Beyond disappointment

I'm sitting in a coffee shop opposite Haymarket Station in Edinburgh. Just up the road, the Institute for New Economic Thinking (INET) is holding its conference. I'm supposed to be there, as I was yesterday and the day before. But I am not at all sure I want to go. The last two days have left a very bitter taste.

This conference, grandly entitled "Reawakening", is supposed to be a showcase for the "new economic thinking" of INET's name. I hoped to hear new voices and exciting ideas. At the very least, I expected serious discussion of, inter alia, radical reform of the financial system, digital ledger technology and cryptocurrencies, universal basic income (recently cautiously endorsed by the IMF), wealth taxation (also recently endorsed by the IMF), robots and the future of work. And I looked forward to the contributions not only from the speakers, but from the young, intelligent and highly educated attendees.

Not a bit of it. In the last two days we have had panel after panel of old white men discussing economic theories developed by old white men, many of them dead. Economic beliefs that I thought had been comprehensively debunked have reappeared, dressed up as "new thinking".

It started to go wrong in the very first panel. Six white men and a token woman (this has been the general form of panels throughout the conference) discussing the economic stagnation of the last decade. Steven Fazzari and Adair Turner made some interesting comments, but the rest of the panel was terminally unoriginal. I lost interest quite quickly, turned to Twitter for light relief and got involved in a far more interesting discussion about whether or not banks earn seigniorage from lending, how we could measure this and whether it constitutes a hidden subsidy that should be removed. That discussion on Twitter sparked an even more interesting debate in the foyer of the Edinburgh International Conference Centre about banking reform. As a result, I now have some serious reading, thinking and writing to do, because I really do think banks need radical reform and it seems to have dropped off the agenda. But it didn't come from the INET conference. It came from Twitter.

Things didn't get any better at lunchtime, which featured a session about Adam Smith and the Scottish Enlightenment. Adam Smith was a great man, but the old, white, male presenters didn't say anything we didn't already know. The only person who made an original contribution was the token woman on the panel, a young INET researcher who did a wonderful analysis of the relationship of Adam Smith and the Romantic poets, especially Wordsworth - who appears to have had little time for Smith's view of the world. Her presentation stopped me from losing the will to live.

But my reprieve didn't last long. Next up, a discussion on the future of the Eurozone, by old white male Europeans - oh and two women, not that they diverted from the party line. One of the old white males (I forget which one, they all looked the same to me) said that the approach to sovereign debt in the Eurozone should not change, because governments need fiscal discipline. The others nodded in agreement. But I despaired. "Fiscal discipline" in the Eurozone has created seven years of stagnation with no end in sight. And don't shout "recovery" at me. "Fiscal discipline" will soon squash that, mark my words.

Fortunately, the rest of the afternoon was taken up with the aforementioned interesting discussion about banking reform, though I did take a brief break to listen to Guy Standing talking about the precariat. But then there was the dinner. Oh dear. Bill Janeway presenting on technology......I thought I had accidentally gone through a time warp into a McKinsey presentation circa 1990. Dear Bill, we were doing data mining and algorithmic searches back then. You don't seem to have moved on, at all. And good though Adair Turner is, this is not his subject. Yet just up the road from the conference centre is one of the foremost technological research institutes for automation and robotics. Why didn't they bring in someone from there, instead of giving the floor to two old white males?

My table lost interest in the Bill & Adair show quite quickly and headed for the pub. Thank goodness. I hoped things would be better the next day.

The morning of the second day started better. The amazing Shannon Monnat was the token women on a panel of old white males discussing "Populist revolts: economics, culture, race, gender?" (seriously, there was one woman and no person of colour on a panel discussing race and gender...). She knew what she was talking about. They didn't. She wiped the floor with them.

That was followed by a very good panel discussing the "gains from trade". It was mostly old white men, again, with two women and one person of colour. But the discussion was infinitely better than anything I had heard so far, with the best contributions being Brad Delong's demolition of Ricardo's theory of comparative advantage, Pia Malaney's list of losses from free trade, and Arjun Jayadev's comparison of the US's trade representative to the Eye of Sauron. Admittedly, there was no opportunity for questions from the audience - indeed, lack of audience participation has been a feature of this conference throughout. But my hope rekindled.

I missed the keynote lunch and the first afternoon session, opting instead for a pub lunch with three university students - my two nieces and the boyfriend of one of them. Discussion ranged from the game theory of Brexit to the psychological drivers of America's opioid crisis and the problems of those who "lose the race" in the richest country in the world. Again, I am left with serious reading, thinking and writing to do - but it didn't come from the INET conference.

I returned for a panel on debt traps, public and private - and I despaired again. Seven white males and a token woman. Admittedly, one of the white males was Steve Keen, who is original, subversive and takes no prisoners. Adair Turner (again) was also good, not surprisingly since this is his subject. But the rest.....oh dear. It went from bad to worse.

Pontus Rendahl, for example, claimed that "banks don't create money" and explained that Barclays creates its own currency "pegged at par to the central bank currency", which apparently only works if the central bank "is complicit". The Bank of England debunked this nonsense back in 2014. Why is it still being presented now? Doesn't he know that the pre-crisis Eurodollar market, made up of shadow banks and European banks, created billions of faux US dollars without the explicit backing of the Fed but priced them as if they had Fed backing? When the Fed declined to back them, the whole thing crashed - and the Fed changed its mind pretty damn quick, providing copious liquidity to shadow banks and European banks alike, some of it via swap lines to the ECB and Bank of England. The international banking system is perfectly capable of creating things it treats as money and expects central banks to honour, even if central banks have never agreed to do so.

And far more importantly - I don't care whether Rendahl thinks the digital deposits Barclays (or HSBC, or RBS) create is money, as far as I am concerned it is what I have just used to buy my coffee and porridge in this coffee shop, and therefore it is money. I have never in my life been able to pay for coffee and porridge with bank reserves, and unless central banks introduce digital wallets for ordinary people I will not be able to do so in the future, either. Did he propose CB digital wallets for ordinary people? Did he even mention ordinary people and their financial needs at all, for that matter? No, he did not. This is not "new thinking", it is the same old elite economists' voodoo in different clothes.

This wasn't the only biased and disappointing panel discussion that afternoon. In another room, there was a discussion on "Identity norms and narratives". Composition of the panel? Yes, you guessed it. Four white males. And another discussion, "New developments in the economics of imperfect knowledge", was an All (White) Male Panel. Only white men have anything useful to contribute to economic theory that recognises that the future is radically uncertain, apparently. Immigration, too, is apparently an all-male concern, since the panel discussing it consisted of three men.

Torsten Bell and James Heckman discussing intergenerational issues redressed the balance somewhat, since Bell is a Millenial and Heckman an old white male. Both are privileged, of course, and I was left wondering where the voices of those who have fewer advantages in life were (plus the voices of women, of course). But Bell represents an organisation that does serious research into the effects of fiscal policy on women and the poor, and Heckman too concerns himself with policy impacts at all income levels. It was a good discussion, though I have heard both of them speak before and they said nothing new.

At the evening keynote over dinner, Winnie Byanyima's fiery speech livened up the room. And for the first time in the entire conference, there was an extensive Q&A with the audience. When a young female attendee pointed out that there were 84 white male speakers at the conference, 14 women and 9 people of colour, and called for INET to be more inclusive, the audience applauded. But the panel went quiet. Her comment was not even acknowledged.

I left the conference last night feeling completely dispirited. This is not a conference of "new economic thinking". It is a conference run by and for the elite - senior academics, rich businessmen, former public servants. Speakers are unrelentingly from the academic establishment: even those with controversial ideas, such as Steve Keen and Mariana Mazzucato, have academic positions. There are no heterodox voices at all. For example, both Ann Pettifor and I were in the audience for the "debt traps" panel. Someone asked why we weren't speaking. The answer is easy. We weren't invited, because we don't have academic positions. We are not important enough.

As I write, I am missing a panel on "reversing dual economies" consisting of five white men and Mariana Mazzucato. I have no doubt Mazzucato is wiping the floor with the white men, but it doesn't change the fact that once again, this is a white male dominated panel with a token woman and no person of colour - and I can't get past that.

Nor can I forget that next up is a lunchtime session on Gender Economics. It has an all-woman panel. I don't want to go - though I will make myself go, for the free food if nothing else. What am I complaining about, you ask?

This is the only panel in the entire conference that has a majority of women - and it is on Gender Economics. It is the equivalent of handing a woman a dishcloth and telling her the kitchen sink is all hers. Women can discuss gender balance, while men discuss important things. This is insulting and demeaning to the many intelligent and highly educated women who have important contributions to make.

And it is followed by yet another Snow White panel - one woman and five white men - and THREE all-male panels where the average age is at least 60. Oh, and the timing indicates that there will be no repeat of the Q&A from last night. The young, intelligent, highly educated attendees are to listen respectfully to the old, white, male elite, not presume to make any contributions to the debate themselves.

For me, the ultimate insult came in the form of an announcement yesterday. INET is creating an Independent Commission on Global Economic Transformation. "Call for New Thinking and New Rules for the New World Economy; Final Report will Outline Solutions for Emerging and Developed Countries", says the announcement. Here's the remit of the new commission:

And here are the members of the Commission, so far:

Now, there are some wonderful people on this list. But collectively, they represent the elite establishment that I mentioned before: senior academics, rich businessmen, former and current public servants and policymakers. There are no new voices here, no-one from the heterodox economic community, no-one who has their feet in the real world. Everyone is at the top of an establishment hierarchy. How dare these people presume to take to themselves the responsibility for creating a radically new economic paradigm, when they have benefited so enormously from the existing one?

This is not "new economic thinking". This is the establishment, reasserting itself at the behest of the elite, which fears the loss of its status and its privileges as the threat of populist revolt rises. The young crowd round the elite, hoping to be picked as their proteges: and the old scan the young to pick out the ones most like them. So the system perpetuates itself.

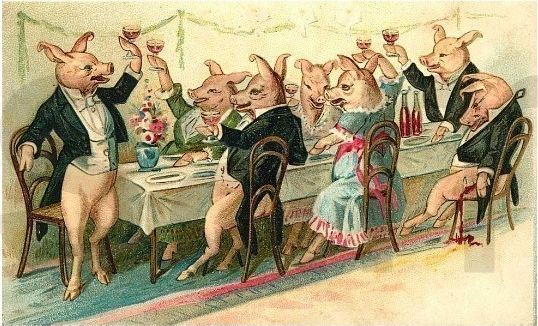

And I, like the rest of the creatures outside, look "from pig to man, and from man to pig, and from pig to man again." But already it is hard to say which is which.

Related reading:

Animal Farm - George Orwell (I have misappropriated his final line, of course)

Image from Encinitas Undercover.

👏

ReplyDeleteRalph Musgrave, I permanently banned you from commenting here a long time ago, for very good reasons that have not even slightly changed. I have therefore deleted your comment.

ReplyDeleteThe fact is that the vast majority of people speaking at this conference are old white men. It is not sexist or racist to say so. Nor is it sexist or racist to object to this massive gender, race and age imbalance.

In your outrage, you missed the real issue, which is the distressing absence of intellectual diversity in a conference that is supposed to be showcasing new economic thinking. In my view this crippling lack of originality, which renders the conference virtually pointless, arises directly from the predominance of old white privileged men among the speakers. They helped to create the current economic paradigm and have massively benefitted from it. No wonder they have nothing new to say.

I'm totally and completely baffled. Re your claim to have banned me "a long time ago" I've been leaving comments on you blog regularly over the last year, as you well know, without any objections from you.!!!!

DeleteRe the "very good reasons", I'm fascinated. What are they?

Re my objections to your racism, that was a joke. Didn't you notice the word "faux" in my comment?

This comment has been removed by the author.

DeleteThis comment has been removed by the author.

DeleteExcellent piece - glad to have kept you entertained on twitter! Concerning that INET appears to be drifting further in the wrong direction - see https://rwer.wordpress.com/2014/03/30/is-inet-nothing-but-a-trojan-horse-of-the-financial-oligarchy/

ReplyDeleteAll of the attendees would be much better off discussing the new paradigm of direct and reciprocal monetary gifting because its depth of insight and resolution of the primary problems of modern economies renders all other reforms, good as they may be, to mere "epicycles". This new paradigm is the subject of my soon to be published book entitled: Wisdomics-Gracenomics: The New Integrative theory of The New Monetary Paradigm

ReplyDeleteWe try hard at Evonomics.com! Sorry for the self-plug. ;)

ReplyDeletewww.thebrokeronline.eu?

ReplyDeleteAnother while male, I'm afraid.

If you have an education system that keeps the best thinkers longest behind school desks listening to elders, if society expects women to raise children, this is what you get:

White males do not manage to find their voice until they are gray and too many women never find it ever.

Interesting piece. They won't be going nowhere until actual MMT-economists are in the panels. Steve Keen has a flavour of this thinking.

ReplyDeleteI am 75 year old male and came to economics late, while running my own company, i.e. puzzling over the impact of neo-liberal thinking on management systems. My beef is that you guys generally spend FAR too much time on macroeconomics when it is a form of microenomics (management systems) in the UK that has destroyed our productivity and allowed neo-libs like Hunt and Grayling destroy our key public sector institutions.

ReplyDeleteMaybe time to get a bit more real???

Both macro- and micro-economy are best understood from a complexity perspective, as ecological economics and organisation ecology. See e.g. "Organisational Ecology: Simplicity in Complexity" by Gerda van Dijk, 2014

DeleteHaving attended the conference on Saturday and Sunday, I would more or less echo Frances' sentiments. Most of the talks were seemingly haphazardly put together, there wasn't much flow in terms of a thematic linkage running through the overall conference, and very little time was dedicated to inter-panel discussion or audience questions. Most importantly, in the day and a half I attended, very little new or alternative economic thought was put forth.

ReplyDeleteIn stark contrast, I also attended INET YSI festival on Thursday and Friday, and found it to be far more engaging, critically-minded and exciting. The student-focused festival was a precursor to the main conference, and featured a nice blend of presentations and discussions by both established academics and doctoral/masters students. These partially centered around the numerous YSI working groups, and generally included heterodox and dissenting viewpoints, as well as time for lengthy discussion with the audience. The highlight for me was a cryptocurrency discussion featuring Perry Merhling, Isabella Kaminska (FT Alphaville) and Rohan Grey. Find a short summary by Kaminska and link to audio of the session here: https://ftalphaville.ft.com/2017/10/23/2195143/do-crypto-enthusiasts-fear-credit/

In keeping with Frances' summary, the lowlight was the keynote dinner speech by Nobel winner George Akerlof, which half of the audience gradually walked out of to head off to dinner...

a lot of people confusing 'heterodox' with 'new'

ReplyDeleteas others have said, a racist and sexist social structure in the 1970s and 1980s produces white male eminent elders in 2017. If you don't want white males, and you want a higher chance of hearing something new, you need more junior researchers, whether mainstream or heterodox. Fine to also have some space for white male eminent elders to respond to the new, that might be interesting too, but if new economic thinking is what you want it should not be the main event.

As another INET conference survivor, I must confirm the overall impressions from Frances. I would like to contribute a rather telling anecdote from my personal experience. At the end of the dreadful dinner panel with Janeway and Turner, a young scholar from India really wanted to raise a question, concerning the complete lack of power in the narratives presented. Despite her standing there with a hand raised for 15 minutes and some loud support from the audience, she did not get to ask her question. So, she just track down Turner and ask him directly. He promptly answered that he "needed to address an issue" and slipped away, rejoining his qualified crowd of rich, white old men, who loudly asked if "he was ok", to which he happily replied "yes of course".

ReplyDeleteThe silver lining is that most of the young scholar were not drinking the kool-aid at all, getting angry instead. Also, the Festival, despite having a tenth of the budget and almost none of the "names", has been much better.

An excellent blog piece that hits at the meat of the matter. The world is shaped by out of touch academics and neo-liberal capitalists, who cannot even begin to fathom the destruction their thinking has wrought. With the world's soils being destroyed, there is a great nutritional collapse underway (due to excess carbon in the atmosphere), tropical forests are now net emitters of outrageous amounts of carbon as opposed to being net sinks (all due to the carnage wrought upon the natural world by mega corporations) & as the recent Harvard forest study shows, the soils beneath us a carbon bomb read. the fact that human survival looks so grim, and the entire conference was not centered around climate change and limiting climate chaos (it's too late for complete saving) and that every session did not build off of this central paradigm is truly shocking. Thank you Frances for giving the world an inside glimpse into the "new economic thinking".

ReplyDeleteRendahl here: Nice little ad hominem there! ("Who is he, I hear you ask").

ReplyDeleteAnyway, what I said was "Banks do not create money out of thin air. If they could, why would we need to bail them out?"

Perhaps you can courtesy of answering my question?

And ironically, your example supports exactly what I said: For private money-creation to be credible, it (often) needs the backing of the central bank.* That's why it's not out of "thin air", and that's why it can only credibly happen if the central bank is complicit. The enormous growth in credit that we have seen in the past 40 years happened under the CBs' watch -- and they could have stopped it. Hence, they were complicit.

*Often, as there are other alternatives such as own capital, or assets of solid liquidity.

"Banks do not create money out of thin air. If they could, why would we need to bail them out?"

ReplyDeleteWell, that's precisely the point. They can and did do exactly that....it's just that they needed to make it appear as if they required the complicity of the central banks and governments. Otherwise their complete dominance of every other business model and probably 99% of the general populace....would become utterly transparent. Yes, the sheep-like and hypnotized complicity of governments in Finance's dominance and in their inability to perceive what the new monetary paradigm is....is damnable as well. But let's not allow Finance's "blue smoke and mirrors" to hide their power, blur the fact that the system effectively has no control over them and for 5000 years and ANOTHER day we remain unconscious of the new paradigm that will finally re-balance the modern economies.

In regard to money creation what we require is a third authority with specific, mandated and un-impeachably beneficial policies for individuals and commercial agents so that such money power is ethically distributed, and that integrates the particles of integrity of the private banks and the government while also being a force for objectivity about their untruths and tendencies toward usurpation of that awesome power. Wisdomics-Gracenomics has the philosophical concept behind the new paradigm, its necessary policies and this third structural bulwark against corruption and folly.

ReplyDelete"How can two economists look each other in the face without laughing?" Proudhon, 1840.

ReplyDeleteThese are reasonable comments. However, don't think that by having more women or ethnic groups you will have more of a diversity of ideas. If they also went to MIT and worked at the IMF you can expect more Samuelson and Sargent.

ReplyDeleteRendahl again: I see that you respond through twitter. Very convenient since I am not there, and have no way of addressing your (empty) points.

ReplyDeleteYou "quoted" me as "Banks can't create money or we wouldn't have had to bail them out". I am not sure why you keep on misquoting me -- perhaps because you have no good answer? -- but to set things straight even for the most lazy of readers, I wrote:

"Banks do not create money out of thin air. If they could, why would we need to bail them out?"

Banks can certainly create money. But not out of thin air. They cannot make seignorage. If they could, they would never need to be bailed out. Just like a country with debt in its own currency never has to default, as they can just press print and walk away.

Now, I'm happy to have this conversation with you, right here. But then it will be two-sided, and you will be exposed as a charlatan, so I doubt you will.

But go ahead, answer my question!

I am getting a bit tired of this debate which clutter my e-mail inbox, so let me try to answer your question:

DeleteBanks need bailing out, because they can NOT create money out of thin air ENDLESSLY INDIVIDUALLY.

They CAN do so COLLECTIVELY, however (as long as the currency holds).

Frances and Rendahl, forgive me wading it, but I think you probably agree with each other. Frances I can recall you writing before now about how some elements of the 'banks create money out of thin air' crowd forget that banks must still finance their lending, in a way that is quite different from seigniorage, a word which I think should only be applied to the creation of reserves (printing money) by the sovereign (that Owen Jones article on nationalising banks got that completely wrong imo).

DeleteThis is all described perfectly well by e.g. that Bundesbank note (April 2017) The role of banks, non-banks and the central bank in the money creation process, which people like to cite as proving banks create money out of thin air, but which actually explains how, as banks expand their credit and people withdraw the money they have borrowed for use outside the bank, then banks need to have reserves to settle those transactions, which they can either get from borrowing from the central bank, interbank markets or if "it succeeds in acquiring new deposits from customers with different banks" (page 17)

Rendhal is right to say that if banks really could just create money out of thin air, with no more needing to be said, then they could never go bust, they would have no need to go to great expense to attract retail depositors, and indeed their balance sheets would have loans on the asset side and nothing on the liability side. But Rendhal is also demolishing something a straw man (or guilty of arguing with the village idiot as Chris Dillow sometimes puts it) - some of the more excitable / ignorant MMT enthusiasts may forget about the liability side of a bank's money creating activities, but I presume the better ones understand all this perfectly well.

Rendahl: as your comment is on my blogpost, and my blogpost is on Twitter, and I am on Twitter, it is not unreasonable for me to discuss it there. People who follow me know that Twitter, not this blog, is my principal discussion forum. Describing me as a "charlatan" because I choose to discuss on Twitter is frankly ridiculous. I see no reason why I should refrain from Twitter discussion because you choose not to be there.

DeleteI intend to reply in detail in a new blogpost. But before I do so, I would like to point out that you are extraordinarily imprecise in your terminology. "Money" is not the same as "seigniorage" (though as you know from reading my blogpost, some argue that banks do in fact earn seigniorage through money creation). "Money" also cannot be narrowly defined as M0 (bank reserves and currency) as you seem to do: as I pointed out in the post, the money that people use every day is not bank reserves and in most cases is no longer currency. We can have an interesting debate about the nature of "money", if you like, though I would suggest that this would be better done on Twitter where we can involve people like JP Koning, Eric Lonergan and Izabella Kaminska, who have written extensively on this subject.

While I am on the subject of imprecise terminology: "bailing out" an insolvent bank is an equity transfusion, not provision of emergency liquidity as you seem to imply. I'm sure you know that equity (or "capital", in banking terminology) is the gap between assets and liabilities on a balance sheet. As the money created by banks is in the form of new demand deposits, which are debt not equity, it is not possible for a bank to bail itself out even though it creates money ex nihilo. In fact creating money shrinks the equity to assets ratio and therefore makes it more likely that a bank will become insolvent and require bailout.

One final point: you imply that banks require funding in order to lend. This is not true. Banks require funding for payments, not lending. They can require emergency liquidity if they lack sufficient reserves (assets, not liabilities) to make payments from deposit accounts as requested by customers. But the deposits drawn upon may or may not have been created through lending - it makes no difference to settlement accounting.

Luis, as Rendahl was originally disputing Steve Keen's assertion that banks create money ex nihilo, he was hardly demolishing a straw man. Steve Keen has never claimed that banks don't need funding. Like me, he distinguishes between lending and payments. Banks need funding in order to make payments. They do not need funding in order to lend, and they do create both loan assets and matching demand deposits ex nihilo when they lend. This is simply a matter of balance sheet accounting and no mystery.

DeletePeople don't just withdraw money they have borrowed. They withdraw other money too - wages, savings, gifts, interest. All of those withdrawals are payments, and they require reserves to settle in exactly the same way as withdrawal of borrowed money. I am puzzled by the refusal of many economists to distinguish between lending and payments. They are completely different functions.

I'm afraid that as banks create money in the form of debt, it is not true that unconstrained money creation would mean they would never need bailing out. To the contrary, unconstrained money creation makes it more likely that they would need bailing out, because money creation through lending grosses up the balance sheet and reduces the equity slice. Rendahl is therefore simply wrong to suggest that the fact that banks needed bailing out (recapitalisation) means that they can't create money ex nihilo. They can, they did and they were bailed out because of it.

well maybe because that's economists think that there's not much point in lending if you cannot also settle payments. One implies the other.

DeleteI think we are talking cross-purposes. You write " it is not true that unconstrained money creation would mean they would never need bailing out" - well it would if you forgot about the need for funding, which is what Rendhal seems to think Keen is doing (I didn't know he was responding to Keen specifically). When Rendhal talks about creating money ex-nihilo, if you take him to be using those words to refer to seigniorage, the ability to print money like a central bank without the need to fund your lending, then it make sense. Whereas when you use the words 'create money ex-nihilo' I think you mean something different -i.e. money creation under fractional reserve banking through credit expansion in the fashion we are all familiar with.

further, so I think 'completely different functions' is wrong. Imagine person walks into bank, agrees to borrow £100. Bank creates demand deposit 'ex nihilo' and matching loan asset on its balance sheet. Person attempts to withdraw £100, bank responds "oh no, when we agreed to lend you £100 we didn't say anything about being able to pay you, that's a completely different function".

DeleteThat's not how it works!

Luis, this is fallacy of composition. Deposits from lending are always drawn (actually they aren't, but let's not go there), but that does not mean that all drawn deposits arise from lending. They don't.

DeleteI think that the integrated lending and payments model favoured by so many economists harks back to the days when people used cash, not banks, to make everyday payments, so bank payments generally arose as a consequence of borrowing. That world is gone, and now the majority of payments don't arise from lending. It really is time you guys updated yourselves.

You are confusing liquidity and solvency, I'm afraid. Bailouts happen when a bank becomes insolvent, not when it suffers a liquidity crisis. Liquidity crises occur when the value of deposit drawdowns exceeds the bank's cash reserves. The solution is central bank funding, which banks can borrow by pledging assets (see the Bagehot Dictum). Insolvency occurs when loan defaults or asset value writedowns reduce the value of a bank's assets so much that its equity (the gap between liabilities and assets) becomes negative.

It is possible to keep an insolvent bank alive with continual injections of central bank liquidity (as the ECB did with the Cypriot bank Laiki, for example), but this merely keeps it functioning, it does not make it solvent. Insolvency can only be resolved by equity injection. This can take the form of sale of all or part of the business, a rights issue (if shareholders will cooperate), conversion of debt to equity (bail-in), or public bailout. Bailout has nothing to do with funding.

Rendahl needs to be much more precise in his terminology. I have no reason to know that by "creating money ex nihilo" he means seigniorage - after all, that is not what we normally mean by the term "ex nihilo". And you need to stop talking about "funding lending". Banks don't fund lending. Central banks don't, either. They fund payments, which don't necessarily have anything to do with lending.

Luis,

DeleteOn the contrary, that is EXACTLY how it works. If the bank agrees a loan on Friday and you want to draw the deposit on Monday, the bank must obtain liquidity between Friday and Monday or you won't be able to draw the loan. Equally, if your employer paid your wages on Friday and the bank was unable to obtain liquidity by Monday, you would be unable to draw your wages out on Monday. It's exactly the same.

As I've actually worked in bank settlements, I can tell you definitively that payments are a completely different function from lending.

Frances

DeleteI am not confusing liquidity and solvency, and I understand bail outs etc. perfectly well thank you. It would be impossible to become insolvent if you could create money out of nothing in the way Rendhal has interpreted Keen. How could you be unable to honour your liabilities if you could just print money to settle them? That's why what he's arguing against is so ridiculous, he's interpreting create money out of nothing as if it's a goose laying golden eggs. If that's what a bank was, gathering golden eggs and lending them out, the concepts of solvency and liquidity are empty.

Yes payments do not necessarily have anything to do with lending (well, I could argue that everything a bank does has to do with everything else, but I shan't) but lending (in the sense of a bank expanding its balance sheet) does require funding (unless you think the money it thereby creates never leaves the bank), so I shall continue to talk about funding lending because that's what I am talking about.

Yes I know you worked in banks settlements, and that inside a bank payments and lending are separate functions, but they are not separate in a substantive economic sense because the little sketch I described is not EXACTLY how it works because if you agree to borrow £100 the bank is also undertaking to pay you! You can have payments that are unrelated to lending, but you cannot have lending without payments (again, if the borrowed money is to be used in transactions out side the bank).

Luis, your definition of insolvency is not the same as mine. You interpret insolvency as meaning "unable to meet liabilities as they fall due". But for banks, this is illiquidity, not insolvency. Insolvency is a negative asset-liability mismatch. And that cannot be fixed by any amount of money printing, if the money created is defined as debt rather than equity. For central banks, whether the money they create is debt or equity is a moot point. But for commercial banks, it is a crucial distinction. The money commercial banks create is debt, not equity, since it is always a liability to a customer. No-one has ever said banks can simply create money for themselves, without any liability to customers. Even the MMT enthusiasts you castigate don't say that. They always say - as I have done - that banks create money WHEN THEY LEND (or purchase securities, which is equivalent to lending). You've created a simply mammoth straw man.

DeleteYou still aren't getting the point about funding not being about lending. Yes, if you agree to borrow £100 the bank is undertaking to pay you. Equally, if you put £100 in your current account the bank is undertaking to allow you to draw it out. It is EXACTLY THE SAME. Lending is not funded. Deposit drawdowns (of any kind) are funded.

To explain it another way, if I have £100 in my current account that is the remainder of my wages paid at the end of last month, and I borrow an additional £100, I have £200 in my current account. The bank is completely unable to distinguish between the £100 that was already there and the £100 it has created through borrowing. If I withdraw £100, neither I nor the bank can tell whether the money I have withdrawn was my wages or the new money the bank has created through lending. It is nonsensical for economists to distinguish between the drawdown of a loan and the drawdown of any other type of deposit. No such distinction exists in reality.

I must add that of course some deposit drawdowns don't leave the bank. They are simply transfers between two customer accounts at the same bank. But that can apply whether or not the deposit was created through lending.

DeleteRendahl here again. I have a job, so I can respond as fast as I would like.

DeleteFirst of all, I didn't call you a charlatan for responding on twitter. But I didn't like being misquoted twice, and in particular leaving out the crucial aspect of "out of thin air". Keen had a slide in which it stated "Banks create money out of nothing". I have heard this phrase repeated over and over again, and it's wrong. You seem to think that I am uncharitable interpreting "out of nothing" as "out of nothing", but I am not alone in doing so, and this is a misconception that must stop. Because it's wrong.

Second, with money I do not refer to M0, but more to (M1-M0). I.e. the money available to us on our bank accounts/credit cards. Surely, no one believes that banks can create the monetary base out of nothing (even the central banks are constrained to do it out of paper). So I think we have the same definition in mind here.

Third, you claim that I "imply that banks require funding in order to lend". No I don't. This is the third time you assign opinions to me that I do not have.

Fourth, as Luis Enrique points out, if banks could create money "out of nothing" a "asset<liabilities" situation cannot arise, as banks would have unlimited capacity to create assets. Hence my rhetorical question; why do we need to bail them out? Then answer: Because unlike central banks, they cannot create money out of nothing.

Fifth, how does private banks create money? They create -- as you correctly point out -- a deposit. A deposit is a Barclays-pound/Bank of America-dollar, or what not, that is traded and accepted as a means of payment at a one-to-one exchange rate with the underlying national currency. But as with currency pegs, such exchange rates can only be maintained if the bank has a healthy asset side on the balance sheet, and sufficient reserves. (More on this below).

But did the bank create this deposit out of nothing? No, it created the deposit out of an asset; a loan. That is not "out of nothing". In fact, it's very far from it; a more accurate description is that the bank converted an illiquid asset (the debtor's future ability to repay) into a liquid one. If the bank did not create the deposit out of an asset, it would end up in a asset<liabilities situation, and -- as you point out -- be insolvent.

In addition, as the asset is illiquid the bank will need further reserves to ensure ensure overall liquidity. And guess who controls the cost of reserves? The central bank. So if a bank has in mind the cost of obtaining reserves when giving out a loan, the central bank must indeed also be able to steer credit expansions. Thus, the growth in debt in the past 50 years or so has happened with the silent consent of the central bank.

And no, I don't think I am attacking a straw man; I truly believe Keen believes what he says, and is fully capable of such gross errors. A straw man, however, is to claim that I have said "Banks can't create money", omitting "out of nothing". Twice.

That's all folks.

Rendahl, thank you for your clarification. It's clear that I had omitted the most important part of your comment, and in so doing, misrepresented what you said. My sincere apologies. Luis did indeed understand your intention better than I did.

DeleteThe heart of this misunderstanding is your fifth point.

I have spent much of the last seven years explaining to anyone who will listen that banks do not "lend out" deposits or reserves. Rather, they create both loan assets and matching deposit liabilities "from nothing" by means of double entry accounting entries. This is what I mean by "ex nihilo". I hope you will agree that creating money with a stroke of the pen (or a few taps on a computer keyboard) is indeed what banks do.

However, your definition of "ex nihilo" appears to be different from mine. As I understand it, you take "ex nihilo" to mean creating money without asset backing. I would completely agree that creating money without asset backing is not what banks do. Nor can they, since creating liabilities without asset backing would render them insolvent. They create money backed by debt assets.

Really, central banks can't create money "ex nihilo" by your definition, either. In open market operations, the central bank buys assets in return for base money (I take this to be what you mean by "constrained by paper"). The central bank could issue helicopter money, which is money created by the central bank without asset backing and spent directly into the economy. If done on a large scale, this would render the central bank technically insolvent. However, in this case there must be implied fiscal backing, namely the NPV of future tax receipts from a credible government that is fully committed to supporting the central bank. Without that, helicopter money would be extremely inflationary, since without either the backing of assets or a credible fiscal guarantee, the central bank cannot maintain the purchasing power of base money. Isn't this equivalent to a bank relying on long-term interest bearing debt assets to support the value of its short-term liabilities?

/to be continued.....

/continued.......

DeleteSo I would say that central banks create base money backed by the (very) long-term ability of the government to pay, and commercial banks create bank money backed by the long-term ability of the borrower to pay. In the case of the central bank, the credibility of the government/central bank combination determines the purchasing power of the monetary base. In the case of the commercial bank, I agree with you that bank money can be regarded as exchangeable at par for base money. However, the credibility of that peg in my view is rather more complex than you suggest.

In the case of insured deposits, the par value peg is guaranteed by the insuring body, usually the government (it could be an insurance fund, but these generally have government backing, so the ultimate guarantor is still the government). Additionally, depending on the structure of the bank's balance sheet, there may be government guarantees for a proportion of uninsured deposits, due to the presence of government debt in the asset base. Of course, government can't guarantee the value of its debt, but as a fall in the price of government debt is the same as a fall in the future value of base money (since government debt is a future claim on base money), this does not affect the peg. Rather, both base and bank money are equally debased and the peg holds. So the bank money that depends for its value on a healthy balance sheet is the proportion that is uninsured and not backed by government debt. It is not *all* bank money. This creates moral hazard - a known problem with deposit insurance - since banks have less incentive to maintain a healthy balance sheet when a substantial proportion of their liabilities are effectively guaranteed by government.

On reserve pricing - yes, I agree, the central bank controls credit creation by means of the price of reserves. There is a limit to its control, however. Raising the price of reserves to discourage lending may not work if the price of collateral pledged by borrowers is rising rapidly, as in a real estate boom. And lowering the price of reserves to encourage lending may not work if banks and/or borrowers have damaged balance sheets. I am unconvinced, therefore, that interest rate policy alone would have prevented the pre-crisis bubble or the post-crisis stagnation. That said, I think there were other things central banks and regulators could have done.

I hope this has cleared up our misunderstanding.

If you tie monetary policy reciprocally to every point of "retail" product sale, that is from one business model to the next within and throughout the entire economic/productive process with a high percentage discount policy to their "consumer" and that a monetary authority rebates back to the business granting the discount you could beneficially integrate price deflation into profit making systems, instantaneously increase individual purchasing by a large percent and hence tremendously stabilize the actually productive economy.

DeleteAs for the FIRE economy, even with a new paradigm, you'd need to stand up on your own hind legs and "grow a couple", that is a couple of new ethical neurons and firmly regulate things like collusive kickbacks to home building firms for them inflating their prices to consumers. The high percentage discount policy would go a long way toward nixing that, but again, you'll need to attack the host of economically de-stabilizing profit wriggling that goes on in the Finance, Insurance and Real Estate economies.

Legal tender laws are actually all a nation actually needs to justify its currency and money system. That it requires taxation is one of the weaker tenets of MMT. Re-distributive taxation is mostly captured by old paradigm thinking. With a sufficiently abundant universal dividend to everyone 18 and older and the discount policy above one could immediately render transfer taxation for welfare, unemployment insurance and quite quickly even social security, therefore benefiting both the individual and enterprise. Taxation could then be free to be used for one of its few legitimate purposes discouragement of individual, commercial-ecological and systemic vices, and at times when the nexus of greed and DSGE fallacy like the derivative mania that lead up to the GFC was in its infancy.

A discount policy as per above of 50% would give everyone a potential 50% raise. When has any politician or economist accomplished such a policy benefit for both individuals and enterprise? What enterprise could resist opting into such a policy? And finally, a 50% increase in purchasing power that was tied to an actual purchase plus a sufficient dividend would also increase the likely profitability of enterprises generally and go a very large way toward smalling up or eliminating their need to continually borrow which is the solution to the problem guys like Steve Keen are searching for because the continual necessity to borrow is currently the only way to keep modern economies from promptly falling into recession...but remains unresolvable without monetary Gifting because continual private borrowing even at 0% interest eventually outstrips individual's and enterprise's ability to service those debts. Please think about it.

DeleteKudos to you Frances for writing that. Such graciousness is vanishingly rare

DeleteRendahl back again: My final answers on the matter.

Delete1, "I hope you will agree that creating money with a stroke of the pen (or a few taps on a computer keyboard) is indeed what banks do."

Under the hypothesis that they have a decent asset at their disposal (i.e. a borrower with a realistic capacity of repaying), and with the understanding that they either have or will acquire the relevant reserves, yes. But this -- and I say this again -- is far from "nothing". In addition, this is also a non-issue for mainstream economist. If you look at the most standard textbook new Keynesian models, money is endogenously created through the demand for goods and services. (Alas, the banking sector is not explicitly modeled).

2, Being technically insolvent is not an issue for a central bank. The liabilities are a just a claim on liabilities, not on assets (e.g. "I promise to pay the bearer on demand the sum of five [ten/twenty/fifty] pounds", as it says on the pound notes). So helicopter drops are indeed possible even without the government running surpluses. Will it be inflationary? Well, that's the hope! But in a zero interest environment, not even that is clear. If the drop ends up in the mattresses instead of being spent, nothing will happen.

3, Here is what you have written on twitter:

"He says (I quote) "Banks can't create money or we wouldn't have had to bail them out."

"Lol. He doesn't seem to know the difference between assets and liabilities."

"I am seriously appalled. I will respond to him, of course. With a detailed post explaining exactly why and how he is wrong."

"Rendahl's claim is that banks do not create money when they lend."

This is not true, as you have yourself admitted. That is, you spread false information about what I have said, and even claimed that you quoted me.

Given that you have now acknowledged that, it would be becoming for you to perhaps admit that to the twitterati.

Frances, I do love a happy ending and I'm pleased that you and Rendahl seem to have now realised you've basically been vehemently agreeing with each other all along.

DeleteOn a purely practical level, isn't it the case that banks (to amend the quotation slightly) 'can't create money out of thin air to bail themselves out' because it's illegal to lend money to themselves? Hence the alleged 2008 Barclays-Qatar workaround which is still being investigated as far as I'm aware. Of course, if Barclays get away with it, we might have to conclude that banks *can*, in fact, bail themselves out. (My definition of 'get way with' in this context is 'not get sent to jail for a long time').

Rendahl, of course I will correct what I said on twitter. We seem in fact to be in complete agreement.

DeleteAnonymous, a bank lending to an investor with the explicit intention that the money will be used to buy the bank's shares is fraud. Barclays has been charged with fraud over the Qatar deal. It's sub judice, of course. https://www.sfo.gov.uk/2017/06/20/sfo-charges-in-barclays-qatar-capital-raising-case/

DeleteIf it were permitted, it would indeed be "bailing themselves out". But it is rightly illegal.

Rendahl, you are awesome! Please start a blog.

DeleteSincerely, Britonomist

Agree.

DeleteI meant to add, on the question of helicopter money, that I don't think the government necessarily has to run surpluses to maintain confidence in the currency. The "NPV of future receipts "is implied, not actual. It is enough that people believe that government is able and willing to back its central bank.

DeleteRendahl again: I just want to thank you for being so honest on twitter about your mistake. That's the right way to go, and I appreciate it.

DeleteAs for Keen, let me just say that I do not respect his work in any way. What he presented at INET 2017 was exactly the same stuff as he presented in Cambridge in 2011 -- so much for NEW economic thinking. Also, haven't we all gotten tired of the "whirlwind" graphs that lacks any economic intuition?

In any case, he seems to be accusing me [on twitter] of not being on top of an economic discussion before I was born (the capital controversy). Yeah, I agree, I'm not. But it seems like most people at the time just rolled their eyes and went on with their lives, which sounds like a good idea to me -- having read up on it, it seems like a non-event. But as a very junior academic then, I created quite a stir by pointing out that: 1, DSGE models are stock-flow consistent; and 2, that Keen's own models satisfy Say's law at all times, and are hence supply driven. Both these statements stunned both Keen and his followers, which I thought reflected very poorly on his intellectual ability.

" haven't we all gotten tired of the "whirlwind" graphs that lacks any economic intuition? "

DeleteYes we've gotten tired of them, but if they also prove that we're stuck between a rock and a hard place because the paradigms of Debt, Loan and For Production Only enforce that "stuckness" ....then we'd better actually look at and come up with a new paradigm pronto.

"DSGE models are stock-flow consistent" The alleged absolute importance of Stock-flow consistency as well as the economic validity of certain accounting identities....are rendered irrelevant to the solution....when one recognizes the new monetary paradigm of Direct and Reciprocal Gifting, and one also recognizes that the costing/pricing system, payment system and the money system are all digital and hence a discount policy to the consumer implemented at the point of sale throughout the entire economic/productive process that was rebated back to those enterprises by a monetary authority specifically mandated to do so. Why? Because it would enable immediate and potentially very large increases in individual purchasing power via what, up until one sees it, is considered impossible, namely the painless and BENEFICIAL integration of price deflation into profit making systems.

Keen and probably every other macro-economist are undoubtedly very bright. What they lack is the integrative habit that aids in paradigm perception and an unfortunate habituation to abstraction. Hence they're generally off in some theoretical and/or mathematical fugue....instead of doing the equivalent of zen meditation on the moment to moment commercial operations that take place in the economy continually....and then integrating the economic insights to be found there into their macro policy solutions.

no Frances, by insolvency I too mean assets<liabilities, and to repeat myself, insolvency would be impossible if you could print money (lay golden eggs) in the fashion Rendhal thinks Keen means. Because you wouldn't have any liabilities! I haven't created a straw man I am trying to describe the straw man Rendhal is demolishing (also, I have encountered some MMT enthusiasts who forget the funding side, I even seem to recall you and I both picking up a certain Murphy R on that). Maybe if you were not falling over yourself to explain how I am wrong you would see I am really agreeing with you (notice I have not said you are wrong about anything substantive about banking, I am only trying to persuade you that you and Rendhal have been talking across each other, because he's attacking a "money creation as laying golden eggs" (seigniorage) story that you agree is not how things work).

ReplyDeleteAnd now we are also now talking at cross purposes--you are explaining things to me that I already understand, but which are besides my point. Yes, "neither I nor the bank can tell whether the money I have withdrawn was my wages or the new money the bank has created through lending", I agree with all that, but I am talking about something else! As I have already written, by 'funding lending' I mean funding balance sheet expansion through lending. And that does need funding because it causes payments that need funding.

Luis, my apologies, the straw man is indeed not of your making. I'm just astonished that Rendahl would seriously think an academic of Steve Keen's standing would make such a gross error. I can only think he has not read any of Keen's work.

DeleteI think it is extremely important to distinguish between lending and funding. I don't deny that lending causes payments, but the bank has no greater liability for those payments than it does for any other sort of payment. If the bank fails between agreeing the loan and the customer wanting to draw it, the customer will not be paid, any more than someone wanting to withdraw their wages will get paid. There is no priority for loan drawdowns. But both customers will eventually be paid from FSCS, if their total deposits in that bank are below the FSCS limit. Do you see what I am getting at here?

I don't understand why economists obsess about lending while completely ignoring the terrible damage to the economy that payments failure can do.

thanks Frances!

Delete[I shall quietly observe that not everybody holds Prof Keen in high esteem, and then move swiftly along]

I see what you're getting at - I am not sure what you mean be economists ignoring the damage of payments failures, at least I was under the impression the dangers of failing to bail out banks (in the liquidity crisis sense) was widely understood.

Luis, sometimes the danger to payments isn't solvable by central banks. IT failures, for example. And locking people out of current accounts has terrible welfare implications. FSCS simply isn't adequate for this. I don't think we have really taken on board the risk to the economy of embedding a mission-critical payments network in banks whose job is to take risks and at times fail.

ReplyDeleteoh and I don't wholly agree with Keen. But I respect his work. He wouldn't make the error that Rendahl seems to think he has.

Deleteah, getcha. Yes I've never seen an economist write about that!

DeleteThe problem in all discussions of Banking, lending, reserves and payments is no one is stepping completely through the looking glass of the paradigm of Debt...and into the new primary (but not Only) paradigm of Direct and Reciprocal Monetary Gifting. Hence they are forced to play on the home field of the current paradigm of Debt ONLY and miss the potency and vision of the new paradigm. So it is and always has been problematic with consciousness raising and paradigm perception....even as economists suggest partial and one off policies like QE for the people and "a modern debt jubilee" both of which are completely aligned with and reflective OF the new paradigm. Steve Keen, who I have numerous times said is worthy of the Nobel Prize for his de-bunking of neo-liberal DSGE, has macro-economically re-discovered what C. H. Douglas discovered via cost accounting and calculus almost a century ago. But even Douglas and his remaining advocates still have the stench of general equilibrium and scant abundance (there's an oxymoron for you) and so still have not completely stepped through the looking glass either. My Wisdomics-Gracenomics does step through because it identifies and does an exegesis of the natural philosophical concept even behind the new paradigm and so more thoroughly and innovatively understands the nature of necessary policy and the importance of integrating the macro perspective of Keen and the micro-foundational one of Douglas.

ReplyDeleteI don't mind you commenting here, but please don't use my blog to promote your own work. Get your own blog.

DeleteI do have my own blog.

ReplyDeleteThe rabbit hole goes deeper than that. I ask: Why do CB profits flow effortlessly to Treasury in most systems by statute but CB realized losses are subject to obfuscation and debate. I submit that private banking crises lead to panic CB backstopping by e.g. buying very long private bonds at zero coupon and posting same as assets at par with cash paid. Eventually these bonds are realized as nearly worthless inducing CB losses. This is how the game is being played. Belief that CB’s can save us without Treasuries running fiscal deficits is about to be crushed by hard experience.

ReplyDeleteAll you have to do is tie monetary Gifting inextricably, sufficiently and saturatedly to the pricing system...and the entire monopolistic paradigm of Debt Only is forced to step down off its throne by what I refer to as "the higher and free flowing disequilibrium" that then awakens and enlightens economic thinking.

DeleteAnd I would add that, historically, new paradigms have always been considered absurd....right up until they are recognized as the new Gordian Knot cutting and deepest problem resolving insight.

«Her presentation stopped me from losing the will to live.»

ReplyDeleteLosing it is an essential requisite for becoming an Economist...

«the best contributions being Brad Delong's demolition of Ricardo's theory of comparative advantage»

Not that original, but interesting that B DeLong delivered it; he has always claimed to be a "Rubin wing of the Democratic party" soft-neoliberal. But I have detected in his blog some occasional deviation from that line towards more realistic approaches, especially in recent years.

«one of the white males was Steve Keen, who is original, subversive and takes no prisoners.»

I don't subscribe to the theory that young white females or colored people are necessarily more original or heterodox, see the prior comment that they are subject to conformity pressures too. Conversely some stale white men feel freer from fruitless conformity, and S Keen has been like that from his first years as undergrad.

Consider for example the case where the panels had been more representative of worldwide population and national economic weight, and a majority of panelists had been indian or brazilian or indonesian or russian or nigerian or chinese or egyptian: the pressures for conformity in their academic and/or professional systems can be even stronger than in "atlantic" ones.

Very fair points, Blissex, especially your third one about conformity among diverse populations. But is it really necessary to lose the will to live in order to become an economist?

DeleteRendahl, Frances,Does anyone want to look at and comment on the complementary policy to a universal dividend I have posted about here?

ReplyDeleteThe point of sale throughout the entire economic process is a terminal summing point of costs and prices for any item or service, and momentary stopping/transforming point of production into consumption. Hence if you implemented at that point a reciprocal policy of discount to the consumer and rebate of that discount back to merchant of relatively high percentage....... it would reduce/reverse the necessary market and hence continual build up of new private debt which is the problem Steve Keen has re-discovered.

Dear Luis,

ReplyDeletewhen I borrow from a bank and withdraw my money via an ATM I'm not actually withdrawing my money but using one kind of money (bank deposit money) to buy another kind of money, i.e. government bank notes. The bank has to buy these notes from the central bank, depending on the country. As the government requires a 1:1 exchange rate between government and bank money, this also (together with the fact that deposit money can be used to pay tax-debts with the same 1:1 exchange rate) guarantees that deposits created by different banks are interchangeable (and even indistinguishable); in a 'free banking' system this would not be the case. Up to a point, balance sheets of banks are not important, because if they lack the funds to buy notes when people 'withdraw' money from the bank, the ECB will provide these banks with ELA (Emergency Liquidity Assistance) which enables these banks to buy the notes. As happened, for a time, in Greece. And governments will bail out these banks. This is of course a chartalist point of view: central banks exist to enable the interchangeability of deposits created by different banks (together with the borrowers, of course) and tax debts can be extinguished using the 1:1 exchange rate (I'm an economic historian: there have been times when taxes had to be aid with cash but when many different kinds of cash were used to do this while some of these coins might have been worn; do not take the present situation for granted!). Let's extend this a little: when a company buys something from another company it generally emits a payable/receivable. When the seller excepts this, a legally binding transaction follows: ownership of goods or transfer of services takes place (guaranteed by law and i.e. by the government). Imagine that the government accepted receivables to extinguish tax debts, using a 1:1 exchange rate. Ot that the government established a bank which accepted receivables at a 1:1 exchange rate in exchange for bank notes. That would turn these receivables into a highly liquid kind of money. In the eighteenth century this something like this happened with bills of exchange: the joint liability rule turned them into quite liquid money! The point: it is illuminating to think of 'money' as in fact many, many different kinds of money, often indeed created by private partners (think of the cash credits of grocery shops of fifty years ago; Goldman Sachs in fact started as a very small company which bought these credits, at a discount, from groceries and cobblers and whatever). Aside: central banks define 'seigniorage' as the interest difference they earn on the government bonds bought with the deposit money they earned by selling bank notes to banks (your withdrawal!) and the costs of replacing worn out notes. A comparable definition can be used for private banks, who earn interest on the debts which are the counterpart of the deposit money banks and borrowers create. http://www.google.nl/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=0ahUKEwjQ7Or7oo_XAhUBmBoKHXnqAhIQFggnMAA&url=http%3A%2F%2Fwww.bankofcanada.ca%2Fwp-content%2Fuploads%2F2010%2F11%2Fseigniorage.pdf&usg=AOvVaw11IdQF1a8AKeast8dQL9Mk

«The point: it is illuminating to think of 'money' as in fact many, many different kinds of money, often indeed created by private partners (think of the cash credits of grocery shops of fifty years ago;»

DeleteM Knibbe as a rule is someone who write excellent and interesting points, but this is nowhere are lucidly written as the famous quote from H Minsky:

www.amazon.com/Stabilizing-Unstable-Economy-Hyman-Minsky/dp/0071592997

“Both the monetarist and standard Keynesian approaches assume that money can be identified quite independently of institutional usages.

But in truth, what is money is determined by the workings of the economy, and usually there is a hierarchy of monies, with special money instruments for different purposes.

Money not only arises in the process of financing, but an economy has a number of different types of money: everyone can create money; the problem is to get it accepted.”

But even H Minsky's description can be improved adding some detail: more precisely, "money" is usually is created by buyers, not by banks; the role of banks is to *endorse* it. Consider the case of someone who wants to buy a car that costs $15,000 they could pay the seller with a "promise to pay" for $15,000, and that "promise to pay" is "money" issued by the buyer. But the seller won't accept that "promise to pay" from the seller because they don't know their reliability. The will however accept a cheque drawn on a bank for $15,000 because they know the bank's reliability.

Therefore what happens in between is that the buyer gives his "promise to pay" $20,000 to a bank (this is called "borrowing") and gets in exchange a "promise to pay" $15,000 from the bank (this is called crediting his account with the bank with a loan), and this allows him to pay with a cheque drawn on the bank.

As long as cheques circulate, lending needs not be funded. As our blogger says, only payments need to be funded, and even that not all payments, except in a purely accounting way: more precisely only *net* payments need to be funded, and even more precisely only one type of payment need to be "really" funded: *net* withdrawals from bank accounts, that is conversion of bank "money" into central bank "money", which can only be done if the bank has "credit" with the central bank.

Just being a bit pedantic :-)

«Goldman Sachs in fact started as a very small company which bought these credits, at a discount, from groceries and cobblers and whatever)»

DeleteTo expand on this story, here are the quite interesting details:

https://www.immigrantentrepreneurship.org/entry.php?rec=100

«Goldman’s start in banking was very austere. Unlike the prominent German-Jewish banking families of New York, he operated alone, assisted only by a part-time bookkeeper. He inaugurated his new career by hanging a shingle marked “Marcus Goldman, Banker and Broker” outside his small basement office next to a coal chute on Pine Street in lower Manhattan. Goldman carved out a niche for himself by becoming a banker and broker of trade bills for the wholesale jewelers on Maiden Lane and tanners in “the Swamp” along Beekman Street. Traversing those neighborhoods in the morning, he purchased their promissory notes ranging from $2,500 to $5,000 (approximately $43,000 and $86,000 respectively in 2010$) at a discount averaging between eight and nine percent. Decked out in a Prince Albert frock coat and tall silk hat, traditional banker’s attire at the time, he tucked the documents into the inner band of his hat. By the afternoon, with his hat bulging, he then negotiated the sale of these notes to uptown commercial bankers, earning commissions of one-half of one percent.

By purchasing and reselling merchants’ promissory notes and providing the sellers with access to working capital on terms more attractive than those afforded by commercial bankers, Goldman essentially operated within the antecedent to the commercial paper market. He was not the only “note shaver” in New York, but he transacted business in a yet largely untapped market. Conducting his business by foot, he observed his environs firsthand. He was therefore able to gauge potential competition and to acquire new clients. Business was good. By the end of his first year, he sold approximately $5 million dollars (approximately $86 million in 2010$) of commercial paper.»

Here the Guardian tells its readers commercial backs crate money out of thin air and does not mention they must be able to finance their lending

ReplyDeletehttps://www.theguardian.com/global/shortcuts/2017/oct/29/how-the-actual-magic-money-tree-works

She does say that banks create money when they lend. And as I keep saying, Luis, it is not lending that is funded, but payments.

DeleteI agree this article is more than slightly misleading, but that is because it completely omits payments - which is also the criticism I level at mainstream economists. It is also very confused. She's not really talking about money creation at all. Her real argument is that bank lending is unproductive, and therefore spending that is currently funded by bank lending should be taken over by the state, because the state will direct it more productively.

Sure sure and lending requires payments (that's why what are essentially bank IOUs are accepted as money, because you can be sure of payment)

DeleteBut read that Guardian piece. Nothing there explains to readers that banks cannot create money for payments, there is nothing about the liabilities side of banking, nothing that deviates from the view Rendhal was attacking.

As for the idea nationalised banking would be more productive. Lord save us from government hubris. I mean ok, a development bank and maybe subsidising start-ups. But "spending that is currently funded by bank lending should be taken over by the state, because the state"?

Hey, I'm not defending her piece, merely translating it! I don't think she has the foggiest idea what she is talking about as far as money creation goes. But her real target is private sector banks, not money creation. She wants to nationalise banks and have the state direct lending to uses that she considers "productive". Like that has worked so well in the past. Welcome to Soviet Britain.

DeleteHistory tells us you cannot trust either the private banks or the government with money creation. That's why we need a third constitutionally arms length institution with unimpeachably beneficial mandated monetary distribution policies like a universal dividend and a substantial discount to the "retail product" of every business model that is reciprocally rebated back to participating businesses. This institution could also serve as a truly objective and balanced central bank whose overweening mandate was increasing economic prosperity and freedom for all agents with a bias toward increased traditional production with fewer actual resource usage. That way it could be a true lender of last resort instead of being the hand maiden of the too big to fail banks.

DeleteThere may be a simple explanation for the gender imbalance. Since the subject is economics, at least in the USA there are far fewer women economists than men. I don't know about the situation in Britain. In 2010 only a third of economics doctorates in the US were earned by women. Psychology, sociology and life sciences doctorates awarded were majority female by the same year. Thus, if majority-women conferences in these fields were held (at least in future after they have got further ahead in their careers, replacing older men in their fields and get invited to speak at conferences) it would not be evidence of sexism against men. https://www.aeaweb.org/articles?id=10.1257/jep.29.1.89

ReplyDeleteAs for people of colour, that's 9% of speakers, not far off what one would expect in the 87% white UK (2011 census).

Norbert Haering considers the problem of whether INET is an establishment Trojan horse. http://norberthaering.de/en/32-english/news/68-george-soros-inet-an-institute-to-improve-the-world-or-a-trojan-horse-of-the-financial-oligarchy

" a far more interesting discussion about whether or not banks earn seigniorage from lending, how we could measure this and whether it constitutes a hidden subsidy that should be removed."

ReplyDeleteI fully agree that that is a crucial question. Personally I think commercial banks' right to create money does amount to a subsidy of such banks. My reasons, for what they are worth, are here:

http://www.kspjournals.org/index.php/JEB/article/view/740