Colds, strokes and Brad Delong

Brad Delong takes issue with me over my criticism of Olivier Blanchard. Here's the paragraph from my piece "The failure of macroeconomics" that he finds particularly uncharitable:

The trouble is that in 2008 the economy did not catch a cold. No, it had a stroke. (Brad Delong's heart attack analogy is good, but I like the stroke better.) A stroke is sudden interruption of blood flow to part of the brain, causing tissue death and brain damage. If damage is not too extensive, the brain can rewire itself, creating new connections and activating new regions to take over functions previously done by the damaged areas. But such redirection of activity can take a long time, and during that time the patient may be unable to care for herself unaided, let alone work at previous output levels.

The authorities did not recognise the stroke for what it was. They thought it was simply a particularly nasty cold, so they put extra whisky in the hot toddies. When the patient developed pneumonia, they gave powerful antibiotics (TARP, TALF, QE....). And they carried on giving some of them long after the pneumonia had cleared up, because the patient was still obviously ill. But they failed to see the underlying problem.

Just as the patient was beginning to show signs of improvement, it experienced a second stroke. This one was not as catastrophic as the first, but it seriously set back the patient's recovery. Once again, the stroke was misdiagnosed, this time as a hospital-acquired infection. More antibiotics were given, and the hospital was placed in special measures. The staff had to deep clean the entire place, which redirected many of them away from patient care, leaving the patients to look after themselves. Unsurprisingly, several of the patients got worse, though so far none has died.

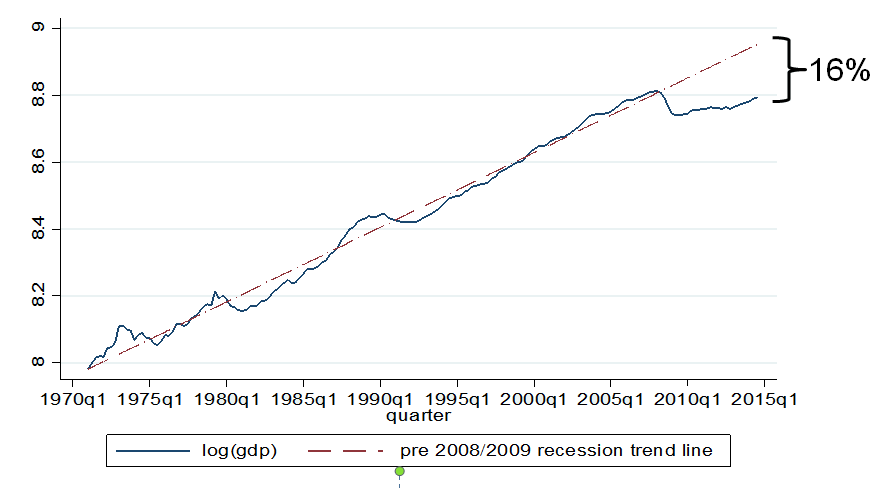

Now, seven years after the first stroke and three years after the second, the patient is still partly paralysed down the left side and has a speech impediment, which makes working difficult. As can be seen from this chart (h/t John Van Reenen), UK output is well below its previous level and shows no sign of returning to previous trend growth:

Nor is the UK the only economy to show such a pattern. Indeed it is now one of the better-performing Western economies: output in the Eurozone, for example, is much worse. So economists are scratching their heads and wondering why the patient is still in such a state. After all, the patient recovered well from previous nasty colds (1975, 1981, 1992) and there was no significant change in output trend growth. Surely the patient should be back to normal by now?

And herein lies my beef with Blanchard. Hot toddies and antibiotics are not the right treatment for strokes. Nor is deep cleaning of hospitals, important though this is. But the economics profession's toolkit seems to be limited to hot toddies, antibiotics and cleaning ladies. It can only treat nasty colds and hospital-acquired infections. It didn't even recognise the 2008 and 2012 strokes, let alone know how to treat them. And it justifies its limited diagnostic skills and inadequate toolkit by arguing that if only we keep warm and dry and eat well, we won't catch colds or suffer strokes anyway. But economists do not know why economies catch colds and have strokes. The argument that if we get policy settings right we will never be ill is an old wives' tale - or rather, an old economists' tale.

To be fair, the economics profession seems to be waking up to the idea that 2008 and its aftermath was no ordinary recession. Central banks and supranational institutions seem to be leading the way on recognising the monetary nature of the modern economy and the critical importance of accurate modelling of the financial system: Haldane at the Bank of England, Borio at the BIS and various researchers at the IMF have all explored non-linear modelling for the financial economy. Borio has called for financial cycles, which are longer than business cycles and seem to be increasing in amplitude, to be incorporated into economists' models. But the financial system is known to be in disequilibrium much of the time. I confess I find it difficult to see how a system that is normally far from equilibrium can be adequately represented by a general equilibrium model, but then I am not a mathematician. I am encouraged therefore to see that Borio seems to share my concerns (my emphasis):

Having said that, Brad's last comment is spot on:

I must say, I do like being described as femina spectabilis. And despite my criticisms, Olivier Blanchard deserves credit for acknowledging the hubris of the 1980-2008 economic paradigm, and for attempting to change it within his own organisation. Some of the IMF's economic research in recent years under his leadership has been outstanding. He is indeed a vir illustris.

Related reading:

When the Nile floods fail

Blanchard's call for policymakers to set policy in such a way that linear models will still work should be seen for what it is–the desperate cry of an aging economist who discovers that the foundations upon which he has built his career are made of sand. He is far from alone…"It's not that bad", says Brad. And he goes on to use the analogy of heart attacks and the common cold to explain why linear models are ok really, mostly:

A more charitable reading of Olivier is that he wants to make this point:Well yes, true. So, when the economy catches a cold, by all means treat it with a hot toddy (plenty of whisky, please!). And if we all keep warm and dry, eat well and get plenty of sleep, we might not get so many colds anyway. This is indeed within the remit of policymakers: avoid obviously stupid or high-risk policies and try to keep the economy on a steady path. If policymakers do this, then clearly linear models will generally be adequate.

- Heart attacks have little in common with the common cold.

- You treat heart attacks with by shocking the heart to restart it.

- Heart attacks and the common cold are both diseases that debilitate.

- Nevertheless, to get out the defibrillator pads when the patient shows up with the sniffles will probably not end well.

The trouble is that in 2008 the economy did not catch a cold. No, it had a stroke. (Brad Delong's heart attack analogy is good, but I like the stroke better.) A stroke is sudden interruption of blood flow to part of the brain, causing tissue death and brain damage. If damage is not too extensive, the brain can rewire itself, creating new connections and activating new regions to take over functions previously done by the damaged areas. But such redirection of activity can take a long time, and during that time the patient may be unable to care for herself unaided, let alone work at previous output levels.

The authorities did not recognise the stroke for what it was. They thought it was simply a particularly nasty cold, so they put extra whisky in the hot toddies. When the patient developed pneumonia, they gave powerful antibiotics (TARP, TALF, QE....). And they carried on giving some of them long after the pneumonia had cleared up, because the patient was still obviously ill. But they failed to see the underlying problem.

Just as the patient was beginning to show signs of improvement, it experienced a second stroke. This one was not as catastrophic as the first, but it seriously set back the patient's recovery. Once again, the stroke was misdiagnosed, this time as a hospital-acquired infection. More antibiotics were given, and the hospital was placed in special measures. The staff had to deep clean the entire place, which redirected many of them away from patient care, leaving the patients to look after themselves. Unsurprisingly, several of the patients got worse, though so far none has died.

Now, seven years after the first stroke and three years after the second, the patient is still partly paralysed down the left side and has a speech impediment, which makes working difficult. As can be seen from this chart (h/t John Van Reenen), UK output is well below its previous level and shows no sign of returning to previous trend growth:

Nor is the UK the only economy to show such a pattern. Indeed it is now one of the better-performing Western economies: output in the Eurozone, for example, is much worse. So economists are scratching their heads and wondering why the patient is still in such a state. After all, the patient recovered well from previous nasty colds (1975, 1981, 1992) and there was no significant change in output trend growth. Surely the patient should be back to normal by now?

And herein lies my beef with Blanchard. Hot toddies and antibiotics are not the right treatment for strokes. Nor is deep cleaning of hospitals, important though this is. But the economics profession's toolkit seems to be limited to hot toddies, antibiotics and cleaning ladies. It can only treat nasty colds and hospital-acquired infections. It didn't even recognise the 2008 and 2012 strokes, let alone know how to treat them. And it justifies its limited diagnostic skills and inadequate toolkit by arguing that if only we keep warm and dry and eat well, we won't catch colds or suffer strokes anyway. But economists do not know why economies catch colds and have strokes. The argument that if we get policy settings right we will never be ill is an old wives' tale - or rather, an old economists' tale.

To be fair, the economics profession seems to be waking up to the idea that 2008 and its aftermath was no ordinary recession. Central banks and supranational institutions seem to be leading the way on recognising the monetary nature of the modern economy and the critical importance of accurate modelling of the financial system: Haldane at the Bank of England, Borio at the BIS and various researchers at the IMF have all explored non-linear modelling for the financial economy. Borio has called for financial cycles, which are longer than business cycles and seem to be increasing in amplitude, to be incorporated into economists' models. But the financial system is known to be in disequilibrium much of the time. I confess I find it difficult to see how a system that is normally far from equilibrium can be adequately represented by a general equilibrium model, but then I am not a mathematician. I am encouraged therefore to see that Borio seems to share my concerns (my emphasis):

Modelling the financial cycle raises major analytical challenges for prevailing paradigms. It calls for booms that do not just precede but generate subsequent busts, for the explicit treatment of disequilibrium debt and capital stock overhangs during the busts, and for a clear distinction between non-inflationary and sustainable output, ie, a richer notion of potential output – all features outside the mainstream. Moving in this direction requires capturing better the coordination failures that drive financial and business fluctuations. This suggests moving away from model-consistent expectations, thereby allowing for endemic uncertainty and disagreement over the workings of the economy. It suggests incorporating perceptions of risk and attitudes towards risk that vary systematically over the cycle, interacting tightly with the waxing and waning of financing constraints. Above all, it suggests capturing more deeply the monetary nature of our economies, ie, working with economies in which financial intermediaries do not just allocate real resources but generate purchasing power ex nihilo and in which these processes interact with loosely anchored perceptions of value, thereby generating instability. In turn, this in all probability means moving away from equilibrium settings and tackling disequilibrium explicitly.So, sorry Brad, but I do not think I am wrong to say that the economics profession's love affair with linear models must be ended. Multiple equilibria, disequilibrium and non-linearities are the new flame.

Having said that, Brad's last comment is spot on:

The key questions of macroeconomic political economy then are not the questions of the construction of nonlinear multiple-equilibrium models that Frances Coppola wants us to study. They are, instead, the questions of why ideological and rent-seeking capture were so complete that North Atlantic governments have not deployed their fiscal and credit policy tools properly since 2008.Indeed, if policymakers want to deny stroke patients essential treatment and force them back to work before they are properly recovered, there is not a great deal economists can do to stop them. Such is democracy.

I must say, I do like being described as femina spectabilis. And despite my criticisms, Olivier Blanchard deserves credit for acknowledging the hubris of the 1980-2008 economic paradigm, and for attempting to change it within his own organisation. Some of the IMF's economic research in recent years under his leadership has been outstanding. He is indeed a vir illustris.

Related reading:

When the Nile floods fail

Non-linear NK DSGE (or otherwise) models aren't that useful yet, if you don't do any kind of log linearization your model will tend to go pretty nuts fast, economists have to do simulations because the models are impossible to solve, and you tend to end up with something completely intractable & overly sensitive to small changes in parameters.

ReplyDeleteI acknowledged in the post that linear models can be useful. But we have big computers these days. We should be able to do something a lot more clever than reductio ad absurdam log-linear modelling. What's wrong with simulations anyway?

DeleteI think this discussion is academic anyway, you don't need non-linear models to make useful predictions about how financial sector instability and imperfect credit markets can majorly amplify business cycles, and simple models were made to demonstrate this decades ago (Kiyotaki-Moore anyone?). I also think what we need now is not better models for forecasting, but a better understanding of the economy in the present, and a better understanding of the stability (or instability) of the current system, and what can be done to make it more stable.

DeleteI'm afraid I disagree, for the reasons I gave both in this and previous posts. Linear models cannot adequately represent a system that is NORMALLY far from equilibrium. We need a better toolkit simply to understand the current system, let alone decide how to improve it.

DeleteSimple non-linear models may well provide some insight, but what if the conclusion is that the root cause of the business cycle is herd effects of some kind or other? Human-driven fiscal policy won't work, because the herd effects applies to every human and so far governments are human-run. The end game is then what? Purely rule-based NGDP targeting (which you may implement with say the VAT rate rather than the interest rate, if fiscally minded)?

Delete"... why ideological and rent-seeking capture were so complete that North Atlantic governments have not deployed their fiscal and credit policy tools properly since 2008."

ReplyDeleteA call for free capital in order to collect rents for free?

Oh, theft by fiscal and credit tools is improper too. Even if, that is often many economists conclusions 95.99% of the time.*

* Why do economists quote percentages to the second decimal place? Because they have a "sense of humor."

RE: vir illustris

ReplyDeleteWho does the P.R. for economists?

I see a few problems. Engineers do control systems very well - their theory is good and the linkages in their systems are solid and trustworthy, each component does as it is told. Economists have a problem - their theories are not universally accepted or proven and the linkages to the components are certainly not solid or trustworthy and the components do not do as they are told. What could go wrong!

ReplyDeleteEngineers prefer linear systems but non-linear is OK too - and often more efficient but with risks attached. I can see how practising economists (aka bankers) might find the higher efficiency of non-linear financial systems attractive. I suspect the risks were realised but ignored - back to theory and linkage. So did no-one really realise the patient had a stroke? or did no-one dare admit it and called it a cold instead.

Its not wholly surprising that the chart does not show a sign of return to growth . The drop is large. extending the chart out - it would require annual growth continual at 3 percent for 15 years, for 5 years at 5 percent ,less than 3 percent then never.

ReplyDeleteThe reason that the previous recessions did not produce an significant change in output trend growth is because the output trend growth includes the recessions in its slope. A tautology.

The reason that 75, 81 and 92 all recovered to the growth line is because the line was drawn through those fluctuations.

What Fig 1 shows is that each in a series of fluctuations around a trend eventually goes through the trend line of the fluctuations by definition of the trend line. Which is an empty truism. To compare the last recovery to the previous recoveries it ts required to draw pre recession trend lines for each of the previous recessions and then compare the recoveries to those trend lines. I think you might be surprised at how long the recovery times take and it doesn’t always occur for some charts that go further back further historically.

We have never recovered the notional lost output from the 1970 recession compared to the 1950 to 1970 trend line.

And the chart in the blog post doesn't recover after 75, 81 and 90 either.

ReplyDeleteThere is no such thing as an Equilibrium and never will be. It is like seeing a cloud formation in the sky and thinking it is a Valhalla or some such paradise.

ReplyDeleteI think (and this is a general point, not directed solely at you Frances) that more clarity is needed about this term non-linear. You can have non-linear models that would remain in equilibrium if not perturbed (yet might suggest more drastic policy measures and exhibit more realistic dynamics that linearized versions of the same) or you can have non-linear models that display deterministic cycles (perhaps endogenous business cycles) and I think the discussion regularly mixes the two. Most mainstream macro people will be talking about the former, my sense is that critics desire the latter.

ReplyDeleteAlso, didn't Blanchard say something about now policy should be conducted so that the economy behaves as if it is linear (i.e. the policy response should be sufficiently strong to keep the economy close enough to on track)

Hi Luis,

DeleteYes, Blanchard did say that, and I have criticised him for it in a previous post. The problem is that we are not good at identifying shocks ex ante. We know about past shocks, and we adapt policy in response to shocks. But the next shock will not have the same origin or characteristics as the last one, and we have no reliable way of knowing what it will look like or where it will hit. We therefore tend to assume that it will resemble past shocks and conduct policy accordingly. Consequently we not only fail to see the next shock coming, we respond to it inadequately or inappropriately. Blanchard said something about setting policy so as to stay away from dark corners. My point is that we can only see the dark corners we have already walked into, not the ones that we haven't. Therefore sudden unforeseen shocks - including extreme tail risk events - are a natural feature of the economic system. I regard it as hubristic to assume that shocks can always be avoided or buffered away.

I would add to this that economists are human too, and human behaviour includes such things as confirmation bias, halo effects and herding. And economists are not clairvoyants. Forecasting is an imprecise art. So the chances of economists accurately forecasting shocks far enough in advance for the policy response to be strong and timely enough to keep the economy on tack are not good.

Perhaps the only potential "shock" that I have seen entirely buffered away was the Y2K bug. And what do people say about it now? They say it was a myth. The fact that IT people (I was one of them) spent years and billions of dollars eliminating Y2K bugs is entirely forgotten. We remember the crises we walked into, not the ones we avoided.

well yes, shocks are unforeseen by definition. Y2K was not a shock. By setting policy to stay away from dark corners Blanchard will have meant, for example, staying far enough away from the zero-lower bound and reacting appropriately to shocks observed after the event. I don't think stay away from dark corners he meant avoid really nasty shocks, more avoid getting trapped by them. I could be wrong.

Deletep.s. mind dropping me an email at luisenriqueuk at g mail ?

Deletep.s. you can see a good example of how mainstream macro people interpret "non-linear" here:

ReplyDeletehttps://longandvariable.wordpress.com/2015/04/14/theres-something-wolfgang-on-the-internet/

p.p.s equilibrium is a poorly understood term, in economics it does not imply static. You can have a model which exhibits these great swings or cycles and yet is always in equilibrium in the sense that people are always doing the best they can given what everybody else is doing - i.e. have no wish to deviate, although they changing their behaviour over time, which is more like what a (dynamic) equilibrium means in economics. Or you can have a model, which is constantly being hit by large shocks, so the economic is always undergoing transition dynamics. Take the neoclassical growth model, and give it initial conditions a long way beneath (dynamic) steady-state and you can have very protracted dynamics (i.e. decades) and if you knock the economy around, it can always be out of equilibrium in the sense of away from its balanced growth path, although equilibrium in the sense that markets are clearing and what not.

ReplyDelete"I would add to this that economists are human too, and human behaviour includes such things as confirmation bias, halo effects and herding. And economists are not clairvoyants. Forecasting is an imprecise art. So the chances of economists accurately forecasting shocks far enough in advance for the policy response to be strong and timely enough to keep the economy on tack are not good."

ReplyDeleteThese words The other side of The mirrror of Economy linearity. Trurh versus precision. A definitely lost war.

Hi Frances,

ReplyDeleteI am thinking that the problem is maybe not the linear/non-linear issue. Maybe the problem is the whole idea of a theoretical 'model' created from first principles that can encompass enough information about the economy to be used on its own (eg Hicks).

What I meant to say is that it is hubris to think that we can model such a complex and dynamic system as the economy. The number of data points we have are many many orders of magnitude too few for the number of dimensions we would need to calibrate such a model. But the idea of modelling the economy using linear models - often not even calibrated by real data (eg. the argument for austerity) - is also ridiculous.

I see it more that we need overlapping ideas in separate areas, each of which can be tested empirically. For example, I was having a rant on Simon Wren Lewis' blog about Ricardian Equivalence. This is a model of behaviour and whether it is linear or non-linear it is just wrong. On the other hand, if you start without a model but with an idea that a higher government debts cause a drag on GDP, why not test that directly? In fact I have done (see andricopoulos.blogspot,com) - and it is a linear test but is, in my opinion, far more useful than a theoretical model.

This can then be combined with what we know about other areas. For example, we also have an idea about the multiplier of government spending on GDP. This could probably be modelled reasonably simply on its own as a function of spare capacity and maybe some other variables. Then calibrated empirically.

Another idea is that built up trade imbalances cause crisis. We can see it in economic history. We know that the UK is going to have a big problem in the future. Can we model when? No, no model in the world can. But we can look at the impact of current account deficits on borrowing. And we can also look at the role of increased debt in making a crisis. And armed with these separate overlapping ideas (or simple models) we can come up with good policy.

Krugman claims the remarkable success of Hicks in everything except predicting the 2008 crisis. He is strangely quiet on this. And yet this is a pretty major blind spot for the model and not one that he has corrected. But using the idea of Hicks alongside other simple models in different areas - especially when aligned with the simple concept of balance used by Michael Pettis - is enough in my opinion. To think that you can model everything from first principles is just wrong.

In conclusion - don't assume people's behaviour and build a model - linear or non-linear - based on your assumptions. Test it empirically and used your combined knowledge to build up a picture of the economy.

Frances: "Indeed, if policymakers want to deny stroke patients essential treatment and force them back to work before they are properly recovered, there is not a great deal economists can do to stop them. Such is democracy."

ReplyDeleteActually, there is - stop advocating for these policies, and make it publicly clear that the economists who do are lying.

-Barry