Raising interest rates is not that simple, Lord Hague

The present period of very low interest rates is widely assumed to be temporary, a consequence of the 2008 financial crisis and subsequent central bank action. Because of this, as the financial crisis fades into the mists of time, there is growing political pressure for "normalisation" of interest rates. Here, for example, is William Hague warning that central banks must start to raise rates or face losing their independence:

the "reach for yield" by savers who want higher returns drives up the price of assets

higher asset prices increase wealth inequality, fuelling popular anger

pension funds are struggling, forcing businesses to put more money into them

banks are struggling to make a profit

people are struggling to save enough for their retirements

companies would rather buy back shares than invest productively

low interest rates support zombie companies

pumping up asset prices could result in an almighty crash

"emergency measures" shouldn't still be in place after nearly a decade anyway

Few would disagree that these are the adverse effects of very low interest rates. But unfortunately none of them necessarily mean that interest rates should rise. If interest rates were naturally very low, rather than being artificially depressed by central banks as Hague implies, these effects would still occur. As Larry Summers has pointed out (pdf), asset price bubbles are a feature of "secular stagnation", where the economy becomes stuck in a low-growth, low-inflation, low-interest rate equilibrium:

There is a growing body of research that suggests that not only are very low interest rates the "new normal", they have further to fall. And the reasons have little to do with the financial crisis.

In an important new paper (pdf), Federal Reserve researchers blame demographic factors not only for the falling equilibrium real interest rate, r*, but also for declining GDP growth:

falling labour supply growth rate

rising dependency ratio

rising longevity

Together, these add up to an environment in which there is a growing propensity to save, a rising capital share and sustained downwards pressure on interest rates. Admittedly, as the US baby boomers retire, their propensity to save should diminish. But the rising dependency ratio will force working-age people to save a larger percentage of their incomes in order to support the growing number of elderly. This is the case regardless of the method of saving, as John Eatwell pointed out.

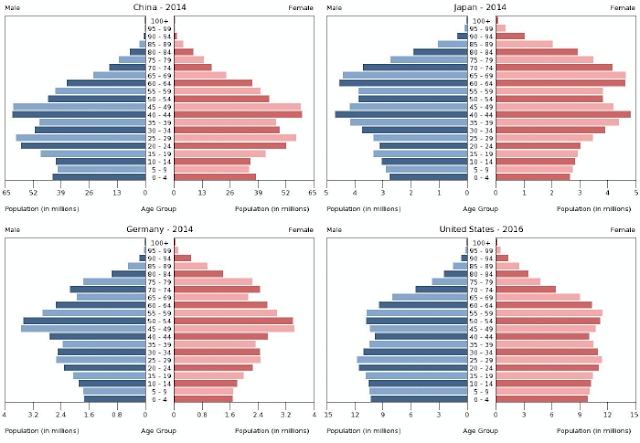

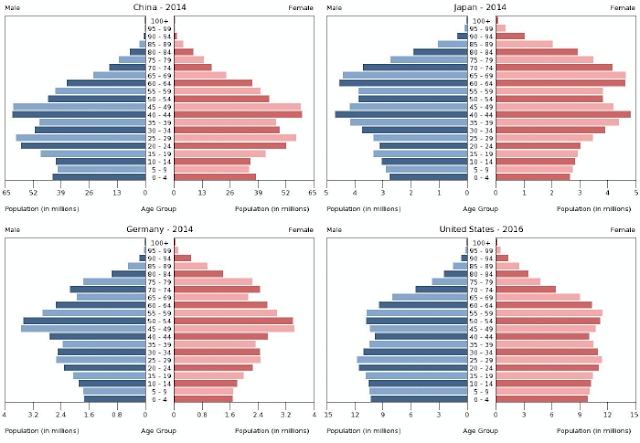

Just how severe the demographic pressures will be in future is evident from these "beehive" charts produced by researchers at Cambridge University:

The researchers identify the introduction of the contraceptive pill in 1967 in Western countries as the principal cause of this striking demographic change. I would probably add to that liberalization of abortion services at around the same time. The effects are particularly pronounced in Germany:

The researchers go on to discuss the effect on saving and spending patterns of this demographic shift:

This striking chart shows the sharp decline in the real interest rate since the 1980 peak:

Worryingly, this chart shows that the real interest rate still has further to fall. By 2035, if the researchers are correct, the real interest rate will have fallen to minus 1.5%, purely due to demographic factors. I suppose we should be relieved that it will gradually rise after that, eventually stabilising at minus 0.5% by the end of this century. But unless something changes, it will never be positive again.

Permanently negative real interest rates have huge implications for the structure of finance. Firstly, banking as we know it will become impossible, since credit intermediation reverses when rates are negative. Secondly, maturity transformation would become unprofitable: although in theory yield curves could still be positively sloped when rates are permanently negative, they would be very flat. There would have to be a major rethink of the way in which financial intermediaries whose job is maturity transformation (banks, pension funds, insurance companies) work.

More importantly, permanently negative real interest rates fundamentally affect the ordering of society. They do not support debtors at the expense of savers, as is popularly believed: rather, they favour those who own assets (mainly the old) at the expense of those who do not (mainly the young). This potentially sets up a highly damaging intergenerational conflict. The older people who expected higher returns on their savings than they will receive are already angry, and their anger is likely to increase. The younger people who see their hopes of owning their own home receding into the distance are also angry, and their anger is likely to increase too. And when younger people face confiscation of growing amounts of income, either in the form of taxes (even if disguised as social security contributions) and/or compulsory saving (auto-enrolment springs to mind - there are already calls for the percentage contribution to be increased), in order to support a rising number of elderly, they will become even angrier.

So what is the solution? Sorry, Lord Hague, it certainly isn't raising interest rates. That would simply transfer still more from young to old, and it would put financial stability at risk. When the supply of savings exceeds the demand for them, the returns on them must fall. However angry the baby boomers are, they have to accept that the high interest rates of their youth are gone forever, and their future is consequently poorer than they expected. This is not because they have been robbed by governments or screwed by central banks: it is largely because of their own failure to produce enough of the next generation to support them in their old age.

Rather, we need to find ways of raising the real interest rate. The risks associated with NOT doing so are simply too great. So, since the real problem here is a structural imbalance between the supply of safe assets for retirement saving and the demand for them, the obvious thing to do is to improve the supply of safe assets. The Cambridge researchers point out that sovereign bonds, state pension schemes and asset price bubbles are logically equivalent:

And, at the other side of the government savings bank, investment of those savings in productive enterprises. After all, the structural imbalance is not just a problem of supply but also of demand. It is not central banks that are in a blue funk, but the whole world. Everyone is terrified of loss, no-one wants to take any risk, and the productive enterprises of the future are being starved of investment at the same time as savers are being deprived of returns. The effect of this will be to depress wage growth and productivity far into the future. If investment doesn't improve, the future for both young AND old is an impoverished one.

As I have pointed out many times before, the primary purpose of sovereign debt is not to finance government, but to enable people to save. And when the private sector is too scared to invest, government must step in. In a world of ageing populations, growing need for saving and fear of loss, the political obsession with reducing sovereign debt/GDP must end.

Related reading:

Rethinking government debt

Bond yields and helicopters

Keynes and the Quantity Theory of Money

The Great Yield Divergence

The safe asset scarcity problem, 2050 edition

Weird is Normal - Pieria

The broken contract - Pieria

The only way out is for the US Fed to summon the courage to lead the way to higher interest rates, and others to follow slowly but surely. If they fail to do so, the era of their much-vaunted independence will come, possibly quite dramatically, to its end.Hague gives ten reasons why low interest rates are a bad idea. His points can be summarised thus:

Few would disagree that these are the adverse effects of very low interest rates. But unfortunately none of them necessarily mean that interest rates should rise. If interest rates were naturally very low, rather than being artificially depressed by central banks as Hague implies, these effects would still occur. As Larry Summers has pointed out (pdf), asset price bubbles are a feature of "secular stagnation", where the economy becomes stuck in a low-growth, low-inflation, low-interest rate equilibrium:

Let us imagine, as a hypothesis, that this decline in the equilibrium real rate of interest has taken place. What would one expect to see? One would expect increasing difficulty, particularly in the down phase of the cycle, in achieving full employment and strong growth because of the constraints associated with the zero lower bound on interest rates. One would expect that, as a normal matter, real interest rates would be lower. With very low real interest rates and with low inflation, this also means very low nominal interest rates, so one would expect increasing risk-seeking by investors. As such, one would expect greater reliance on Ponzi finance and increased financial instability.Raising interest rates above their natural rate is ultimately unsustainable, since it means that the productive sector is slowly drained to provide rents to the unproductive sector. The problem therefore is identifying what the "natural" rate is. Is this just a blue funk by central banks, as Hague thinks - or are there other reasons why interest rates are still so low?

There is a growing body of research that suggests that not only are very low interest rates the "new normal", they have further to fall. And the reasons have little to do with the financial crisis.

In an important new paper (pdf), Federal Reserve researchers blame demographic factors not only for the falling equilibrium real interest rate, r*, but also for declining GDP growth:

We find that demographic factors alone can account for a 1.25 –percentage-point decline in the equilibrium real interest rate in the model since 1980—much, if not all, of the permanent decline in real interest rates over that period according to some recent time-series estimates, such as Johannsen and Mertens (2016b) and Holston et al. (2016). The model is also consistent with demographics having lowered real GDP growth 1.25 percentage points since 1980, primarily through lower growth in the labor supply; this decline is in line with changes in estimates of the trend of GDP growth over that period.And they add that the apparent correlation between the financial crisis and low interest rates is an illusion:

Interestingly, the model also implies that these declines have been most pronounced since the early 2000s, so that downward pressures on interest rates and GDP growth due to demographics could be easily misinterpreted as persistent but ultimately temporary influences of the global financial crisis.Gavyn Davies identifies three reasons why r* will remain low:

Together, these add up to an environment in which there is a growing propensity to save, a rising capital share and sustained downwards pressure on interest rates. Admittedly, as the US baby boomers retire, their propensity to save should diminish. But the rising dependency ratio will force working-age people to save a larger percentage of their incomes in order to support the growing number of elderly. This is the case regardless of the method of saving, as John Eatwell pointed out.

Just how severe the demographic pressures will be in future is evident from these "beehive" charts produced by researchers at Cambridge University:

The researchers identify the introduction of the contraceptive pill in 1967 in Western countries as the principal cause of this striking demographic change. I would probably add to that liberalization of abortion services at around the same time. The effects are particularly pronounced in Germany:

.....the fertility rate fell from 2.5 in 1967 to 1.4 in 1970. In the long run, this will lead to a decline of the steady state population growth from 1.5% to -0.5% per year. However, during the transition to the new steady state, the age composition of the population will deviate strongly from its steady state structure. The fall in fertility led to substantially smaller cohorts born just after the introduction of the pill, with an echo-effect when the first, smaller, post-pill cohort of women starts giving birth themselves. The last cohorts born before the introduction of the pill are therefore much larger than the cohorts born before and after. For Germany, the cohort born in 1995 is just half the size of that born in 1968.In China, where the fertility shift lags the others, the cause was undoubtedly the one-child policy. Interestingly, the US does not show such a dramatic fall in cohort sizes: the researchers don't discuss the reasons for this, but I suspect it is due to immigration. But even in the US, increasing longevity will mean a rising dependency ratio.

The researchers go on to discuss the effect on saving and spending patterns of this demographic shift:

People initially borrow to finance their education; next they enter the labour force and begin saving, at first to repay this loan and then to save for retirement; finally they deplete these savings during retirement. For this reason, the desired stock of assets is at its maximum just before retirement. The current demographic profile, with large cohorts approaching retirement, means that the population is disproportionately biased towards saving. As the large cohort desires to hold a large stock of savings, there is a surplus of savings. At the same time, the absorbers of savings – the young cohorts who borrow to finance their education – are in short supply. This implies that the real interest rate will be low, in fact even negative.The researchers omit to note that in many Western countries the young borrow to buy property, not just to finance their education. In theory, demand for housing should help to support the interest rate. But most people buy houses with mortgage loans. As property price rises outstrip wage rises, mortgage demand pushes up the price of property, putting additional downward pressure on interest rates. Rising property prices mean the young must take on ever larger mortgages, and rising mortgage debt relative to household income is unsustainable unless interest rates fall. When the acquisition of assets is generally financed by debt, asset price bubbles provide only short-term relief to the problem of falling interest rates. Over the longer term, they make the problem worse.

This striking chart shows the sharp decline in the real interest rate since the 1980 peak:

Worryingly, this chart shows that the real interest rate still has further to fall. By 2035, if the researchers are correct, the real interest rate will have fallen to minus 1.5%, purely due to demographic factors. I suppose we should be relieved that it will gradually rise after that, eventually stabilising at minus 0.5% by the end of this century. But unless something changes, it will never be positive again.

Permanently negative real interest rates have huge implications for the structure of finance. Firstly, banking as we know it will become impossible, since credit intermediation reverses when rates are negative. Secondly, maturity transformation would become unprofitable: although in theory yield curves could still be positively sloped when rates are permanently negative, they would be very flat. There would have to be a major rethink of the way in which financial intermediaries whose job is maturity transformation (banks, pension funds, insurance companies) work.

More importantly, permanently negative real interest rates fundamentally affect the ordering of society. They do not support debtors at the expense of savers, as is popularly believed: rather, they favour those who own assets (mainly the old) at the expense of those who do not (mainly the young). This potentially sets up a highly damaging intergenerational conflict. The older people who expected higher returns on their savings than they will receive are already angry, and their anger is likely to increase. The younger people who see their hopes of owning their own home receding into the distance are also angry, and their anger is likely to increase too. And when younger people face confiscation of growing amounts of income, either in the form of taxes (even if disguised as social security contributions) and/or compulsory saving (auto-enrolment springs to mind - there are already calls for the percentage contribution to be increased), in order to support a rising number of elderly, they will become even angrier.

So what is the solution? Sorry, Lord Hague, it certainly isn't raising interest rates. That would simply transfer still more from young to old, and it would put financial stability at risk. When the supply of savings exceeds the demand for them, the returns on them must fall. However angry the baby boomers are, they have to accept that the high interest rates of their youth are gone forever, and their future is consequently poorer than they expected. This is not because they have been robbed by governments or screwed by central banks: it is largely because of their own failure to produce enough of the next generation to support them in their old age.

Rather, we need to find ways of raising the real interest rate. The risks associated with NOT doing so are simply too great. So, since the real problem here is a structural imbalance between the supply of safe assets for retirement saving and the demand for them, the obvious thing to do is to improve the supply of safe assets. The Cambridge researchers point out that sovereign bonds, state pension schemes and asset price bubbles are logically equivalent:

In an economy with perfect foresight, bubbles, PAYG, and sovereign debt are perfect substitutes for trade in bubbly assets. Whether resources are transferred from the young to the old by the trade of bubbles, by a government enforced PAYG pension scheme, or by a government that sells bonds to the young to repay the last period’s bonds held by the old, the outcome is the same in all three cases.Asset price bubbles put financial stability at risk, and government enforced PAYG pension savings sufficient to provide pensions for all those elderly are likely to worsen intergenerational conflict. So the solution is sovereign debt. Lots of it. Enough to meet the saving needs of the entire population. Or, if you prefer, government savings schemes - safe high-interest savings accounts such as those provided by NS&I. Lots of them.

And, at the other side of the government savings bank, investment of those savings in productive enterprises. After all, the structural imbalance is not just a problem of supply but also of demand. It is not central banks that are in a blue funk, but the whole world. Everyone is terrified of loss, no-one wants to take any risk, and the productive enterprises of the future are being starved of investment at the same time as savers are being deprived of returns. The effect of this will be to depress wage growth and productivity far into the future. If investment doesn't improve, the future for both young AND old is an impoverished one.

As I have pointed out many times before, the primary purpose of sovereign debt is not to finance government, but to enable people to save. And when the private sector is too scared to invest, government must step in. In a world of ageing populations, growing need for saving and fear of loss, the political obsession with reducing sovereign debt/GDP must end.

Related reading:

Rethinking government debt

Bond yields and helicopters

Keynes and the Quantity Theory of Money

The Great Yield Divergence

The safe asset scarcity problem, 2050 edition

Weird is Normal - Pieria

The broken contract - Pieria

Spot on Frances. But will governments understand and act? I'm not holding my breath :-) Tim

ReplyDeleteFrances, you say "So the solution is sovereign debt. Lots of it. Enough to meet the saving needs of the entire population." But who would be willing to buy the sovereign debt at the very low coupons which would be offered? Only speculators (hedge funds etc.) would do so, hoping for a capital gain as yields drifted ever lower. The elderly would likely continue to pour money into stocks and property, and the young would continue to be left behind by those markets.

ReplyDeleteAs the central banks are holding massive amounts and indeed buying more/rolling over matured government bonds it is difficult to understand the argument that gov debt is creating private sector assets.

DeleteIn Japan it is certainly not the case, the BoJ is buying up all the debt.

Noel, increasing the supply of safe assets substantially should reduce their price, which would increase their yield (which is equivalent to raising interest rates). In fact, if we are to make housing affordable in the future, we have to make the returns on other safe assets attractive enough to replace property as the long-term investment of choice.

DeleteHi,

ReplyDeleteA lot of ground covered in this post. I agree with the conclusion but find the premises not totally convincing. Economics is to blame?

Apropos contraception. Finally, I hope, it looks like a male contraceptive could be available in a few years. This will almost certainly slash the birthrate even further as men will then have equal control.

How many of us would exist today if the man had to visit a doctor to remove an implant before becoming fertile again? All the 'little accidents', including me, would not be born.

With an estimated 200,000 quid cost of each kid, a lot of whom are still in the nest at thirty, almost all my male friends would prefer 400,000 quid to spend on toys and travel than to pay maintenance and alimony.

You really think any woman would trust a man who said he was on the pill?

DeleteIn the future to get full pension you should have contributed to the pension system AND produced at least your demographic replacement.

ReplyDeleteHans, there is absolutely no reason why we should not all get a decent State pension.

DeleteThe BoE has one of the planet's most generous schemes. They could also pony up for us all. It is possibly the most acceptable form of a helidrop. The wrinklies are not saving for the future nor paying down debt, so all the money would go straight into the economy to buy goods and services.

And who would begrudge mom and dad a decent pension, except for the likes of Cameron and Osborne?

Hans,re. "demographic replacement" don't you think reducing population has benefits - think about the environment and quality of life. An economic system that can withstand reducing global population would be a good thing. Martin T.

ReplyDeleteThat's where we will have to go, but I don't think you can do that via pension system.

DeleteMartin,

DeleteI agree, but tptb are stuck on the "growth".

Why we should all beaver away like loonies to create growth today with money borrowed from tomorrow is beyond me.

Can't we just slow it all down? Take more holidays and relax?

Slavery was theoretically abolished years ago. We have simply reinvented it with new masters.

Re: striking chart.

DeleteSince when have economists been able to forecast anything accurately? These guys are making a 200 YEAR forecast.

I think we can safely consign it to the vast rubbish heap of failed economist prophesies.

As William Hague said in the article he is not a politician. But what he did not say what he did not say is that it is Conservative politicians belief in Austerity as a response to the GFC that has brought us to this pass. The evidence has long been there that Monetary policy is not going to solve what is a lack of aggregate demand. Even the IMF is calling for a renewed emphasis on Fiscal policy but I am not holding my breath that there will be any significant progress there

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteI earned my living as a designer and developer of large-scale computer hardware and software systems for large enterprises. My generation is the one that computerized the western world. You are welcome. As a systems designer, I view this article as an excellent summary of what is wrong with our system of economics. Your last paragraph is definitely the way to go, and as a serious project to occupy my days, I have designed a system that implements the ideas presented therein. In that system, which I call democrato-capitalism, the only interest rates are paid to citizens who save. There will be no interest rates on loans. The Universal Bank of the United States (Uni) will make interest-free loans for worthwhile, non-inflationary projects. Building homes and apartments will be financed by interest-free loans as will home-buyer mortgages. The Uni also will use its unlimited supply of money to finance all sorts of projects that work for the common good. In essence our lives will be tax-free.

ReplyDeleteI am sure that others who are far more knowledgeable than I am can design even better uses for our unlimited supply of money.

Put another way, the points raised in this excellent article are a catalog of the weaknesses of our economic system. On the one hand, it is baffling to me that our current system of economics (tyranno-capitalism) is still in action, on the other hand, it is obvious that greed has seized control of our governors and things may never get better. I mean that climate change may destroy us because we will be unable to fund the many technological projects that will give us a chance to save us from ourselves.

“So the solution is sovereign debt. Lots of it. Enough to meet the saving needs of the entire population.”

ReplyDeleteHang on: “savings needs” can be met with base money (which normally pays no interest). I see no justification for taxpayers having to pay taxes to fund interest for someone just because that someone wants to save or hoard cash. And as MMTers have long pointed out, base money and government debt are essentially the same thing, a point recently echoed by Martin Wolf.

In fact that point can be taken further: Milton Friedman and Warren Mosler (who founded MMT) advocate/d a zero government debt regime. I.e. they argued that the only liability the state should issue should be base money.

Perhaps you should have read on a little further before reaching for the comment button:

Delete"Or, if you prefer, government savings schemes - safe high-interest savings accounts such as those provided by NS&I. Lots of them."

Cash savings accounts provided by the government. Containing, of course, base money.

I thought about 90% of NSI's assets were Gilts. They certainly SHOULD be if NSI is to maximise the interest it can pay depositors. So I looked at the NSI balance sheet. Far as I'm concerned it's gibberish. It makes Enron's accountancy look like a beacon of clarity and honest. Maybe see what you think and write about it?

DeleteHi Frances,

ReplyDeleteexcellent post as always.

1. I do have to ask why you don't consider neo-fischerianism (if i got the word right). That raising nominal interest rates might get higher inflation without changing real interest rates (If possible i think this would decrease a lot of problems in todays world).

2. Raising output is not as easy as it used to be in many areas, cant double the amount of fish by doubling fishing fleet due to not enough fish in the Sea for instance. Harder to find mines with high degree of wanted metals etc.

3. I think the nature of infrastructure investments have changed a lot over the years so its harder to find profitable ones.

4. I didn't quite follow your conclusion since you seemed to say that higher interests were the wrong way to go, but somehow still landed with needing safe high interest savings accounts.

I am frustrated that a politician as sensible as William Hague can't see the problems with what he writes. There are trade offs in any economic decision, and there are down sides with the low interest rates we currently have. However, the benefits outweigh the disadvantages. Mark Carney would love to raise rates, but without a large fiscal stimulus it's crazy.

ReplyDelete