The Basic Income Guarantee: what stands in its way?

Guest post by Tom Streithorst

The Basic Income

Guarantee (BIG) is back in the news. The

Finns are considering

implementing it, as are the Swiss, replacing all means

tested benefits with a simple grant to every citizen, giving everyone enough

money to survive. Unlike most current benefits programmes, it is not contingent

on being worthy or deserving or even poor.

Everybody gets it, you, me, Rupert Murdoch, the homeless man sleeping

under a bridge. Last seriously proposed by Richard Nixon in 1969, more and more economists and bloggers are suggesting that the Basic Income Guarantee may ultimately be

the salvation of capitalism. The BIG

will eliminate poverty, lessen inequality, and vastly improve the lives of the

most vulnerable among us. But that is not why we need it. It may seem

impractical, even utopian: but I am convinced the BIG will be instituted within

the next few decades because it solves modern capitalism’s most fundamental

problem, lack of demand.

Technology and

capitalism have largely solved the problem of supply. We are able to make more

stuff, with fewer inputs of labour and capital, than ever before. We have the

knowhow, we have the resources, we have the trained labour, we have the money. The only thing businesses lack is customers. Making

stuff has become easy. It is selling it that keeps entrepreneurs (and central

bankers) awake at night. Stagnant wages tell us that the supply of labour

exceeds demand. Microscopic interest

rates tell us that we have more capital than we need. Since the Great

Depression most economists have recognised that demand is the Achilles heel of the

modern economy.

Over the past 80

years, we have solved the problem of demand in three very different

ways. The first is war. In 1938, US unemployment was almost 20%. In 1944 it was barely 1%. Everybody knows World War II ended the Great

Depression: but it is worth remembering that it wasn’t the slaughter of civilians

or the destructions of cities that reinvigorated the global economy, but rather

the massive fiscal stimulus of government borrowing. Had we borrowed and spent

as much on building schools, homes and roads as we did on defeating the Axis

powers, the economic effect would have been even greater. The advantage of military Keynesianism is

political: conservatives who loathe government spending are able to overcome

their distaste when it comes to war.

The second, during

the post war Golden Age, was rising salaries. Between 1950 and 1970, the

average American worker saw his real wages double: since then, they have barely

gone up at all. Back then, productivity improvements translated almost

immediately into wage gains. As workers’ wages went up, so did consumer

spending. Productivity increases meant each worker was able to make more stuff.

Wage increases meant he was able to afford to buy it. Advertising transformed

luxuries into necessities. Productivity

gains combined with wage hikes gave the Golden Age the greatest GDP growth the

world has ever seen.

In our most recent

era, from 1982 until the financial crisis, the engine of economic expansion was

ever increasing levels of private debt. After Reagan and Thatcher, median wages

stopped going up, even as productivity maintained its inexorable rise. With wages stagnant, only by taking on more

debt were consumers able to keep spending enough to buy all they

produced. As long as banks were happy to

lend, the economy managed to grow (albeit much more slowly than during the

Golden Age) and the party could go on.

But after the financial crisis, both household willingness to incur more

debt and bank willingness to lend contracted, leaving us with the stagnant

economy we are trapped in today.

These three old

methods of stimulating demand have passed their sell by dates. Global war would reinvigorate the economy,

but at an unbearable cost. Rising wages, unfortunately, are unlikely, with more

and more of us replaceable by robots, software or much cheaper foreign

workers. And higher levels of debt not

only increase inequality, they also engender financial instability. What is to

be done?

Every year,

technological progress allows us to make more goods and services with fewer

inputs of labour and capital. As consumers, this is wonderful. We can buy better and cheaper goods than ever

before. As workers, however,

productivity increases threaten our jobs.

As we need fewer workers to make the same amount of stuff, more of us

become redundant. And it is likely to get worse. The rise of the robots may

eliminate 47% of existing jobs within the next two decades. Unfortunately, even though a robot can make an

iPhone, it cannot buy one. If we are

hurtling towards a post scarcity future,

only a Basic Income Guarantee can ensure sufficient demand to keep the global

economy ticking over.

It is not just the

poor that profit. The rich get exactly the same payment, in the form of a tax

cut. Corporations also win. With more money in consumers’ pockets, sales

increase, raising profits. And since firms no longer need provide a living

wage, labour costs could go down, which would give employers reason to hire.

Meanwhile, workers, with a guaranteed income, no matter what, will have the

freedom to tell an unreasonable boss to “take this job and shove it.” These

benefits suggest that a Basic Income Guarantee could command considerable

support from diverse sectors. But these

are all merely side benefits of the BIG.

If technological

progress continues to eliminate jobs, the Basic Income Guarantee may well be

only way we will be able to maintain demand in a post-work future. By giving

every citizen a monthly cheque, a Basic Income Guarantee will be as fiscally

stimulative as World War II without requiring the murder of millions. The Basic

Income Guarantee is economically sensible and politically practical. What then stands in its way?

The first problem

with the Basic Income Guarantee is that it sounds too good to be true. We have been told to be suspicious of anyone

promising a free lunch, and giving people money for doing nothing certainly

seems like a costless gift. Fear of scarcity is built into our DNA. For the Basic Income Guarantee to seem viable

for most people, they need to learn that demand, not supply, is the bottleneck

of growth. We need to recognise that money is something humans create, not

something with fixed and limited supply.

With Quantitative Easing, central banks created money and gave it to the

financial sector, hoping it would stimulate lending. Today, even mainstream figures like Lord Adair Turner, Martin Wolf and even Ben

Bernanke recognize that “helicopter drops” of money into

individuals’ bank accounts could have been more effective. Technocrats are beginning to recognise the

practicality of Basic Income. We in the

economic blogosphere need to bring this message into the public eye. The rise of the robots, ever declining prices

for goods and services, and disappearing jobs may ultimately teach this lesson

more effectively than any number of well-meaning essays.

The second problem is

sociological. Most of us are still in

employment. We feel, in some fundamental

way, that our work makes us more worthy than lazy layabouts on benefits. This simultaneously makes us disinclined to

raise benefits for others (or increase the number of people on benefit) and

equally disinclined to think of ourselves as the kind of people that receive

money from the state. Adam Smith, in The Theory of Moral Sentiments (the book

he considered his masterpiece), said that we humans are motivated primarily by

the regard of others. We want people to

think well of us, and we want to think well of ourselves. The psychological

pleasure of considering ourselves better than welfare recipients can trump

genuine economic benefit. To overcome this objection, we need to

recognise that defining ourselves by our jobs is very 20th century.

If technological progress continues to kill traditional jobs, this objection

too will eventually dissipate. As full-time jobs become harder to find, more of

us will recognise the need for a Basic Income Guarantee.

The third problem is

perhaps the most central. By stimulating the economy and pushing it towards its

production possibilities frontier, the Basic Income Guarantee will be growth

enhancing, but it is undeniable that it will also be redistributive. The pie will be larger, but it will be sliced

differently. For the past 30 years, we

have stimulated the economy by shovelling money towards rich people. A Basic Income Guarantee shovels money

towards poor people. And for many in the top 1%, that is anathema.

Conservatives

generally favour tax cuts as a way of stimulating the economy. Although they don’t like to admit it, this is

textbook Keynesianism. As long as the

government does not cut spending, more money in consumers’ pockets will

inevitably increase demand.

Unfortunately, tax cuts generally favour the richest among us, and they,

unlike the poor, are liable to save rather than spend their windfall. Stimulating

savings is a waste of a tax cut. Today,

we have an over-abundance of saving and a shortfall of investment and

consumption. A Basic Income Guarantee can be thought of as a tax cut targeted

to those most likely to spend it, which is what the economy needs.

The Basic Income

Guarantee solves the problem of demand, stimulates the economy, increases

corporate profits, gives workers more freedom, and provides a safety net to the

most vulnerable. It is economically

sound and politically savvy. But the

very rich don’t fear unemployment, they fear redistribution and they will be

the most significant force against the implementation of the Basic Income

Guarantee.

Related reading:

The wastefulness of automation - Pieria

The central paradox of the 21st Century - Tom Streithorst, Pieria

Basic income and a room of one's own - Anna Hedge, Pieria

In support of a Universal Basic Income - Anthony Painter, RSA

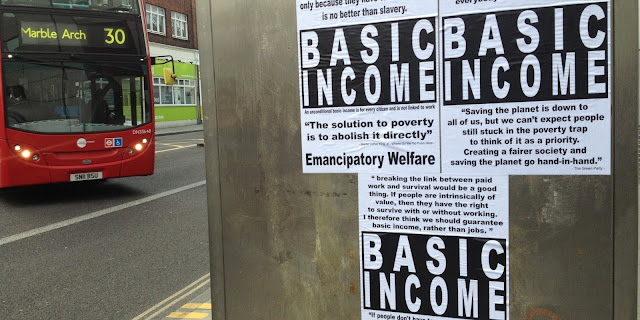

Image from Huffington Post. The quotation on the bottom poster is from Frances's post "The Changing Nature Of Work", link above.

Very vague how it is financed .

ReplyDeleteNew money , yes.

From the existing tax / bank system , no.

The central problem is the banks monopoly of credit.

Also rereading J.S.Donnellys Captain Rock - The Irish Agrarian rebellion - 1821 - 24.

ReplyDeleteSure the modern Irish garrison / judicial system was perfected from this experience.

But the most effective method to quell rebellion from the central states point of view was to introduce subsistence either directly or accidentally via poor harvest years.

Very colourful accounts of Irish Rockites dining on rustled cattle in remote mountain corries while the still captured sea level peasants looked on

On some occasions real meat was distributed to the poor misfortune spud eaters robin Hood style.

ReplyDeleteImagine the affect on ones senses!!!

Many of these rebels were rejecting Catholic teaching also.

This made them extremely dangerous.

While the guys in the low lands were being fed a diet of Signer Pastorini writings the wandering Gaels were living the high life of freedom on the hill.

Meat and mountain views - a explosive combination.

How I imagine Ireland in the 1820s.

ReplyDeletehttps://m.youtube.com/watch?v=TVk4nh-hBKY

I still prefer the Job Guarantee. You get the same effect - workers have an always-available "fall back" option in case they're fired or no longer like their employer - but at a much cheaper price (some of which you recoup through income taxes on the income they earn, as well as consumption taxes). You can also tailor the program so it's more like a basic income for folks who can't work much, in terms of what they need to do in their jobs.

ReplyDeleteJob Guarantee and Basic Income are not alternatives to each other. They are complementary. If you read the RSA report on Basic Income (available from the link in Related Reading) you will see that they propose a form of job guarantee as well.

DeleteI disagree that a job guarantee scheme without a Basic Income would be cheaper, unless it was workfare - which is fundamentally unproductive, since it forces people into any job rather than the right job.

Job guarantee type schemes have been tried many many times in the small in the last couple of centuries, we're way beyond pilots on this.

DeleteBasically it's a similar result every time: it works for a few people for whom it's the right kind of help, but is generally overwhelmed by the cost and collateral damage of running what is effectively a labour camp for all those for whom it's not the right solution, which tends to be the bulk of the inmates.

Doesn't BIG just accelerate infinite growth. Its good to redistribute resources. Not money. But it encourages and depends on excess consumption too doesn't it? Which is worse for everyone on a planet with limited resources.

DeleteA JG will be a disaster for the human spirit.

ReplyDeleteHowever I do accept some people like to toil for a living.

Give them 30acre of rock and bog as well as a income.

Cistercian and Tudor ranch farming will cease.

A return of the small cow...

A land of little Dexters and chicken coops.

Oliver Heydorn again.

ReplyDeleteAwkward chap .

The BIG difference between basic income and national dividend

ND would mean the end of the central bank and its replacement with a national credit office.

http://www.socred.org/index.php/blogs/view/the-big-difference-between-a-basic-income-and-the-national-dividend

The world is only so big. Growth has to transform into something more reflective of the global predicament or the BIG will only lead to more global inequality.

ReplyDeleteAgree. This is a crucial point to me. BIG specifically worsens this problem in a way that currently when the rich save and don't spend (bad as it is for inequality for those without basic resources for consumption) it means they don't actually spend much on excess. Excess consumption and destruction of the plannet is a bigger problem, its redistributing poverty not wealth, wealth can't exist in a finite planet. Nor should it.

Deletehttps://books.google.ie/books?id=sKLQnYmmPLMC&pg=PA112&lpg=PA112&dq=although+noth+munster+was+affected+as+early+1817&source=bl&ots=lasgXphzfE&sig=uEbgghAoyZNP5Kwfb6setIXjzVM&hl=en&sa=X&ved=0ahUKEwjC7pmDuePJAhXDqA4KHcq3AT4Q6AEIHDAA#v=onepage&q=although%20noth%20munster%20was%20affected%20as%20early%201817&f=false

ReplyDeletehttp://www.geograph.ie/photo/3496918

ReplyDeleteAncient road to Cahirciveen cattle fair / mart.

Shortest distance between Kells and trade / pub etc - over the mountain pass.

Does today's production / distribution / consumption system resemble Norman / Gaelic trade in any way.

In form or in function ?

https://m.youtube.com/watch?v=6Fz67YCIz1o

ReplyDeletehttp://www.geograph.ie/photo/3348466

ReplyDeleteCurrent trade practice designed to increase capitalistic friction and thus aid concentration.

The above droving mountain pass is still the shortest distance between the interior of Kerry and seaside Waterville.

When the 18th / 19th century road system was built there was no need to link communities .

The function of the modern Victorian roads was to export stuff out rather then trade locally or trade direct with Spain.

All Kerry roads after the Cromwellian conquest eventually lead to Cork.

Capitalism is a concentration game.

I can see the basic income as popular idea with educated, socially adept liberals. However I think it is pretty clear that not everyone would (be able to) pursue constructive, self-advancing paths with their BI. There will always be a significant chunk of society that would be better off with the organised nature of direct employment. That said a key aspect of a universal income (benefit) is that it gives everyone something in common, rather than the current situation of benefit "scroungers" pitted against "hard working" taxpayers. Calling it a "citizens dividend", with all of us "stakeholders" in the nation, might make it more sellable to the political right.

ReplyDeleteI like the term "citizen's dividend", and I'm not particularly right-wing. It removes the idea of basic income being "welfare" and replaces it with "participation" - making it also easier to sell the idea that those receiving BI should be involved in society, not just through their paid work but through civic responsibility, starting with voting and continuing with participation in social ventures, volunteering etc.

Delete@Francis

DeleteThe dangers inherent when engaging in civic responsibility.

Reverend I.M. Jolly.

https://m.youtube.com/watch?v=0Cpb8rqYFd8

"I like the term "citizen's dividend", and I'm not particularly right-wing. It removes the idea of basic income being "welfare" and replaces it with "participation" - making it also easier to sell the idea that those receiving BI should be involved in society, not just through their paid work but through civic responsibility, starting with voting and continuing with participation in social ventures, volunteering etc."

DeleteThey should be. But there is no guarantee they will be. So just create 'jobs' for these people doing these things at a Living Wage. The private sector then has to compete with that to get labour.

Put another way -

Delete* Firstly wages in the private sector will come down over time to compensate for the basic income received (how do we know this - people receiving state pension work for less money).

* Secondly tax rates have to go up to compensate for the basic income - estimates for the UK are a basic tax rate of about 45%.

So if you are working you end up with a lower salary and paying a massively higher tax rate on it. All so millionaires get their 'fair' Basic Income.

Definitely a vote winner that one.

The banks cannot let the economy overheat. So, if the government gives money, it could translate into more spending and more borrowing and more overheating. The Fed can't allow that since banks bet on low interest rates not on high.

ReplyDeleteI don't agree with this. Low interest rates are deadly for banks, so a bit of inflation forcing the central bank to raise interest rates would currently be welcomed by banks.

Delete@Francis

DeleteInflation,credit banks...usury.

Your proposal sounds like the dole without the running costs and shame.

Just enough to keep social stability while maintaining the extraction scheme intact.

https://m.youtube.com/watch?v=9T9NM2ZkXVQ

DeleteChristmas in Glasgow.

Rab gives a neo Baptist (Giving the Jesus in the temple speech) some encouragement

Maybe, Frances, but still the banks bet on low rates and when LIBOR exceeded the Swaps rate, the Great Recession began. Please look at this chart: http://www.talkmarkets.com/content/us-markets/scott-sumner-and-friends-want-unbridled-growth-chicago-school-update?post=80548

Delete@Danny

ReplyDeleteWhy do you wish to impose your morality on others?

Rob C Nesbitt is a classic Glaswegian humanist.

A very honorable man.

Its hard to describe how sad the place became post 1995 ~

DeleteIt became a extreme mercantile jurisdiction

Post 1995 it became absurdly dark in its efforts to export.

They even resorted to exporting the true holy ground of Ireland.

The Irish pub.

A hybrid of the English import and the Irish Shebeen.

Always terrible terrible places when placed in a out of context environment.

This desperate effort to commercialize everything comes from a extreme shortage of money. (Taxes / usury)

It leaves places with little or no value remaining.

Between the health fascists and the euro farmers it stood little chance.

https://m.youtube.com/watch?v=nvYAJZ4hKcQ

@Gary

ReplyDeleteFrom a firms perspective wages add to costs, it must recover its prices in sales.

To survive in a wage inflation world means bitter competition for prices.

People with money in their pockets can choose.

The better quality establishments will survive.

The Aldi and wetherspoon firms would rapidly hit the wall.

The economy would not overheat as there would be no point to wasted effort.

The economy would become more local again.

Kerry publicans would not have to rely on Star Wars tourist revenue (Exports) to survive.

Current mercantile practises of the most basic of activities have become absurd.

Can you not see this?

Try to get your head around this.

ReplyDeleteThere is a couple of pubs remaining in Portmagee - they will close unless they capture the Star Wars market.

As the locals cannot afford a pint.

The boatmen will make a living (if they are lucky) transporting Darth Vader and Luke Skywatcher nerds to Skelig....

I have vivid memories of that town doing real work at one time.

Of trawlers full of fish

Not anymore baby.

Have you any idea of the inputs required ( Jet Kerosene etc) to capture this purchasing power.

The waste involved is simply incredible.

@Dork of Cork, you clearly have a lot to say, can I suggest you get your own blog instead of hijacking other people's?

ReplyDeleteYou talking to me ?

DeleteListen I tell ya.

No discipline I am afraid.

What was the question again ?

https://m.youtube.com/watch?v=K3d55p2G_Ac

The third problem is the show stopper. Since the 80s, "liberalisation" of capital and government has become the new orthodoxy. Do we see any challenge to this new orthodoxy? Only at the margins. The only political challenger in the UK is Corbyn and, although his policies are relatively mild, he is being painted as a lunatic. The "establishment" Labour MPs are firmly in the liberal camp. Sanders has no hope in the US. Is there any kind of movement in the EU? I think not - it's till mired in Swabian housewife analogies. The rich - who can buy what they like - are not going to let this go.

ReplyDeleteGood post. A couple of questions - are you proposing that BI is funded by taxing the rich? I wasn't entirely clear on this point. I do think BI is a good framework for income redistribution. To the extent it is not funded with deficits or money-printing, it will not have adverse macro effects. However, downward income redistribution faces political barriers that may be difficult to overcome.

ReplyDeleteSecond question: it doesn't seem BI as described in this post will have counter-cyclical effect. Could you elaborate on the counter-cyclical features in your proposal?

H.Publius

DeleteYou do not understand goods things.

Taxing either the rich or poor means concentration - wealth flows back to the bank.

Our economic problems is a result of concentration.

It creates these huge costs of unused consumption usually reflected in distribution / transport inputs.

This is known as capitalistic friction.

Again when usury was firmly established in the south of Ireland all agricultural goods / roads flowed to Cork because that was where the money was.

End of.

(Try walking to Cork from Kerry with a Donkey load of butter.

Why did they travel so far when the sea was at their door?)

Not where the wealth resided.

The wealth was concentrated.

A continuation of credit / central banking in Ireland means the residents will always have to depend on New York guys with the money.

They must always engage in wage prostitution to access purchasing power.

Industrial Tourism is perhaps the most absurd manifestation of this phenomenon.

Great post Tom. Here is one opinion from Finland.

ReplyDeleteNowadays, if you work for day or two, you have to also calculate how much time you spend with welfare bureacracy and be afraid whether you lose your benefits. Basic income makes life simpler. You work a bit and you dont have to figure out what happens to your benefits. It has a huge psychological effect. You dont lose, you gain. Another positive effect is that BIG increases your autonomy over controlling state. You can more easily tailor your future to respond forever changing world.

Economically its not a drastic change. BIG is a survival package and majority of people wants more.

The big elephant in the room that is not addressed at all is efficiency. With BI you give money to a lot of people who do not need it. And to raise this money you need high and distorting taxes.

ReplyDeleteFor a nice example with actual simulations and calculations, see this paper here.

There are many "nice papers", but not much robust analysis. I'm afraid this paper is no more robust than the RSA's, which comes to a different conclusion. But if you think about it, high taxation of the rich (which you may regard as "distortionary") effectively taxes away their BI. This is a whole lot better than imposing marginal tax rates of 70% or more on people on low earned incomes. I'd regard THAT as inefficient and distortionary, frankly - but that is what we currently have and apparently no plans to change it.

DeleteI am actually very impressed by the Fabre et al. study. While it only looks at unemployment insurance, it includes the kind of effects that you want to take into account: tax distortion, labor supply, asset accumulation, financing, administrative costs, etc. I would not easily dismiss that. In fact, I do not know of a better study.

DeleteThe problem is that it is too narrowly focused on a comparison with unemployment insurance. On a narrow comparison with any benefit, UBI will always fail, because it is not targeted at any particular group and is therefore less efficient than a targeted benefit would be. But supporting particular groups is not its purpose. It provides a GENERAL safety net. The comparison is therefore invidious.

DeleteI have seen a presentation of the paper, I suppose the online version fits what I saw.

DeleteIt all about the principle: unemployment is one particular risk, and you have UBI against that. But you could add a lot of different risks correlated with each other as they are in reality, and have a sum of all the UBIs. Then you get the UBI Frances has in mind.

For each of the risks, UBI is vastly outclassed by targeted intervention, even after accounting for moral hazard and administrative costs. Even when the risks are correlated, UBI loses when you scale all the risks together.

Thus, UBI is a poor tool to deal with risks. It can serve other purposes, but insurance against risks is not one.

Unfortunately it doesn't work like that. Creating a targeted insurance (conditional benefit) programme for every risk results in a very expensive, complex and highly bureaucratic welfare system. It also removes from individuals much of their power to choose their own path. UBI does not aim to insure all risks fully. It requires individuals to bear some risk themselves. That is a feature, not a bug.

DeleteEfficiency is a capitalist illusion.

ReplyDeleteIn 2013 75 % of Irish diesel inputs went into transport , 6 % agriculture , 1% fishing (outsourced)

This was not always the case.

Pre EEC must of the oil inputs went into small farms working small Ferguson tractors .

Agricultural productivity was much higher per acre on the west coast.

Again taxes defeats the entire purpose of the scheme.

In the late 60s early 70s in Ireland there was a major (euro centered ) drive to increase the efficiency of small western farms.

ReplyDeleteThis lead to a major beef cattle boom and bust.

In the late 70s / 80s must the same thing happened in Dairy

Today the productively of many western sea level fields is zero.

https://m.youtube.com/watch?v=PZJwpW-_lIY

.

The more pilots the better, so we can see how it pans out over a five year period or longer. It will change behaviour in all sorts of ways - some predictable, others less so - and will give us all time to rethink how society will operate in a world beyond work, with fewer borders and virtual community.

ReplyDeleteAnne C

Frances, I am not an economist so forgive me if I’ve got this wrong, but on reading Tom Streithorst’s article, I got the distinct impression that the Basic Income Guarantee would do nothing to reduce poverty and would only benefit the rich and the better off.

ReplyDeleteIf BIG is to replace existing benefits, then the only people who will gain from it are those who do not currently receive state benefits. An article in today’s Independent attempts to put numbers on the idea by reporting that the RSA have recommended a paltry £3,692 a year or £71 a week for each adult and I understand that the Finns are looking at a figure of €800 per month. These are sums that might pay for a round of drinks in a City or Helsinki night club, but will hardly help a family on the breadline or, for that matter, kick start the economy.

Mr Streithorst seems to favour a Citizen’s QE, but I fear that is not what politicians have in mind.

Dave Hardy

The RSA's estimate is low, but it excludes housing. But remember that this does not REPLACE earned income, it SUPPLEMENTS it. For most people, income would be much higher.

DeleteI do think you have entirely misunderstood Tom's point.

If I have misunderstood Tom, then perhaps you will explain to me how, for example, the spending power of 12.5 million state pensioners will increase with BIG. If BIG replaces welfare, then surely the people in work, and therefore least likely to need a financial lift, will benefit disproportionately?

DeleteA basic income implemented properly would involve reshuffling the tax system to compensate for that. The tax system is really part of the benefits system so it does not make sense to change benefits without adjusting tax at the same time.

DeleteSo you'd want to arrange things so that someone who earns 100k gets an increase in tax equal to the basic income so as to be net flat. Without tax tweaks it would indeed increase inequality as a lot of poorer people would be net flat (basic income replacing existing benefits) while all rich people would be (nominally) better off.

(Also remember all that is in the short term, prices and wages will also react, possibly compensating some of the first order effects.)

When filming David Leans "Ryan's Daughter " in late 60s Dingle there is a story I remember of the actor Christopher Jones staring into the screen for hours watching "Mart to Market"

ReplyDeleteEvery evening for 12 months or so he must have watched this gripping television . (They say he was not that bright or drugged)

Robert Mitchem was of course whoring every night but poor Aul Chris....

I am sure he was perplexed by it all.

He was witnessing one of Ireland's never ending mercantile boom and busts.

Ireland is a capitalist caricature.

Dork, I endorse Danny's comment wholeheartedly. You are welcome to comment here, but please observe rule 2. STAY ON TOPIC. My blog is not a place for you to brain dump whatever random thoughts hit your head. Cool it, please.

ReplyDeleteSorry , I am the only Dork that thinks I am on topic.

ReplyDeleteI was just about to post something about the Caledonian canal

How do you get a bunch of Rabs with a folk memory of oat eating freedom into the latest big idea / Job scheme...etc etc .

Without historical context these discussions mean nothing.

I guess I am beginning to foam at the mouth with Irish state media projection of 1916.

Its just too much for the delicate soul.

If I could skip 2016 entirely it might be best.

Join my imaginary friend Tommy Weir for a long hill walk perhaps.

Another good idea! Like transaction tax, taking money creation away from commercial banks, people's QE...but will be resisted and squashed by the Establishment!

ReplyDeleteI actually don't think BIG will be squashed. It does too many things that we need. The key is getting it in the discussion. Once more people know about it, it will become inevitable.

DeleteThere's a problem with that kind of advocacy for the basic income. We have two distinct questions we're answering here:

ReplyDeleteA) Is there a better way to run a benefits system, for any GIVEN welfare budget (including tax effects)?

B) Is more redistribution beneficial to society as a whole?

The author of this post is arguing for B as a textbook Keynesian who believes the economy has a demand problem that would be fixed by more redistributive benefits. The thing is, if redistribution has positive macro effects, really it doesn't matter much how you do it. For instance, you could just blanket increase all nominal payments (and means testing thresholds etc) in the current welfare system by 50%, and it would achieve a very similar effect.

So I think the basic income is more essentially an answer to question A, which is why many non-Keyneysians also support the basic income idea.

Tactically there's an issue: when I see such advocacy I see it as excluding: the author seems to say that if I'm a macro agnostic or a supply sider (I happen to be the former, but some of the latter also support the basic income idea), I'm not welcome to his ideologically pure basic income tent.

Thanks for that Cig. I think you are right. Basic Income is a better way of running the benefits system. By giving people money without making them jump through hoops it empowers individuals without increasing the size of the Nanny State.

DeleteAnd you are also right that we could have the same stimulative effects by merely increasing the size of current welfare payments. Politically, however, there is little support for raising welfare payments. The middle class generally doesn't want to shovel more money towards the poor. Basic Income, by giving money to everyone could overcome that objection.

Basic Income is both a better way of creating a safety net and a way of stimulating the economy. I am convinced it will ultimately be the salvation of capitalism and I certainly don't want us to be so ideologically pure we lose any potential supporters.

Surely a sustainable world needs less consumption, not more?

ReplyDeleteVery dangerous rope; defending GLI/BI as increasing demand,

ReplyDeletegrowth". Aim is to stop excess demand, cancerous growth. Haven't you heard of something called the natural environment? The limits of what we can draw from it?

Also something called genuine democracy, requiring that people have the leisure to participate in it?

GLI is for increasing personal leisure and freedom, ending unjustified demand and growth. That is not a threat to the "very rich" but to the very powerful.

Tom, I enjoyed this post. In response, I have tried to work out a feasible level for the basic income - one that gets demand to the level needed for a fully functioning economy without leading to inflation etc. It is done here http://www.notesonthenextbust.com/2015/12/how-high-could-uk-universal-basic.html and there is a spreadsheet in which you can input other assumptions.

ReplyDeleteThe main problem with BIG is not affordability or reasonability. It's that the powers in charge - which is: not politicians and even lesser 'the people' - doesn't recognise the benefits of BIG or similar approaches to fit into their economical targets. They prefer more competition for jobs (cost per unit/wages), growth (more liquidity). Therefore they go for more feudalistic structures that benefit mostly the few above a system that could possibly curb growth and job-competition. Therefore I only see two options to get something like BIG realised: Take the power back from those actually having it (Corbyn sounds like a promising approach into that direction) or get a technically sound solution that provides enough liquidity and (job)competition so the powers can agree with it.

ReplyDeleteHi Frances, not sure if you allow links in the comments but here are my thoughts on this post. In short I remain to be convinced of the arguments http://in-cyprus.com/is-basic-income-the-answer-to-robots/

ReplyDeleteHi Fiona, Thanks for the link to your very interesting article. Your argument that robots won't take our jobs, I think, is that new jobs will be created. Mechanization of agriculture sent surplus farm workers to factories. Therefore automation of factories will free assembly line workers to become massage therapists. Yes but. I may want more massages but it would be impossible for me to hire a massage therapist for the same forty hours he or she was working at the Ford plant. Technological progress seems to be accelerating. That means that we can produce more with fewer inputs of labour and capital. I think this trend will continue. As less labour is required and as capital goods continue to get cheaper, that may well overwhelm the demographic effects you noted.

DeleteBasic income helps the poorest among us. It lessens inequality. It rationalizes Byzantine welfare systems. It helicopter drops money into individuals bank accounts and so stimulates economic growth. I think it is worth considering and not discounting out of hand.

Thanks. My main argument is not that new jobs will be created. It is clear that this will not help the most vulnerable who will be least able to adapt. The main argument is that the labour force will shrink, so maybe robots will, in aggregate at least, replace those retiring. I also agree that ignoring inequality is not just morally wrong but risky for the rich too. I just don't know if basic income is a) the answer or b) will get the political buy-in (including from those who fund political parties). But I'll be watching the Finnish experiments with interest.

ReplyDeleteDear Tom, dear Frances, thanks for this post. I did not go through all the comments so my apologies if my remark has already been made and replied to. I know there is a long-standing debate between proponents of BIG and proponents of Job Guarantee (JG, ie. government provides a job to anyone willing to work for a living wage). The JG should become a buffer of available jobs to contract or expand according to cyclical conditions. JG proponents argue that BIG will reduce labour supply, hence output, therefore it will become inflationary before reaching full employment. JG, is argued, would be better than BIG because it would give actual jobs to people (there are many things that can be done but the market won't do at the moment, like environmental preservation, energy saving investments, care for elderly, etc). I am curious to know what you think about it. Thanks

ReplyDeleteFrances, so sorry to circle back on an older post, but two lines in the article have me furrowing my brow a bit and I was hoping for some help. "Today, we have an over-abundance of saving and a shortfall of investment and consumption", this line confuses me. I do agree that stagnation in consumption is negative. However, considering the large percentage of the working population that lives pay check to pay check, where is the abundance of saving? Is the author referring to the savings of the rich few? I'm just confused as to how a Basic Income Guarantee would have any change in their saving. Finally the line "A Basic Income Guarantee shovels money towards poor people" rings true. However, unless I've misunderstood the spirit of BIG; would it not shovel money equally at the well off as well? Thanks for any clarification you may be able to provide.

ReplyDeleteJatindar, I have a fair amount of savings and I'm far from rich.

DeleteI'm not inclined to spend it as I've concern about future income.

That help?

Nice work!

ReplyDeleteLove to see you add discussion of impact on innovation, childrearing, eldercare, improving corporate culture, stopping job flight, and a little more emphasis on the fact eventually there may be lots of people and very few jobs.