prosperity for all might like to reflect on this.

Related reading:

It will all be hunky dory once the government has managed to get a few more onto the housing ladder and house prices keep on going up.

ReplyDeleteThere is nothing like a new house to create a wave of borrowing and spending in order to fill it with stuff.

Always worked before. I believe that once again pension savings are being looked at as a source of deposits to "get that foot on the bottom rung".

This comment has been removed by the author.

ReplyDeleteThere is no opacity. The actual figures behind the ONS trade charts in this piece can be downloaded from their publication. Click the link in the first paragraph.

DeleteYou acknowledge that the UK switched to trade surplus some time before the pandemic restrictions started. This was my actual point, so what exactly are you are trying to criticise?

This piece has nothing whatsoever to do with Jo Michell. I am not one of his students.

Gross figures matter. The total value of UK trade has fallen considerably relative to a year ago. The switch to net surplus is simply because imports have fallen more than exports.

There isn't anything confusing about the ONS figures, and all I have done is drawn some reasonable conclusions from them. If you are confused, that says more about you than it does about me.

This comment has been removed by the author.

ReplyDeleteThe data can be downloaded from the ONS publication, as I have already pointed out. You may also find it helpful to look at previous releases of ONS trade statistics. That's where you will find the data for q4 2019.

DeleteI am still wondering what your criticism is, exactly, since you are not actually disagreeing with me about anything.

Lockdowns are not supply-side shocks. They are severe negative shocks to demand that are deliberately engineered by temporarily restricting or closing down parts of the supply side. They are not intended to cause longer-term damage to the supply side, but they do have negative supply effects beyond the lockdown itself because of collapsed consumer confidence (as I said in this post), continuing restrictions on trading activity after the end of the lockdown, and supply chain disruption.

There may indeed have been virus effects prior to lockdown. I have not said otherwise. But the primary cause of the pre-lockdown slowdown was falling consumer confidence starting in Q4 2019. Retail sales fell in the three months to February 2020: https://www.ons.gov.uk/businessindustryandtrade/retailindustry/bulletins/retailsales/february2020

And household spending was flat in Q4 2019 https://www.ons.gov.uk/economy/nationalaccounts/satelliteaccounts/bulletins/consumertrends/octobertodecember2019

Hope this helps. I am happy to discuss the economics further when you have looked at the data. I would however appreciate it if you would refrain from making assertions about my political beliefs.

This comment has been removed by the author.

DeleteThe ONS data is complex because economic data is complex, not because they are out to confuse you.

DeleteI know what "supply side shock" means, thank you. And as the only person here who is insisting that a lockdown is a supply-side shock is you, I don't need a handy definition. You might find it useful to look one up, though.

I am not necessarily assuming supply-side shocks have long-term effects, though they do tend to. Nor am I necessarily assuming long-term financial support for affected businesses.

Post-lockdown restrictions, supply chain disruptions and collapsed consumer confidence are all legitimate explanations of supply-side damage.

My Twitter account tells you nothing about my political beliefs. And this article simply examines the data and draws rational conclusions. The political bias exists only in your imagination. Not for the first time, your own (painfully evident) political beliefs distort your perception of my work.

My pieces are never the final word on anything. I encourage readers to discuss aspects of the post constructively in these comments and provide additional information. Perhaps you could do that in future, rather than nit-picking.

"I have not said otherwise" means "I have not said otherwise".

Primary cause is evident from the data.

This comment has been removed by the author.

DeleteI have in fact kept the rules you say I should keep. I separated supply and demand, I explained that supply side damage was a later effect, and I distinguished between short and long term.

DeleteCollapse of imports is evident in the trade data. Collapse of retail sales is evident in the sales data. Collapse of consumer confidence is evident in the consumer confidence data. I don't really think it is reasonable to assume that the reason why imports fell was that other countries' exports failed, when there is such evidence of falling domestic demand. In an open consumption-led economy like the UK, falling domestic demand inevitably means fewer imports. This is not controversial.

You evidently do not understand my "desired blog model", since you continue to allege that it is politically motivated even though I have told you many times that it is not. You also say things that have no basis in fact. For example, I have never rejected moral hazard.

Now I am going to end this conversation, as I feel it is going nowhere and I want to encourage others to comment. I won't publish any more comments from you on this article.

Do you think the UK's trade surplus started before the pandemic occurred because of uncertainty over brexit?

ReplyDeleteHaving said that, the savings behaviour is an obvious response to both lockdown and the risk of infection.

The problem is that lockdown was never an appropriate response to the virus, other than as a short-term emergency solution to the government's failure to apply sensible measures earlier. It was evident during January that a pandemic would occur, and this was confirmed on 31 January when a plane-load of arrivals from Wuhan were quarantined in Arrowe Park hospital in Wirral. I thought at the time that this was a test run for complete closure of the UK's borders, so that there would be the capability to quarantine all UK nationals then abroad when the time came for them to return home.

Closing the borders would have prevented the rapid spread of the disease in February and March as described in https://www.bbc.co.uk/news/health-52993734 . Clearly this would have damaged the economy, but not as much as the lockdown we have experienced.

In effect, lockdown requires us all to behave as if everybody around us is infectious. This has resulted in nearly 10 million people being furloughed. There is a view that it would have been

less economically damaging to allow the infection to spread uncontrolled, and accept the higher death rate, see: https://voxeu.org/article/uk-lockdown-balancing-costs-against-benefits and

https://www.theguardian.com/business/2020/jun/14/the-past-three-months-have-proved-it-the-costs-of-lockdown-are-too-high . I don't think society would have accepted that.

Having closed down the economy, the government is trying to support those it has prevented from working. It's clearly struggling to do this, yet the near-negative interest rates would suggest

that it should have no difficulty whatever in borrowing money to fund this - can you explain this conundrum? Such borrowing would cause inflation; in part because people unable to work will never be able to replace their lost earnings so the money they receive must be regarded as a gift.

Lockdown rules are now widely flouted, to the extend that there is civil disobedience, see:

https://www.bbc.co.uk/news/uk-england-merseyside-54535481 and I imagine that by winter we will see more serious civil unrest as people without sufficient income seek to make their point.

The alternative is to test absolutely everybody at least one per week, so that only those people proven to be infectious need be isolated. From:

https://www.ons.gov.uk/peoplepopulationandcommunity/healthandsocialcare/conditionsanddiseases/bulletins/coronaviruscovid19infectionsurveypilot/englandwalesandnorthernireland9october2020

This might be as few as 400,000 infectious people if we assume that in most cases they are only infectious for a couple of weeks. In February blanket testing would have been virtually impossible, but we now learn that the necessary laboratory facilities have not been constructed, so even now the capacity is only about 350,000 per day rather than the nearly 10 million per day that is needed.

So immediate construction of the necessary laboratory facilities is essential, and I for one would be prepared to invest some of my savings to achieve this.

Can you explain why the UK government is not offering savers a reasonable rate to fund blanket testing?

I tried to reply with a multi paragraph comment, but it hasn't appeared. Is there some arbitrary limit, or do I have to wait for you to approve my posting?

ReplyDeleteHi Graham, comments here aren't moderated for the first two weeks, but there is a limit on the size of the post you can make. You are welcome to post your comment in several parts if it is too long for a single post.

Delete"When there is a trade surplus, domestic saving must be high, since the country is exporting capital."

DeleteDo not understand this - surely the country is exporting goods not capital?

Could you expand?

@Peter

DeleteThis comes out of the "national saving and investment" identity.

https://opentextbc.ca/principlesofeconomics/chapter/23-4-the-national-saving-and-investment-identity/

It's one of the ideas that economists use to confuse everybody. It is understandable at the abstract level, but impossible to relate to at the hoi palloi individual level.

Ouch, RP! but you're right, it is confusing.

DeleteMy original submission took many minutes to appear. More worrying was that the response to my clicking "Submit" after going through CAPTCHA was the message: "Service Unavailable Error 503" - it was this that led me to make my second post. Have you thought of testing your blogging system?

DeleteGraham, my blogging system is Google's Blogger, over which I have zero control. However, other people are clearly having no difficulty posting here. Can I respectfully suggest that you test your broadband?

DeleteFrances, I understand your lack of control over Google. Dealing with broadband connections is what I do for a day job, and I monitor my connection continuously because it is used to monitor services for my customers. So I am completely confident that my broadband service did not fail at the time I saw the "Service Unavailable Error 503" message. Further, that message is normally generated by a server, so my guess is that it was Google's server that was temporarily overloaded. All my messages since then have appeared immediately, without any errors.

DeleteThank you for your help. Let's get back to the original topic.

I've sent this before but to no avail - to thank RP for the link and his information. Hope it works this time...

DeleteThanks for your work. It is very interesting to read the opinion and analysis of the professionals in research economic situation in the UK.

ReplyDelete