More on productivity

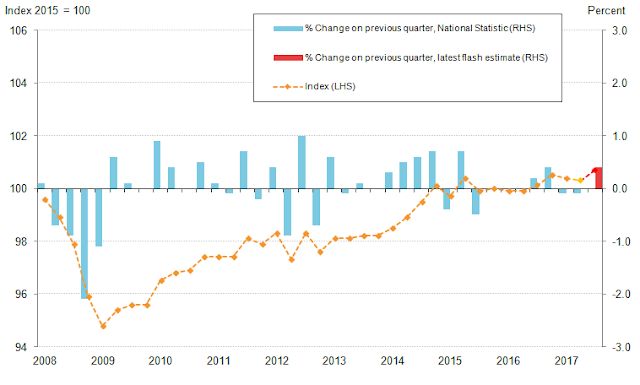

The ONS's latest flash productivity estimate is rather good. Productivity in Quarter 3 2017 was up by 0.9% on the previous quarter. Here's what ONS has to say about it:

The ONS says that productivity has been weak because the labour market has been relatively strong during this time:

This chart gives further weight to the argument that trade contraction and disrupted supply chains are a principal driver of the UK's productivity slump:

The "three shocks" of which I have previously written are very obvious here: the deep economic recession of 2009, followed by the Eurozone crisis, and then the emerging-market shock. For comparison, here is Peter Praet's chart of the three shocks, annotated by Toby Nangle:

So for the UK's open economy, there is an obvious positive correlation between global PMI and productivity. Well I never. When global businesses get hit by financial shocks, they cut production. Who knew?

And this brings me to a serious warning. It is clear from the chart above that the UK's small open economy is crucially dependent on external trade. Don't be fooled by the trade balance, or the small proportion of businesses that export directly: many domestic businesses support exporters while not exporting themselves, and many domestic businesses are importers. When external trade suffers a shock, GDP and productivity growth both fall, sometimes significantly. And Brexit - any variety of it - will be a major shock to external trade.

Brexiteers' upbeat forecasts for the UK are founded on the idea that external trade will be resilient to the UK leaving the EU. Some even say it will improve. They will no doubt crow about the fact that the UK's productivity is currently rising and dub gloomy forecasts as "Project Fear".

But there are already indications that EU trade partners are diverting supply chains away from the UK. And IHS Markit reports that business optimism in the UK is the lowest it has been since 2011. Disrupted supply chains are a serious drag on both output and productivity. I fear that the Brexiteers' optimism may prove to be "Project Fantasy".

Related reading:

Lehman's Aftershocks

We need to talk about productivity

Output per hour growth in Quarter 3 2017 was the result of a 0.4% increase in gross value added (GVA) (using the preliminary gross domestic product (GDP) estimate) accompanied by a 0.5% fall in total hours worked (using the latest Labour Force Survey data). This fall in total hours was driven primarily by a 0.5% fall in average hours per worker.Yes, yes, I know - economics jargon. Let me translate. ONS in plain English:

People are working fewer hours, but they are producing more every hour.Of course, this should be set against the backdrop of persistently low productivity since the 2008 financial crisis. Productivity has taken nearly a decade to return to its pre-crisis level:

The ONS says that productivity has been weak because the labour market has been relatively strong during this time:

Both employment – which captures the total number of people in work – and total hours – which captures both changes in employment and working patterns – fell in the course of the economic downturn, but total hours fell further reflecting falls in the average hours of those in employment. However, as GDP fell by a larger proportion in the economic downturn than either hours or employment and has grown slowly by historical standards during the recovery, productivity growth has been subdued since the downturn and has recovered more slowly than following previous downturns.Yes, yes, I know.....here it is in plain English:

People carried on working during the downturn, but they didn't produce as much.We can speculate why this might be. Both international trade and domestic demand suffered a severe contraction after the crisis, which would have reduced output, but if businesses were expecting the downturn to be short-term they might simply have reduced people's working hours rather than laying them off. Also, disrupted supply chains might have made it difficult for workers to maintain output levels: managing those disrupted supply chains would have created additional work for admin & management without adding anything to GVA. There was also something of a boom in regulation, especially in financial services, which does absolutely nothing to increase output but employs lots of people.

This chart gives further weight to the argument that trade contraction and disrupted supply chains are a principal driver of the UK's productivity slump:

The "three shocks" of which I have previously written are very obvious here: the deep economic recession of 2009, followed by the Eurozone crisis, and then the emerging-market shock. For comparison, here is Peter Praet's chart of the three shocks, annotated by Toby Nangle:

So for the UK's open economy, there is an obvious positive correlation between global PMI and productivity. Well I never. When global businesses get hit by financial shocks, they cut production. Who knew?

And this brings me to a serious warning. It is clear from the chart above that the UK's small open economy is crucially dependent on external trade. Don't be fooled by the trade balance, or the small proportion of businesses that export directly: many domestic businesses support exporters while not exporting themselves, and many domestic businesses are importers. When external trade suffers a shock, GDP and productivity growth both fall, sometimes significantly. And Brexit - any variety of it - will be a major shock to external trade.

Brexiteers' upbeat forecasts for the UK are founded on the idea that external trade will be resilient to the UK leaving the EU. Some even say it will improve. They will no doubt crow about the fact that the UK's productivity is currently rising and dub gloomy forecasts as "Project Fear".

But there are already indications that EU trade partners are diverting supply chains away from the UK. And IHS Markit reports that business optimism in the UK is the lowest it has been since 2011. Disrupted supply chains are a serious drag on both output and productivity. I fear that the Brexiteers' optimism may prove to be "Project Fantasy".

Related reading:

Lehman's Aftershocks

We need to talk about productivity

This comment has been removed by the author.

ReplyDeleteSo, to be clear, you're emphasizing the point of factor utilisation as the driver of low productivity?

ReplyDeleteThere are other, non-cyclical reasons that productivity is low. In fact, a large body of literature is dedicated to explaining why productivity is likely to remain low for a long time, and how these would have played out even without the recession.

Also, PMI is a bit misleading since it a a general indicator of production, which involves both demand and supply. While the story of productivity (supply) is undeniable, demand side factors are much more relevant in explaining volatility in PMI (I don't know much about the index, so I might be wrong on that). Besides, if productivity was the only factor, we would not be having the low inflation rates we have right now.

PS. I'm amazed with your patience with some of the comments.

Yes, I think factor utilisation (or lack of it) is an important cause of the cyclical productivity slump.

DeleteHowever, there is an underlying secular productivity decline as well, which has multiple causes such as demographics, automation, the falling rate of return on capital, diversion of investment into less productive sectors such as property, the rentier economy, the myth of "work must pay", hysteresis in the workforce, insufficient investment in skills, perverse incentives, etc. etc. This decline has been going on for a long time. I've discussed it extensively on this blog and elsewhere, over some years now.

The supply-demand relationship itself is a driver of productivity (high demand encourages investment to improve productivity so that supply can rise to meet demand), so I think it's reasonable to compare productivity with PMI.

I don't really agree that there is a strong causative link between productivity and inflation. The reasons for low inflation are complex and in my view significantly driven by international forces, notably commodities supply/demand and the global demographic shift.

My patience wears thin sometimes! but thanks :)

I see where my problem comes form now. Unlike the UK, productivity in the US shot up between 2009-2011. One explanation of the US counter-cyclical phenomenon is that labor markets in fact became more flexible, hence less hoarding more firing. But I can see why the opposite may be the case in the UK.

DeleteAlso I see your point that productivity has to improve with higher demand, especially now that unemployment is so low. Again, this is hard to reconcile with inflation figures, but you are right that this is likely a result of the foreign sector.