A dent in the surface of time

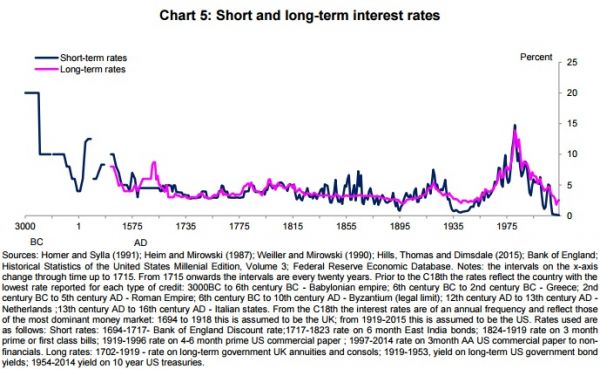

This chart has been fascinating me for ages. It was produced by the Bank of England to illustrate a speech by Andy Haldane . Shock, horror - we have the lowest interest rates for 5,000 years. Even in the Great Depression they were higher than they are now. These are, of course, nominal interest rates. Real interest rates are even lower - though not by much, since inflation is close to zero in all major economies. Note also the divergence of long-term and short-term interest rates. This is encouraging, since it suggests that investors view future prospects as brighter, though hardly scintillating. Central banks have been trying to close that gap with various monetary policy tools, the idea being to bring forward some of that future enthusiasm into the present day. But so far, all they have succeeded in doing is depressing expected interest rates far into the future. Now, policy makers are beginning to talk about interest rates remaining permanently lower than their long-run av...