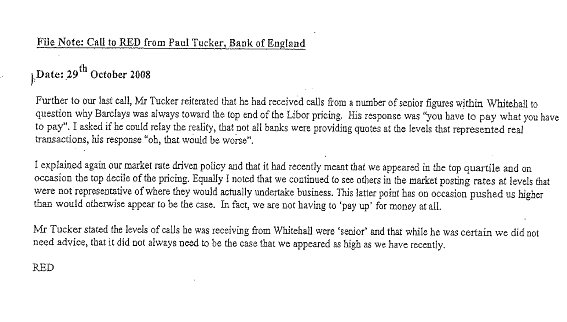

What was the real reason for the Bank of England's gilt market intervention?

.jpg)

Why did the Bank of England intervene in the gilt market this week? The answer that has been doing the rounds is that it was protecting the solvency of pension funds. But this doesn't make sense to me. The Bank doesn't have any mandate to prevent pension funds going bust. And anyway, the type of pension fund that got into trouble isn't at meaningful risk of insolvency. There was never any risk to people's pensions. I don't think the Bank was concerned about pension funds at all. I think it had a totally different type of financial institution in its sights. Let's recap the sequence of events from a market perspective. This was, on the face of it, a classic market freeze. Pension funds sold assets, mainly long-dated gilts, to raise cash to meet margin calls on interest rate swaps (of which more shortly). The sudden influx of long gilts on to a market already spooked by an extremely foolish government policy announcement caused their price to crash. I am told th...