The Eurozone's Long Depression

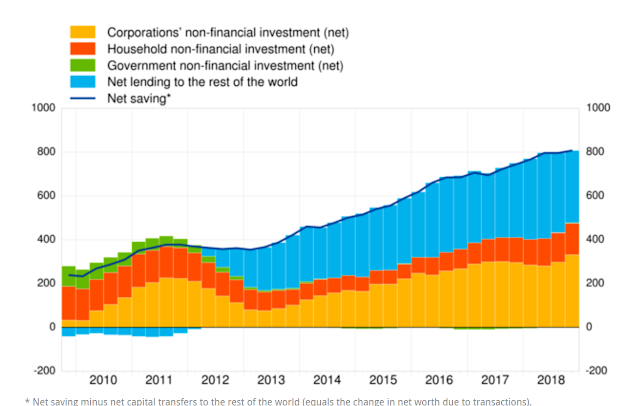

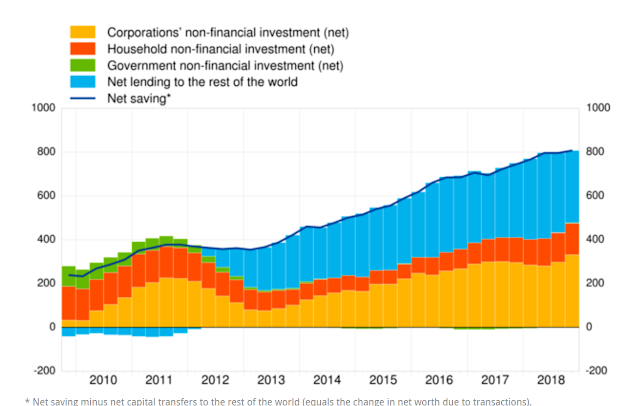

Sectoral balances can tell us so much about what is going on in an economy. Especially when they are expressed as a time series, as in this remarkable chart from the ECB:

Although it is a time series, this is not a rate-of-change chart. The y axis is in billions of Euros, not in percentage growth rates. But the chart nevertheless shows that Eurozone net saving has risen steadily since the financial crisis, except during the Eurozone crisis of 2011-12 when it dipped slightly.

What do we mean by "net saving"? The legend appears to conflate saving with investment, and the brief explanation at the bottom of the chart doesn't really help. So here's some simple algebra to sort it out.

In national accounting, "saving" is the excess of income over desired consumption. For the private sector, it looks like this:

Sp = Y - T - C

where Y is the net income of the private sector from all sources, T is tax payments, and C is all other consumption.

Thus, "net saving" is what is left over after the private sector has paid its taxes, met its other obligations such as rent and debt service, fed and clothed itself, and bought the latest Mulberry handbag. It is a residual. So when economists and politicians say "we need more saving in the economy," what they really mean is people and corporations should spend less.

The public sector can also "net save". It looks like this:

Sg = T - G

where T is tax revenue (the same T as in the private sector equation) and G is government spending. The OECD defines government net saving thus:

Putting private and public "net saving" together gives us this:

Sp+g = Y - G - C

which is also equal to total net investment:

S = I

This identity is crucial. The chart above breaks down total net saving, S, into its investment (not saving) components:

S = Ih+ Ic + Ig + Ix

where h is households, c is corporations, g is government and x is the rest of the world (positive sign here indicates outward investment, ie capital exports).

The chart shows us that since 2009, with the exception of the two worst years of the Eurozone crisis, the Eurozone as a whole has been investing like crazy. But as Adam Tooze observed on Twitter, the investment has not gone into the Eurozone:

But European corporations didn't stop investing. They simply looked elsewhere. Net saving didn't dip much in the Eurozone crisis - but the associated investment no longer went into the Eurozone economy. It flowed out of the Eurozone to the rest of the world. Ever since the crisis, as net saving has increased in the Eurozone, the rest of the world has benefited from its rising exports of capital.

It wasn't only Eurozone corporations that stopped investing in the Eurozone. As Adam says, the growing external surplus is the flip side of the Eurozone's current account balance. The chart shows that in 2011, the Eurozone abruptly switched from net borrowing from the rest of the world to net lending to it. This is consistent with a "sudden stop", in which external investors abruptly pull their funds, causing severe economic damage. If so, then we would expect to see the current account switch from deficit to surplus at this time (net borrowing from the rest of the world indicates a current account deficit). And that is indeed what Eurostat shows:

The Eurozone's "sudden stop" in the last quarter of 2011 is hardly news. Many people have commented on it. But the point is that it is driven by the behaviour of external investors. It was not just domestic investment that collapsed in the Eurozone crisis. External investment fled too. And the persistently wide current account surplus since then tells us that it has never returned.

Economies don't always bounce back after a "sudden stop." If investment doesn't return, then the economy stays stuck in a slump. That is what has happened to the Eurozone. It needs much, much more investment. Investment by domestic corporations is slowly growing, but the ECB says that households are still deleveraging. And government investment is all but absent, as balanced-budget rules proliferate across the Eurozone and Brussels threatens to impose draconian sanctions on any country that dares run much of a deficit. Meanwhile, external investors stay away, put off by the Eurozone's poor growth prospects and rising political risks.

But the Eurozone authorities have very good reasons for pursuing policies that discourage external investment. The "sudden stop" in 2011 nearly destroyed the Euro. Those in charge in the Eurozone daren't risk another one. The current account surplus, and associated capital exports, are protective. After all, if you never borrow from the outside world, they can't hurt you. And if you are a net lender to the outside world, you have some leverage over them. Of course, they can still trash your currency, but as you don't need to service external debt, that doesn't cause you a major problem. It simply helps you to sell them more goods. Alternatively, they can refuse to buy your goods, in which case the loss of export income will make your population poorer. But hey, the people are already used to austerity, because that's how you maintain your current account surplus. They won't notice even more pain when the export income dries up.

In fact the Eurozone is behaving in much the same way as developing countries have since the Asian crisis of 1997, and for much the same reasons. Just as developing countries pursued export-led growth strategies and built up large FX reserves to protect themselves from sudden stops, so now the Eurozone, scarred by its own "sudden stop", is doing the same. Perhaps Eurozone leaders think the investment chill that is causing the Eurozone's poor growth, high unemployment and stubbornly low inflation is a fair price to pay to keep the Eurozone together.

But the Eurozone is not a young developing country whose population is generally living on a low income. It is a mature Western economy with a population that is used to a relatively high standard of living and whose net worth took an absolute beating not only in the 2007-8 financial crisis, but also in the Eurozone crisis:

(chart from the ECB)

Rising property prices seem to be the only means the people of the Eurozone have of restoring their lost wealth. But for the young, already suffering from high unemployment, rising house prices mean an even more impoverished future. For how much longer will they tolerate this Long Depression?

Related reading:

Lessons from the Long Depression

How do you say "dead cat" in Latvian? (I need to revisit this post in the light of what we now know about Latvia's banks and money laundering...!)

Although it is a time series, this is not a rate-of-change chart. The y axis is in billions of Euros, not in percentage growth rates. But the chart nevertheless shows that Eurozone net saving has risen steadily since the financial crisis, except during the Eurozone crisis of 2011-12 when it dipped slightly.

What do we mean by "net saving"? The legend appears to conflate saving with investment, and the brief explanation at the bottom of the chart doesn't really help. So here's some simple algebra to sort it out.

In national accounting, "saving" is the excess of income over desired consumption. For the private sector, it looks like this:

Sp = Y - T - C

where Y is the net income of the private sector from all sources, T is tax payments, and C is all other consumption.

Thus, "net saving" is what is left over after the private sector has paid its taxes, met its other obligations such as rent and debt service, fed and clothed itself, and bought the latest Mulberry handbag. It is a residual. So when economists and politicians say "we need more saving in the economy," what they really mean is people and corporations should spend less.

The public sector can also "net save". It looks like this:

Sg = T - G

where T is tax revenue (the same T as in the private sector equation) and G is government spending. The OECD defines government net saving thus:

Net saving arises, and accrues over time, when revenues exceed expenditures without taking into account capital expenditures, such as public investment, transfers to publicly-owned enterprises or transfers to financial institutions (for instance, rescuing them during the financial crisis).Thus, a government that is running a persistent budget surplus is "net saving."

Putting private and public "net saving" together gives us this:

Sp+g = Y - G - C

which is also equal to total net investment:

S = I

This identity is crucial. The chart above breaks down total net saving, S, into its investment (not saving) components:

S = Ih+ Ic + Ig + Ix

where h is households, c is corporations, g is government and x is the rest of the world (positive sign here indicates outward investment, ie capital exports).

The chart shows us that since 2009, with the exception of the two worst years of the Eurozone crisis, the Eurozone as a whole has been investing like crazy. But as Adam Tooze observed on Twitter, the investment has not gone into the Eurozone:

It is clear from the chart that something fundamentally changed when the Eurozone crisis struck. As Adam points out, government net investment completely vanished and has never returned. But it was not exactly large prior to the crisis. The chart shows that collapsing corporate investment is the real story of the Eurozone crisis. European corporations all but stopped investing in the Eurozone in 2012-13. Even now, corporate investment in the Eurozone is barely higher than it was in 2011, in the wake of the Great Financial Crisis.This data on Eurozone net saving should be retweeted daily! Large foreign lending is the flip side of the current account balance. But it is the low level of domestic investment and the complete absence of net public investment since 2012 that is truly dramatic. @SoberLook pic.twitter.com/5qtbpGiny3— Adam Tooze (@adam_tooze) May 2, 2019

But European corporations didn't stop investing. They simply looked elsewhere. Net saving didn't dip much in the Eurozone crisis - but the associated investment no longer went into the Eurozone economy. It flowed out of the Eurozone to the rest of the world. Ever since the crisis, as net saving has increased in the Eurozone, the rest of the world has benefited from its rising exports of capital.

It wasn't only Eurozone corporations that stopped investing in the Eurozone. As Adam says, the growing external surplus is the flip side of the Eurozone's current account balance. The chart shows that in 2011, the Eurozone abruptly switched from net borrowing from the rest of the world to net lending to it. This is consistent with a "sudden stop", in which external investors abruptly pull their funds, causing severe economic damage. If so, then we would expect to see the current account switch from deficit to surplus at this time (net borrowing from the rest of the world indicates a current account deficit). And that is indeed what Eurostat shows:

The Eurozone's "sudden stop" in the last quarter of 2011 is hardly news. Many people have commented on it. But the point is that it is driven by the behaviour of external investors. It was not just domestic investment that collapsed in the Eurozone crisis. External investment fled too. And the persistently wide current account surplus since then tells us that it has never returned.

Economies don't always bounce back after a "sudden stop." If investment doesn't return, then the economy stays stuck in a slump. That is what has happened to the Eurozone. It needs much, much more investment. Investment by domestic corporations is slowly growing, but the ECB says that households are still deleveraging. And government investment is all but absent, as balanced-budget rules proliferate across the Eurozone and Brussels threatens to impose draconian sanctions on any country that dares run much of a deficit. Meanwhile, external investors stay away, put off by the Eurozone's poor growth prospects and rising political risks.

But the Eurozone authorities have very good reasons for pursuing policies that discourage external investment. The "sudden stop" in 2011 nearly destroyed the Euro. Those in charge in the Eurozone daren't risk another one. The current account surplus, and associated capital exports, are protective. After all, if you never borrow from the outside world, they can't hurt you. And if you are a net lender to the outside world, you have some leverage over them. Of course, they can still trash your currency, but as you don't need to service external debt, that doesn't cause you a major problem. It simply helps you to sell them more goods. Alternatively, they can refuse to buy your goods, in which case the loss of export income will make your population poorer. But hey, the people are already used to austerity, because that's how you maintain your current account surplus. They won't notice even more pain when the export income dries up.

But the Eurozone is not a young developing country whose population is generally living on a low income. It is a mature Western economy with a population that is used to a relatively high standard of living and whose net worth took an absolute beating not only in the 2007-8 financial crisis, but also in the Eurozone crisis:

(chart from the ECB)

Rising property prices seem to be the only means the people of the Eurozone have of restoring their lost wealth. But for the young, already suffering from high unemployment, rising house prices mean an even more impoverished future. For how much longer will they tolerate this Long Depression?

Related reading:

Lessons from the Long Depression

How do you say "dead cat" in Latvian? (I need to revisit this post in the light of what we now know about Latvia's banks and money laundering...!)

Strange that the author failed to mention the negative interbank rate in the eurozone... You can't get free money and good yields. Investors will go wherever the risk adjusted return is highest.

ReplyDeleteThe interbank deposit rate was not negative until June 2014. Investment fled long before then. And the interbank lending rate is not negative.

Delete"The chart above breaks down total net saving, S,"

DeleteNo, you've conflated saving with net saving. Net saving for the domestic private sector is (S - I), i.e., saving net of investment, not S. The equation for the sectoral balances is:

(S - I) = (G - T) + (X - M)

When the domestic private sector desires to "net save", i.e., be in surplus, the sum of the government sector and the foreign sector must be in deficit, otherwise, the economy contracts.

I see you've learned your MMT, but this isn't an MMT post.

DeleteI don't need educating on the sectoral balance equation, thanks. I'm talking about THIS CHART, which equates net saving to total investment. You may not like that, but that is what it does.

Globalisation - an inexhaustible well that doesn't dry out (until it does and it's the wells fault). Magical demand for all your needs is provided (goods, services (savings), contempt for debt/profligancy and externalising your own problems).

ReplyDeleteMotto of the swabian housewive is - Ignorance is bliss

One factor that should be in the mix is the poor investment climate in the Eurozone courtesy of things like carbon pricing and pushes for ever tightening environmental standards and regulations. Think of Bayer buying Monsanto rather than investing in Europe.

ReplyDeleteNot enough is made of the micro climate for investments.

How will GDPR and the new copyright rules help innovation and risk taking?

***Alex from 8 May 2019 at 14:42***

DeleteThat sounds like the austrian or schumpeterian excuse. Just go to rock bottom and investment is going to flood the eurozone. And you are even saying that corporations don't want solid environmental standards and regulations, that's why they are not investing in the eurozone. How does that even work in a self-regulating capitalism framework, that is always good for the people?

Against whom has the eurozone a poor investment climate? USA? There is someone called Trump with a new debt party. China? Authoritatian Government with Capital Controls and their own Credit binge. There aren't many countries left which are big enough (GDP). In which countries do eurozone corporations invest to satisfy their good investment climate?

Was that even investing what Bayer did with Monsanto? Was Porsche investing as they tried to buy VW and got bought from VW in the end?

***not the same Alex***

ReplyDeleteIIRC various German politicians have made the case that precisely because the population is ageing, Germany should be running a capital account surplus to accumulate claims on the rest of the world.

***Alex from 8 May 2019 at 14:42***

DeleteThat's a terrible excuse. Other countries have old people, too. How does that work with living within their means, but still trying to get claims on something "far away in the realm of globalization" outside their own economy.

Who does even benefit from investing abroad? Are the ageing population or the corporations accumulating a surplus? How do germans finance their retirement? Who owns stocks to benefit from successful companies outside their own economy?

And there is some fear that all those claim aren't solid. Germans fear Target2, US-Mortgages, Chinas/Turkeys Credit, PIIGS profligancy, Britains Brexit (no more debt from there). That's slighty weird. You want claims to live within your means as you get old, but fear all claims are for nought and you should save even more to get more claims.

The Eurozone crisis was caused by.. a sudden stop of external financing? The Eurozone is.. scarred by this sudden stop?

ReplyDeleteWhat in God's name are you talking about? Last I checked the Eurozone crisis was caused when the only surplus-recycling-mechanism that the Eurozone had, that of lending the surplus-capital of the North to the deficit South, broke down. The reason it broke down was completely of the Eurozone's own making, and to this day the Eurozone is refusing to restore that flow of funds within the union. Unsurprisingly, the attempt to expand the North's beggar-thy-neighbor policies throughout the EMU brought stagnation because the ROW refused to go into debt to buy the EMU's output.

yes, the breakdown of that surplus recycling mechanism caused the periphery "sudden stop" that almost destroyed the Euro.

DeleteThe ROW has in fact gone into debt to buy the EMU's output. EMU is running a trade surplus with the ROW.