So whose fault IS it, then?

Following Bob Diamond's resignation this morning - forced, according to the BBC, by an unholy alliance of the Bank of England's Mervyn King and the FSA's Lord Turner - Barclays is fighting back. It has produced this statement in advance of Diamond's meeting with the Treasury Select Committee.

The impression this statement gives is that Barclays feels it has been hung out to dry for manipulating a rate when they believed they were doing so under instruction from the Bank of England. And Barclays insists that other banks were submitting lower rates and that Barclays repeatedly complained to the British Bankers' Association (BBA), the Bank of England, the FSA and the Federal Reserve about this to no avail. If it's true that Barclays warned regulators that other banks were manipulating their submissions and regulators ignored the warnings, it doesn't exactly show the regulators in a good light. That's bad enough.

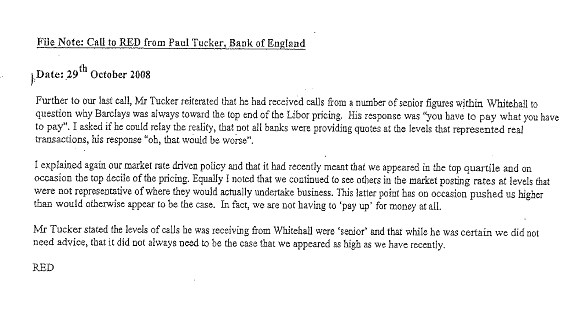

But scroll down through the statement and the charts in the appendices, and right at the very end there is a file note recording the main points in a telephone conversation between Paul Tucker of the Bank of England and Bob Diamond at the height of the financial crisis in 2008. Here it is in full:

It would appear that someone 'senior' in Whitehall didn't want Barclays out of line with other banks. Wonder who that was?

I'm not the only person who noticed this, by the way. Joseph Cotterill at FTAlphaville did too.

The impression this statement gives is that Barclays feels it has been hung out to dry for manipulating a rate when they believed they were doing so under instruction from the Bank of England. And Barclays insists that other banks were submitting lower rates and that Barclays repeatedly complained to the British Bankers' Association (BBA), the Bank of England, the FSA and the Federal Reserve about this to no avail. If it's true that Barclays warned regulators that other banks were manipulating their submissions and regulators ignored the warnings, it doesn't exactly show the regulators in a good light. That's bad enough.

But scroll down through the statement and the charts in the appendices, and right at the very end there is a file note recording the main points in a telephone conversation between Paul Tucker of the Bank of England and Bob Diamond at the height of the financial crisis in 2008. Here it is in full:

It would appear that someone 'senior' in Whitehall didn't want Barclays out of line with other banks. Wonder who that was?

I'm not the only person who noticed this, by the way. Joseph Cotterill at FTAlphaville did too.

Diamond is clearly going to try and take as many down with him as he can, that memo is particularly explosive as it implicates senior members of the last government, either ministers or civil servants in trying to rig a market. If that holds up then the question becomes who all knew about it?

ReplyDeleteEd Miliband could regret jumping on this bandwagon.

Miliband has nothing to lose and a lot to gain. Ed Balls, though....no wonder he's keeping his head down

DeleteYou mean forgetting he was on it!

DeleteI wouldn't be so sure Frances, if it's shown that the last Government was complicit in this then questions are going to be asked about Who knew what and when? As a senior minister and former SPAD of Brown, Ed's bound to be asked some awkward questions. There will also be questions about why he was so quick to make an issue of Barclays when perhaps the better course of action would have been to keep a low profile as there was so much potential damage for Labour. Also if Balls has to go then it will be very embarrassing for Labour and, whatever you may think of Balls personally, he's one of Labour's best performers. It would also mean Ed would be on his third Shadow Chancellor in under 2 years. It all depends on what comes out tomorrow but Balls is certainly in trouble

DeleteWhy the obsession with Balls? He was education minister at the time wasn't he?

DeleteHe was City minister.

DeleteThe mandarins might have shown their true colours at last. For decades weak and ineffectual politicians have allowed themselves to be swayed by them. It would appear their overreaching and overbearing smugness has been identified. Any Government sacking the lot of them would gain a great deal of respect. Can't be done? Where the will is there it can.

ReplyDeleteAs a non finance person who has been a little bemused by the reaction to this brief note, can I ask - in ignorance - why everyone seems to think it incriminates the BOE/last govt?

ReplyDeleteOne possible reading would suggest:

1. Tucker rings up, asks indirect question about why Barclays are out of line with other banks;

2. Diamonds replies, "it's not us out of line, it's the rest of them."

3.Tucker replies: "... that would be worse" (i.e. if the *majority* of banks were falsifying stuff)

4. Diamond's middle paragraph largely seems to be justifying his/Barclays' position in more detail

5. Tucker finishes by saying, " It's not just me y'know, your LIBOR returns look pretty fishy to some other people - fairly high up other people as well. We're not convinced you're being straight here."

Which seems to me to be a perfectly defensible conversation from the BOE's point of view. But perhaps, in my ignorance, I'm missing something?

You're missing quite a lot, actually. If you read Barclays' statement, there are pages and pages of LIBOR submission charts that show that Barclays was persistently submitting higher rates than other banks - it was not a one-off event. A bank would have no reason whatsoever to make its funding costs look higher than they actually were. So if Barclays' submissions were noticeably higher than other banks' either it was in worse shape financially or the other banks were lying. The other panel banks include RBS and UBS, both of which were bailed out in the financial crisis, so it seems unlikely that Barclays was in worse financial shape than them. Therefore it would appear that they were lying, as Barclays said. This investigation does not end with Barclays, and I expect that in due course other banks will be censured and fined even more heavily.

DeleteIf it were not for the last line in this file note, Whitehall's question could have been regarded as innocent. But the last line raises serious questions about the intentions of both Whitehall and the BoE.

I think your answer (for which I thank you for sparing your expertise) may contain the clue to my doubts:

ReplyDelete"...either it was in worse shape financially or the other banks were lying. The other panel banks include RBS and UBS, both of which were bailed out in the financial crisis, so it seems unlikely that Barclays was in worse financial shape than them"

Is there perhaps a possibility that Barclays were lying to avoid the fate of RBS ( i.e. technical nationalisation)?

Forgive me: I'm not presuming to disagree with you on technical grounds, my understanding wouldn't permit that. But I smell a rat in political terms ...

You're still not getting it. Higher funding costs relative to other banks indicate financial stress. If Barclays wanted to avoid the fate of RBS it would have reduced its submissions back to the midrange, thus allaying suspicions about its financial strength. That it did not do this until (possibly) pushed is the surprise.

DeleteI really can't see how making LIBOR submissions that were noticeably higher than other banks' helped Barclays in any way politically. Financially there may have been an incentive, if it was holding long positions in derivatives priced to LIBOR.

But isn't the big problem with this that it is RED's report of a conversation?

DeleteMr Tucker seems very keep to put his side of the story, perhaps things will look a little different when he does?

Yes, we need Tucker's side of the story. My guess is that the Treasury team was worried that the high LIBOR submissions indicated that Barclays was in trouble and would need bailout a la RBS - i.e. nationalisation. Del Messier got the drift from RED's report of Tucker's comments and acted to reduce the submissions to "get back in the pack", allay Treasury worries. Not good, but in the circumstances understandable, and definitely not the worst crime in this unholy mess.

DeleteMy thanks for your patience in answering.

ReplyDeleteThe other element of this is that since Barclays were already manipulating Libor on behalf of their derivatives division, we should be much more sceptical than Frances is about the notion that they only began when pressured by the government.

DeleteThis is of course why we need a judicial inquiry with actual powers to dig out evidence. Barclays is selecting the elements from the email archive that make it look good. We need to see the emails they didn't choose to publish before we let them off the hook.

This comment is very wide of the mark and I do not accept the implied criticism within it. I doubt if you have read the FSA report, or you would not make such a glaring error as "Barclays manipulating Libor ON BEHALF OF their derivatives department". That is not what the FSA report says.

DeleteIn my previous post about Barclays LIBOR-fixing I analysed the FSA report. There are TWO separate issues - attempts at LIBOR-rigging by INDIVIDUAL TRADERS to bolster their own positions, and LIBOR-fixing on the instructions of senior management to improve perception of Barclays' financial strength during the financial crisis. You are confusing the two. I suggest you read my post and the FSA report (link is in the post) to improve your understanding of the situation.

The emails are damning, actually, since they make it clear that there was a major failure of internal control at BarCap when Diamond was in charge of it. Failure to establish and maintain Chinese walls is itself a sackable offence. But this is a separate issue from deliberate manipulation of LIBOR to make the bank look stronger.

C'mon Frances, the early rate fixes show that low level bods at Barclays were prepared to fix their quotes for a bottle of champagne (Christ knows what they would have down for a serious bribe). So we should be doubtful about whether they would have fixed it when they were worried about being nationalised?

DeleteI'm not doubtful about that at all. We know they fixed it. I'm simply pointing out that it is not the same issue and not the same people.

Delete