Libor and the Bank

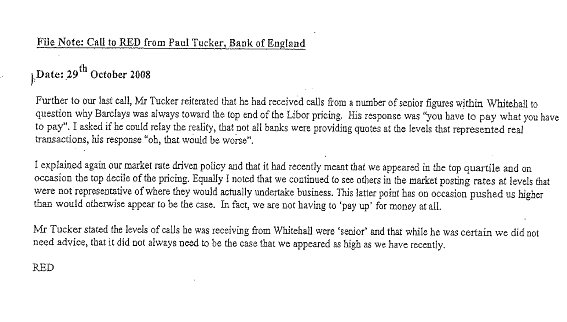

Nearly five years ago, the former CEO of Barclays Bank, Bob Diamond, defended himself against accusations that on his watch, Barclays had deliberately falsified Libor submissions. To no avail: after widespread adverse press coverage, Diamond resigned. Was this at the instigation of the Governor of the Bank of England and the head of the FSA? We will probably never know. But events yesterday make not only Diamond's resignation, but also the prosecution and jailing of traders and Libor submitters from Barclays and other banks, look distinctly odd. The BBC's Andy Verity has revealed the existence of a recording which appears to indicate that the Bank of England and the Treasury pressured banks to "lowball" their Libor submissions during the financial crisis. According to Verity, the conversation, between a junior Libor submitter (who was subsequently jailed) and his manager, ran like this: In the recording, a senior Barclays manager, Mark Dearlove, instructs Libor...