Currency Wars and the Fall of Empires

This post was first published on Pieria in July 2013. I have re-posted it here on Coppola Comment because it now seems terribly, terribly timely.

I have been reading James Rickards' book Currency Wars. In this, Rickards reviews the use of fiat currency over the course of the last century, and concludes that the present global fiat currency system is inherently unstable and on the point of collapse. He calls for return of the gold standard to stabilise firstly the US dollar and, following on from that, international trade currency.

I am no historian, but the first thing that struck me about this book was its partial view of history. Rickards does not discuss the reasons for the classical gold standard being abandoned in 1914. Indeed since he writes almost entirely from an American perspective throughout this book, the European historical dimension is seriously neglected. There are two major omissions:

- the background to World War I and its consequences

- the collapse of the Soviet Union.

Both of these involved catastrophic failure of fixed currency systems: admittedly only the first involved a gold standard, but really that does not matter. The chaos caused by the collapse of empire is the real issue in each case. Indeed the global dislocations arising from the First World War and its associated events reverberated for the rest of the 20th century.

A "golden age"?

Let's look first at the background to World War I. Rickards reminisces about a "golden age", when the world operated on a self-balancing gold standard. He mourns its passing, and at least partly seems to blame the creation of the Federal Reserve after the panic of 1907. I beg to differ. The passing of the classical gold standard had very little to do with the Fed, or indeed with America. It had everything to do with the maelstrom in Central Europe.

Gold standards and other fixed or managed currency systems work well when countries are peaceful, prosperous, economically well aligned and well-disposed towards each other. And empires, by and large, create such conditions much of the time. It's one of the main reasons why people deliberately choose to become citizens of empires. But gold standards and their kind don't usually survive wars, revolutions and economic disasters. They are too inflexible to accommodate gross distortions in trade patterns and collapsing economic and social systems. Only fiat currencies can adjust sufficiently, and that is why fiat currency systems are nearly always adopted whenever there is a war or a major economic disaster*. Fiat currencies collapse when trust in their issuers is so diminished that people reject them, causing hyperinflation: Rickards correctly points out that adopting some kind of hard currency system can be a way of restoring trust in the currency. But even then it doesn't have to be a gold standard, and in fact very few of the examples of hyperinflation in the last hundred years were ended by adopting a gold standard. Most involved pegging to some other currency, usually the currency of whatever the dominant global power was at the time.

The dominant global power prior to World War I was Britain. The British Empire was the largest empire in recorded history, controlling one-fifth of the world's population and rather more of its territory. Rickards notes that India joined the gold standard in 1898, but omits to mention that at the time it was part of the British Empire - Britain, of course, being the principal driver behind the gold standard. India's joining the gold standard was not a free act. It was coerced by Britain as a means of ensuring India's subservience.

But there were four other important empires too - the German Empire, the Russian Empire, the Austro-Hungarian Empire and the Ottoman Empire. The appalling carnage of World War I was the most visible sign of the concurrent breakup of all four - but it was only the beginning, not the end, of the massive global dislocation caused by their collapse. The Austro-Hungarian Empire was dissolved in October 1918 as a direct consequence of World War I. The Russian Empire ended with a people's revolution in 1917, but then reinvented itself as the Soviet Union: it took another 60 years for it finally to fall apart (well, maybe not quite finally...). The German Empire was wrecked in the First World War but then resurrected under Hitler before being destroyed in World War II (again, maybe not quite finally). And the Ottoman Empire, already in decline, finally ended in 1922 - the same year that the first serious cracks appeared in the British Empire, with the secession of Ireland. The British Empire was already failing by the time of World War II, as was the French Empire, and both disintegrated during the 1950s and 60s. And the Soviet Union - the last of the great 19th century empires - collapsed suddenly and disastrously in 1989-91. Indeed the turbulent history of the 20th century is largely the story of the fall of empires.

So bearing in mind this (admittedly very sketchy) overview of European 20th-century geopolitics, let's look at the three periods that Rickards considers to be Currency Wars.

Currency War I: the legacy of World War I

This encompasses the Weimar hyperinflation, the stagnation in the UK caused by its disastrous attempt to return to the gold standard, and - particularly - the Great Depression. Rickards does not mention the Austrian hyperinflation that preceded Weimar, nor the hyperinflation in Danzig Free State. But all three were simply a continuation of World War I on a different stage. They were not "caused" by fiat currency any more than World War I itself was "caused" by the gold standard. Currency wars they may have been, but the nature of the currency was not the issue. The problem was the inadequate resolution of World War I and its continuation in the form of punitive reparations and the desire for revenge. Indeed the Weimar hyperinflation period included a physical act of war, when France invaded the Ruhr industrial area to seize its production in lieu of reparations. How this can be seen as caused by fiat currency is beyond me. War is war, however it is fought.

The part the gold standard played in the Depression has been extensively documented. But the underlying issue was the failed attempt to re-establish the gold standard in the 1920s. Rickards recognises the return to the gold standard in the 1920s as a problem, but seems to think the problem was the form that the gold standard took. Again, I beg to differ.

Geopolitical instability throughout the 1920s and 30s made returning to any sort of fixed or managed currency system disastrous. World War I was by no means over. Too many countries were still severely damaged, not only by the physical wreckage and the loss of nearly an entire generation of young men, but by the mental scars from the comprehensive realignment of political and cultural boundaries in Europe. Where there had previously been four Central European superpowers, there was now only one - the Soviet Union: the remainder had disintegrated into a melting pot of small states and principalities, held together in uncomfortable allegiance by continuing tension between France and Germany, Germany and Russia, and Britain and everyone else. Germany was terribly scarred by World War I and its hyperinflationary aftermath: Britain was fighting to preserve its financial supremacy, not least by insisting that everyone (including itself) should cling to gold: and France was still fuming over the wrongs it felt it had suffered. All three were highly indebted and devastated by the war.

Meanwhile the US, which experienced massive inflows of gold during World War I due to the European powers' borrowing to fund the war effort, was defending its gold hoard (now by far the largest in the world) and fighting domestic inflation by means of tight monetary policy, which unfortunately also tightened monetary conditions for countries that returned to the gold standard - exactly the opposite of what the shattered European economies needed. The economic differences between the booming US and depressed Europe in the 1920s became a subject of bitter disagreement: Murray Rothbard, in his account of the Great Depression, blames the US credit boom that led to the 1929 Wall Street Crash on Britain's attempts to persuade the US to loosen monetary policy.

There was not only insufficient economic convergence between these countries, there was too much ill-will for any managed currency system to work. Given that, it is hardly surprising that countries suffering economic collapse in the Depression used tit-for-tat devaluations as weapons in their fight for a share of declining world trade, rather than cooperating to repair their economies and improve trade. The collapse of the Central European empires cast a very long shadow. With his US-centric focus, Rickards ignores much of this - as, to be fair, do most writers about the 1920s and 30s.

Currency War II: the Cold War

The second of Rickards' Currency Wars is the oil price wars and high inflation of the 1970s and 80s following the collapse of Bretton Woods. Bretton Woods was a thinly-disguised attempt to establish US monetary and trade sovereignty over the rest of the world, which is why Keynes' proposal to establish a genuinely supra-national trade currency system fell on deaf ears. Britain was losing its global dominance as the British Empire slowly disintegrated, and the Soviet Union was looking increasingly powerful. The US desperately needed to establish its claim to Britain's throne, and a US dollar-dominant managed trade system was part of its strategy for achieving that. The background to Bretton Woods is therefore the establishment of the US quasi-empire, followed by the US-Soviet Union Cold War. This delayed necessary geopolitical adjustments arising from the end of World War II, though it brought some stability to the ruin that was Europe, allowed time for terribly damaged countries to heal without further disastrous economic shocks, and perhaps most importantly, allowed the British and French empires to unwind without triggering yet another global conflict. Consequently, like the classical gold standard, it is all too easy to see the Bretton Woods period as a "golden age". But when it failed, the economic chaos in Europe was similar to that arising from the end of a war - because that is what it was.

However, the failure of Bretton Woods did not mean the end of the US dollar's international power. Indeed the period from 1945-1991 should correctly be seen as the period of two competing currency zones - the dollar zone and the rouble zone. Rickards is indeed right that there were currency wars going on, but it had nothing to do with the currency system. The Cold War did not end with the failure of Bretton Woods. In fact in keeping with my argument that gold standards and their kind don't survive wars, it is my view that the Cold War was the fundamental cause of the failure of Bretton Woods, not - as Rickards suggests - flaws in the construction of the currency system itself. Cold it may have been, but it was still war. From a currency war perspective, Nixon's suspension of US dollar convertibility could be regarded as a brilliant strategic move: it broke the link between US domestic production and the value of the dollar, and staked out the US dollar's claim to be a truly global currency. The Soviet Union's command economy and acquisition-led expansion strategy rendered it incapable of offering a credible response. After Bretton Woods ended, the Cold War played out in the Middle East and on global commodity markets, resulting in shock after shock to Western economies dependent on oil, and eventually forcing the Soviet Union to abandon autarky as its command economy disintegrated.

This brings me neatly to the collapse of the Soviet Union and the rise of the European Union, both of which Rickards pretty much ignores. The two are related (I know Europhiles will scream "NO THEY AREN'T" at this point, but please bear with me....).

Currency War III: The new empires

When an empire fails, it leaves a gap. Europe is used to having empires. But by the end of the twentieth century, every European empire had failed, mostly in disorderly fashion. After World War II, Europe was effectively carved up between the US and the Soviet Union. When the Soviet Union failed and its satellites broke apart, the chaos in Eastern Europe was on the same scale as another European war - swathes of economic collapses (some of them hyperinflationary), local battles over borders, wreckage of infrastructure and migration or even massacres of population. Rickards' description of the end of "Currency War II" as a "soft landing" is way off beam. A world war may have been avoided, but the disintegration of the rouble zone had catastrophic economic and political effects.

The embryonic European Union, born out of the chaos of World War II and significantly strengthened after the end of Bretton Woods, became the obvious safe haven for ex-Soviet Union, Iron Curtain and Yugoslavian states as Russia under first Yeltsin then Putin became increasingly aggressive and potentially acquisitive.** The EU's founders may not have intended it to be a nascent empire - but that is what it inevitably became. At last, Europe was comfortable. There was a new empire that could fend off both Russia's tendency to gobble up nearby countries and the US's liking for satellite states. And after the adoption of the single currency in 1999, there was a new currency capable of counterbalancing the US dollar. Indeed the new currency was deliberately created to be independent of the states which use it: there is little doubt, to my mind at least, that the intention of the founders of the Euro was that it should eventually supplant the US dollar as global reserve. Rickards seems to think the US dollar - Euro relationship is essentially benign. That may be true from the US side, but not from the Euro side. With the creation of the Euro, currency wars entered a new phase - though it seems not one that Rickards envisages.

But the world has moved on. In fact, more accurately, it has moved East. The third of Rickards' Currency Wars is the current period of central bank unconventional monetary policies and alleged Chinese currency manipulation. And here I have to agree with him to some degree.

US victory in the Cold War firmly established the US dollar as the world's trade currency and the Fed as de facto the world's central bank. The direct cost of the Cold War was the inflation of the 1970s and the painful restructuring of the 1980s. But the global economic impact was far wider. Henceforth US monetary policy would be driven by global demand for the US dollar (including future demand in the form of US debt). Worldwide demand for US dollars soared as countries such as China started to use the US dollar as an anchor for their own currencies while pursuing highly expansionary economic policies and flooding Western countries with cheap exports. The US trade deficit and sovereign debt pile grew ever larger, but the inflows of cheap goods kept consumer price inflation low and GDP high, which encouraged successive Fed chairmen and US presidents to adopt loose monetary and fiscal policy despite rising asset prices and consumer debt. The Great Moderation in the West was driven by the Great Expansion in the Far East - and in turn drove more expansion in emerging markets.

But China is fast becoming the new world superpower, eclipsing the troubled European Union (and even more troubled Russia) and challenging the US for global economic dominance. Whether it intends the yuan to become the next global reserve currency is unclear: Chinese politicians have expressed interest in a global currency similar to the bancor envisaged by Keynes. But there is no doubt that the US, at any rate, considers China a serious threat to its global dominance. In the end this is not about currencies. It is about trade - and about military dominance. Even if China does not want a currency war, it seems some in the US do.

Rickards' claim that the only way to prevent global currency meltdown is a return to a gold standard assumes that the US dollar remains pre-eminent, simply because the US still has by far the largest gold reserves: it is not surprising that Euro or renminbi supplanting the US as global reserve currency features nowhere in his "disaster scenarios", although he does mention the SDR (and dismisses it). We have seen this before, with Britain's disastrous insistence in the 1920s on returning to the gold standard along with its colonies, and its desperate attempt to maintain sterling's global reserve position after World War II by using its Marshall Plan aid to build up gold reserves instead of rebuilding its economy. But despite the considerable pain that attempting to preserve its world dominance caused it, Britain was eventually forced to concede dominance to the US. The closure of the London Gold Pool that presaged the end of Bretton Woods was the final nail in sterling's coffin. I fear that calls - mainly from the US - for restoration of a global gold standard are the start of the US following in Britain's footsteps. Defend your currency's global dominance, even at the cost of your country's prosperity.

A golden disaster

There is in my view virtually zero chance of the world agreeing to another managed currency system with the US dollar as global anchor, whether or not it is in turn anchored to gold. The future lies elsewhere: whether with the Euro, renminbi or SDR, or something else entirely, remains to be seen. The SDR becoming global reserve currency would in effect turn the IMF into the world's central bank and the SDR into Keynes' bancor: Keynes envisaged bancor being anchored to gold, and it is not inconceivable that the SDR could be anchored to gold at some point. But a global reserve currency anchored to gold is only sustainable when there is global peace and countries are economically well aligned. Is this the case at the moment? Well, things are reasonably peaceful (except in the Middle East), but countries can hardly be said to be economically well aligned. There are massive trade imbalances and huge differences in prosperity between countries. Adopting an international gold anchor at the moment would set those differences in stone, which would eventually create social unrest on a massive scale, tearing apart the global geopolitical system just as World War I did a hundred years ago. I see no benefit from any sort of managed international exchange rate system unless the world also agrees to adopt a managed trade system to limit imbalances while improving general prosperity. And I remain unconvinced of the benefits of a gold standard anyway. A gold standard is a tender plant - it requires good conditions. Why bother with it, when there is a tough old weed of a fiat currency system that covers the ugly wall just as well and will withstand drought, floods and the neighbours' cats?

Of course Rickards doesn't see the current global fiat currency system as a tough old weed. He thinks it is unstable and on the point of collapse. But currencies - whether fiat or commodity - don't collapse out of the blue: they fail because of wars, revolutions, economic disasters and massive disruption of production and trade. So the question is, is the global economic and political system on the verge of collapse? It doesn't look it to me, though others may disagree. However, there would be one surefire way of bringing about disorderly collapse of the global economic system - and that would be for the US to attempt to return to the gold standard while it has enormous trade and fiscal deficits and a debt pile that reaches to the moon.

A key feature of a gold standard is that a large trade deficit is unsustainable because of continual gold outflows. The US's trade deficit is far larger now than it was in 1971: Rickards notes that funding its current trade deficit under a gold standard would more than wipe out its existing gold stocks, vast though they are. Adopting a gold standard while this trade deficit remains in place would bankrupt the US as it tried to purchase (or perhaps confiscate from its own people, as Roosevelt did) enough gold to satisfy its creditors. So presumably the US would have to renege on its existing trade commitments, either by printing enough fiat money to satisfy them in the certainty that this money would become worthless as soon as the gold standard was adopted, or simply by refusing to honour them.

The trade deficit is not the only problem. The US's financial situation has deteriorated considerably since the end of the Cold War, and particularly in the last decade. Maintaining its global dominance has required it to pursue a series of damaging wars in the Middle East, squandering its capital inflows from the Far East and leaving it indebted to China in much the same way as the European powers were to the US after the end of World War I. Since government debt is simply a future claim on currency, the US's enormous debt pile would also become unsustainable under a gold standard: it is only sustainable now because the US has the capability to print unlimited quantities of currency (admittedly at risk of inflation), which would no longer be the case under a gold standard. Presumably, therefore, the US would not only have to renege on its trade commitments, but also default on its sovereign debt. This could easily be regarded by other countries as an act of war.

Even if outright war was avoided, the US returning to the gold standard would have appalling economic effects. Unilaterally reinstating a gold standard would force the US to balance its trade and (probably) fiscal budgets, causing a disastrous global monetary contraction. The world would be forced to counter this by bringing forward the use of other currencies for trade. So the US adopting the gold standard would indeed end the present currency war - but not in the way that Rickards seems to think. By trying to preserve the dollar's supremacy, the US would bring about its precipitous fall.

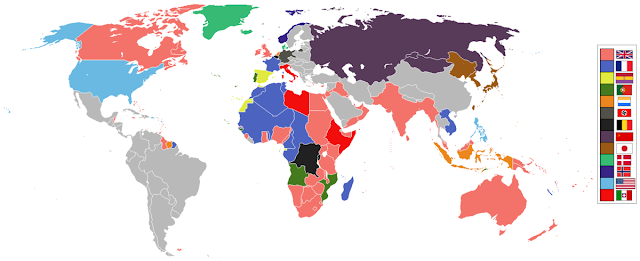

Image is of colonial possessions in 1936, courtesy of Wikipedia. How the world has changed since then!

Related reading:

Links

China as a monetary superpower: the Sino-Monetary Transmission Mechanism - Lars Christiansen

When Money Dies - Adam Fergusson (pdf)

America's Great Depression - Murray Rothbard (pdf)

The British Economy between the Wars - Eichengreen (pdf)

The mercantilist threat to global rebalancing - Frances Coppola (Pieria, archived)

A theory of optimum currency areas - Robert Mundell

Hyperinflation: more than just a monetary phenomenon - Cullen Roche

Books

Currency Wars - James Rickards

The Lords of Finance - Liaquat Ahamed

The Economic Consequences of the Peace - John Maynard Keynes

Golden Fetters - Barry Eichengreen

The Great Rebalancing - Michael Pettis

Geopolitical Economy: After US Hegemony, Globalization and Empire (The Future of World Capitalism) - Radhika Desai

* America retained the Gold Standard for most of World War I, but it was nowhere near as seriously disrupted as the European countries that were forced to abandon the Gold Standard in 1914.

** Rickards' description of Russia's attempt to corner the European gas market in order to establish the rouble as a competitor global reserve currency to the US dollar rings true. In my view the trashing of Cyprus in 2013 by the European powers and the IMF had nothing much to do with sorting out Cyprus's economic problems and everything to do with undermining the rouble as a credible reserve currency.

My layman thoughts:

ReplyDeleteWhat gold standard do people like Rickards want? Do they want a ceiling for M in the quantity theory of money (M*V= P* T)? The government must be capable to stop every private money/claim creation, because if I understand von Mises right every increase in the quantity of money is inflationary.

"In Mises's definition, inflation is an increase in the supply of money"

https://en.wikipedia.org/wiki/Austrian_School#Inflation

A ceiling is enacted, but the money supply can shrink through hoarding and the only corrective would be to increase the velocity to stop deflation. I don't think people are going to keep up with such an authoritarian measure and would start to create money like crypto currencies or simply barter more.

Proponents of the gold standard like to point to history, but I am more curious how prevalent was even the exchange with 100% gold-backed money or gold coins in the the dominant empire (British Empire). For example in British India indian farmers paid their tithe in gold-backed indian rupee or with their harvest.

The tithe in the middle ages wasn't always paid with gold coins, but with agricultural product or other commodities. Generally the question is - in the present I am paying 99% with one currency/money in my country for different goods and services. How high was that percentage in the middle age? Did people live under the gold standard in a hayekian world of different currencies (was there competition?)

I am living in the middle ages and providing care for my parents isn't that in a weird sense a small-scale PAYGO system, but not in monetary terms. Would something like that count towards money for a statistician? There is some talk about commodification and isn't that weirdly GDP growing if you are able to quantify that in money. Are we able to measure/quantify growth under a gold standard?

Hayek idea about competing currencies and the winner would be something close to gold in terms of value is backwards. Ottmar Issing has written about that with Gresham's law. In a free market valued money would not be used as a means of exchange, but as a long-term asset (example) that would dissipate into something like Art or Jewellry.

3. Hayek and Gresham 's Law.

https://www.ecb.europa.eu/press/key/date/1999/html/sp990527.en.html

There is a grime with the Bretton-Woods-System, too. The fixed but variable exchange rate wasn't rock solid from the beginning. Germany had some appreciations of their currency and France was capable to accumulate enough FX to cripple the Bretton-Woods-System. From the get-go the system didn't work.

For germany I do like that discussion paper. Just don't know how rock solid all the implications are.

The German Undervaluation Regime under Bretton Woods

Max Planck Institute for the Study of Societies, Cologne

http://www.mpifg.de/people/mh/paper/dp19-1.pdf